Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN‘’Don’t try to eat more than what you can chew’’ – Many companies have struggled more because of Indigestion rather than starvation and this is exactly what happened with our Entertainment hero – ZEE Entertainment Ltd. (ZEEL)

Just like the movies, the story of the company also has a lot of ups and downs, and the hero of our story is Subash Chandra who is also the founder of the company. The journey of our hero started in the year 1965 and he had to drop his Higher education as he has to repay his family loan worth 3.5 lakhs and our benevolent hero started manufacturing flexible tubes which are used in the toothpaste.(which is now known as Essel Propack)

In the year 1982, he started ZEE Tv which was he second private television in our nation and from here subash Chandra has built a strong ZEE brand and the company has a strong portfolio of more than 41 domestic channels and 39 international channels.

What went wrong with ZEE ENTERTAINMENT?

On May 2020 – An Economic Times article was released titling – “The Essel group defaulted 616 crores’’.

The key companies of the Subash Chandra – promoted Essel group of companies doubled their debt and the Everything was going fine and at some point of time, everyone realised that the group was sitting under a ticking time bomb of Rising debts and Minimal Revenues as most of the investments was directed towards Infrastructure development.

Essel group is burdened with a huge debt of over 11,000 crores and the company had default most of obligation to pay the Interest and thus they were left with only one option and that is “Disinvestment”

They had to disinvest from their Cash cow which is ZEEL and over the years the promoters have reduced their stake from 35% to a mere 4% as per the recent filings made by the company. After the disinvestment, Subash Chandra chose to step down as the chairman of the company and thus the story of our hero starts and ends with Debt.

Though he didn’t get a happy ending like in the movies but the role he had played in creating the company is nothing less than phenomenal and has indeed left behind a legacy.

The issue of the promoters have impacted the share price of the company significantly and now the dust has settled in a little and let’s have a look at the fundamentals of the company and analyse whether the irrationality of the market has given us an opportunity or is it falling knife that cuts the throat of the Investor?

The Competitive edge of the company:

Market Leader in the Entertainment segment:

The brand ZEE has established itself a reputed brand in India and it is also one of the most recognised brand in our nation.

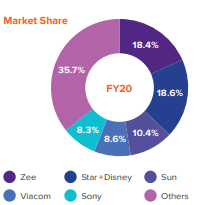

Source - Annual report

ZEEL has the highest market share of 36% in the Indian Television market and its next competitior Star Entertainment has only half of the market share of ZEEL, which makes it as the market leader of the segment.

India’s widest TV Entertainment network:

With more than 130 crores of population, India is one of the biggest market for the entertainment Industry and which makes it as a multi billion dollar industry but then here is the catch!!!

India is also one of the most diverse nation and a blockbuster content in Mumbai might be a flop in the Tamil community. Hence, the diverse nature has been one of the greatest hindrance for any successful regional player to dominate the whole nation. ZEEL has conquered the diversity and with a launch of 4 new domestic channels has given it’s a PAN India status and making it the widest language footprint private network in the country.

The company claims that every 7 out of 10 total TV consumers in India access Zee’s content every week, which makes it the entertainment network with the highest reach in the country. Zee’s diverse content offering draws ~350mn consumers to its network daily, giving advertisers an unparalleled reach.

Content creation abilities and wider reach:

In the entertainment industry, the content is the king and The company has a strong in house expertise and multiple partnerships with various content creators with an agile distribution network the company has been to create and deliver quality content at a competitive costs.

The company produces original content for 12 different languages and a 500 hrs of content every week. ZEE also owns Intellectual property rights for its 1,25,000+ hrs of its content.

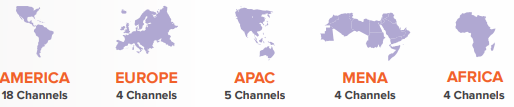

Increasing global footprints: Indians are all over the word, their way and standard of living might differ to the nation they get settled in but their taste and hunger for the digital entertainment remains the same.

This gave the company an opportunity to transcend beyond the Indian boundaries and now the company has its operations across 170 nations and now the company derives 12% of the revenue from the International market

ZEEL was the first Indian entertainment company to expand beyond the nation and the company offers a mix of channels that mirror India feed as well as channels that curate content specifically for some of the markets.

Source - Annual Report

The challenges:

A Paradigm shift to the digital platforms:

Television is losing its market share to the new digital platforms and thanks to Covid the shift has happened at a faster pace than the estimates. Increasing smartphone penetration and affordable data tariffs have led to an increase in digital content consumption. While this trend is expected to continue, digital consumption so far has been largely supplementing television viewing. If there is a faster than expected migration to digital platforms from television, it may have an impact on the television business revenue of the Company.

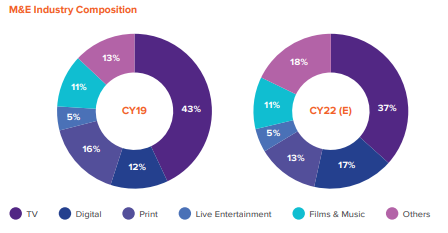

Source - Annual Report

From the chart, we could see that the Television segment is the dominant segment in the segment in the Media & Entertainment Industry but the dominance has been reduced significantly and the Digital media is gaining momentum at a faster pace.

The company is overcoming the challenge by launching its own digital platform under the name ZEE5 and they are all set to compete with Netflix, Amazon and Hotstar. ZEE5 is ramping up its presence across various geographies and the company envisages to become the number one OTT platform in India.

Decreasing Advertisement Revenue:

Indian Advertisement Industry is a 60,000 crore Market and is one of the biggest source of the revenue for the company.

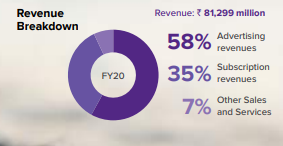

Source - Annual report

Advertisement revenue constituted 58% of the revenue of the company and the decrease in the revenue is totally attributed to the Covid led disruption as many companies are fighting for their survival, they don’t seem to have enough money left to spend on Advertisement and the never decreasing Covid cases can again bring a downfall to the company but the company has showed its resilience and the topline revenue of the company grew by 2.5% despite a fall in the Advertisement revenue.

Valuation and other key metrics

The company has reported a net loss on Trailing 12 month basis, thus the PE calculation is not possible but the company had a median PE of 27 for the previous 5 years.

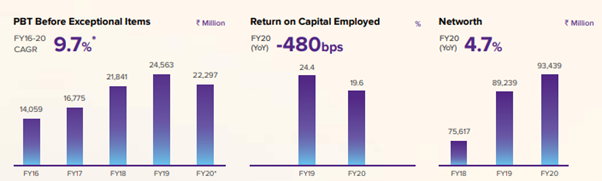

Source - Annual report

The top line performance of the company is relatively a decent one with a ROCE of 19 which was a decrease 480 basis points and the decrease can be majorly attributed to the Covid disruption. The net worth of the company has increased 4.7%.The company is virtually debt free and its Debt to equity ratio stood at 0.04%.

The Market capitalization of the company has decreased 55% from its life time high because of which the company is no more a part of the Nifty 50 index and the company is trading at the zone of 200 levels and the majority of the fall can be attributed to the corporate governance issues.

The book value of the company 98rs and the stock is just trading around 2x of the book value which offers a good Margin of safety for the investment.

The only fundamental concern remains on the sales growth of the company. ZEE witnessed a negative sales growth of 6% on YoY basis and the company also has a poor sales growth 10% over the past 5 years.

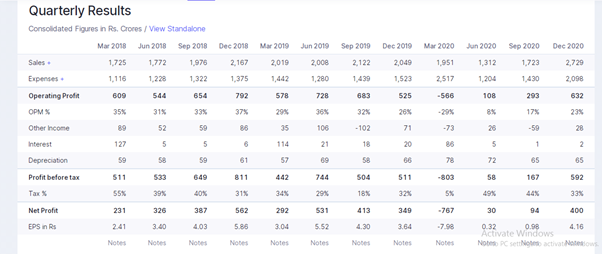

Quarterly result analysis

Source- Screener.in

The best way see whether the stock can be a potential turnaround or not is through analysing its quarterly results. In the above case, we could see that the companies sales were impacted on 2020 due to the Covid and also the OPM has also witnessed a fall but then the company has poised a good turn around in the December Quarter and the OPM has also increased and the company has also managed to make higher Net profits.

So fundamentally, the company has improved its operations and has been doing well and competing on all other fronts

The Road Ahead:

After the exit of the promoters of the company, ZEE will not be judged by the sins of its promoter group of companies and now it doesn’t have to take the burden of its promoters and when the time is right ZEEL is poised to give a comeback and might find its position again in the Nifty 50 index.

share your thoughts

Only registered users can comment. Please register to the website.