Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Asian Paints (NSE:ASIANPAINT) is one of India’s leading paint companies with a history dating back to 1942. It is double the size of any other paint company in the country.

Asian Paints primarily manufactures a wide range of paints for decorative and industrial use. It also offers wall coverings, adhesives, and services under its portfolio. The company also has a presence in the Home Improvement and Decor and bath and kitchen (sleek and Ess Ess brands) segments. With a diversified range of home improvement products and services, Asian Paints is no longer just a paint company and has become the one-stop decor destination in India. Its wide range of product offerings includes paints, metal finishes, wood finishes, tools, adhesives, waterproofing products, bath fittings and sanitaryware, kitchens and wardrobes, wall coverings, sanitizers, and surface disinfectants, and it also provides services like home painting, interior designing, color consultancy sanitization services.

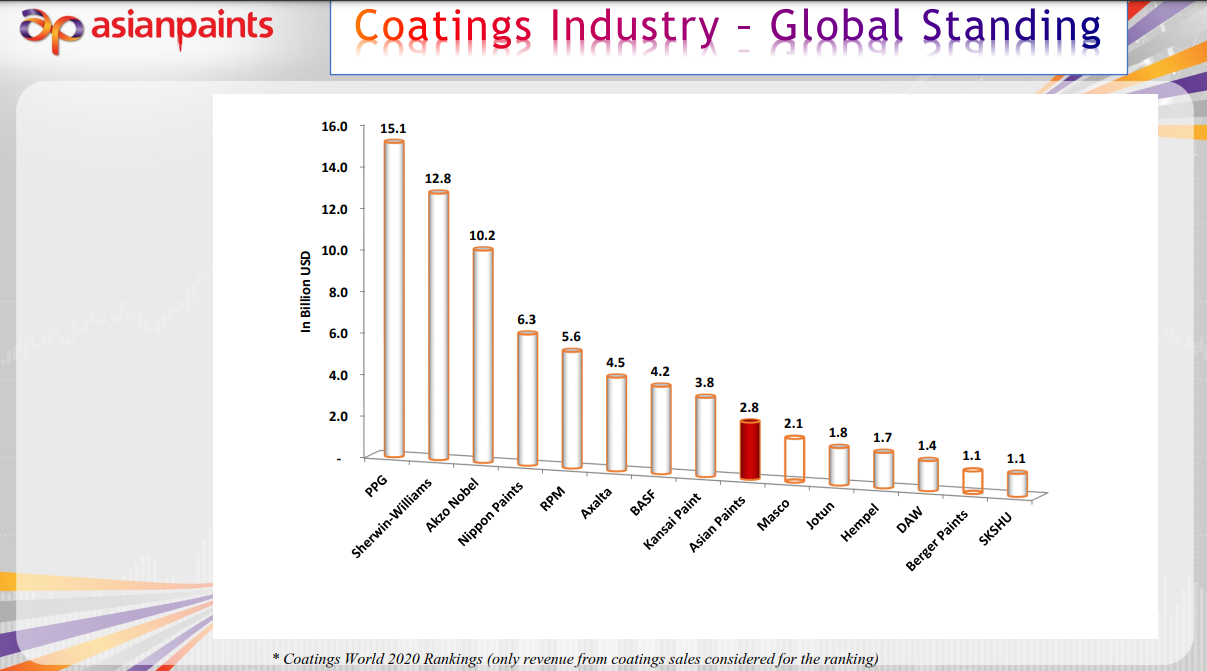

Asian Paints operates in 15 countries in Asia, Middle East, South Pacific, and Africa and has 26 paint manufacturing facilities in the world. It has eight decorative paint manufacturing plants in India and an extensive distribution platform. The company has completed large capacity additions at Vizag and Mysore. It caters to consumers in over 60 countries worldwide. Asian Paints is the third largest paint company in Asia and ninth largest coatings company in the world. Strong brand name, large distribution network and geographic footprint, and a wide product portfolio are strong competitive advantages for the company.

Asian Paints Pros

i) Wide range of consumer products - Other than having a large portfolio of paint products, Asian Paints also offers wall coverings, adhesives, and home products. The company also entered lightings, furnishings and furniture, and Health and Hygiene segment. It operates through its subsidiaries Asian Paints Berger, Apco Coatings, SCIB Paints, Taubmans, Causeway Paints, and Kadisco Asian Paints. Asian Paints is a vertically-integrated company and has diversified into chemical products such as Pentaerythritol, which is used in the paint manufacturing process. Paints, waterproofing, wall coverings, account for 84% of the company revenues, followed by international operations (12%), and industrial and home improvement (~2%) each.

ii) Large customer base - Asian Paints has a strong presence in Interior Wall Finishes, Exterior Wall Finishes, Enamels, Wood Finishes, Waterproofing, etc. Other than the large residential and commercial consumer base, the company also serves large industries like the automotive coatings, protective, industrial powder, industrial containers, and light industrial coatings markets in India. The company has a large offering both in the Premium and Luxury categories as well as Smartcare and Economy range. Asian Paints has a strong brand reputation and customers trust it for its premium quality and service. The Asian Paints brand enjoys a strong customer connect which is a big plus for the company.

iii) Strong consumer-focus and innovative spirit - Asian Paints has more than seven decades of experience in paints. The company continues to expand its product offering basis the changing consumer demand and needs. It launched the waterproofing range across international units and bath businesses in South Asia countries. Asian Paints is leveraging its age-old expertise in the consumer industry as is evident by the launch of the ‘Beautiful Homes’ service through which it partners with the customers providing them complete delivery of home decor. Other initiatives include ‘Colour Consultancies‘ across its ‘Colour Ideas’ and ‘Ezy Colour‘ Stores.

iv) Leading Market share - Asian Paints has been the market leader in paints since 1967. It enjoys a dominant market share position in the domestic paints market. In addition, Asian Paints also commands a 60% market share in the decorative paints segment and 20% in the automotive industrial coatings segment. The company has been steadily expanding its global capacities and technologies.

Source: Asian Paints Presentation

v) Increasing consumerism - Asian Paints should benefit from growing consumer interest in transforming homes and has developed various avenues like AP Homes, beautifulhomes.com, Interior Design service, Asian Paints Colour Ideas Stores to facilitate a holistic and integrated customer experience. In the post-pandemic world, people at large will seek to make changes in the way they live and work. With many large corporations shifting to work from home people will spend maximum time indoors and could take up renovating and refurbishing their homes which will act as a tailwind for the company.

Covid-19 impact

Asian Paints witnessed a lackluster first quarter as a result of the nationwide lockdown, with a rebound in demand conditions in the second and third quarters supported by new construction, renovation, and festive demand. The company also experienced increasing demand in tier 2/3/4 markets. Asian Paints registered a 33% volume growth in Q3 for the domestic decorative business. Its Safe Painting and San Assure services gained momentum during the pandemic. Asian Paints also launched Viroprotek surface sanitizer in June 2020. The company already has anti-bacterial paints and is working on asthmatic-friendly paints as well.

Asian Paints reported a strong recovery in Asia and the Middle East with all international units registering a double-digit volume growth in Q3. The company also suffered from a slowing automotive segment.

Future Growth Opportunities

Asian Paints’ decorative business continues to focus on product innovations and growing the overall market in various areas of home decor. The company will also focus on certain key areas in protective coatings, value for money emulsions, innovative solutions in waterproofing, and construction chemicals. Asian Paints is going big on waterproofing and construction chemicals segments and expects these to contribute to its market expansion strongly.

Challenges

Increased competition - Asian Paints faces competition from large national as well as regional players. Though the company has always witnessed fierce competition, it has never shied away from introducing new products and entering new segments to prove its mettle. The company has truly established itself as an integrated home decor player with an exhaustive range of furniture, furnishings, and lightings in one place with a technology-led proposition. There is little competition in the organized home decor segment in India.

Increasing raw material price - The company has been witnessing an increase in the prices of raw materials with crude prices going up. The crude derivatives and most coatings raw materials prices have seen a sharp appreciation since the month of December last year.

Valuation

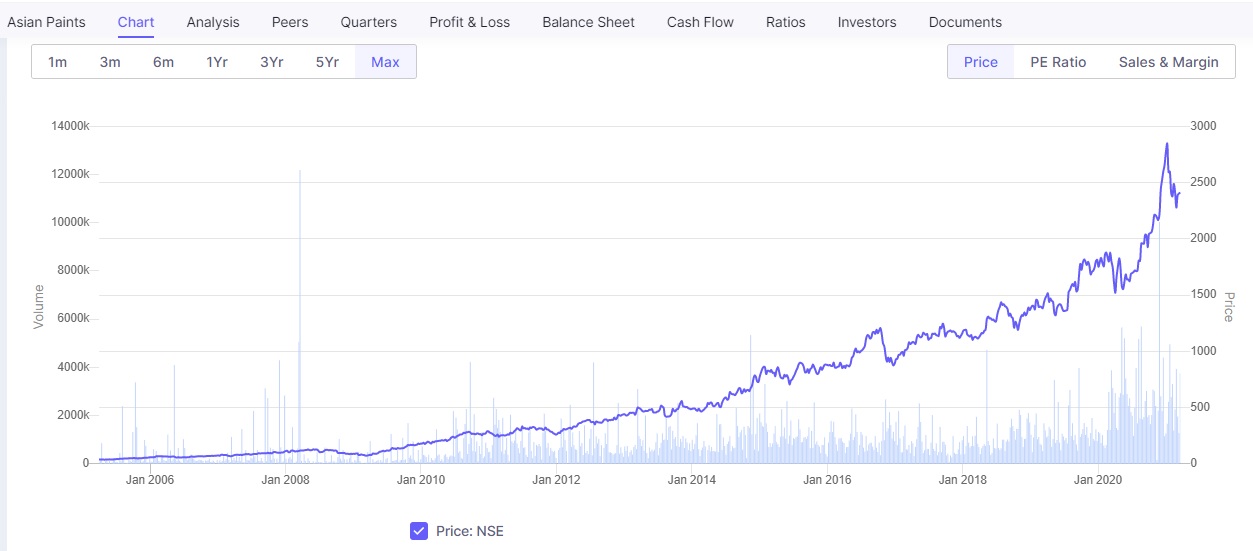

Asian Paints has a market capitalization value of 236,700 crores and is trading near the Rs. 2,470 mark just 16% its all-time high price. Asian Paints is a shareholder-friendly company. The stock has returned more than 1,400% in the last completed decade (FY2011-FY2020). The company is almost debt-free. It has maintained its dividend payout at ~40% and has a good track record of maintaining its ROE at 25% in the last three years. Shares of Asian Paints sport a PE of 86x which is reasonable when compared to peers like Berger Paints having a PE of 114x and Indigo Paints at 243x. Asian Paints has a strong capital structure and surplus liquidity.

Source: Screener.in

The stock is trading at 21x its book value and has delivered poor sales growth of 8% over the past five years. Promoters held ~52% of the company.

Bottom Line

Asian Paints’ near-term revenues will remain impacted by a slowdown in the construction activity along with lower discretionary spending. The home improvement segment offers a large scope of services and Asian Paints with its rich heritage, expertise and a wide portfolio of related products stands a good chance to maintain a leadership position in this segment. It has come a long way from just a paints company to a home decor company with a wide range of products covering this segment. The roll-out of the Covid vaccination program augurs well for the domestic demand recovery and demand conditions are expected to be strong, supported by the recovery in consumer sentiments. Asian Paints should continue to deliver shareholder value driven by a gaining market share and good demand conditions due to construction resurgence and festive demand.

share your thoughts

Only registered users can comment. Please register to the website.