HDFC Asset Management Company Limited: Strong Brand Recall and Market Presence Should Lend Support

Summary

- HDFC asset management company plans to capitalise on existing reach and distribution network and focus is on enhancing it.

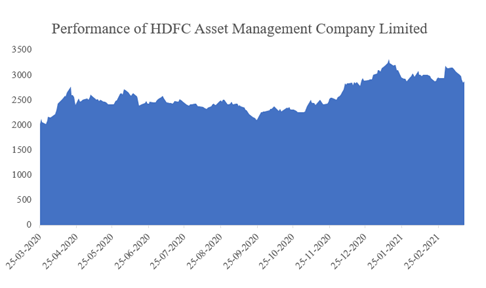

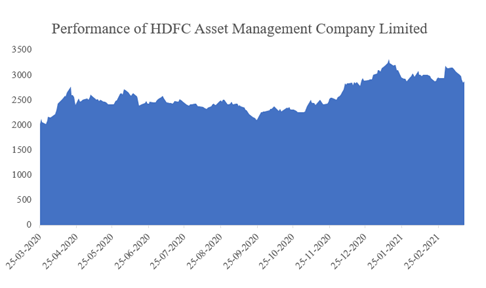

- Performance of HDFC asset management company should seek support from significant recovery in stock markets.

- Rising awareness about mutual funds should result higher participation of individual investors.

HDFC Asset Management Company

HDFC mutual fund is counted as one of India’s largest and most profitable mutual fund manager. Started in 1999, this company was set up as a joint venture between Housing Development Finance Corporation Limited and Standard Life Investments Limited. During FY18-19, the company carried out an initial public offering, becoming a publicly listed company in August 2018. HDFC asset management company is an investment manager to schemes of HDFC mutual fund. This company offers suite of savings and investment products across several asset classes, providing income and wealth creation opportunities to large retail and institutional customer base.

Growth Enablers of HDFC Asset Management Company

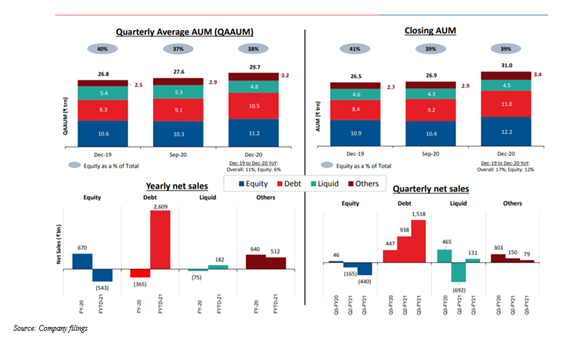

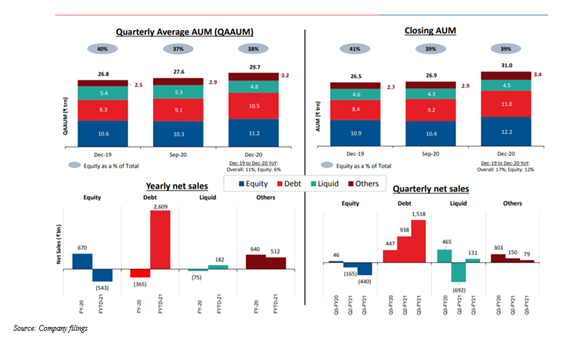

- Growth Seen in AUM and in Net Profit: HDFC asset management company limited’s net profit for 3Q21 was INR3,694 million, exhibiting a year on year increase of 5%. Total AUM was INR4,068 billion as on Dec 31, 2020, a year on year 10% growth. This company is categorised as India’s largest mutual fund manager, having AUM market share of 13.1% as on Dec 31, 2020. Ratio of equity-oriented AUM and non-equity-oriented AUM is 40:60 in comparison to industry ratio of 39:61. The company saw processing of 2.98 million systematic transactions with a value of INR9.1 billion during Dec 2020. There was some impact on financial performance in initial period of this financial year due to COVID-19 on markets. While there is still some uncertainty regarding COVID-19, markets were upbeat and financial performance of this company saw improvement in 3Q21. Operating profit of the company for 3Q21 was INR3,697 million. Though this was lower by 7% than operating profit of INR3,987 million for 3Q20, it exhibits a rise of 6% than operating profit of INR3,491 million for 2Q21, which is a trailing quarter.

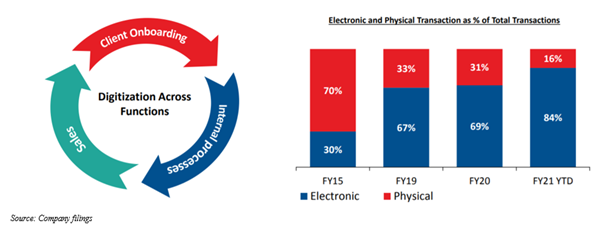

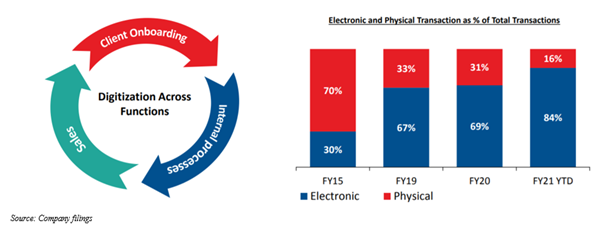

- Enhanced Digital Presence Should Result in Seamless Operations: Technology platforms of HDFC asset management company limited are built on cloud leveraging emerging technologies and they are robust and scalable. Focus is to build and retain direct online investor base and to power solutions with direct access and control to business users. Steps taken to improve digital presence has benefitted the company. In FY20, transaction volumes on in-house platform saw a growth of 17% and mobile-to-web ratio saw an increase as every third digital transaction was on mobile. Its strong digital presence is being supported by integrated online platform. Between FY15-FY20, the company has compounded electronic transactions at 36%, with total transactions being compounded at 15%. Assuming 22 working days per month and for both partner and investor, the company sees logins of 50k+ per day on MF online and 40+ new user registrations every hour. HDFC AMC has best-in-class IT systems and resilient IT Infrastructure & processes. These systems support in increasing productivity. Thus, it helps in reducing turnaround time across operations, customer service, dealing, research, risk management and other functions.

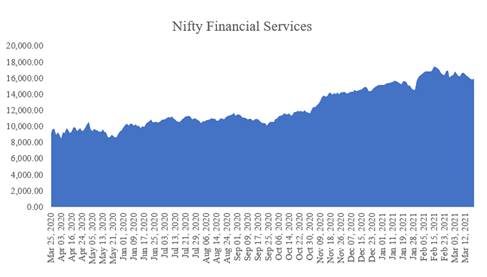

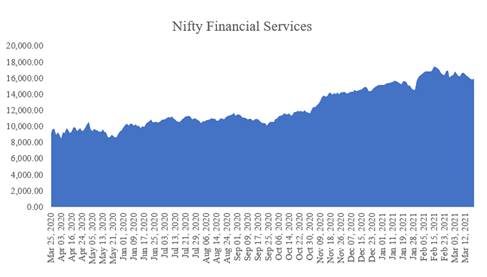

- Operational Performance for FY20: The company’s closing AUM as of Mar 31, 2020 saw a fall of 7% to INR3.19 lakh crore against a closing AUM of INR3.44 lakh crore as of Mar 31, 2019. During this period, actively managed equity-oriented AUM fell from INR1.64 lakh crore to INR1.20 lakh crore, with non-actively managed equity-oriented AUM growing from INR1.80 lakh crore to INR1.99 lakh crore. Fall in overall AUM was principally due to fall in equity-oriented AUM. HDFC AMC’s equity-oriented AUM saw a fall because of a fall in markets, exhibited by 23% fall in NIFTY 50 during Mar 2020. Even though large selling was seen during Mar 2020, FPI flows for FY19-FY20 were positive at USD1.3 billion. Domestic equity oriented mutual funds saw inflows getting moderated to USD9.5 billion, in comparison to previous year. Inflows continued to seek strong support from SIPs, averaging ~USD1.2 billion per month during course of year. As of end-Mar 2020, country’s market capitalisation to GDP was ~50%. If history is any indication, whenever market capitalisation to GDP falls below ~60%, future returns delivered by equity over 1 to 3 years have been strong. Investments made when FPIs have been large sellers have yielded good returns over medium term.

- Recent Trends in Indian Mutual Fund Industry: Mutual fund industry in India has compounded its AUM at ~15.5% over five years. Increased participation of domestic individual investors in Indian mutual fund industry has stemmed from rising awareness about benefits of investing in equity markets and growing popularity of ways of investing, like SIP. Net inflows into industry over five fiscal years were INR9.46 lakh crore, of which INR6.47 lakh crore were in equity-oriented schemes. Fixed income products including liquid funds have also seen popularity. This was amongst corporate, and retail and high net worth investors. Monthly SIP flows saw 2.8 times growth from Apr 2016 to INR8,641 crore in Mar 2020. Number of SIP transactions processed in Mar 2020 was 3.12 crore in comparison to 1.01 crore in Apr 2016. During this period, domestic equity markets saw healthy balance between domestic institutional investors and foreign portfolio investors. This reduces reliance on FPI inflows, lending more stability to Indian markets.

- Strong Brand Recall Should Support Future Growth: There is immense scope for Indian mutual fund industry to grow. Given HDFC asset management company’s strong positioning in this industry, the company should be able to capitalise on opportunities. The company sees that there is enough scope for savings and investment related products which should translate into material growth in mutual fund industry. Strong growth is expected to be seen by the company and this should stem from strong brand recall, disciplined investment philosophy and process, customer-centric approach, strong distribution network and reach and healthy financials. The company plans to maintain its focus on offering diverse range of products across asset classes and product categories so that financial needs and aspirations of consumers can be catered to.

- Take on Debt Markets: Fixed income markets in India saw a mixed FY19-FY20. G-sec yields were lower during FY20 but credit markets faced tough times. Yield on 10-year benchmark G-sec moved lower from 7.35% to 6.14%, exhibiting a fall of ~121 basis points. With additional 40 basis points rate cut in first two months of FY20-FY21, fall in yield of 10-year benchmark G-sec stemmed from 185 basis points rate cuts by RBI, ample system liquidity, slowdown in growth and fall in global yields. There was steepening of yield curve in FY20 with difference between 10-year benchmark G-sec yield and repo rate rising to 174 basis points from 110 basis points a year ago. This was due to widening of fiscal deficit and ample liquidity. Credit markets saw a tough FY20 because of series of events. Stress in credit markets worsened as there was write down of Additional Tier – I bonds of Yes Bank, impact of lockdown and announcement of winding up of 6 schemes by Franklin Templeton in Apr 2020.

- Industry Overview: Mutual fund industry’s closing AUM as of Mar 31, 2020 saw a fall of 6% to INR22.3 lakh crore against a closing AUM of INR23.8 lakh crore as of Mar 31, 2019. During this period, equity-oriented AUM saw a decline from INR10.2 lakh crore to INR8.3 lakh crore while non-equity-oriented AUM grew from INR13.6 lakh crore to INR14.0 lakh crore. Fall in overall AUM stemmed from fall in equity-oriented AUM, as this AUM saw a fall of 19% due to fall in market, primarily in Mar 2020. During FY19-FY20, industry saw net inflows to tune of INR0.67 lakh crore in equity assets and INR0.64 lakh crore for others (including arbitrage funds, exchange traded funds and fund of funds). Debt saw outflows to tune of INR0.37 lakh crore. On overall basis, there were net inflows of INR0.87 lakh crore in industry.

Conclusion

HDFC asset management company has a total market cap of INR60,96,587.06 lakhs and free float market cap of INR15,28,317.14 lakhs. As of Mar 2020, individual investors made contribution of 52% of industry monthly average AUM adding up to INR12.9 lakh crore, with institutional investors contributing to tune of INR11.8 lakh crore making up 48% of industry monthly average AUM. Today, India is one of most vibrant global economies and this is principally due to strong banking and insurance sectors. Relaxation of foreign investment rules has been perceived well from insurance sector, as many companies are announcing their plans to increase stakes in joint ventures with Indian companies. There could be a series of joint venture deals over coming quarters. These deals are expected to take place between global insurance giants and local players.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.