Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINLast year, the government of India took a bold move of opening up the coal sector for the world by allowing 100% Foreign Direct Investment in coal extraction amid surging imports and falling output from the Coal India and India opened up the coal mining to all companies, amending laws which restricted the entry of the private players into the segment and they will bring a lot of technological advances to lower the costs and compete the Monopoly Miner of our nation.

BSNL, Air India – What is the similarity between these two companies?

Both BSNL and Air India was a monopoly in their Industry and when the Industry was opened for the private players, the great BSNL is begging the government for money so that it could pay its employees and Air India is waiting for its rescue operations and can we expect the same case with Coal India after a couple of years? Only Time can tell what beholds the company.

Why Privatizing the coal fields is still unfeasible to attain?

The companies can bid for the coal and the highest bidder can keep the mine for a particular period of time but then there was not a lot companies showing interest in the bid process because it takes lot of years for getting state level clearances and many other risks like transportation hinders the new entry into the segment.

Privatization is indeed a threat to the state run Coal Giant but the impact of the same will be limited and the concerns are overdone as we could see limited fundamental impact over three to five years will be less as supply ramp up would be back ended and incremental supply would bridge the widening demand supply gap and prevent imports from rising further.

Coal India is one of the biggest Monopoly in our nation and the company alone produces 83% of the total coal output in India and the government of India has given the highest Maharatna status to the company and with a Net profit of more than 16,000 crores the company is also one of the most profitable Public sector enterprises.

Keeping the Government Happy

The Government is not happy with coal India because of the raising imports of Coal by the domestic consumers and the Indian users imported a record of 250 million tons of the fuel in the fiscal year and the government has enough reason to be concerned as we have abundance of resources in our own land.

Thus to keep the Government happy the company took a bold move which even shocked the analyst of Dalal Street.

Coal India approved 32 Mining projects worth 6.4 Billion Dollars as the company seeks to boost the output to replace the imports of the fuel and the projects will produce 81 Million Tons annually from the financial year starting April 2023, by when the company has a humongous target of reaching 1 Billion tons of annual production.

Let’s see whether the company is able to meet its ambitious targets

Coal is the King

Coal plays a pivotal role in the world’s energy production and the coal production is Dominated by China accounting for 47.5% of the total Global production and India comes in the second of the list accounting 9.9% of the total production followed by the United States, Indonesia and Australia. These Five nations jointly contribute around 80% of the global production.

Coal powered stations is run by 40% of the global power generation plants and despite its impact on the environment, coal is mostly used because of its affordability because of which coal has become the cheapest and most affordable source.

The competitive edge of Coal India.

Monopoly in operations – India is one of the largest producer of coal and it has abundance of coal resources and Coal India 48% of India's proven reserves in its command area and accounts for the bulk of the domestic coal production. The large scale of operations has enabled the company to reap the benefits of the large economies of scale. The company also has a consistent track record of growth & strong track record of financial performance.

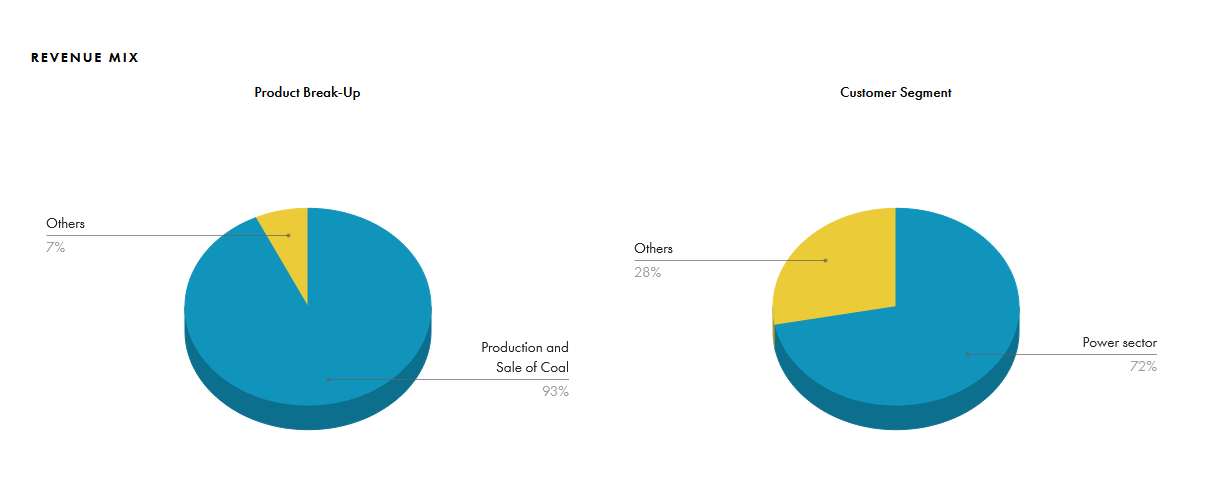

Catering the huge energy demand of India - Given India's abundant coal reserves and non-availability of other sustainable sources of fuel, coal will continue to play a dominant role in meeting the country's energy requirement. CIL accounted for an estimated 85% of domestic coal production in fiscal 2020. Total production by the company and offtake during the fiscal were 602 and 582 million tonne, respectively (607 and 608 million tonne, respectively, in the previous fiscal). Around 80% of its supplies were to the power sector.

Rich dividends - Coal India is one of the big bank accounts for the Government of India and the company has a dividend yield of 8.5% which beats the Interest rates earned through fixed deposits and Coal India is the highest dividend paying company among the Nifty 50 companies. Even during the times of pandemic the company paid a total dividend accounting to 7000 Crores and During the year 2014 the company paid a whopping dividend of 24,000crs.

Though the stock has given a negative returns of 20% for the past three years, the Dividend income has surpassed the negative returns generated by the falling stock prices.

Diversification into Non Coal Mining Areas – ‘’In 2021, we will try to get Coal India to diversify into non – coal mining related areas. It will make major investments in sectors other than coal mining so that it is well prepared to make the transition away from the fossil fuel,’’ Coal secretary Anil Kumar Jain told PTI.

CIL is also exploring opportunities to diversify into coal to chemical business. This will enable the company to provide value addition and thereby improving financial performance of the company and ensuring long term sustenance.

Coal India is a Cash rich company and its reserves are more than 30,000 crores and with that kind of money the company can foray into any segment but the company plans to make investments in renewable energy, get into aluminum and clean coal technology and other areas

The Challenges

ESG Groups -ESG stands Environmental, Social and Governance Group, Armed with various sets of belief, the ESG group started to classify various Industries as ‘Good’ and ‘Bad’ and you might have guessed right. The have classified it as archetypal climate villain and it is indeed true that the extraction of the Coal is hazardous to the environment and though there are alternatives, the change also takes time to adopt to the greener sources of energy and till then ESG group will continue to haunt the company through one litigation after the other.

High Employee costs – The Employee cost of the company remains at the elevated levels of 41% and which is troubling factor and this cost burn a bigger hole in the pocket of Coal India if the coal production reduces and the major reason for the higher employee cost is due to the pensions given by the company to its retired employees is also something that coal India will have to bear over many years, irrespective of it’s profitability.

Huge Contingent liabilities – Coal India takes coal from digging the earth and there is always a limit for how much you can extract from a particular land but the company went beyond the limit and extracted coal and they didn’t do it in only one mine but they did it with 42 mines and thus the company had to pay a penalty for the doing the deed and which accounted to 13,600 crores only.

Valuations & Other Key metrics

Coal India is available at a Price to Earnings multiple of 7 and the company has one of the highest Return on Capital employed of 73% and the company is virtually debt free. We might not find many companies like these available at a cheaper valuations but then we should also focus on the Ownership of the company.

There is a saying that goes like this “A person who works in a Government company will never invest in the same company” – We all have from time to time heard about the red tapism and the inefficiency of the employees because of lack of accountability.

Source - Screener.in

To have a fair analysis let’s leave the government and have a look at the company. The Balance sheet of the company is solid as the coal it produces and the company has a ample of reserves to fund the future operations without seeking external borrowings. Coal India has also made enough investment for its expansion of operations and the Capital work in Progress stands around 5000 crores.

The valuations are attractive but the growth remains a concern despite the ambiguous targets set by the company. The Monopoly Miner has poor sales track record as the companies 3 years sales growth stood at 5.3% for the last five years and Due to the covid the receivables of the company has increased substantially as the Debtor days increased from 36 days to 54 days.

The company has its own goals but then the promoters of the company has set a different fate for the company. As the government is planning to disinvest its stake in many Public sector enterprises, Coal India was also diluted by the government by decreasing the holding by 13% and this has increased the supply of the share in the open market which is also one of the reasons for the negative returns generated by the company.

Coal in India and Coal India Limited

The journey ahead for the company is going to be full of battles, In one side the company has to wage a war which the big private players and on the other side the company has to armor itself against the Environmental groups and the shift to the greener renewable sources. The company can be a huge turnaround story if they are able to revamp its production and meet its production target and making the government happy.

Can Coal India remain as the Coal King of India in the days of come?

Share your thoughts on the comment section.

share your thoughts

Only registered users can comment. Please register to the website.