Heritage Foods Limited: Strong Distribution Network and Working Capital Management Should Help in Next Leg of Growth

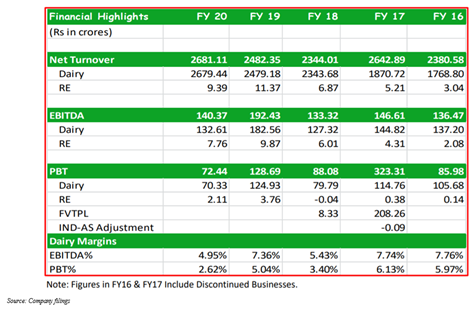

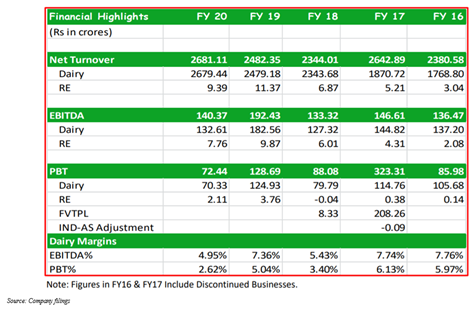

Summary

- Heritage Foods Limited has an extensive presence and is consistently expanding its distribution, enlarging its portfolio and making continuous investments in brand.

- Market position and management of working capital should act as principal growth enablers.

- Strong distribution network should continue to help in product supply. Heritage Foods Limited focuses on penetrating into newer geographies and expanding presence into existing ones so that distribution footprint and product outreach can be increased.

Heritage Foods Limited

Heritage Foods Limited is one of leading and fastest-growing private sector Indian dairy companies. It is serving 15 lakh households. Having a key focus on product innovation, the company has developed a strong portfolio of milk and value-added products such as curd, ice cream, frozen dessert, paneer, butter milk, flavoured milk, lassi, A2 milk and milk powders under Heritage brand. The company’s capabilities include state-of-the-art milk processing facilities, R&D infrastructure having technologically-advanced equipment and testing laboratories and stringent quality control. Heritage Foods Limited has two business divisions - Dairy and Renewable Energy.

Growth Enablers of Heritage Foods Limited:

- Strong Relationships Lent Support in 3Q21: Heritage Foods Limited released its 3Q21 results and also highlighted its financial and key strengths. The company is having strong relationships with 3 lakh+ dairy farmers. It is also having high return on capital employed and high operational efficiency in terms of working capital cycle. The company managed impact of COVID-19 quite well. Since lockdown, it procured milk from all farmers and it ensured uninterrupted supplies to consumers. In 3Q21, profit of the company was INR2,564.73 lakhs on total income of INR58,967.44 lakhs.

- First Line of Products: Heritage Novandie Foods Private Limited announced its entry in Indian market with first line of products. There will be introduction of french yoghurt recipes for Indian market through a yoghurt brand – Mamie Yova. During initial phase, brand will be available across 5 cities in India. These cities are Mumbai, Pune, Surat, Ahmedabad, and Baroda. Plans are there to scale up to Hyderabad and Bangalore soon. Heritage Novandie Foods Private Limited is a joint venture between Heritage Foods Limited and Novandie Foods. Along with launch of 2 unique ranges of products, this brand takes a unique digital approach to replicate in-person experience for consumers. Using augmented reality based connected packaging, Mamie Yova makes way to phones and to lives of their audience. This should help overcome challenges of physical distancing which we need to follow currently.

- India- A Growing Market: India has been transformed from a country of acute milk shortage to world’s leading milk producer. Tide has turned for India only in past few decades. Growing consumer preference for branded and value-added milk and milk products, and increased awareness of nutrition should act as growth enablers in India. While demand for liquid milk lends support to Indian dairy industry, value-added products hold more potential and promise growth in corridor of 15%-20%. Growth is widely supported by value-added products including UHT milk, cheese, ice-creams, flavoured milk, curd and butter milk, among others.

- Improved Financial Risk Profile: The company has seen its financial risk profile getting improved as a result of prepayment of term debt and improvement in operating performance. Heritage Foods Limited sold its entire stake in Future Retail Ltd and Praxis Home Retail Ltd. Proceeds from selling is utilised for long-term debt reduction. The company has seen an improvement in operating performance. Though operating margin may moderate with rise in milk procurement prices, financial risk profile should be strong. This is principally because cash accrual should be enough to fund incremental capital expenditure and working capital requirement. Heritage group has an established market position in dairy business and it also has a strong distribution network. With significant market share in Andhra Pradesh, Telangana, Karnataka and Tamil Nadu, Heritage Foods Limited is counted as one of largest private dairies in South India. Liquidity should remain healthy. Significant reduction of debt has been seen which should help in improving its credit risk profile.

- Heritage Foods Should Capitalise on Industry Dynamics: Agriculture is primary source of livelihood for about 58% of this country’s population. Indian food industry should see strong growth, increasing contribution to world food trade every year because of immense potential for value addition, principally within food processing industry. Indian food and grocery market is world’s sixth largest and retail contributes 70% of sales. Indian food processing industry makes up 32% of India’s total food market, one of largest industries in this country and ranks fifth in terms of production, consumption, export and future growth. Agriculture sector in India should be able to see growth in next few years because of increased investment in agricultural infrastructure like irrigation facilities, warehousing and cold storage. Growth in demand and population should help in achieving growth in Indian dairy market. Significant population is in dairy production, making a source of income for rural population. Government plans to triple food processing sector capacity in India from current 10% of agriculture produce and has also committed INR6,000 crore as investments for mega food parks in this country. Indian government allowed 100% FDI in marketing of food products and in food product e-commerce under automatic route. Indian government has taken several initiatives to help dairy industry and to improve production capacity. With stagnation in world dairy prices, Indian dairy industry’s emphasis has been on achieving greater cost efficiencies. This industry focuses on improving quality of products so that premium price can be achieved in world market and reliance on government can be reduced. Milk consumption in India should see an increase than any other country and this consumption growth should stem from growth in population and income and urbanization. Inspite of lower per capita income, country’s demand for milk at 48.8 million metric tons overshadows demand in other parts of world.

- Focus on Increasing Footprints Should Help Achieve Desired Growth: The company is having an extensive presence and is consistently expanding distribution, enlarging its portfolio and is making continuous investments in brand. Apart from deeper penetration into existing territories, the company works on increasing footprint in high milk producing and consuming states. So, while milk procurement is done in Haryana and Rajasthan, selling of products is taking place in Uttarakhand, Haryana, Rajasthan, Uttar Pradesh and Delhi NCR. Initiatives to expand presence to states beyond southern and western parts of India are also on cards.

- Strong Capabilities: The company is expanding milk processing capacity and is improving research & development infrastructure with technologically advanced equipment and testing laboratories. It focuses on maintaining stringent quality control, apart from enhancing product innovation. Optimising management of supply chain with development of customised processes and systems is another focus area of Heritage Foods Limited. Integration of modern technology across all verticals should help in procurement and distribution capabilities and better management of inventory. Aim is to reduce costs and achieve better operational efficiency.

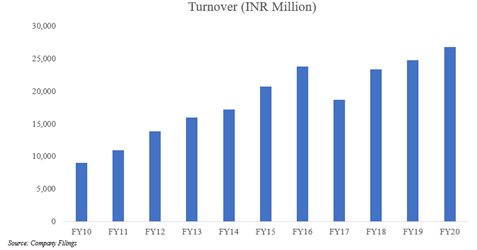

Strong Outlook Means Going Long on Heritage Foods Limited

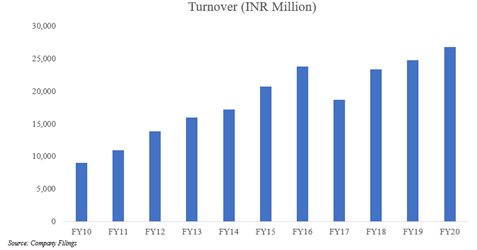

Heritage Foods Limited has a total market cap of INR1,59,145.14 lakhs and free float market cap of INR77,355.91 lakhs. The company has compounded its turnover at ~12% over FY10-FY20. Rising awareness and preference for healthier and nutritious alternatives stemmed increased demand for value-added dairy products. Heritage Foods Limited focuses on expanding portfolio of value-added products including curd, buttermilk, flavoured milk and paneer etc. so that evolving consumer aspirations can be taken care of. This should result in increased growth potential and improved margins.

Dairy industry offers a range of opportunities. These opportunities stem from population growth and urbanization, changes in dietary patterns and demand growth for value-added milk products. The company should be able to capitalise on rising opportunities and create innovative products, addressing diverse consumer requirements. Focus is on enhancing presence in high milk producing and consuming states, extension of distribution network and enhancement of production of value-added products. Investment on marketing and advertising should help the company deepen its brand engagement. Automation in operations should strengthen supply chain and improve processes. Milk procurement system of Heritage Foods Limited comprises 3 lakh+ farmers, spanning from 8 states across India. Milk procurement at remunerative prices, timely payments and programmes targeting improved milk production helped the company maintain strong relationships with farmer community. Judicious investments in village-level milk collection infrastructure, bulk coolers and chilling centres and processing capacity should help the company in scaling milk procurement levels.

Conclusion

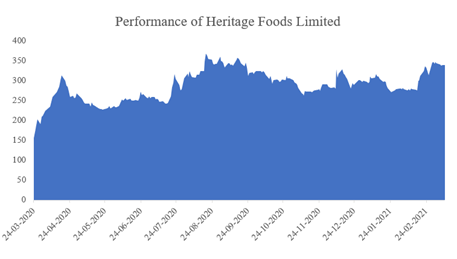

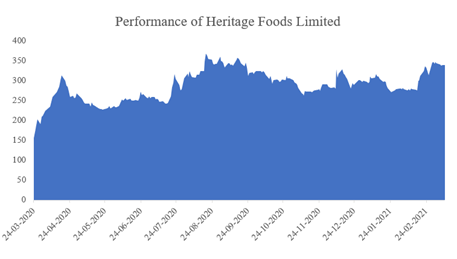

Heritage Foods Limited has delivered a strong return of ~119% between Mar 24, 2020 and Mar 12, 2021, outpacing returns generated by NIFTY50. Between Mar 24, 2020 and Mar 12, 2021, NIFTY50 delivered a return of only ~93%. Sound supply chain management, efficient management of procurement and sales, financial strength and strong distribution network have all contributed to this rise in share price.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.