Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINA bank is responsible for the growth of the nation as it involves in lot of things like accepting the money from the people who want to save and lend the money to the people who need it and many other services which has propelled the growth of the nation but then there is Non – Banking Finance Companies (NBFC) who are the unsung heroes of our nation who have contributed a lot for the country by stimulating consumption.

NBFC’s are certain type of Banking Institutions who perform certain Banking functions but without a Banking License. These are institutions which cater to the customers that have largely been ignored by the mainstream banking institutions namely the people who have lower incomes to the people who come from places that we have no idea that existed before. NBFC’s has helped a lot of unfortunate people who have no access to the organized banks.

Remember that India is a land of Villages, 90% of the Indian population lives in the Rural India The NBFC industry in India has seen promising growth in the previous few years on account of the rapid economic progress. The industry not only aids the financial inclusion of millions of people living in rural India but has also been instrumental in increasing the GDP contribution of lower and middle-income households and MSMEs.

Today we are going to see about one of the company which not only had uplifted the lives of Millions of customers but also made its investors a Millionaires

About Bajaj Finance

Bajaj Finance started its journey in 1987 to advance loans to the people who purchases 2 and 3 wheelers under the entity ‘’Bajaj Auto Finance”. From being started its journey for financing the vehicles, it has emerged as the India’s largest retail lender with more than 14000 crores of Assets Under Management (AUM). It was only in 2008 that the company started diversifying its lending portfolio and now it has a wide range of products and keeps on adding new products as and when an opportunity comes. The company also operates in the Housing Finance and Broking and Depositary through its subsidiaries.

How did a company managed to create this much wealth in a short span of time???

The company did many things at the right way but then most of its success can be contributed for its understanding of the Middle class people in India. Bajaj Finance pioneered the concept of Zero Cost EMI in the Indian Market which enabled the company to capture the huge pie of the thriving Indian Consumers.

Bajaj Fin has a customer franchise of 44M, out of which it filters 23M customers for cross-selling its products. Giving ‘zero-cost’ EMI has been a good customer acquisition method. Even on this ‘zero-cost’ EMI, it can earns an Internal Rate of return (IRR) of 15+%.

How does Zero cost EMI works and What’s the catch here for the companies ?

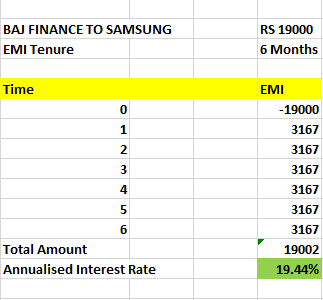

I was looking at a Samsung mobile worth 20,000 on Amazon and as I moved to pay, I received an option for paying the same across 6 Installments. 6 EMI’S of 3333. No Interest rate or No Processing fee and it wasn’t a Gimmick. The next thought that I had in my mind was ‘’There is something fishy happening here’’, Why would someone offer me Installments and that too without any Interest rates or Processing fee and then I realized that it was more of a sales than the Finance.

So Bascially, there are three Entities Involved here. The Platform (Amazon) , Mobile Brand (Samsung) , and the Finance Company ( Bajaj Finance). Imagine you are an employee or a student who has less income and spending 20,000 may not be possible for all of us. But All of us are comfortable paying a premium of 3333 a month for the next six months, we have got the best deal right? Amazon gets a commission and Samsung gets to sell more of its Produce.

But what is in it for Bajaj Finance??? How will it get compensated for the huge credit risk?For starters, First Samasung will cut a deal with Bajaj and give them a 5% Discount, that is Bajaj Finance will pay 19000 to Samsung and receive 20000 from the customers. But then Bajaj Finance doesn’t make the big money only through the commission.

Here comes the Cash flow, As month passes by the Bajaj Receives EMIs, and the outstanding amount decreases every month and so does the Interest on it. It deploys the received EMIs for another funding which enables them to make more money and through which the company earns an Annualized return of 19% per month and this has been the hidden weapon of Bajaj Finance.

The Moat analysis of Bajaj Finance:

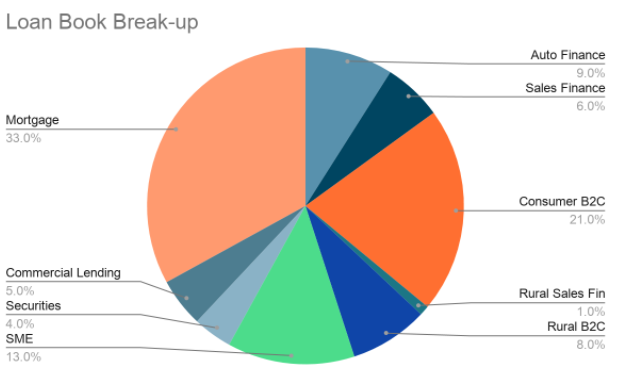

Well Diversified Loan book

BFL survived the Covid crisis aided by a diversified product mix, robust volume growth, prudent liability management, efficient operating costs and effective risk management. With a standalone AUM of H 116,102 crore and a consolidated AUM of H 147,153 crore, the Company has emerged as one of the leading diversified NBFC in the country today

The AUM consisted primarily of personal and consumer durables loans (35%), mortgages (loans against property [LAP] and home loans including LRD; 13%), SME loans and vendor financing (21%), two- and three-wheeler financing (12%), rural financing (12%), loan against securities (5%) and others (2%). While the group has been reporting strong growth in the AUM over the past five years, growing at a CAGR of 27%, the current weak macro-economic environment is expected to impact the growth in the near term. Nevertheless, over the medium term, the company is expected to continue to outpace the industry.

The company has a PAN India presence with 2,392 locations across the country, including 1,357 locations in rural/smaller towns and villages, BFL focuses on six broad categories: (i) consumer lending, (ii) SME lending, (iii) commercial lending, (iv) rural lending, (v) deposits and (vi) partnerships and services

Lower costs of funds

A companies profitability increases when it can access the raw material at a cheaper price and Bajaj Finance has been doing that exactly for years. Generally, A Nbfc has to borrow at a higher Interest rate from the Banks or from the Money Market which increases the cost of funds which lead to high lending rates but then Bajaj Finance has their edge as they enjoy high retail deposits because of which Bajaj Finance has one of the lowest cost of Funds among NBFC’s at 8.04

Bajaj group has also demonstrated the ability to raise capital at regular intervals to keep the gearing metrics under control. Over the past five fiscals, the group has raised Rs 14,908 crores of equity which has significantly increased the net worth of the company with the recent capital raise being of around Rs 8500 crores in November 2019. This has helped the company to provide loans at a cheaper rate of interest and lower Interest will attract the best of the Borrowers.

Resilient performance has supported a Healthy earnings profile

Bajaj Finance reported 5264 crores as Net profit for the year FY – 20, which is a impeccable given the crisis. It has best-in-class people running great businesses; it has excellent systems and processes; it has developed outstanding risk metrics; and it has shown nimbleness in adapting to changed circumstances. Therefore, despite COVID-19, and the results are a solid proof that the company has done well even during the times of crisis.

The company had an overall credit cost estimate of Rs 6000-6300 crore for fiscal 2021, which has been revised to Rs 5,925-5,975 crore currently, with additional provisioning requirement of about Rs 1200-1250 crore in the current fiscal. Further, the company had also done interest reversal of Rs 811 crore in the first 9 months of current fiscal. Nevertheless, earnings profile is supported by higher fee income and comfortable net interest margins. Additionally, the company has increased efforts to diversify earnings by focusing on various fee-based income avenues, such as existing member identification cards, co-branded credit card and third-party product distribution.

Nevertheless, earnings remain susceptible to high credit costs, especially during continued macroeconomic stress, despite the conservative provisioning policy. While Bajaj Finance's profitability may moderate as the proportion of mortgage loans increases under its housing finance subsidiary, it is expected to remain better than that of peers over the medium term.

Strong Balance sheet

The business of Lending is very risky as there is always of probability of Non – repayment and thus lenders have to be cautious because of the high leverage nature of the Industry. A small Asset quality issues can become a big trouble for the company. The company had 8% of its Loan Book under Moratorium which is roughly around 10,800 crores.

The Loan book of the company remains well diversified which acts a cushion and there is less probability of a huge increase in Non Performing assets. And with the moratorium coming to an End we can expect a stress in the loan book of the company in the coming days. The company is one Amongst the largest new loan acquirers in India (6.04 MM in Q3 FY21)

The Challenges

The Avalanche of NPA’s post covid

The company has said that the Two – thirds of the costumers have opted for moratorium. Even the people with the most impeccable track record have opted for the Moratorium. Expectations of elevated default on timely payment of instalments and collection related constraints are likely to result in higher credit costs than witnessed hitherto. BFL has committed requisite investment to deepen its collections infrastructure to control its credit costs. Based on early indicators of moratorium and delayed payment metrics observed in April 2020, the Company has made a contingency provision of 900 crore for COVID-19 in FY2020. The loan provision has rose 63% over the year, while the company also provided a one time restructuring to loans worth 2040 crore

Though the stock Markets have been soaring high the real impact of the Covid on the Financial institution is still unknown. With the moratorium coming to an end, the stress in the book of Bajaj Finance will begin to show. Its SMA-2 book has risen from Rs.3000crs last year to Rs.11000cr in Sep’20. Segments like 2 & 3 wheeler finance have 25% of its book in SMA-2.

The major issue that Bajaj Finance will face down the road will be the hardship in assessing the borrowers cash flow after a such economic disruption will pose as a huge threat for the company despite its higher advancement in the technologies.

Let’s Talk some Numbers

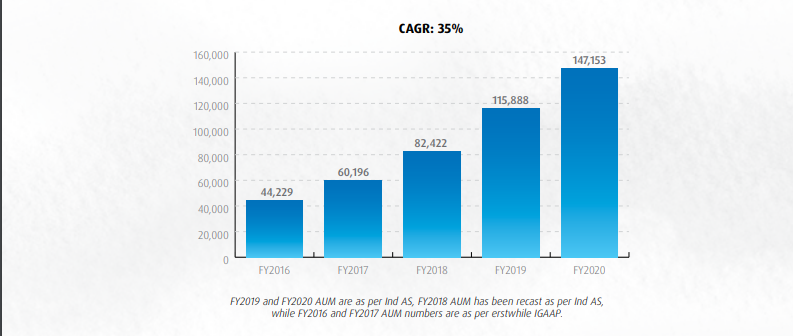

Bajaj Finance is one of the bluest of the blue chip and it is one of the darling stock for many of the Investors. The company has grown faster and especially at a consistent pace. The companies Assets Under Management has grown at a CAGR of 35% over the past three years.

When it comes to financial Institution the Non performing assets is more crucial than the profits of the company. Generally, The NPA’s tend to rise as the AUM increases but Bajaj Finance is always known for beating the odds. Bajaj Finance consolidated net NPA at 0.65% was among the lowest across all NBFCs. BFL is well capitalised with a capital-to-risk weighted asset ratio (CRAR) of 25.01% as at 31 March 2020. It remains one of the most capitalised among large NBFCs in India. During the year, it also raised equity capital of 8,500 crore through the QIP route.

The companies borrowings stood at 129,806 as on 31st Mar 2020, The company has a prudent Asset Liability management. with a strategy of raising long-term borrowings and maintaining a judicious mix of borrowings between banks, money markets, external commercial borrowings and deposits.

Bottom Line.

Bajaj Finance was indeed an undisputed market leader in its segment and an impeccable growth story but the future holds lots of uncertainties under its sleeve. Covid – 19 is not the first and it will mot be the last either. But then looking at how the company has tackled crisis like IL& FS fall and the Demonetisation, we can strongly believe that the company can tide through the uncertainties that lie ahead. ‘’In the unprecedented times, the company is focussed on capital preservation, balance sheet protection and operating expenses management’’, said Bajaj Finance in the Investor presentation. The companies motive only got stronger as the company’s now focused to get back to pre- COVID-19 growth rates.

Will Bajaj Finance rise as a phoenix or is it an another victim of the Covid – 19. Let us know your thoughts in the comment section :)

share your thoughts

Only registered users can comment. Please register to the website.