Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINOverview of the company

EPL Limited (formerly known as Essel Propack Limited) is presently a global manufacturer of Laminated Plastic Tubes and Laminates. Its products are extensively used in the packaging of products across categories such as Beauty & Cosmetics, Pharma & Health, Foods, Home and Oral care and Home. The journey at the year 1982 when the company introduced Laminated tubes in India for the very first time and the company have witnessed exponential growth from its inception and has earned the credibility and respect across the globe.

The company was acquired by the Blackstone group on Aug – 2019 from the Essel group of companies. The Blackstone Group is one of the leading investment firms in the world with an AUM of around USD 511 billion across sectors like private equity, real estate, hedge fund solutions and credit businesses. The Group also has an exposure in the packaging industry through acquisition of varied companies such as the USA based Graham Packaging, Owens-Illinois Inc, Ohio and China based packaging firm ShyaHsin.

The packaging Industry – The Global packaging Industry is worth 289 billion dollars and is set to grow at a 7% CAGR for the next five years.The boom in the global packaging sector hinges on both the growth in the global economy as well as the performance of the diverse range of industries that this sector caters to – pharmaceuticals, food and beverages, cosmetics, and other consumer goods. Additionally, thanks to the exponentially emerging E – commerce sector and rising demand for packaged foods have a direct bearing on the packaging sector. However, the sector has also become more competitive because of the emergence of more manufacturers in the Industry.

THE COMPETITIVE EDGE OF EPL

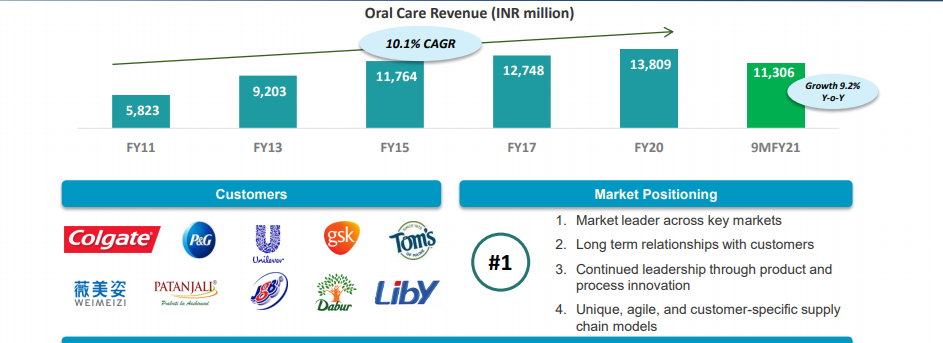

Global leadership in Oral care segment – I am not sure whether your tooth paste contains salt or not but I am confident that your tooth paste tube might be manufactured by EPL. Every one in three Toothpaste pack globally is manufactured by EPL, whether it be your Colgate or Patanjali. As the company claims the Global leadership in the laminated tubes packaging and they are also the number one global speciality packaging company. It has established strong relationships with reputed multi-national and Indian clients such as P&G, Colgate, Unilever, GSK, Reckitt Benckiser, Johnson & Johnson, Dabur, Emami, Himalaya, Patanjali and many more. Their strong relationship with its customer has helped to maintains its leading market share and to face the competition from the unorganised players.

*Source – Investor Presentation

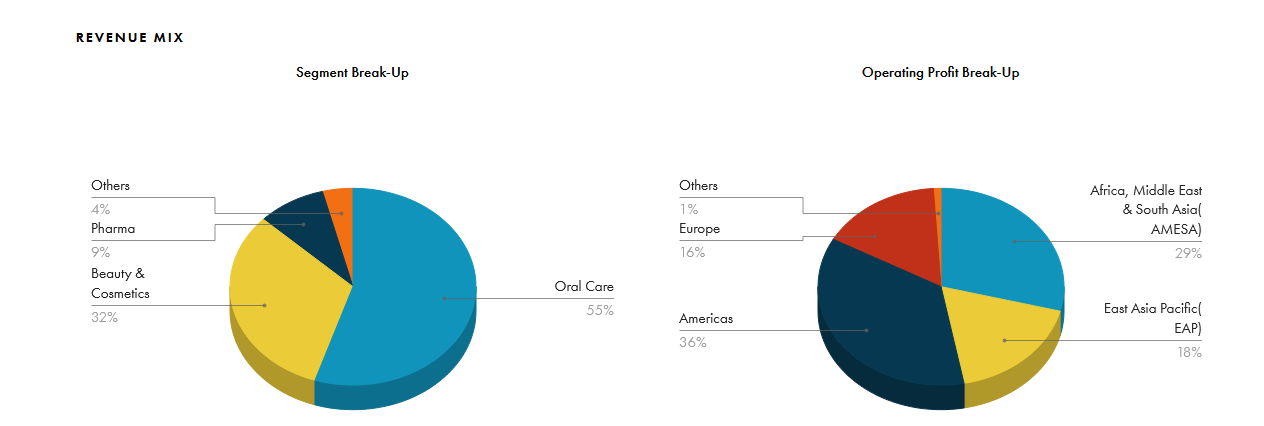

Geographically Diversified Revenue base - EPL’s 20 state of the art facilities in eleven countries are classified into four geographical segments viz. Americas (USA, Mexico and Colombia), Europe (UK, Germany, Poland and Russia), AMESA (Africa, Middle East & South Asia with operations in Egypt and India) and EAP-East Asia Pacific (with operations in China and Philippines). Sales remain well diversified across the geographical segments. Such globally diversified presence assists EPL to mitigate the geopolitical and macroeconomic risks emanating from specific region/country.

A Strong Management team – A strong management will help the company to transcend the tough times ahead. After being acquired by the Blackstone group, the company have gone through a revamp of the Management team.

Strengthened management team, Board, and advisor network

• Sudhanshu Vats (ex-Viacom18, Unilever) hired as Managing Director and CEO

• Parag Shah (ex-Unilever, Nike) hired as CFO

• New board constituted with fit-for-purpose professionals

• Deep engagement of Blackstone’s global advisor network

The company have showed resilience in the business performance despite the challenges faced it faced in the context of Covid – 19. The company proactively worked with the regulatory authorities to classify EPL in the essential category and thus most of the plants were actively functional during the lockdown thus resulting in a 18% increase in PAT despite the crisis.

Creativity and Innovation – Research and development have been one of the key drivers of the growth of the company and the company believes that the Innovation is the only way ahead and the company have been true to its words as EPL becomes the first in the industry to obtain the certification from the Association of Plastics Recycler (APR, USA) for a 100% recyclable laminate, christened as Platina. Sustainability is a goal of all global majors in the FMCG and pharma industry. EPL has also taken various initiatives and worked closely with customers to identify their requirements. At end-FY20, the company had filed 154 patent applications, of which 59 patents were granted. They have also launched sanitizers in tube forms which are widely accepted across globe. EPL on boarded 50 new customers across globe for the said product. Through focusing on proper Innovation, the company is able to gauge the consumer preference and launching products accordingly.

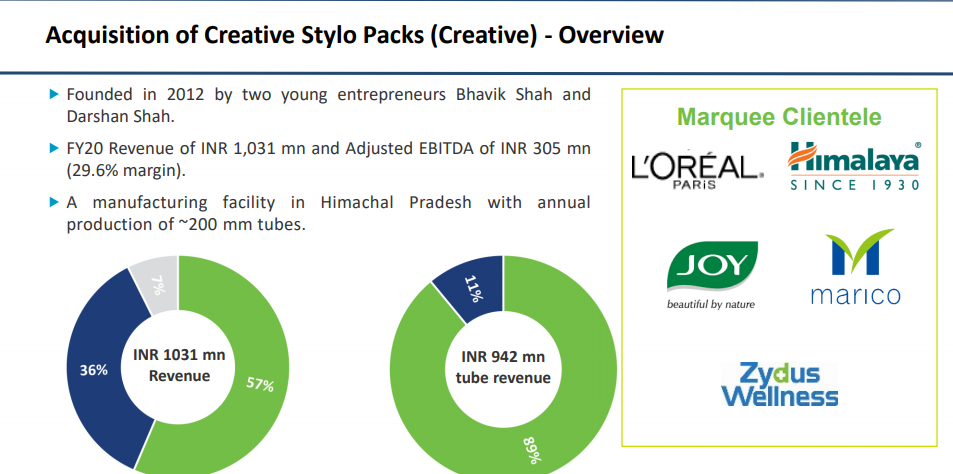

Strategic Acquisitions- Beauty and Cosmetic is one of the Personal care segment which is growing at a significant pace and the Company forayed into the segment by Acquiring Creative stylo packs Pvt ltd. The Acquisition of the company have enabled EPL to enrich its Product portfolio.

*Source – Investor Presentation

About Creative Stylo Packs

The company Acquired Stylo packs for 2.5billion rupees. The company is engaged in the business of plastic tubes, laminated tubes and corrugated boxes for the Beauty & Cosmetics and Pharma industry with marquee clients such as L’Oreal, Marico, Zydus and many more. The company derives 80 – 85% of the revenue from the Cosmetic segment and the remaining is from the Pharmaceutical Industry

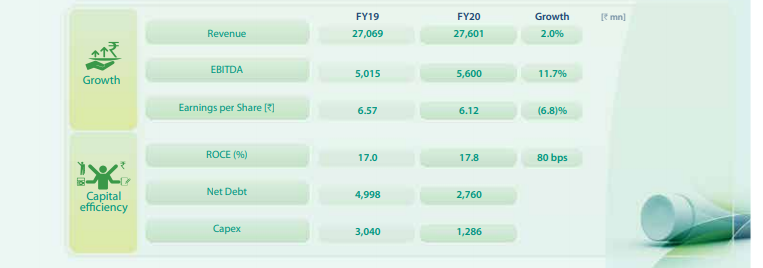

Valuation and other Key metrics – EPL is currently trading with Price to earning Multiple of 26, trading 36% below its 52-week high price of 319. The company has a decent dividend yield of 1.59%

*Source – Annual report

The company has a healthy financial metric with a Net Debt of 2760cr and the debt to equity stands at 0.33%. The company have also maintained and sustained a strong Operational and Financial performance. After the Acquisition by Blackstone Group implemented cost optimization and productivity improvement measures that resulted in improved profitability. The company’s PBILDT margins improved to 20.45% in FY20 compared to 19.19% in previous year.

The company is also maintaining a strong liquidity with cash and cash equivalents at 260cr.The reserves stands at 1548cr as on Sep 2020. The acquisition of the controlling stake by Blackstone Group has improved financial flexibility of the company owing to superior financial strength of the group.

The challenges – EPL has its own sets of Challenges and risk in the business and the major risk is its volatility in its key raw material which is polymer granules a derivative of the crude oil and is highly sensitive to the price of crude oil and thus any increase might impact the operating margin of the company. EPL mitigates this risk by engaging in the long term contract with its customers thus escalating the raw material costs. Oral care segment contributed 55% of the Total revenue, thus making it as a single product dependency and the strength of the company is tampered by the limited pricing flexibility in the Oral care segment. The sales growth of the company remains as a major concern as the company have delivered a poor sales growth of 3.53% over the past 5 years.

The Road Ahead – Oscar Wilde said “The answers are all out there, we just need to ask the right questions”- The answer that I give is that with a strong management and an established business the company is well poised to tackle the uncertainties that the future behold. Given the phenomenal growth potential in the Packaging industry the company is well positioned to take advantage of this growth factor. With a solid Fundamentals and a resilient team the company is starting to shift gears for a New growth era and will continue its journey of leading the pack.

share your thoughts

Only registered users can comment. Please register to the website.