Think Fixed Deposits Are Better Than Equity Investments? Well, Think Again!

Summary

- Equity investments can result in a hedge against inflation while fixed-income instruments can hardly beat inflation

- Several options are available in equity investments like equity mutual funds, direct equity, etc.

- Investment in equity mutual funds result in professional management of capital and diversification

Investments have their own risks and opportunities and both should be evaluated before investing hard-earned money. Several asset classes are available in market place and rationality lies in achieving a balance between risks and opportunities. There are different asset classes for different age categories. While assessment of risks remains an important task, idea behind investing should be that returns generated should be able to beat inflation. Surprisingly, not all investments are able to achieve this milestone.

Following are key points and different investment options available:

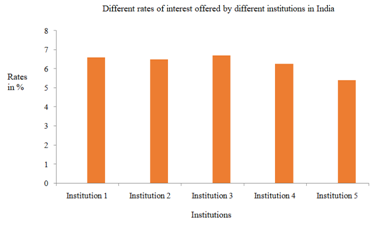

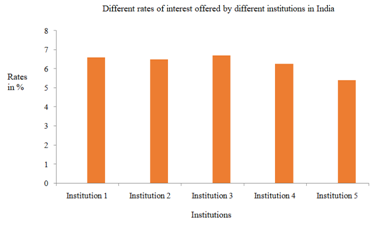

- Investing in Fixed Deposits: While there are several new investment opportunities, some investors prefer going for fixed deposits or post office saving scheme. Interest rates on fixed deposits vary on factors including economic conditions and policies of government. One principal reason why investors prefer investing in fixed deposits is that it offers a fixed rate of interest. One should think it through. Though this instrument is offering a fixed rate, is it beating inflation rate? If not, are there any other investment opportunities providing inflation-proof return? Most investors think that investing in fixed deposits is simple and involves less paperwork compared to investing in equity markets. Most people think that investing in equity is a highly intellectual game and it needs high IQ. You’d be surprised to know that it’s actually otherwise. Successful investing needs very less intelligence. Why should you not consider those asset classes that can actually deliver inflation-proof return? Given inflation rate in India, there is a high probability that investing in fixed deposits might lead to losses.

These rates are taken only for explaining context and are not related to a particular institution.

- Investing in Equity: Clearly, some investors prefer investing in fixed deposits due to its minimal risk. Investing in fixed deposits has a major disadvantage of low liquidity. Though investing in equity is also risky, but it can be minimized by what we call “diversification.” If you are a young investor, investing in equity is a perfect option for you. Sole reason for this is that you’d be having higher risk appetite compared to an investor nearing retirement. Apart from higher risk appetite, you can also focus on wealth creation by diversifying capital and choosing appropriate mix of asset classes. When we say equity investing, we have several options like direct equity, ETFs, mutual funds, etc. Over long-term, no asset class can match up returns given by equity. Even investing in equity mutual funds can deliver better returns in comparison to fixed deposits. These mutual funds provide benefits like professional management, benefits of diversification, etc.

Options Available in Fixed-Income Instruments: When we say investing in fixed-income instruments, there are several options available in today’s time. Fixed deposit is just one of several options available in marketplace. Some other options people are investing in are Post office recurring deposit, post-office monthly income scheme, public provident fund, government bonds, national savings certificate, etc. These options are available for almost every individual, but investments in these instruments are generally done by people nearing retirement. Another point because of which modern day investors avoid making investments in these products is that these investment options offer returns lower than equity investments.

It is a well-appreciated thought that importance of savings is realized during time of need and that’s when we regret our decision of ignoring value of savings and investments. Savings which are done at right time should deliver returns beating inflation by a wide margin. If efficient practices for financial management are followed and people learn value of investing, wealth can actually be created without investing in these fixed income instruments.

Options in Equity Investments: People do equity investments so that they can generate inflation-proof return over long-term and can create wealth for retirement purposes. Principal benefit of equity investment is probability of an increase in initial amount invested. While benefit of capital gains is something one can’t ignore, equity investments can also end up delivering dividends.

Some people even call investing in equity as a hedge against inflation. If one decides to invest in blue-chip dividend paying companies, it can result in additional cash flows. Options available in equity investments include equity mutual funds, exchange-traded funds, direct equity, etc.

- Equity Mutual Funds: Investing in equity instruments through mutual funds is one of simplest forms of investments. By doing this, one is in advantageous position by diversification and distribution of risk. Some people believe in taking professional help for investments. Investing in mutual fund takes care of that need also. Buying a mutual fund charges a certain amount of fee which is known as management fee. Simply put, this is a fee a mutual fund investor pays to hire professional manager for managing his funds. Mutual funds give an option to invest their dividends back, which allows their investment to grow further. Some people prefer taking dividend payout option, in which dividend is credited to investor and not re-invested. Diversification principally focuses on reducing risks related to investment as mutual funds invest in a variety of stocks. According to risk profile, investors can choose to invest in mutual fund scheme. Mutual funds are accessible to all and one can invest even a small amount which is better as some stocks are expensive and inaccessible.

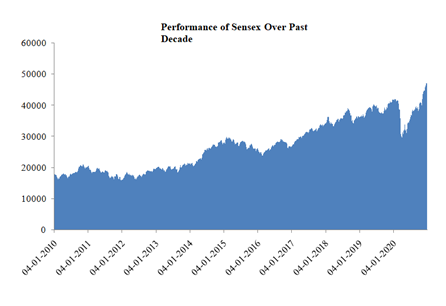

- Direct Equity: Direct equity is sometimes considered risky as compared to mutual funds as diversification level is not matched most of the time. Most investors diversify their portfolio by investing in variety of different stocks, reducing their exposure to one particular stock. Though direct equity is a bit risky, but it comes with high returns as compared to mutual funds in some cases. When investing in direct equity, one should be capable of balancing risk and return so that risk can be eliminated or atleast minimized. For example, over last decade, stock of Asian paints has delivered a return of ~1578.3%. This means that INR1,00,000 invested on January 4, 2010 would have become INR16,78,313.91 on December 30, 2020.

- Exchange-traded Funds: An exchange-traded fund is like a common stock and it trades on a stock exchange. Units of an ETF are bought and sold with help of registered broker. NAV of an exchange-traded fund varies according to market movements. Mostly, exchange-traded funds track indexes and this investment fund believes in holding assets like commodities, foreign currency, stocks, etc.

Mutual Funds Are Considered As an Alternative for Direct Equity

In direct equity, investors directly invest their funds into stocks through their demat accounts. While through this method investors have complete control over their funds, it also increases level of risk. Sometimes direct equity has proved better than investing in mutual funds because with higher risk, comes higher returns. Investors have to be cautious if they choose to invest directly into equity. Investing through mutual funds has proved effective in recent years principally because of diversification. Level of risk reduces as capital gets diversified across stocks in a particular scheme. So if a bunch of stocks are not performing, some stocks are there making up for losses. This helps in improving overall performance of a particular fund. Apart from risk diversification, investors can also enjoy professional management of capital. Investing into mutual funds does not require any professional knowledge about securities market as your capital will be taken care by a group of professional people. Some mutual funds have performed better than fixed deposits or any fixed-income instruments and they have delivered inflation-proof returns.

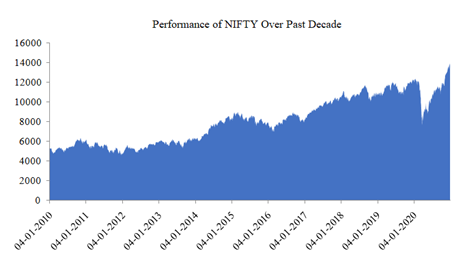

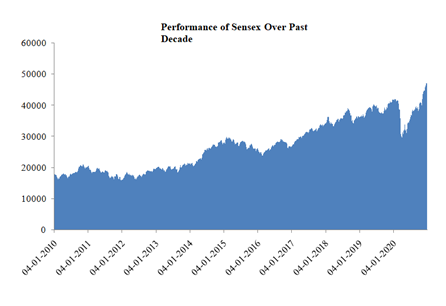

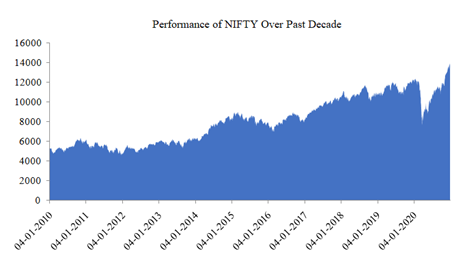

Schemes of mutual funds have a particular benchmark and all schemes have a target of exceeding returns delivered by a benchmark. Some mutual funds track NIFTY50 index on which one can safely place their bets. Over FY10-FY20, NIFTY50 delivered ~167.2%. If one would have invested INR1,00,000 on January 4, 2010, it would have become INR2,67,228.9 by December 30, 2020. On other hand, if INR1,00,000 was invested in a fixed deposit at a rate of 8% in FY10, it would have only become INR220,804. Such a huge difference is something one can't ignore.

Preferably, a beginner should invest into mutual funds rather than investing into direct equity. After gaining some experience of stock markets, one should work his way up and then try to go for direct equity.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.