Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINOverview of the company:

“In a free enterprise, the community is not just another stakeholder in the business, but is in fact the very purpose of its existence.”- JAMSETJI TATA

Incorporated by the founder of the Tata Group, Jamsetji Tata, the Company opened its first hotel - The Taj Mahal Palace, in Bombay in 1903 with a rich legacy of establishing the First licensed bar in India to bringing in Jazz and Cabaret to India. Now the company is a part of the Tata group conglomerate which owns more than 100 plus companies and has a 113$ Billion revenues. Indian Hotels has 116 years of experience in the Hotel business is hailed as the South Asia’s largest hospitality company by Market capitalization.

*Source – Annual Report

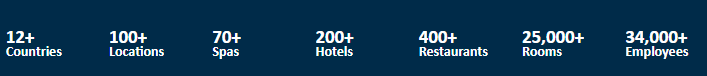

IHCL has taken the Indian hospitality to the global map, they currently operate in more than 12 countries and have been reinventing hospitality by evolving from a hotel-only business to a comprehensive hospitality ecosystem. The company owns several iconic hotels which includes TAJ, Ginger, Vivanta, Seleqtions and several other brands. The brand TAJ has been hailed as the strongest Brand in India for the year 2020 by Brand Finance.

Hospitality and the Pandemic: The year 2020 was like no other year in our memory and with everyone indoors the hospitality sector witnessed one of the worst recessions after the Great Depression. At the end of the year 2020, it was estimated that there was a loss 5.5 trillion dollars to the Travel and Hospitality sector. As India went for a Lockdown there was an unprecedented loss for the Hospitality sector as the Hotel occupancy rate fell 75%.

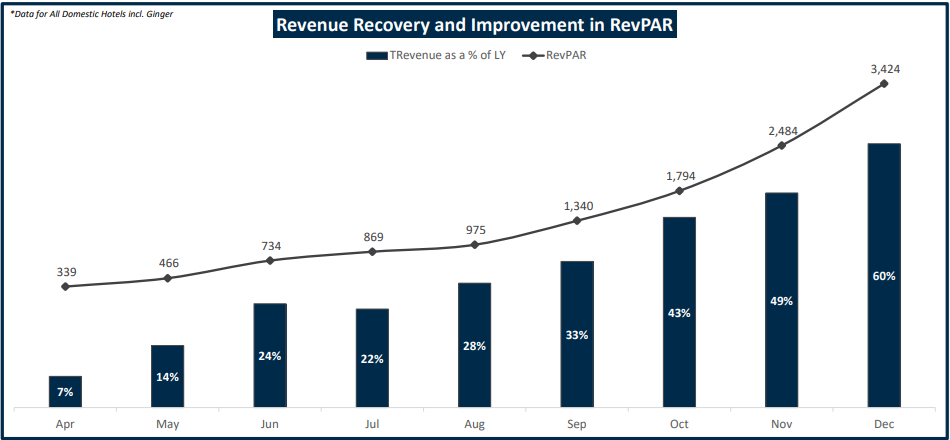

A ‘V’ shaped recovery: The worst is over and the best is yet to come for the Hotel Industry, the air traffic has been going up in the recent days and there has been a huge surge in the domestic tourism and we would witness a revenge tourism which would help the industry to gain its lost charm.

RevPAR – Revenue Per Available Room

There has been a consistent improvement in the room bookings which has led to a significant increase in the Revenue Per Available room. Every crisis brings with it an opportunity and Thanks to the Pandemic, there has been a huge shift in the preference of the Indian customers to change into the Branded hotels than the local ones and the well-established Brand portfolio of the Indian Hotels will gain from the change in the equation.

Why Indian Hotels?

TAJNESS vs PEERS – IHCL, over the past 115 years have been maintain its leadership position in most of the segments it operates in and TAJ – A iconic hallmark of the Indian Hospitality has 113 years of legacy which can’t be compared. IHCL has successfully built for itself an unrivalled reputation and an irrefutable leadership. At the core of it, is the sense of service with a touch of warmth. This strong foundation of IHCL, rooted in Indian hospitality and expressed through authentic experiences has uniquely established us as South Asia’s largest hospitality-focussed company.

Strong Brand Portfolio – From a ‘Branded house’ to ‘House of Brands’ IHCL owns several iconic hotels which includes TAJ, Vivanta, Ginger, Seleqtions, Expressions and several other brands. In total the company has 22 subsidiaries, 6 associates and 8 Joint ventures. The brand TAJ has been hailed as the strongest Brand in India for the year 2020 by Brand Finance. IHCL’s brands enjoy the tremendous trust of its patrons, guests as well as the neighbourhoods in which it operates its hotels and with a powerful portfolio of compelling propositions, optimise opportunities in hospitality across different customers and landscapes. The company through its various brand caters to different consumer segment with a in depth expertise across various business models.

Healthy Revenue mix – The room revenue constitutes 45 percentage of the revenue which is also the highest provides the highest margin for the company. A drop in GST slab rates for accommodations priced above ₹7,500 from 28% to 18% also assisted IHCL in improving room demand. The Food and Beverages (F & B) contributed 40 percentage of the revenue and is backed by the strength of IHCL’s banqueting business. The Company has always been a pioneer in F&B in India, being the first to introduce new cuisines and the remaining 15 percentage from other services like Spa, chambers, Khazana and many more. The company have been maintaining a higher Operating profit margin of 20 percentage

Resilient Management – Today it was COVID-19, Tomorrow it will be less consumption and the day after will be another thing but only a good management to navigate through the good and the Bad times. IHCL has shown their resilience in the way they tackled the crisis through various methods like Monetisation of Non – core assets - ₹205 Crore was monetised through the sale of residential apartments and the company have performed various Cost actions like instituting a robust spend optimisation programme to reduce fixed costs and rationalise resources. While variable costs have reduced with lower business volume.

Strategically located properties - IHCL has presence at 10 countries and they operate at 93 locations in India through their various brands. This enables the company to tackle any geographical issues and the company have made significant growth in restructuring to an Asset light model, with management contracts now accounting for 42%. We have signed over 50 new hotels in the past two years, reaching a milestone of 200 hotels with 25,000+ rooms across 100+ locations.

The challenges – Execution and Funding risks for project under development and the company has huge renovation costs in order to maintain a high standard of the rooms and which have a direct impact on its Profit margins. As of the new projects halted due to the Covid crisis, the cash spent on developing those projects are stuck which directly hurts the liquidity of the company and they have a low interest coverage ratio. Though the company have made enough Capex in the past years the company have delivered a poor sales growth of 5.66% for the past three years. The long term future of the industry is bright as ever by the near term is as bleak as possible and with an average roll out of vaccines, the growth in the medium term is limited which would affect the growth of the company

Valuations and other key metrics:

The company have reported a net loss during the year; hence the PE ratio can’t be calculated but the stock is trading at 16 percentage low from its 52week high. The company also has healthy dividend payout 28%, which is an added advantage.

Hotel Industry requires high Capital Expenditure and IHCL Debts stands at 4572cr with a Debt/Equity ratio of 1.24%. and the company has a healthy reserve of 3571cr.IHCH has a Free cash flow of 511cr. The Company has not sought any moratoriums and is well-positioned on the liquidity front with strong financial ratios of debt/ equity and debt/EBITDA. Further, the Company borrowed a fresh loan of ₹695 Crore from banks. Its credit rating has been reaffirmed as AA (stable) from ICRA & AA+ (negative) by CARE ratings.

*Source – Annual Report

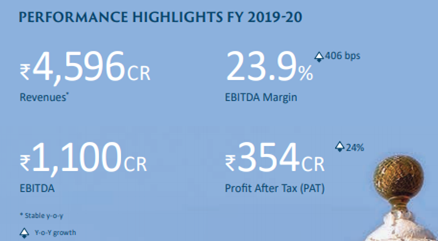

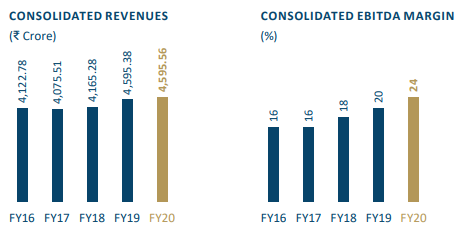

The company’s bottom line has been improved despite the macro turbulence and they have also opened one hotel every month during the FY – 20 which have added another 1565 room capacity. The EBITA margin have seen 460 base point improvements.

*Source – Annual Report

However, there are some short comings as well, the Company had a minimal sales growth of 3.5% for the past three years and one has to watch out for the future growth prospect of the company and consider for investments.

The Road Ahead:

IHCL has been an epitome of warmth, service and luxury and will continue to be the same. The Journey ahead will bring its own challenges and IHCL is far more firmly entrenched than yesterday with a belief to conquer several barriers tomorrow. The crisis has given a good opportunity to explore companies with a good valuation and IHCL is a worth looking at with a long term perception.

share your thoughts

Only registered users can comment. Please register to the website.