Increasing Consumerism Should Help Godrej Consumer Products Limited's Stock Price

Summary

- Godrej Consumer Products Limited should benefit as it is FMCG company, with strong portfolio to deliver in COVID-19 world. Roughly 80% of its product portfolio includes health, hygiene, and value for money products.

- Godrej Consumer Products Limited launched sanitiser products across India and SAARC, Indonesia, Africa, Latin America, and USA businesses. Plans are there to scale these up into full portfolios.

- Diversified revenue profile and strong brands should help Godrej Consumer Products Limited perform in challenging times.

Overview of Godrej Consumer Products

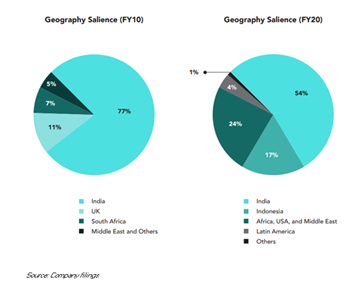

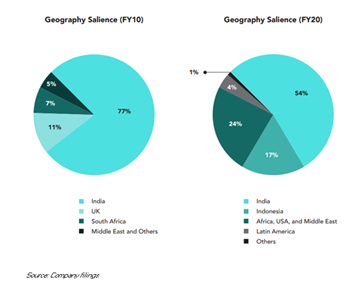

Godrej Consumer Products is a part of over 123-year-young Godrej Group. As an emerging market company, it has seen rapid growth and is pursuing exciting and innovative aspirations. Group has patronage of 1.15 billion consumers globally, across varied businesses. In line with 3 by 3 approach to international expansion, it is building presence in 3 emerging markets, which are Asia, Africa, and Latin America, across 3 categories like home care, personal care, and hair care. In emerging markets, it ranks among largest household insecticide and hair care players. In household insecticides, it is categorised as a market leader in India and Indonesia and it is expanding its footprint in Africa.

Growth Enablers of Godrej Consumer Products

- Improvement Seen in 2Q21 Results: In 2Q21, Godrej Consumer Products Limited saw an increase of 11% on year-on-year basis in its consolidated sales, with its consolidated EBITDA increasing 19% on year-on-year basis and consolidated EBIDTA margins expanding to 23.7%. Excluding exceptional items and one-offs, consolidated net profit saw a growth of 19% year-on-year. The company is ramping up innovation and has launched several new products, strongly price-enabled, across geographies. It is making a shift, across channels too and is doubling down on digitisation and platforms including e-commerce and chemists. Focus is also on strengthening supply chain operations and distribution. Geographically, India saw 11% growth and Africa, USA and Middle East business showed strong recovery, as there was a growth of 10% in both constant currency and INR terms. Indonesian business posted soft performance, growing at 3% in CC and 5% in INR terms.

- Demand Revival Expected in 3Q21: During 3Q21, demand in categories across key countries the company operates in was stable. In Indonesia, it expects a very less decline in constant currency sales. This is due to tough macroeconomic variables, a gradual recovery in Air Fresheners category, and high competition in Wet Wipes category. The company expects delivering sales growth in Latin America business which should be strong in constant currency terms. SAARC business is delivering healthy sales growth.

- Growth Seen in Indian Business: In 2Q21, the company’s India sales saw a growth of 11% to INR1,650 crore, while volumes saw an increase of 5%. EBITDA growth was 17% to INR460 crore. Net profit without exceptions and one-off saw a growth of 16% to INR351 crore. Growth in Household Insecticides grew by 4%, partially due to supply side issues as there were regional lockdowns. Given market presence, underlying consumer demand in this category was strong. Market share gains helped soaps category in delivering strong performance as there was 18% growth. New launches in Health have been scaling up well and the company focuses on micro-marketing initiatives. Hair Colours saw a gradual recovery and sales of this category saw a decline of 5% because of discretionary nature.

- India Business Should Maintain Dominant Share: Out of total revenue from operations in 2Q21, India business of Godrej Consumer Products made up ~57.6% and this trend is likely to continue. In 3Q21, the company’s India business should be supported by change in consumers’ behaviour and increased consumerism. With this growth, it should see its revenues from operations improving.

- Capitalising on Favourable Industry Dynamics: India business of Godrej Consumer Products should principally be supported from increasing opportunities and demand growth. Growing awareness and changing lifestyles should act as key growth enablers. Rural consumption saw an increase, led by increasing income. Increased demand for branded products in rural India should also contribute. Rural FMCG market in India should grow to USD220 billion by 2025 from USD23.6 billion in FY18. Share of unorganised market in FMCG sector has been falling, which should lead to growth in organised sector because of increased level of brand consciousness.

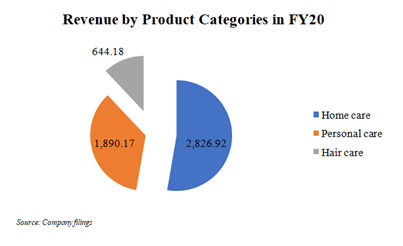

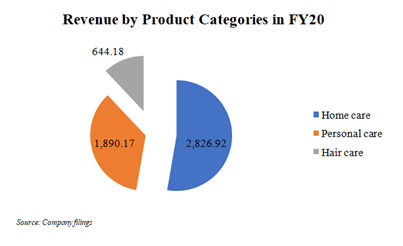

- Diversification of Revenue Profile: The company has seen its revenues getting support from diversification across geographies and product segments. Revenue has been distributed across product segments as Personal wash contributed 22%, hair care contributed 31% and household insecticide contributed 28% in FY20. Product launches and focus on health and hygiene are likely to act as key growth enablers in FY21. Management of costs should keep a check on operating margins.

- Pricing Power Should Support in Maintaining Profitability: Godrej Consumer Products has strong brand portfolio globally and in India. Given its dominance across various segments, the company has pricing power in those particular segments, which should help in maintaining margins and profitability.

- Product Launches Should Be in Limelight: Godrej Consumer Products Limited forayed into home cleaning products segment as it launched Godrej ProClean. This brand provides surface cleaning and disinfecting solutions. Brand aims to cater to rising demand for home hygiene products as there is emphasis on products offering protection against germs. Market size of home cleaning products (branded floor, toilet and bathroom cleaners segment) is ~INR2600 crore, as claimed by AC Nielsen. Such new launches should be able to help in growth.

Strong Returns in a Decade

We have just finished a decade and it is worthy to spend some time and analyze how stock of Godrej Consumer Products Limited has performed over this recent decade. We will also see what factors have actually contributed to this increase and whether this performance is likely to sustain or not. The company has moved from over 50% soaps portfolio in 2010 to a more balanced and strategic category portfolio. Now, it has three core categories, namely household insecticides, personal wash, and hair care. Entrance into new category to serve hair care needs of African women exhibits that the company capitalizes on market opportunity. In FY10, 23% of its overall revenues were from international businesses. This has increased to 46% in FY20, with Indonesia and Africa making up 41%. Continued support from government and growth in demand have principally supported the company in past decade and these growth enablers are likely to support in years to come.

Internet has also contributed in a big way as it has facilitated cheaper and more convenient mode and increased the company’s reach. All these factors have contributed to make this stock a multi-bagger one in past decade. Shares of Godrej Consumer Products Limited delivered a strong return of ~932.5% over FY10-FY20. Do you know what that means? This means that if you would have invested a sum of INR1,00,000 on 4th January 2010, it would have grown to INR10,32,526.54 on 30th December 2020.

Cheaper Valuations despite Significant Increase

Godrej Consumer Products Limited has a total market cap of ~INR 80,79,686.53 lakhs and free float market cap of ~INR29,88,916.54. The company saw impact of lockdown but it displayed strong agility and ramped up production and resolved logistics challenges. Recovery has been seen across most markets of operations and it leveraged technology and strong relationships with channel partners which should help in improving business in 3Q21. India business saw an improvement in operating performance, with growth seen in soaps and recovery seen in hair colour. Business saw hygiene portfolio getting scaled up and ramping up of rural distribution.

Performance in household insecticides saw some disruption due to supply issues as there were regional lockdowns but its impact was somewhat mitigated by strong underlying consumer demand. Demand is likely to be strong in 3Q21 given a change in consumers’ behaviour.

Growth strategy is focused on emerging markets and emergent consuming class in them. With rise in income, markets should mature and greater reach should be helped by new distribution systems and digital economy. Godrej Consumer Products Limited is ramping up go-to-market and digital strategies and reach so that it can go deeper and there can be improvement in penetration.

Stock trades at ~53.55x of FY20 EPS which is at a discount to sectoral average of ~56.72x, exhibiting that it should be considered for a long position.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.