Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Aurobindo Pharma (NSE:AUROPHARMA) is the seventh-largest generic company by sales globally and the second-largest pharmaceutical company in India by revenues. The company engages in the manufacturing of generic pharmaceuticals and active pharmaceutical ingredients (APIs). It is a market leader in semi-synthetic penicillins. Its specialty product portfolio includes a wide range of vaccines, biosimilars, topicals, nasals, inhalers, and other products focusing on consumer healthcare.

Aurobindo Pharma’s robust product portfolio is spread over six major therapeutic areas encompassing antibiotics, anti-retroviral, CVS, CNS, gastroenterological, pain management, and anti-allergic. It operates through 29 manufacturing and packaging facilities globally. The company derives ~50% of its revenues from the US, 25% from Europe, and 10% from domestic markets. Growth markets now account for 6% of revenues.

Aurobindo Pharma Positives

i) Growing through successful M&As and strategic alliances - Aurobindo has a presence in more than 150 markets through its 25+ manufacturing facilities. The company is focusing on growth through M&As and continues to add more specialized products, new technologies, and scale in its core markets. It is growing its presence in the Chinese market and has already started filing products from India making good progress on the construction of its own oral formulation manufacturing facilities. It established a JV with Shandong Luoxin Pharmaceutical, China to manufacture nebulizer inhalation formulation products. The company derives nearly 90% of its revenues from international markets increasing from ~60% a decade ago. Aurobindo’s customers include premium multinational companies.

ii) Scale and large global presence - Aurobindo Pharma has large manufacturing and R&D facilities. It has 15 state-of-the-art formulation manufacturing facilities located in India, the USA, Portugal, and Brazil. The company is known for delivering innovative solutions and has launched a range of affordable products that are accessible across the globe. It possesses the required technology and expertise for specialty formulations. Aurobindo Pharma also has a large international presence and benefits from its large network of alliances and partnerships across the globe. Aurobindo markets more than 300 products in various therapeutic segments in over 150 countries. Formulations now account for more than 80% of its revenues rising from ~45% a decade ago.

iii) Large Vertically Integrated business Model - Aurobindo Pharma is a large vertically integrated company having a presence from discovery to development and commercialization. Around 70% of the API requirement is manufactured in-house. It has a large diversified product portfolio having a presence in key therapeutic segments such as neurosciences, cardiovascular, anti-retrovirals, anti-diabetics, gastroenterology, and anti-biotics, among others. The company has successfully reduced its dependence on orals and has expanded its injectables portfolio over the last five years. Aurobindo now derives 63% of its total revenue from orals, bringing it down from 93% in FY 2014. Injectables (18%), branded oncology (6%), and dietary supplements (10%) account for the balance 37% of total revenues. Aurobindo Pharma is focusing on building a diverse and robust specialty products portfolio. The company is credited with more than 26 billion diverse dosage forms.

iv) Growth through the Years - The company has come a long way starting out as a single unit manufacturing Semi-Synthetic Penicillin (SSP) at Pondicherry in 1988-89 to becoming the market leader in SSPs, non-penicillins, cephalosporins, and non-cephalosporins. Over the years, Aurobindo Pharma has developed proven regulatory expertise. Cost-effective drug development and substantial manufacturing are its key competitive strengths. The company is expanding its U.S. portfolio mix towards differentiated products and the future pipeline could include Oncology, Hormones, Depot injections, Inhalers, Biosimilars, Topicals, and Patches.

Challenges

a) Aurobindo Pharma is subject to strict regulatory standards and norms in India and other foreign countries including the USA. The company recently faced multi-state lawsuits filed in the USA for manipulating prices and attempting to reduce competition. Regulatory issues might cast a shadow on Aurobindo’s pending drug filings.

b) Aurobindo Pharma competes with other India’s top pharma firms including Cipla, Lupin, Dr Reddy’s Laboratories and Sun Pharmaceutical Industries. The company is also facing increasing competition from China which has been exporting active pharmaceutical ingredients in recent years.

c) Aurobindo Pharma’s had a debt load of Rs.5,200 crores as of September, compared to Rs.5,800 crores in March 2020 and Rs. 3,470 crores in cash and cash equivalent. Its interest coverage ratio is 41x, indicating that Aurobindo Pharma has enough margin of safety for paying interest on its debt. Its Debt/ EBITDA ratio, however, increased from 1.15 as of March to 3.55 in the current quarter. An increasing debt/EBITDA ratio means that the company is increasing debt more than its earnings.

COVID-19 Impact

Aurobindo’s revenue and profit for the quarter increased by 16% and 26% in the latest quarter, respectively on the back of strong demand in the US market, and formulations. International revenues increased to 95% of total revenues. It completed phase I clinical trials for its first biosimilar and started trials for three more products during the quarter. The company together with CSIR has announced a collaboration to develop COVID-19 vaccines. Aurobindo Pharma received final approval for 10 ANDAs from the USFDA during the quarter.

Opportunities

Aurobindo Pharma is well-known as a global supplier of generic Antiretroviral (ARV) drugs because of its sticky customer relationships. Its strategic alliances with global pharmaceutical majors also position it well to cater to their formulation manufacturing needs. The company has a large US portfolio with 572 ANDAs filed, 391 with final approval, 27 tentative approval, and 154 under review. The addressable market stands at $102 billion ( as per IQVIA) including $74 billion for under review and tentatively approved ANDAs. The company is among the largest filers of DMFs and ANDAs in India. Aurobindo Pharma is focusing on growing through territory expansions, partnerships, globalization. Its key focus markets include Canada, Brazil, and China. It is also well-positioned to gain from further penetration through joint ventures and subsidiaries in attractive markets. Aurobindo Pharma is favorably placed for sustained growth in more advanced regulated markets of EU, Japan, and the USA.

Valuation

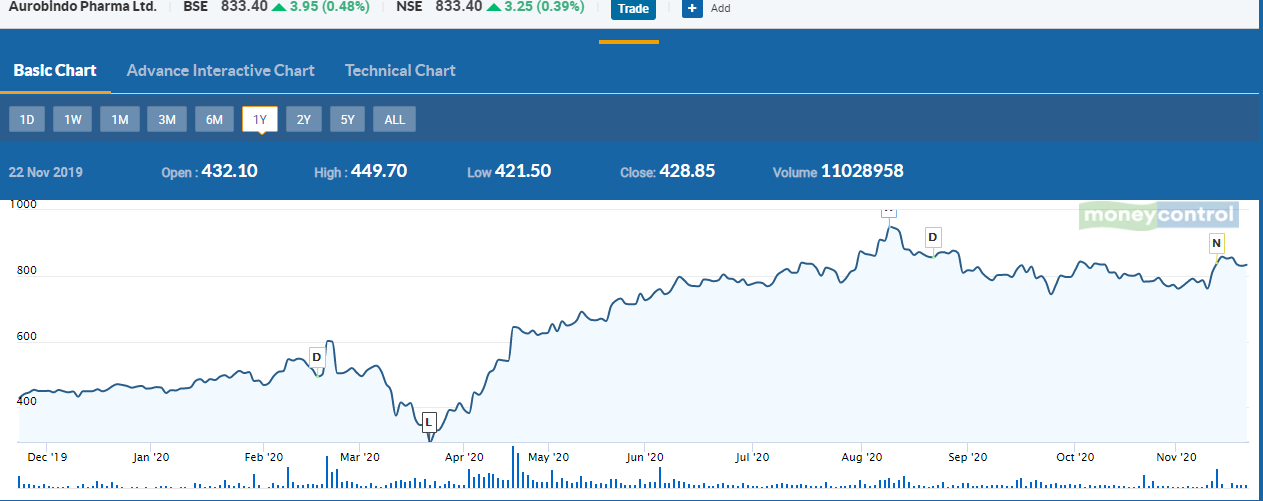

Aurobindo Pharma became a public company in 1992 and listed its shares on the Indian stock exchanges in 1995. Shares of Aurobindo Pharma are currently trading near the Rs. 830 mark. The company has decent investment fundamentals with ROE and ROCE at ~18% each. The stock is currently trading at 15x its earnings which is cheaper than the industry PE of 36x. Aurobindo Pharma’s market capitalization value is more than Rs. 48,800 crores. The company has registered stock returns of 21% CAGR and profit growth of 18% CAGR in the last decade. Shares have almost doubled in the last year. Aurobindo Pharma also approved an interim dividend of Rs.1.25 per equity share.

Source: Money Control

Bottom Line

Aurobindo Pharma is well placed to build and establish its brands as it continues to strengthen its footprint in chosen markets. The company is focusing on growth through future product launches in Oncology and Specialty injectables and is targeting to build branded generics presence in select markets. An extensive product portfolio and pipeline across the globe, leading market share across the global generic market, supply-chain excellence, cost-competitive manufacturing, and successful partnerships should drive future growth.

share your thoughts

Only registered users can comment. Please register to the website.