Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINHDFC Life Insurance Co. (NSE:HDFCLIFE) is one of the leading life insurance companies in India. The company offers Protection, Pension, Savings & Investments, Health products, etc to its customers. It is a joint venture between HDFC Ltd., India’s leading housing finance institution, and Standard Life Aberdeen, a global investment company.

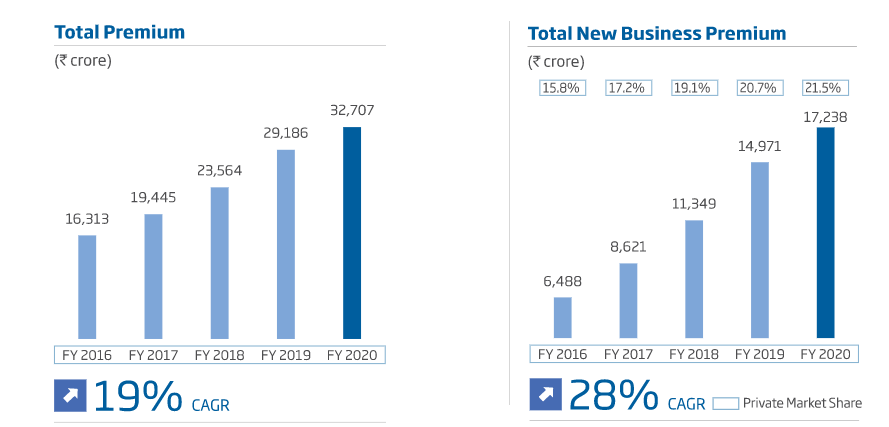

HDFC Life came into existence in 2000 and has insured more than 6 crores of life, over Rs. 32,700 crore in premiums, and has Rs. 1.27 crore as assets under management to date. It was the first private player to sell life insurance products in India. HDFC Pension Management Company Ltd. (HPMC) and HDFC International Life and Re Company Ltd. (HILRC) are the two subsidiaries of HDFC Life.

HDFC Life Insurance Co.'s Pros

i) Wide range of product portfolio to meet the needs of its customers - The company offers a wide range of individual and group insurance solutions that meet various life stage needs of customers. It had 36 individual and 13 group products in its portfolio, along with seven optional rider benefits at the end of September 2020. HDFC Life carries an impeccable brand name that has helped it maintain a leadership position.

ii) A large footprint and an extensive distribution network across India - HDFC Life has a large presence across the country having a wide reach with 420 branches and additional distribution touch-points through tie-ups and partnerships. The company has partnered with 300 leading names ranging from traditional banks to NBFCs and new-age fintech and insurtech firms. It partners with NBFCs, MFIs and SFBs, and more than 50 new-ecosystem partners. HDFC Life has continued to add partners at a good pace to further strengthen its diversified distribution and increase its insurance footprint in India. The company is also adding agency, direct and online channels to its distribution network.

iii) Well-positioned to Adapt to changing customer needs - The company is well-positioned to adapt to changing technology and consumer needs. It has designed ‘New Gen’ branches that blend futuristic technology with new-age branch infrastructure. HDFC Life has allowed multiple payment avenues for the convenience of its customers through various partnerships and integrations. It has also been investing in digital initiatives to transform itself from a traditional insurer to an insurer for the future.

iv) Growth over the years - HDFC Life has been witnessing steady growth in premium income, balanced product mix, and cost efficiency through technology. It is growing through building capacity and improving efficiencies. HDFC Life has grown its premiums by 19% CAGR and total new business premium by 28% CAGR, in the last five years. Its market share increased to 17.5% from 15.2% during the first half of the current year in terms of individual weighted retail premiums. The company is focusing on growth by widening its insurance penetration as well as servicing customers digitally.

v) Solid Lineage in the finance industry - The company is a part of the reputed blue-chip company HDFC Group which is a leading financial conglomerate in India having a presence in banking, life and general insurance, asset management, venture capital, and education finance segments. The professional population in India today trusts to do business with private players in the country due to their agility and better customer service. Given a strong lineage, HDFC Life stands a good chance to gain from its association with the HDFC Group.

vi) Leading position in the huge Untapped Indian market - India is one of the most populated countries in the world. Rapid urbanization, increasing working population and rising affluence has led to an increase in the demand for insurance products. HDFC Life is well placed to gain from the large untapped life insurance opportunity in India. The number of people above the age of 60 years is expected to triple by 2050 as compared to 2015. Moreover, improvement in life expectancy has also increased by ~20 years in the post-retirement period. India remains vastly under-insured, both in terms of penetration and density. Improved and a large distribution channel and awareness about the need for life insurance act as strong tailwinds for HDFC Life. The interest on savings bank accounts has also fallen in the country, as such insurance products pose a diverse investment opportunity for Indians, other than equities and mutual funds.

COVID Impact

HDFC Life created a COVID reserve in anticipation of worsening mortality experience across the country. The company registered unprecedented growth despite the economic distress caused by the COVID-19 pandemic. Its focus on online channels assumed even more importance in light of the pandemic.

Challenges

The insurance industry is highly competitive in India and has both well-established private and public players. From a single-player industry two decades ago, today, the market has 24 players. HDFC Life ranks among the top three companies in the private sector in terms of new business premium. SBI and ICICI Prudential are the other two large competitors. The leading public insurance player, LIC is rapidly losing market share to private players in the country. However, the insurance business is a highly capital-intensive business that forms a strong entry barrier for new players.

There is a rise in the number of natural calamities lately. If there is an earthquake, flood, or Tsunami affecting any region, then HDFC Life would have to pay the claim. Moreover, a fear of job loss and salary cuts might dissuade people from investing in insurance products. However, people have also realized the importance of having life insurance in times like the current one.

Valuation

HDFC Life Insurance Co. has a market capitalization value of Rs. 119,317 crores and trades at a PE of 89x while the industry PE stands at 68x. Shares of HDFC Life are currently trading near the Rs. 590 mark just 9% below its 52-week high price. Though shares have not gained much in the last year, it has returned more than 60% in the last five years.

The stock is trading more than 15X its book value, which is higher for one’s liking. But HDFC Life is almost debt free. HDFC Life was added to the MSCI India (Global) Index in August 2019 and the Futures and Options segment of NSE in February 2020. The promoters - HDFC Ltd. and Standard Life (Mauritius Holdings) 2006 Limited held 51.4% and 12.3% respectively in HDFC Life, as of March 31, 2020.

Source: Money Control

Bottom Line

The Indian life insurance industry has grown multifold over the last 20 years. Moreover, the current crisis caused by the COVID-19 pandemic has further stressed the significance of having life insurance policies. The company’s focus on digital transformation has reduced the need for face-to-face interactions and further supported new investments from potential clients. Insurance is a multi-decade opportunity in India and investors are well poised to maximize the long term growth potential through investing in HDFC Life. Investors can look at buying at dips.

share your thoughts

Only registered users can comment. Please register to the website.