Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndiaMART Intermesh Ltd. (NSE:INDIAMART) is India’s largest online B2B marketplace, for buyers and suppliers. The company provides wide product offerings ranging from drugs & pharma, hospital & diagnostics, food & agriculture to industrial machinery and supplies, and electronics. IndiaMART hosts a suite of well-known brands such as ABB, Hyundai, Airtel, Canon, Jaquar, Bosch, Cummins, Stanley Black & Decker, etc. The company caters to more than 107 million buyers, six million suppliers, and has a large product base of over 68 million products and services. It has a wide network with over 84 offices in India. The company has nearly 80% of its business in India. IndiaMART is well-diversified by geographies across metro cities, tier-II cities, and the rest of India. It operates through various subsidiaries and associates like 10times, Pooraa, Vyapar, and Mobisy Technologies.

IndiaMART Pros

i) Growing Market Share in the large consumer market - IndiaMART owns nearly 60% market share of the growing B2B market in India. It has a large presence in a highly fragmented market. IndiaMART has a subscription based revenue model which protects its earnings. The subscriptions account for ~95% of the company’s revenues. Moreover, about 55% of its buyers are repeat customers and 36% of suppliers are buyers. All of these factors make revenues more predictable and secure. Some of IndiaMART’s leading customers are Tata Steel, Tata Motors, Airtel, Bosch, Siemens, ABB, Philips Healthcare, etc. Coats, the world’s leading industrial thread manufacturer got recently listed on IndiaMART. Business inquiries on IndiaMART have grown at a rate of 42% CAGR in the last five years, driven by 39% CAGR growth in registered buyers and a 30% surge (CAGR) in traffic. India is a huge market with a large potential for growth given that just 32% of SMEs in the country were digitally connected in 2017, and 17% used the internet for business purposes, as per the KPMG Google report on ‘Impact of internet and digitization of SMBs in India’.

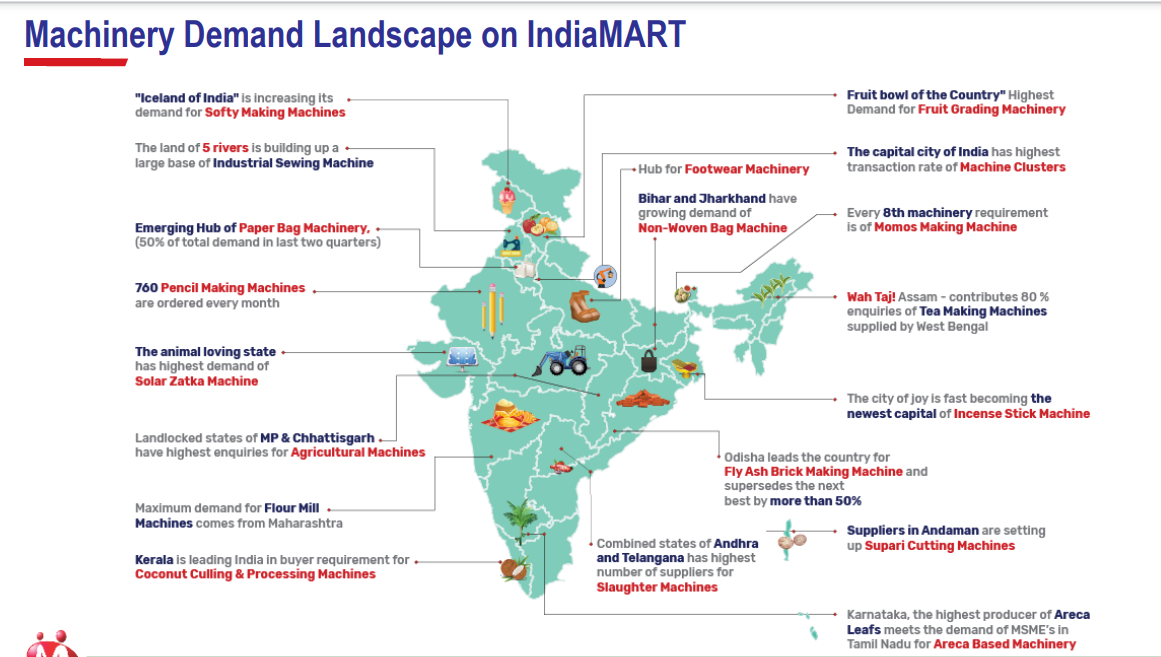

ii) Large Product Portfolio and network coverage - IndiaMART is well-diversified across more than 100,000 categories which helps to mitigate any industry-specific risks at the time of a downturn. Industrial plants, machinery & equipment; construction & raw material; apparel, clothing & garment; and consumer electronics and household appliances are a few of IndiaMART’s leading suppliers. The company has a reach extending to eight metro cities, 69 Tier-II cities, and more than 4000 towns and cities with a population of less than 500,000 in India. Metro cities account for just 35% of the buyer base while small villages and tehsils, as well as districts across India, are gaining momentum on IndiaMART. The company has a nation-wide sales and service coverage in the country. It recently invested in a software-as-a-service (SaaS) startup Bizom, which offers sales force automation and distributor management system to businesses.

iii) Shares PM vision for India - IndiaMART is well-positioned to gain from the Indian PM’s of Make in India, Digital Bharat, and Buy Local campaigns. It focuses on providing a platform to SMEs, large enterprises as well as individuals. IndiaMART’s traffic has increased by 30% CAGR in the last five years and more than 80% of that traffic is through mobile phones. The company gets over 60 million visits on its platform every month and 100% of this traffic is organic. Moreover, with GST implementation in the country, the nationwide shipment of goods has become even easier. IndiaMART should benefit greatly with the ease of doing business emerging as a key growth parameter in the digital landscape.

Source: IndiaMART Presentation

iv) Convenient Platform - IndiaMART offers a convenient platform for both buyers and suppliers in India. A wider market place, convenient payment protection program and verified sellers are a few of the benefits for the buyers. Enhanced business visibility, lead management system, and instant payment gateway attract suppliers on IndiaMART. It is a lot easier to find the products that you are looking for from the comfort of your home rather than toiling out in the sun. The company’s AI and ML algorithms help in matching a buyer’s requirements with relevant supplier preferences taking into account important factors like price, location, product, quantities, location, history, etc. In the B2B space, a customer can save a lot of time, money, and pain around questions like which supplier to trust, seller authentication, etc. if he takes the IndiaMART route. IndiaMART facilitates online collections via various online modes such as credit cards, debit cards, UPI, Netbanking, etc.

COVID-19 Impact

IndiaMART’s first quarter’s results were marked by marginal improvement in realization of existing customers, various cost optimization measures, an increase in traffic, and the same number of paying subscription suppliers. The company posted total revenue from operations of Rs. 153 crores in the quarter which is a 4% growth YoY despite a slowdown in the economy due to the pandemic and lockdown. IndiaMART’s average revenue per customer stood at ~Rs. 45,000. About two-thirds of its categories continued to perform in a robust fashion. IndiaMART’s field sales operations, however, suffered in the lockdown. The company might face issues if its customers (who are mostly MSMEs) do not fair well after the crisis ends.

Growing Competition - Biggest Challenge

IndiaMART faces intense competition from the growing e-Commerce retail platforms in India like Flipkart and Amazon.in in India. While the two have an imminent presence in the B2C market, they are planning on expanding the B2B marketplace as well. Amazon has already made an entry into the B2B marketplace with Covid-19 related products. Given their sheer size, logistical infrastructure, and funding, they are very much capable of gaining market share in the B2B market place as well. IndiaMART has nation-wide sales and service coverage which acts as a huge competitive advantage when compared to other online retailers in India. Moreover, it continues to invest in innovation and technology to stay ahead in the growing Indian marketplace. The company is also anticipating its cost base to continue to decline going forward. IndiaMART keeps looking for strategic acquisitions and partnerships with Fintech or SaaS opportunities to strengthen its competitive position and increase its value offerings.

Valuation

IndiaMART has a market capitalization value of Rs.14,440 crores and currently trades at ~76x its earnings. The share price currently sits near Rs. 4,945 mark, just ~10% below its 52-week high. The shares trade at a lower PE compared to the industry PE of 98x. IndiaMART does not look expensive at the moment, and potential buyers could look at buying for long term prospects. Shares of IndiaMART have more than doubled in the last six months indicating its resilient business in challenging times. The shift in consumer preferences due to work from home and lockdowns has redefined the mobile-focused priorities of organizations globally. The promoter group holds ~52% of IndiaMART’s shares.

Source: MoneyControl

IndiaMART went public in 2019. The company has maintained a growth rate of 25%-30% over the last few years. A strong balance sheet and a resilient business model should help the company navigate through the ongoing crisis.

Conclusion

The company stands a good chance to leverage its large footprint and strong brand reputation, and gain from the growing number of online businesses. IndiaMART is a growing platform with more than 44 million monthly business inquiries delivered. With no debt, a strong balance sheet impeccable brand reputation, and low capital requirements IndiaMART is better positioned than many listed companies in India who are currently struggling to meet their funding requirements. As a leading online marketplace in India, companies like IndiaMART should gain from huge supply chain disruptions across the world as they offer a platform to uncover genuine suppliers.

share your thoughts

Only registered users can comment. Please register to the website.