Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAffle India (NSE:AFFLE) is a global technology company with a proprietary consumer intelligence platform. It delivers consumer-related data through relevant mobile advertising. The company’s business segments are Consumer (~97% of FY 20 revenues) and Enterprise (~3%) platforms. It helps advertisers in new user acquisition and uses consumer data responsibly.

Affle has a wide global reach with international revenues accounting for more than 48% in FY2020. The company has a presence in South East Asia, Middle East and Africa, North America, Europe, LATAM, Japan, Korea, and Australia. The company started its operations in 2006. Affle is well-placed to gain from increasing screen time with a majority of Indians stuck at home and following the work-from-home culture. While at home, people are more digitally occupied and are experiencing an increase in screen time.

Affle India Positives:

i) Profitable Business Segments - Affle’s consumer platform engages in delivering contextual mobile ads while addressing consumer privacy needs. The company enables an online to offline (O2O) platform that converts online consumer engagement into in-store walk-ins. Its enterprise platform provides end-to-end solutions for enterprises to improve their engagement with mobile users. The company has a 15-year track record and has developed customer trust with a unique business model, scalable data and fraud detecting platforms. Its mFaaS platform helps to detect fraud on a real-time basis. Affle’s customer base is mostly comprised of large enterprises with good credit ratings. The company recently won a $1 million contract from Singapore government.

ii) Expertise and R&D - Affle has developed deep technology assets and partnerships with top global e-commerce companies, brands, and agencies. The company has a solid R&D focus with a strong patent portfolio. It engages top mobile OEMs and apps developers to deliver on-device personalized app recommendations to mobile users globally.

iii) Conversion of Potential users - Affle runs a cost per converted user business. More than 91% of its consumer platform revenues (FY 2020) were driven by its CPCU model, which comprises user conversions based on consumer acquisition and transaction models. The company has a large user-base with 2.1 billion connected devices. Affle is uniquely placed to convert potential users into buyers for both new and existing users through in-app advertisements and mobile app recommendations. The company is also growing through strategic alliances and partnerships. It recently acquired full control of Appnext Pte. Ltd., Singapore and 100% IP of Appnext app discovery and recommendation platform in June 2020.

iv) The Great India Growth Story - India is a growing economy and has a large number of potential buyers. With the growth of smartphones, e-commerce activities have grown multi-folds in the country. The smartphone segment in India is poised to grow at a rate of 27% CAGR in 2017-21. The e-commerce market is also expected to grow by 27% CAGR, during 2017-22, while online Indian buyers are estimated to grow at a rate of more than 20% CAGR by 2025. Affle should benefit from these rising trends as it occupies a leading position in the mobile advertising space in India.

v) Strong Competitive Advantages - Affle India occupies a leading position in a high growth market with large barriers to entry. The company has built a reputation for addressing consumer privacy and ad fraud over the years. An in-house platform enables processing and storing large scale user data using cloud computing infrastructure. Its ability to generate actionable outcomes attracts more businesses. A flexible and scalable platform, strong R&D capabilities are Affle’s other strong competitive advantages.

Challenges

Dependent upon Customer choices - Affle India may face difficulty in data collection from various sources if restricted by customers, publishers, and browsers or other software developers, or changes in technology. The company is also dependent upon the actions of web browser developers, such as Apple Inc, Microsoft Corp., or Alphabet Inc., implementing changes in browser or device functionality that impairs Affle’s ability to understand the preferences of consumers.

COVID-19 impact - Affle’s industry verticals like hospitality, travel and transport are highly susceptible to Covid-19 and will continue to have near term impacts from the pandemic.

Intense Competition - The market for mobile advertising solutions is highly competitive and rapidly changing. It is dominated by digital giants such as Google and Facebook. Other competitors include InMobi, Criteo, Tradedesk, Freakout, Mobvista, and YouAppi. Though competition is increasing given the highly lucrative market potential, Affle’s prediction and recommendation algorithm, operating real-time and at a significant scale, sets it apart from peers.

Valuation

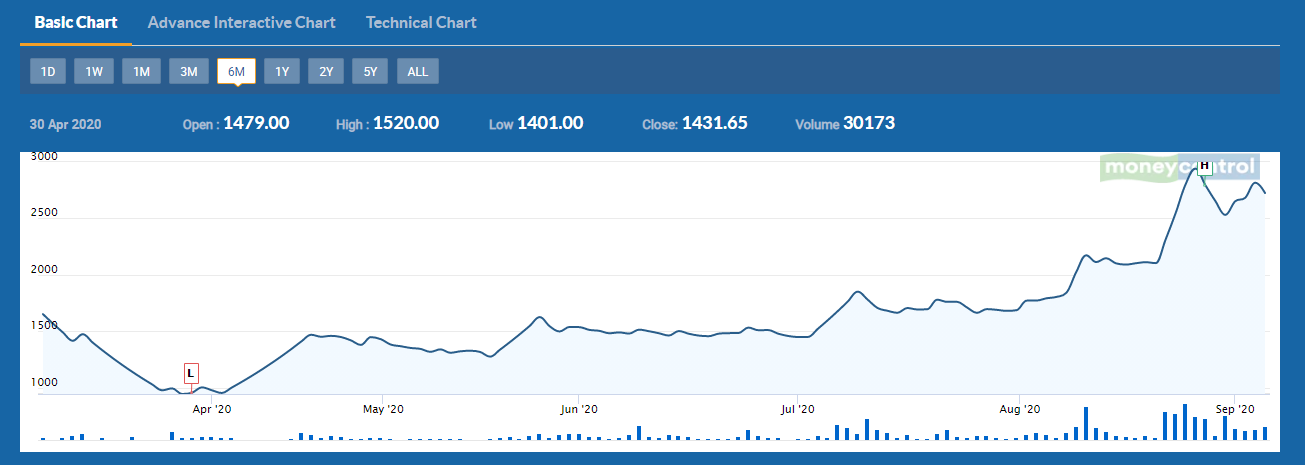

Affle India has a market capitalization value of Rs.6,965 crores and currently trades at 230x its earnings. The share price currently sits near Rs. 2,700 mark, just 13% below its 52-week high. The shares seek a high PE compared to the industry PE of just 23x. Affle India surely looks expensive at the moment, and potential buyers could look at buying on the dip for long term prospects. Shares of Affle India have gained ~65% in the last six months indicating its resilient business in challenging times, and by more than 260% since its IPO in August 2019. The shift in consumer preferences due to work from home and lockdowns has redefined the mobile-focused priorities of organizations globally. The promoter group holds ~68% of Affle’s shares.

Source: MoneyControl

The current crisis situation has led to consumers buying more online and has revolutionized e-commerce, Edtech, gaming, groceries, healthtech, Fintech, and FMCG industries which contributed over 76% to Affle’s Q4 2020 revenues.

Conclusion

Affle offers a leading comprehensive mobile advertising platform in the fast-growing Indian market characterized by rapid growth in the internet, e-commerce, and digital advertising. The company’s scalable advertising platforms and predictive optimization algorithm should further drive increases. Affle also has a proven international track record with significant growth potential signifying enough room for expansion. It is better positioned to gain market share through careful strategic investments and acquisitions.

share your thoughts

Only registered users can comment. Please register to the website.