Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Bosch Group is a leading multinational engineering company in the world. With more than a century’s old existence, the company has a huge presence worldwide. Bosch Ltd. (NSE:BOSCHLTD) is one of the twelve companies of the Bosch Group in India and is a leading provider of technology products and services. It is the flagship company of the Bosch Group in India and one of the country's leading automotive components suppliers. Bosch Ltd. has expanded into 18 manufacturing sites and employs more than 30,000 people in India. It also has an extensive presence in the industrial and consumer goods technology. The company is set to benefit from the increasing trends of innovation and technology in smart mobility and connectivity. Its extensive R&D, diverse product portfolio, as well as renowned brand name, are key competitive advantages.

Bosch Ltd. Positives

i) Diverse and huge Product Portfolio - Over the years, Bosch Ltd. has successfully carved out a holistic presence in our day to day lives. The parts manufactured by the company can be found in our cars, our homes or at work. The company has a strong presence across diverse sectors like mobility solutions, industrial technology, consumer goods, and energy and building technology in India. In the mobility sector, the company provides auto parts, accessories and car services. It develops smart mobility solutions in the areas of hardware, software as well as services. Bosch manufactures smart appliances for our homes and designs complex drive and control technologies, as well as energy and building solutions for industries.

These diverse businesses are absolutely a necessity in one’s daily life and hence most of them are recession proof. This diversity also protects the company from a slowdown in one of the sectors.

ii) High Quality and Impeccable Reputation – The Bosch Group has an almost ninety-year-old existence in India. The company today has 18 manufacturing sites and seven development and application centers in the country. With such a rich experience, the company has established a strong footing in the country. Bosch Group has become synonymous with quality and customers trust the brand name, resulting in sticky customer relationships. The company has a suite of brands which are customized to suit distinct market requirements.

iii) Huge Untapped Potential in the form of future trends - Bosch Ltd. is favorably placed to benefit from the fast growing auto parts industry in India. The automotive industry in India is one of the largest in the world and it has also become an outsourcing hub for many global automobile manufacturers.

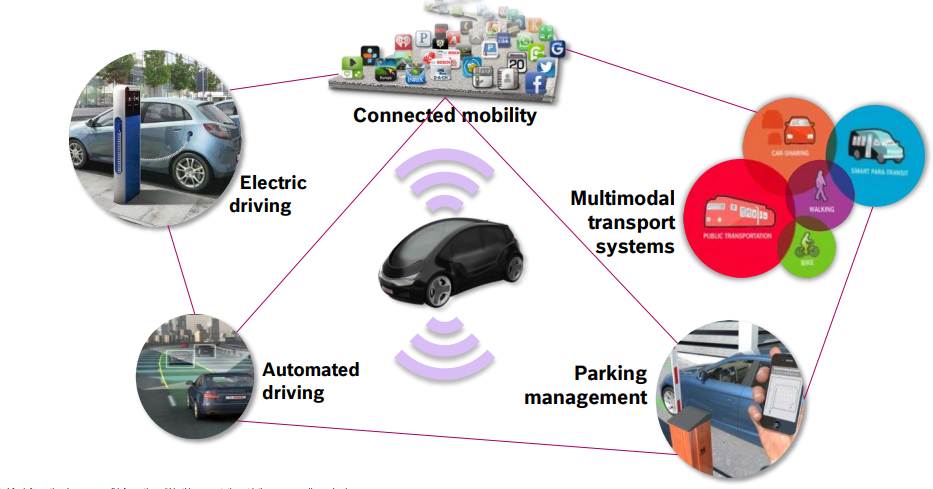

As a leading IoT company, Bosch Ltd. stands in a good position to benefit from the growing trends of technology and innovation in the country. With a rising population, there is a huge demand for innovative solutions in smart homes, smart cities, connected and electric mobility, and connected manufacturing. Bosch aims to deliver such solutions for a connected life through its expertise in sensor technology, software, services, and IoT. Currently, India is implementing its smart cities policy and Bosch can hugely benefit from the opportunity. Another prospect for the company is the country's plan to electrify at least 30% of its vehicles by 2030. Bosch’s mission is to ensure that every product is connected via the IoT by 2020.

Challenges

a) Transition to BS VI norms – Given the rising levels of air pollution in India, the government has decided to completely skip BS V norm for the Indian vehicles and transit to BS VI norms by 2020. Though the company is ready to support OEMs for timely introduction of BS VI, India will be the first country to skip one level of emission legislation; hence results cannot be predicted at the moment.

b) Other Risks – Though Bosch Ltd has diversified businesses, it still has a majority of its revenue coming from the auto sector. As such, the company is heavily dependent on the auto industry in India. The company also faces intense competition from existing players as well as new entrants. At present, India has more than 500 key players in the auto components industry. Other than these, Bosch Ltd. is also subject to a strict regulatory framework.

Valuation

Bosch Ltd. is one of the most expensive stocks trading in the Indian stock exchange today. Shares are currently trading near INR 18,000 levels which is almost 35% lower than its 52-week high. Though prices have dipped over the last three months, it might still not be a good time to buy as valuation is higher than industry peers. Bosch's P/E stands at 38.6x when compared to industry average of 36x. But given the company's positive outlook and growth potential, investors might keep a tab on the stock for a potential entry point. Investors should also be aware that the stock has low liquidity on the bourse.

Bosch Ltd. is a shareholder-friendly company. Over the last decade, the company has grown shareholder returns by 21% CAGR. The company also has a buyback program in place.

Conclusion

Bosch Ltd. will leverage from its leading position as an automotive components maker in India, given that India has the world's largest automotive industry. The company should benefit from the increasing demands of both commercial and passenger vehicles in the country, as well as futuristic trends leading automotive suppliers of connectivity and smart mobility. Bosch is a huge diverse company having a presence in diverse areas ranging from automobile components to energy and security, to household appliances. But, a lot of its stock's performance will depend upon the futuristic trends of mobility in India and how well will the country embrace it. Investors are advised to closely follow the approaching trends in the automobile industry which may have a major impact on the stock.

share your thoughts

Only registered users can comment. Please register to the website.