Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Headquartered in Bengaluru, MindTree Ltd. (NSE:MINDTREE) is an information technology and outsourcing company. The company engages in providing digital transformation and technology services to its clients. It runs 43 offices in 17 countries worldwide and has a wide global footprint in the US (70%), Europe (21%) and Asia Pacific regions (9%). Founded in 1999, it was ranked the seventh best IT company in India by the Fortune. Strong diversification and presence across the digital value chain, a stable client base, growing pipeline and improving macros are strong competitive advantages.

MindTree Positives

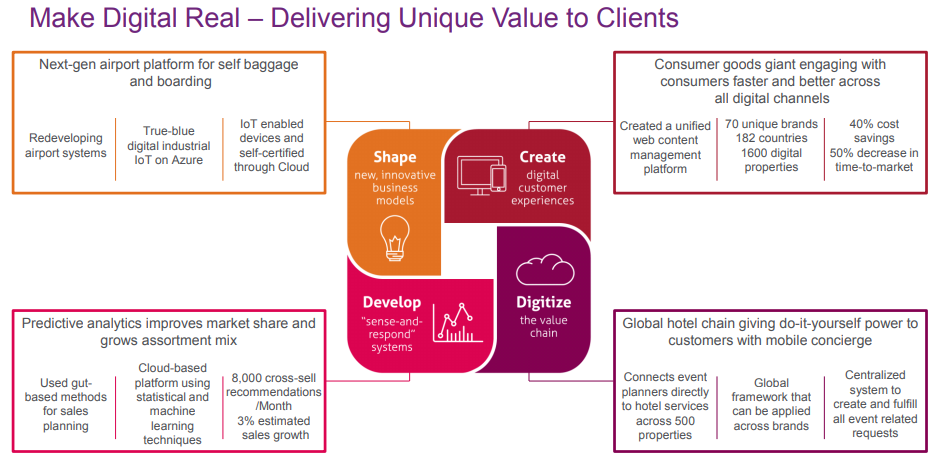

i) Strong presence Across the Digital Value Chain - The company also provides customized solutions across the digital value chain. MindTree provides services across digital, cloud, engineering and R&D, operations and enterprise software. It expects Digital to be its strong growth engine for the next 2-3 years, as people continue to make huge investments in this field. Some of the large global enterprises regard MindTree as their ‘Digital Anchor Partner’, for delivering results in a complex environment.

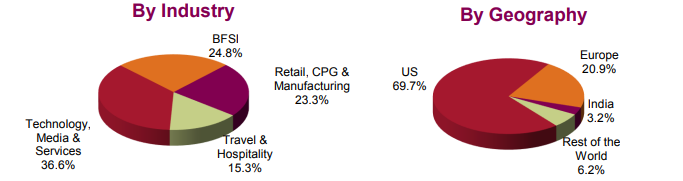

ii) Strong Diversification by Industries & Geographies - MindTree is well diversified by industry. As a mid-tier IT services firm, MindTree serves a wide range of industries like banking, electronics, insurance, travel, technology, retail, media & entertainment and many more. Technology, Media & Entertainment segment accounted for 36% of Q3 revenues, followed by BFSI (25%), Retail, CPG & Manufacturing (24%) and Travel & Hospitality (15%). By geography, the US is its largest market comprising 70% of revenues, while India accounts for 3%-4%. The company also has a strong customer base consisting of high quality and diversified clients.

Source: MindTree Investor Presentation

iii) Improving Financial Metrics – MindTree reported strong Q3 results with net profit increasing by ~14% on revenue growth of almost 4%. Its digital technology services accounted for more than 40% of revenues. Travel and hospitality grew by 9.3%; retail, CPG, and manufacturing grew by 5.8%, BFSI grew by 3.7% during the quarter. The CEO has further indicated that Q4 should be a good quarter for MindTree and expects a high single-digit growth. The company has executed a good win ratio increasing to 33%-34% from 21%-22% in December 2016. MindTree’s deal pipeline was about 50%-60% higher in December 2017 year-on-year. The company achieved a revenue growth of more than 11% in constant currency for FY 17, which was higher than the industry average.

Source: MindTree Investor Presentation

iv) Should Benefit from the Digital Growth in India – A ‘Digital India’ is set to act as a huge tailwind for MindTree’s growth. Digital India was launched in 2015 by the government to make the country digitally empowered in technology. India is adapting fast to the rapidly changing technological landscape with the government’s vision to make India a $1 trillion digital economy in the next 5-6 years. Businesses need technology both to drive efficiency within their business and also to grow their business. MindTree should, therefore, have numerous avenues to grow in future.

Source: MindTree Investor Presentation

The new age emerging technologies like Artificial Intelligence (AI), Blockchain, Cognitive Computing and Internet of Things (IoT) are disrupting several industries. Mindtree is making significant investments in these technologies to grab potential opportunities.

Key Risks

MindTree acquired Bluefin for £42.3 million in July 2015. However, the firm will take another couple of quarters to stabilize the acquired entity. Moreover, challenges might surface when integrating a British work culture. Analysts believe the company’s revenues could be adversely affected by acquired entities like Magnet360 and Bluefin, and that they have dragged MindTree’s margin for the past few quarters.

The company is also suffering declining revenues (in absolute terms) from its top clients over the last few quarters. However, this trend could be temporary as MindTree is set to benefit from its growing Digital business and a stable client base. In fact, revenue challenges were eased to a great extent in the last quarter.

Other risks include potential competition from Tata Consultancy Services and Infosys, and automation. Though the company does not see automation as eliminating human jobs but is expecting it to reduce cost, improve reliability, and focus on more value-added activities, automation has been cited as a potential threat for digital firms.

Stock Valuation

MindTree shares are currently trading near the INR 775 mark, soaring high since the last year. Shares jumped 11% back in January this year, hitting a 52-week high of INR 694 on the back of encouraging Q3 result. The company has a market capitalization value of INR 12,700 crore. Its P/E stands at 26x which is higher than Tata Consultancy Services Ltd.'s (NSE:TCS) and industry’s P/E of 21x.

Source: Money Control

The company has a dividend policy in place and has a reasonable payout ratio of 40% and the board of directors has recommended an interim dividend of INR 2 per equity share. MindTree also bought back 43.2 lakh shares in July last year at INR 625 per share.

Conclusion

Rapid technological change is disrupting industries. It is, therefore, pertinent for enterprises to adopt new technologies and solutions faster. Clients are partnering with enterprises like MindTree proven record of delivering business outcomes. Strategic investments in capabilities and partnerships have enabled the company to stay ahead in the race. Though the shares are trading at higher valuations currently, investors can look at buying at dips given MindTree’s growing pipeline, improving win ratios and stability in revenues. The company should also benefit from faster adoption of digital technologies in India and abroad.

share your thoughts

Only registered users can comment. Please register to the website.