Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

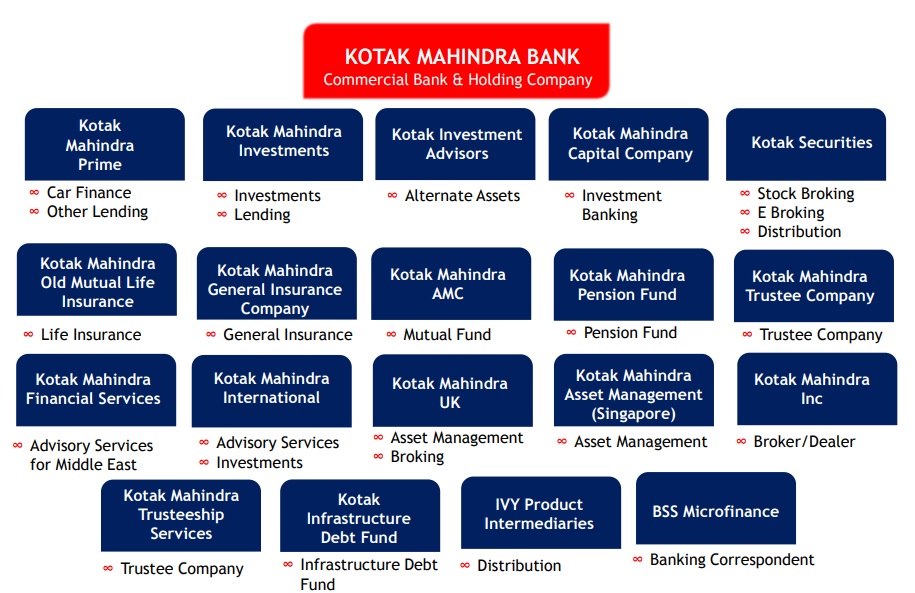

Kotak Mahindra Bank (NSE:KOTAKBANK) is one of India's leading banking and financial services company. Starting out as Kotak Mahindra Finance Ltd. in 1985, Kotak Mahindra Bank has become one of the country’s most trusted financial institutions today. Kotak Mahindra Finance Ltd. was the first non-banking finance company in India to convert into a bank. The leading Indian private sector bank offers a wide range of financial services including banking (consumer, commercial, corporate), credit and financing, equity broking, wealth and asset management, insurance (general and life), and investment banking solutions. At the end of December, Uday Kotak along with his family owned 33.61% stake in the bank. I think Kotak Mahindra should be a good way to play the digital growth in financial systems in India.

Kotak Mahindra Bank Positives

i) Digital Growth is impressive - The bank is growing digitally and launched 811, a digital banking ecosystem on mobile. It also launched DigiLocker which provides secure access and storage of documents on Government of India’s platform. Following the demonetization and Aadhaar uproar in India, the bank’s 811 product is expected to deliver seamless connectivity and convenience. It is an Aadhaar-verified, pure-play digital, paperless savings bank account, enabling customers to open a bank account in less than five minutes from anywhere. The bank has achieved a good traction in its digital growth with 52% of its customers being digitally active as of March 2017. About 77% and 60% of its recurring and term deposit respectively, were sourced digitally in Q2FY18.

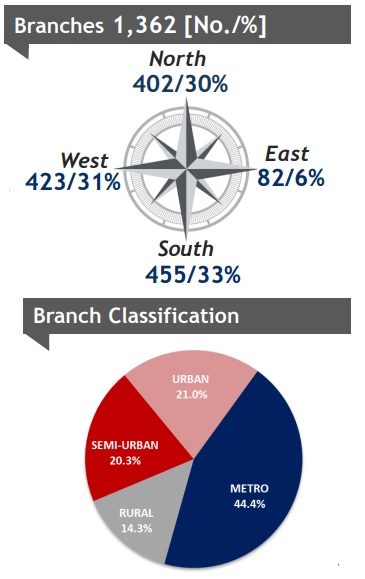

As of June 2017, Kotak Mahindra Bank has a network of 1,362 branches across 689 locations and 2,173 ATMs in the country. The bank plans to reach around 1,400 branches by FY18. The bank has a good presence in the north, south and western zones in India. About 44% of its branches are located in metro areas and 21% in urban areas.

Kotak Mahindra’s Geographical Presence & Branch Classification

Source: Kotak Mahindra Bank Presentation

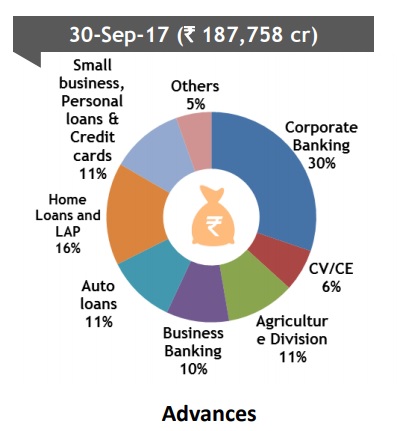

ii) Large Customer Base - The Bank has four strategic business units – consumer banking, corporate banking, commercial banking, and treasury, which cater to 8 million retail and corporate customers across urban and rural India. Its customer base is also diversified ranging from agriculture to construction and infrastructure, to transport, retail, and manufacturing. It also has a large and active customer base of 5 million debit card holders and over 1 million credit card holders. Its merger with ING Vysya Bank in 2015 also resulted in a widening of its customer base.

Kotak’s Diversified Customers

Source: Kotak Mahindra Bank Presentation

iii) Diversified Businesses – Kotak Mahindra has a presence across the entire value chain with a wide product portfolio platform. Leveraging from its leading financial background, Kotak Mahindra group also has a presence in insurance, mutual funds, investment banking and international business. This organization structure drives cross-selling and customer cross-buying opportunities across various products. Kotak Securities, Kotak Life Insurance, and General Insurance have also shown strong digital growth.

Kotak’s Diversified Businesses

Source: Kotak Mahindra Bank Presentation

iv) Growing Indian Economy - The overall Indian macroeconomic position has strengthened with policy support over the last couple of years, providing structural strength and imparting efficiency to the Indian banking system. Several institutional reforms like implementation of the Insolvency and Bankruptcy Code, the creation of Monetary Policy Committee, the passage of GST, and the establishment of a less-cash centric economy were undertaken in India. Given the fact that the financial sector generally grows at a faster pace than a country’s GDP and the bank’s low NPA levels, investors can look at buying shares of Kotak Mahindra Bank.

Kotak Mahindra Bank’s Weaknesses

Kotak Mahindra has only 14% penetration in rural areas. While it signifies a bigger room for the bank to expand in these areas, it also indicates that the bank might lose some ground here because of being a late entrant. Bigger private banks like HDFC Bank and ICICI Bank have a good reach in the rural parts of India. Kotak Mahindra is also plagued by low publicity and marketing as compared to other premium banks in the urban and rural areas.

Stock Valuation

The banking stocks surged after the Centre announced INR 2 lakh crore capital infusion plan for state-owned banks and an ambitious road development programme, but are now showing some correction. Shares of Kotak Mahindra bank is trading INR 990 level. The bank has a market capitalization value of more than INR 189,000 crore currently. Its P/B at 4.8x is lower than that of HDFC Bank (NSE:HDFCBANK) at over 5x. The annual return has also been better that peers like Yes Bank (NSE:YESBANK) and ICICI Bank (NSE:ICICIBANK) as can be seen from the chart below.

Source:MoneyControl

Kotak Mahindra Bank’s board has also approved the issue of 6.2 crore shares to raise over INR 5,000 crore. The fundraising will dilute the bank’s equity base by 3.37%.

Conclusion

Being a flagship company of the financial conglomerate Kotak Mahindra Group, Kotak Mahindra Bank has several competitive advantages. Its integrated and diversified business model, strong brand and leadership in various businesses, experienced management team and prudent risk management capabilities are its USPs. Even though the group had a late entry in the banking sector, it was among the largest private sector banks in India by balance sheet size as on March 2017. It is also amongst one of the banks maintaining high capital adequacy in the Indian banking sector. The bank’s digital outlook should also benefit from a strong and growing Indian economy. The marketshare of private sector banks in India is poised to double to 50% in the next five years, and Kotak Mahindra bank is targeting to grow by at least twice the nominal Indian GDP growth rate.

share your thoughts

Only registered users can comment. Please register to the website.