Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

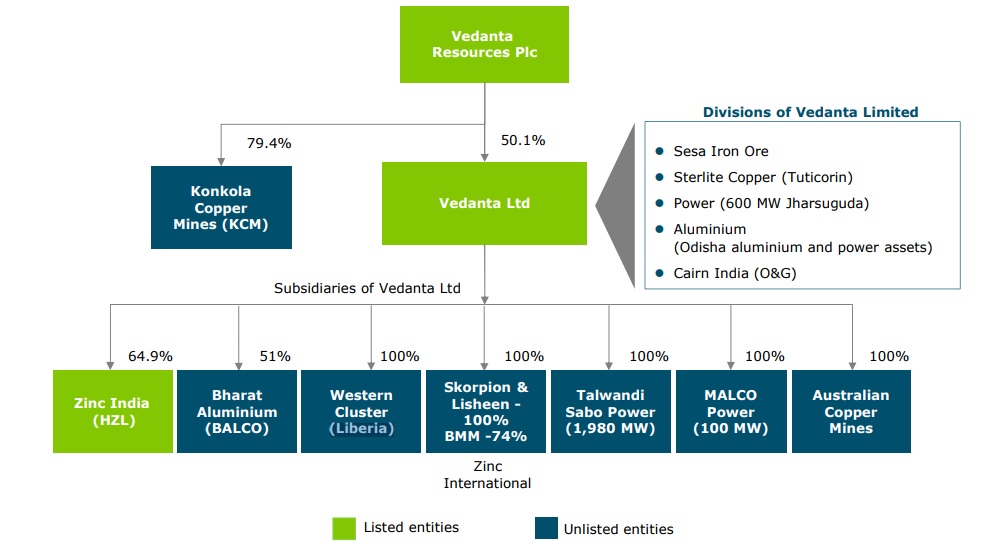

REGISTER NOW OR LOGINVedanta Limited (NSE:VEDL) is the biggest private mining company in India. Formerly known as Sesa Sterlite, it is the Indian subsidiary of Vedanta Resources, the London-listed, sixth-largest natural resources company globally. Vedanta Ltd. accounts for more than 60% of Vedanta Resources’ total revenues. Vedanta Ltd. is a large conglomerate having a presence in mining as well as power generation. It is one of the largest exploration and production companies in India accounting for 26% of India’s oil production. Vedanta also commands 72% of market share in India’s zinc industry.

The completion of the Cairn merger is a major milestone, transforming Vedanta into a diversified natural resources powerhouse. Vedanta Ltd. stands in a good position to benefit from the growing Indian demand for infrastructure and power.

Operational Structure of Vedanta

Image Credit: Vedanta Resources

Vedanta Ltd. Positives

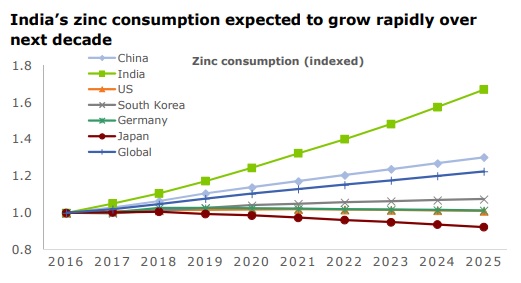

i) Impressive Asset Portfolio and Geographical Footprint – Vedanta Ltd. owns a large mineral base and has substantial operations in oil & gas, as well as commercial power. It also has a power portfolio of 9 GW, consisting of 96% thermal power and 4% from renewable energy sources. Vedanta Ltd. is India’s leading producer of Zinc-Lead, and the world’s second largest integrated Zinc-Lead producer. The company's portfolio includes a wide variety of mineral assets such as zinc, lead, silver, aluminum, copper, iron ore. India is among the top countries in the world with large reserves of iron ore, bauxite, zinc and coal. Other than India, Vedanta also has a large presence in South Africa, Namibia, Ireland, Australia, Liberia and Sri Lanka.

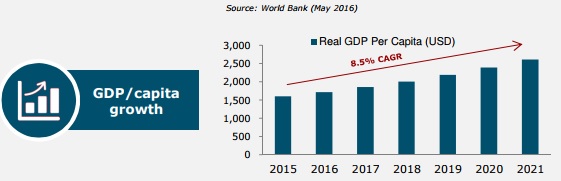

ii) The Indian Growth Story - Vedanta Ltd. is a good way to invest in the Indian growth story. India is Vedanta’s largest market, which is currently experiencing strong urban as well as industrial growth. Development is seen on various spheres like infrastructure, housing, smart cities, Make in India initiative etc. Vedanta has a long operational history in India. Being India’s largest base metals producer and largest private sector oil producer, Vedanta is ideally positioned to capitalize on India’s growth potential.

Image Credit: Vedanta Ltd.

iii) Cash Rich Subsidiaries – Vedanta Ltd. has large subsidiaries like Hindustan Zinc and BALCO. Even after paying a dividend of INR 14,000 crore, Hindustan Zinc has a healthy cash balance of around INR 15,000 crore at the end of the year. It also merged with Cairn India, one of the largest Indian oil and gas private producers in FY17. Vedanta is now in a good position to also expand energy production.

Image Credit: Vedanta Ltd.

iv) Robust Outlook – During FY17, Vedanta Ltd. delivered a strong performance across operational as well as key financial metrics. The company continues to ramp-up production across most of its portfolio in India. It has set a target of achieving 1.2 MT of mined metal capacity in fiscal year 2020 and total aluminum production capacity of 2.3 MT. Vedanta is also ramping up its power load factor in BALCO and Jharsuguda to provide competitive rates to the Indian consumers. The company is thus, all set to expand its reach within India.

v) Strong Balance Sheet – Vedanta Ltd. is known for its tight cash flow control and capital discipline. The company is successfully reducing its debt balance and delivering robust EBITDA which is driving high free cash flows. It reported cash and liquid investments of over INR 63,400 crore as of March 2017. The Cairn merger will further grant greater financial flexibility to allocate capital to highest return projects.

Vedanta Ltd. also undertook a cost savings program in FY’15 and has achieved $ 4,500 crore in cost savings over the last two years. The strong free cash flows has enabled the company to distribute record dividends of about 7,000 crore during the year (Hindustan Zinc Limited also declared 14,000 crore in dividends). The company also announced a dividend policy, committing a minimum payout of 30% of PAT (ex Hindustan Zinc PAT), and a pass through of HZL’s regular dividend.

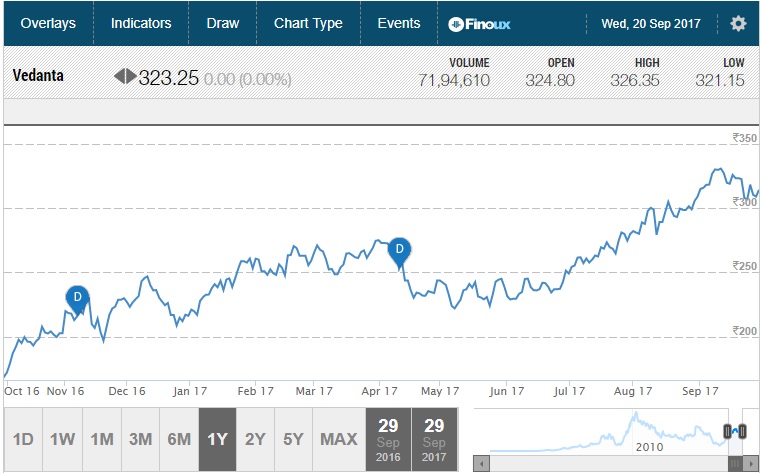

vi) Cheap Valuation –The shares have rallied in the past year returning more than 86%. It has a market capitalization value of INR 116,700 crores and VEDL is trading at 14x P/E which seems reasonable. The share is currently trading at INR 310 levels, which seems to not factor in Vedanta’s optimistic outlook. Most analysts have given a target price of INR 350 for Vedanta. At INR 310, the stock looks pretty cheap. CRISIL also upgraded credit rating to AA with stable outlook.

Source: MoneyControl

Risks

Vedanta operates in a highly capital-intensive industry. Its large operations require huge funds. Gross debt at Vedanta Ltd. was INR 71,569 crore as of March 2017 declining from INR 77,952 crore a year earlier. Mounting debt is a huge concern for the company. But Vedanta Ltd is now focusing on deleveraging with a Net Debt/ EBITDA level of 0.4x, which is the lowest and strongest among Indian and global peers. Though the company has reduced debt by more than INR 4,000 crores in FY16-17 and by 6,200 crore since April 2017, the company still has a long road to go.

Conclusion

India is a big growth driver. An improvement in commodity prices in FY2017, good performance by zinc, improvement in the U.S. and Chinese economies boosted Vedanta Ltd.’s performance in FY 2017. Vedanta has been consistently delivering increasing shareholder returns with market leading growth and low-cost position. Vedanta Ltd. contributed INR 40,000 crore to India’s exchequers. India has immense growth potential. Despite economic progress, India still has a low per capita consumption of commodities. Vedanta through its strategically located high-quality assets is well-positioned to leverage the opportunities in India and other emerging economies. At current valuation, the stock is a steal.

share your thoughts

Only registered users can comment. Please register to the website.