Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndia has become the largest hub for sourcing information technology services in the world. The country’s biggest strength is its cost competitiveness which has led to the industry accounting for 67% of the U.S. market. According to IBEF, the Indian IT sector accounted for 9.5% of the country’s GDP in FY15 from just 1.2% in FY98. IT sector revenue is expected to increase by three times to reach $350 billion by FY 2025. Leading Indian IT firms are also expanding their product and service offerings for clients using innovation hubs, research and development centres etc. Wipro Ltd. (NSE:WIPRO) is amongst the top five IT firms contributing over 25% to the total industry revenue with over 150,000 employees.

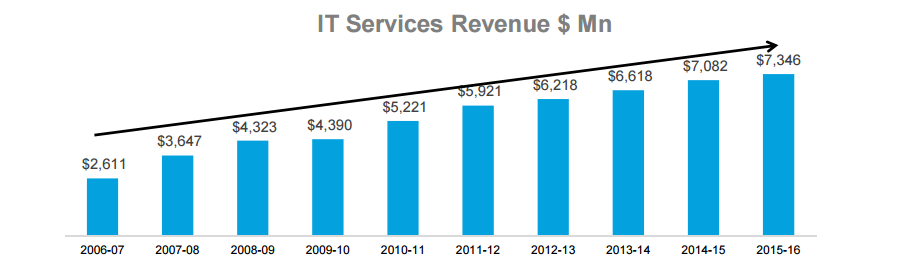

12% CAGR in IT service offerings

Wipro Ltd. has over 1250 active global clients with a presence in more than 60 countries. The company successfully grew its IT services business at 12% CAGR in the last nine years. Financial services, and manufacturing and technology are the two largest business units accounting for 25% and 22% of Wipro’s revenues. The U.S. accounts for a whopping 55% of the company’s business while Europe’s share is around 23%. The company reported a growth of 0.7% in the U.S. business and a 2.3% decline in Europe.

Source: Wipro Investor Presentation

Mixed Numbers with a weak Q4 outlook

Wipro’s recent results have shown an inconsistent performance across different verticals and geographies. Total revenue of $2 billion increased by 6.4% y/y but missed analysts’ estimates of $2.01 billion. Wipro’s IT services revenue in the third quarter grew by 3.5% to $1.9 billion from the same time a year ago. However, Wipro provided a weak outlook for the fourth quarter. Net profit also declined by 1% to $309 million from $312 million in the preceding quarter.

Wipro Positives

1) Appointment of a new CEO

Things look like they might turn around with the appointment of a new CEO at Wipro Ltd. Abidali Neemuchwala believes his initiatives would take another three to four quarters to show results. Wipro expects revenue to grow by 1%-2% in constant currency terms in the upcoming quarter. The new CEO is expected to change Wipro’s business strategies to focus more on digital and cloud-based solutions.

2) Focusing on Acquisitions to adapt to the Digital Age

Wipro has been on a buying spree over the last two years. The company recently bought a Brazilian company, Infoserver to strengthen its banking and insurance offering. Wipro also acquired HealthPlan services, a leading technology and business process as a service provider in the U.S. health insurance market. Other than Infoserver, Wipro bought Appirio, the cloud-services firm and three other companies which are expected to translate into a 4% growth. These acquisitions should help the company further strengthen its product offering.

3) A bouquet of services that is continually evolving

Wipro offers a wide range of services including consulting, enterprise, professional and outsourcing. The company is recognised globally for its comprehensive portfolio of services. It expanded its digital eco-system in digital, BPaaS and cloud applications which grew by 9.9% quarter over quarter and constitutes almost 22% of revenues.

4) Shareholder friendly management

Investors of Wipro Ltd. have been awarded through attractive dividend payouts and share buy-backs. It announced a buyback worth INR 25 billion in June last year and is planning a share buyback soon which may amount to INR 30-40 billion. Peers like Infosys (NSE:INFY) and Tata Consultancy Services (NSE:TCS) also announced share buy-backs earlier this year.

Wipro also announced an interim dividend of INR 2 per share in January.

Challenges

Trump’s Threat to H1B Visas

The IT industry has been struggling to post better dollar revenue. While Wipro Ltd. reported 0.7% sequential decline in dollar revenue, Infosys Ltd reported a 1.4% sequential drop while Tata Consultancy Services Ltd posted just 0.3% growth. To further add to their woes is U.S. President’s H1B Visa reform threat. This might force IT firms to make fundamental changes in their business strategies and adversely affect their overseas business.

Valuation

Shares of Wipro Ltd. are trading near INR 497, close to the mean 52-week price. The company has a market capitalization value of INR 1,233.55 billion and trades at a relatively cheap P/E ratio of 14.57x. The valuation looks cheap when compared to industry P/E average of 18.7x. The company has a dividend yield of 1.2%. Though the stock lost 10% over the last year, the performance has improved in the last three months with shares increasing by 8%. The stock performance in the last six months has also been better than its peer Infosys Ltd. (NSE:INFY) as is evident from the graph below.

Source: Moneycontrol

Conclusion

Wipro Ltd. is a leading information technology, consulting and business process services company. Information technology and business services have become major components of the Indian economy and the latter is expected to grow at 7% in the next year. Wipro is also expanding into other growing markets like Latin America, Canada and plans on investing in big data and analytics, cognitive computing, artificial intelligence, Internet of Things and other innovative areas. The company is a good way to invest in India’s off-shore IT services market which is expected to grow at 14% CAGR for the next nine years.

share your thoughts

Only registered users can comment. Please register to the website.