Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndia is one of the strongest contenders in the emerging markets and developing economies of the world. IMF in its World Economic Outlook April 2021 report projected that Indian economy saw a de-growth of 8% compared to previous forecast of 10.3% degrowth reported in Oct’20 wherein this deficit can be attributed to the Government imposed lockdown to contain the viral spread, sluggish manufacturing growth and restrained demand from the previous year.

India’s manufacturing sector activity rose to a near eight-year high in Jan’21, driven by sharp rise in new business developments amid a rebound in demand conditions that led to a rise in production and hiring activity. Purchasing Managers’ Index (PMI), dropped to a seven month low 55.4 in Mar’21 from 57.5 in Feb’21 and from 57.7 in Jan’21 owing to renewed lockdowns to curtail a resurgence in COVID-19 cases which dampened domestic demand (Source: IHS Markit India Manufacturing). However, new business opportunities as a viable alternate source have projected a steady rise in GDP to 12.5% in 2021 and 6.9% in 2022 (Source: International Monetary Fund World Economic Outlook April 2021). Government of India’s focus on renewable energy ensured very good growth in manufacturing of wind turbine and related aggregates during 2020-21. Indian Railways’ ambitious plans of modernization, electrification and safety, apart from others, has generated significant demand for infrastructure and rolling stock build. The road to recovery for India is a challenging one, one which requires swift reforms and monetary support to boost sustainable growth.

BEARING STRUCTURE AND DEVELOPMENT

The global bearing market is projected to touch USD 186.1 billion by 2025 thereby registering a CAGR of 9.1% between 2014 and 2025 (Source: Grand View Research, Inc., Report). Bearings are an integral component of all equipments and the ever so rising demand is a derivative of its diversified application in the global manufacturing sector namely the automotive and industrial sector. The estimated consumption of anti-friction bearings in India is about INR 95-105 billion. India is an emerging economy and the market is optimistic for a revival in GDP in the foreseeable future. The budget allocation to infrastructure will boost the demand for commercial vehicles. The Government’s pledge for an Atmanirbhar Bharat has encouraged the bearing manufacturers with local manufacturing capability

About Timken India:

Timken India Ltd., (TIL) a Timken Company subsidiary, started manufacturing bearings in India nearly three decades ago and today has state-of-the-art manufacturing plants in Jamshedpur and Bharuch to serve local bearing market needs and beyond. Employing the highly collaborative technical selling model for which Timken is known, the India team works directly with large OEM customers and with end users through a network of authorized distributors to make design and application recommendations to optimize performance and reliability. The Timken Technology Centre in Bangalore, one of four such centres in the world, provides customers access to engineering expertise and the latest technological advancements. It also offers a breadth of bearing repair and related mechanical power transmission services to its customers. Timken India was incorporated in 1987 as Tata Timken Limited (TTL), a joint venture between Tata Iron and Steel Company (TISCO) and The Timken Company, a world leader in bearings. It commenced commercial production at its Jamshedpur plant in March 1992. The Timken Company is a world leader in tapered roller bearings.It commenced commercial production at its Jamshedpur plant in March 1992. TISCO and TIMKEN each held a 40% equity stake in the company and the public held the rest.

In 1999, Timken acquired from Tata Steel its 40% stake in Tata Timken Limited. The name of the Company was changed to Timken India Limited on July 2, 1999.

Product/ Services Offerings

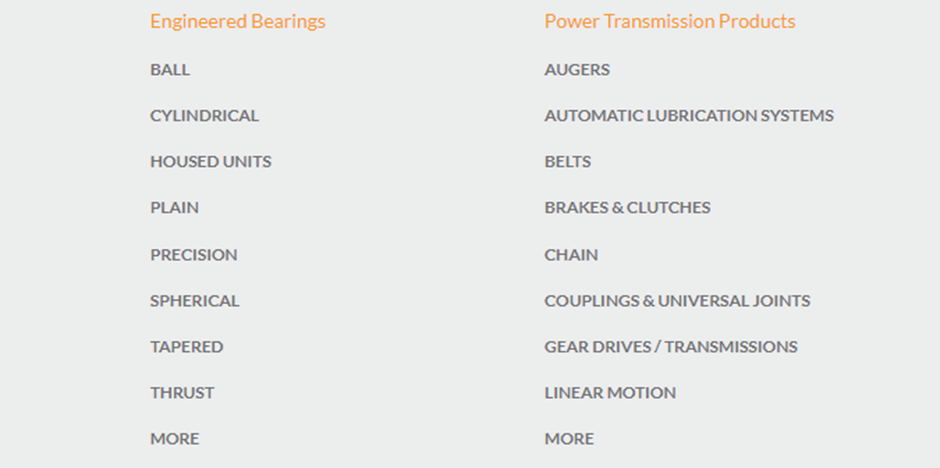

The company's products include a wide range of engineered bearings and power transmission products in its portfolio.

It also offers a wide range of industrial and overhaul services for bearing and power systems.

Revenue Breakup

During FY20, bearings accounted for 63% of revenues, followed by components (30%), maintenance and refurbishment services (4%) and bearing accessories (3%)

Geographical Revenue Breakup

In FY20, India accounted for ~75% revenues, followed by USA (13%) and others (12%)

Customers

The products are sold mostly to the automotive industry and Indian Railways. It works with 50+ Industrial and 100+ Automotive channel partners.

The revenues from its largest customers accounted for ~25% of total revenues in FY20.

Manufacturing Capabilities

The Co. has tapered roller bearing manufacturing plants in Jamshedpur and Bharuch in Gujarat. Bharuch also has a manufacturing footprint for Cylindrical Roller Bearings, Spherical Roller Bearings and Slewing Bearings.

Over the years, the company have doubled capacity at the plant in Jamshedpur.

R&D Support from Parent Company

The Timken Company is a global manufacturer of bearings and power transmission products. Timken operates in 42 countries across the globe. It derives benefits from the developments made by the R&D team at The Timken Company(US).

The Timken Technology Centre in Bangalore, one of four such centres in the world, provides customers access to the global pool of engineering expertise and the latest technological advancements.

Portfolio of Successful Brands:

The Companies expertise in the domains of metallurgy, tribology and mechanical systems enables collaboration with Original Equipment Manufacturers to design and develop solutions as per application. With about 50+ Industrial and 100+ Automotive channel partners, your Company reaches out to end-markets for its product & services and assists customers in improving the reliability and efficiency of equipment, machinery, and vehicles

Royalty Expenses

The Company does not generally design products. Designing is done by The Timken Company, ultimate parent company and in return Timken India incurrs royalty expenses to The Timken Company, USA and had paid 29 crores of royalty in FY20 as compared to ~31 crores of royalty in FY19.

Merger of ABC Bearings Limited

In 2017, The co. entered into a definitive agreement to acquire ABC Bearings Ltd, a manufacturer of tapered and cylindrical roller bearings and industrial bearings including spherical roller bearings and slewing rings. ABC Bearings Limited with manufacturing facilities at Bharuch and Dehradun merged with Timken India Limited.

Pursuant to the Scheme, the Company allotted ~72 Lakh equity shares to the shareholders of ABC Bearings Ltd in the ratio of 5 equity shares of ₹ 10/- each of the Company for every 8 shares of ₹ 10/- each held in ABC Bearings.

Opportunities Ahead:

In the railway segment, TIL continues to make inroads in ‘passenger coach’ segment amid new trains like Train 18, Shatabdi’s and Rajdhani’s use TRBs. As per management estimate, the opportunity from this segment is at ~| 80 crore every year (4000 cars x eight bearings per car x | 25000 unit cost). It is also capitalising on replacement market, where spherical roller bearings are now getting replaced by cartridge tapered roller bearings (CTRB). On the freight side, TIL is one of the few entities to which Indian railways’ has outsourced ‘maintenance of bearings’ the market size of which is | 300 crore (3L freight coaches x eight bearings x | 5000 per bearing – one-fourth bearings come for maintenance every year).

The Red Flag:

Great Performance but expensive Valuation:

The companies Q2 FY22 results were robust and the company reported its highest ever sales and profits and the reported an EPS of 10.53 and the performance has been above expectations and despite the increase in the raw material prices, the company has been able to maintain its Operating profit margin which shows the companies ability to pass on the increase in the production cost to its customers.

Source: Screener.in

Leaving performance of the company aside, lets have a look at the valuations of the company, the company is trading at price multiples of 64x and is trading 10times to its Book Value and if one wishes to invest in the sector, then there has been other opportunities like NRB bearings which is trading at a lower price multiples. The expensive valuation doesn’t give much margin of safety and in a bull market ,valuation has taken the back seat but for long term investment horizon, valuation of the company matters and it should be given more priority than the any other factors.

share your thoughts

Only registered users can comment. Please register to the website.