Market Share Gains and Recovery Should Lend Support to VRL Logistics Limited

Summary

- Planned infrastructure push sounded by Indian Government awaits implantation and economic revival is only possibility ahead.

- Logistics industry should be able to benefit from growth in manufacturing and allied industries.

- Being an organized player and recent initiatives should help VRL Logistics achieve sound growth levels.

Overview of VRL Logistics Limited

VRL Logistics Limited is a nationally renowned logistics and transport company, currently being categorised as largest fleet owner of commercial vehicles in India. The company was able to pioneer in providing safe and reliable logistics network in avenues of parcel service. The company ensures last mile delivery in remote locations. VRL Logistics Limited has integrated hub-and-spoke operating model, enabling optimal aggregation of consignments from diversified customer base across multiple industries and locations. The company has been categorised as one of front-runners in Indian Passenger Travel Industry from a list of private sector players. The company was able to diversify its operations to courier service, priority cargo & transport of passengers by Air to meet increasing demands of burgeoning customer base.

Growth Enablers of VRL Logistics Limited

- Pick-up in Demand Should Lend Support: In 2Q22, the company saw pick up in overall demand while business growth was seen going back to pre-pandemic levels. Despite difficulties, impact on business was lesser in comparison to first wave in previous year. This was because supply chains were evolved enough to cope up localized and staggered lockdowns. With addition of 22 new branches in 2Q22 and 31 new branches in 1H22, the company plans to expand network with opening of new branches in a market which is yet to be tapped. Number of GT vehicles saw a rise from 4,575 in FY21 to 4,687 vehicles in 1H22, while 54 new vehicles were added in 1Q22 and 138 vehicles in 2Q22. In 1H22, the company saw an addition of 192 total vehicles. During 1H22, the company was able to add 9 electric vehicles.

- Competitive Strengths: VRL Logistics is well-established brand in India for surface transportation and it has secured place of industry leader in parcel transportation space. Having track record of 4+ decades, the company has a large size and diversified scale of operations. The company operates on pan India basis, with strong distribution network. Two principal advantages that the company has over its competition are its well-established network of branches and franchisees and the company’s owned fleet of commercial vehicles which has in-house vehicle body designing and vehicle maintenance facilities. This is for catering to parcel transportation. The company operates across 22 States and 4 UTs in India and it has strong reach for offering of LTL goods transportation services. VRL Logistics Limited has built up capability to maintain owned vehicle fleet internally. Cost savings are being achieved because of economies of scale through tie-ups with fuel suppliers, vehicle manufacturers for supply of spare parts, tyres etc. Ongoing in-house R&D in this domain enabled the company to use vehicles for significantly longer term vis-à-vis industry and at significantly lesser maintenance costs. The company has well diversified customer base. The company has no dependencies on any customers or product categories. Similarly, VRL Logistics Limited has no geographical or product related dependencies for its business. This insulates the company vis-à-vis competition.

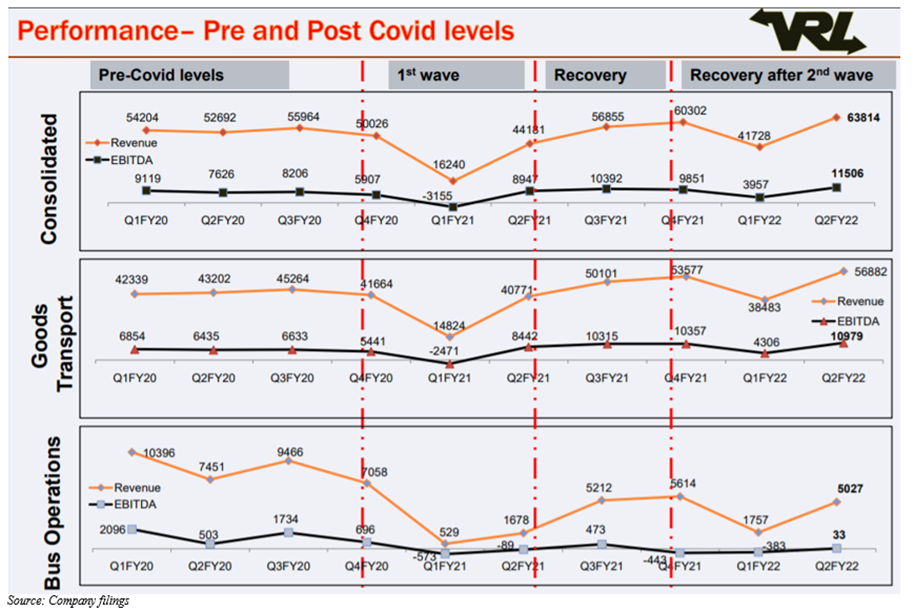

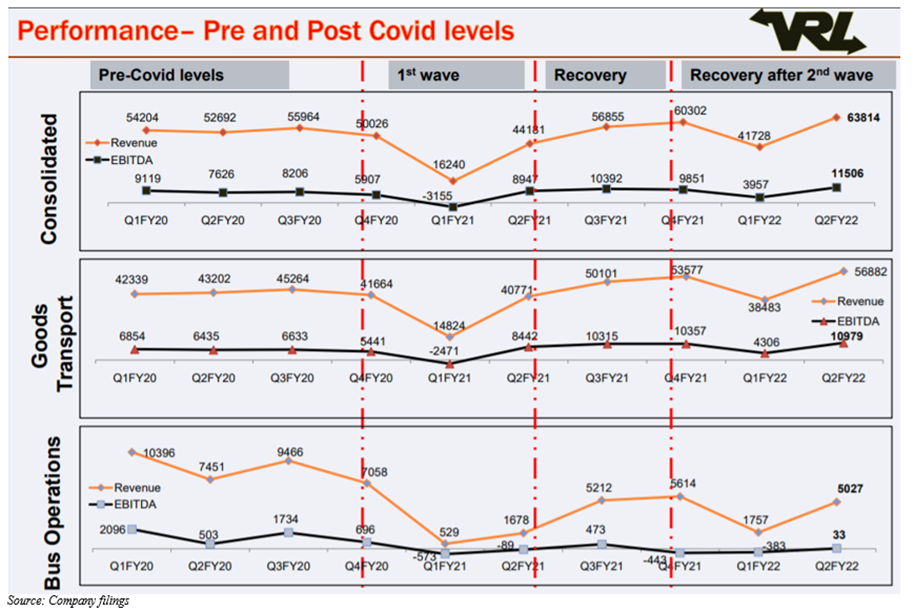

- Strong Pick-up: Year gone by saw uncertainties due to pandemic and financial performance, with 1Q of fiscal year seeing massive operational cash losses. Gradual recovery and eventual stunning growth in volume seen in latter portion of fiscal year aptly exhibited inherent business model strength of VRL Logistics Limited. Operationally, the company was ready to revive and handle business coming its way. Strong inherent ability supported the company in bearing brunt of COVID-19 and recover fast in face of adversity.

- Capitalising on Opportunities: FY22 can see some disruptions on business volume front. Lockdowns which were imposed in various states affected brick and mortar industries, resulting in lower demand, conservative consumer behaviour and restrictions in movement of men and materials which impacted everyone in surface logistics industry. Freight volumes are increasing and should be able to surpass pre-Covid-19 days in near short-term. This is so because being organized helps the company to better handle ongoing scenario as several unorganized smaller operators decided to shut their shops. This happened because they were unable to cope up with financial stress presented by pandemic. Given that industry is seeing domination by unorganized players and they are bearing financial brunt, organized players like VRL Logistics Limited should benefit.

- Optimism Around Vehicle Scrappage Policy: Vehicle scrappage policy is government-initiated program focusing on replacing old vehicles from Indian roads. As per new policy, commercial vehicles of 15+ years and passenger vehicles of 20+ years should be mandatorily scrapped. This will happen if they fail to pass fitness and emission tests from Apr 1, 2022. Eventual situation of increased demand for vehicles should work favourably. Inevitable freight rate hike as result of this policy implementation should result in higher margins for VRL Logistics Limited. The company has internal expertise on vehicle maintenance front which should result in availability of all useful spare parts from vehicles being scrapped for usage. This will be in addition to one-time salvage income expected. Any such scrappage should not entail any hit to profitability as vehicles are fully depreciated.

- Recent Initiatives Favour VRL Logistics Limited: In aftermath of COVID-19, financially strong and organized players should be able to benefit at cost of smaller and marginal players dominating industry. The company expects better utilization and revenue realization per vehicle for goods transport vehicles in view of revision in safe axle weights for goods transport vehicles, permitting carrying of higher weight on goods transport vehicle and increasing payload. On passenger bus operations front, the company should be able to benefit from now introduced ‘All India Permit’ for private buses. This should help the company reduce operational cost for that segment. In difficult times, available drivers and vehicles are being put to use for full truck loads and parcels depending on return load and other ground level position.

- High-Margin LTL Segment: LTL freight service focuses on transportation of consignment, belonging to multiple customers in one vehicle to multiple destinations. This helps the company in generating higher net revenue per vehicle in comparison to FTL service. FTL service focuses on transportation of one customer’s freight to single destination. The company has an integrated hub-and-spoke model, entailing consolidation of goods from several locations at transhipment hubs and then redistributing at respective destinations. LTL business is a principal revenue enabler and margin contributor, which accounted for 80% of the company’s FY21 total revenues.

- Healthy Financial Profile: The company continues to have a healthy financial profile, with solid profitability indicators and strong cash accruals. VRL Logistics Limited’s comfortable capital structure makes up for an attractive opportunity. Liquidity position remains adequate which seeks support from undrawn working capital lines and financial flexibility so that more credit lines can be availed in case any need arises. The company’s liquidity is supported by free cash and liquid investments and undrawn term loans for capex.

Conclusion

Logistics cost in this country is ~14% of GDP in comparison to global average of ~8%. India has 2nd largest road network globally, totalling 5.5 million kms. Despite this, national highways make up for less than 2.7% of total network. This puts strain on national highway network, carrying ~40% of road traffic. Indian road transport sector transports goods worth $150 billion/year. Trucks provide more benefits in comparison to railroads. Indian logistics sector saw recovery after seeing disruption in 1Q21 due to nation-wide lockdown, resulting into demand side and supply side challenges. These challenges were eased in subsequent months on account of recovery in economic activities. After restrictions eased and there was revival in economic activity, freight availability for logistics companies saw an improvement.

Many logistics companies were able to revert to pre-pandemic levels by 2Q21 end and they reported year-over-year growth from 3Q21. This continued into 4Q21. Freight rates remained firm. To talk about profitability, logistics companies were able to keep earnings contraction within bounds to significant extent even though these companies saw lower revenues and higher fuel prices. This was seen because of aggressive rationalisation of fixed overheads and cost-control initiatives.

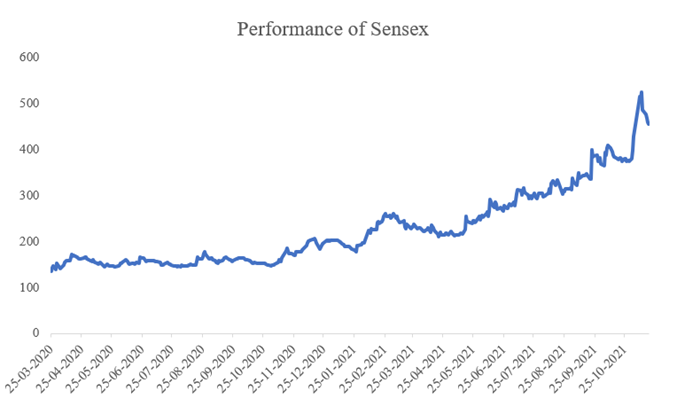

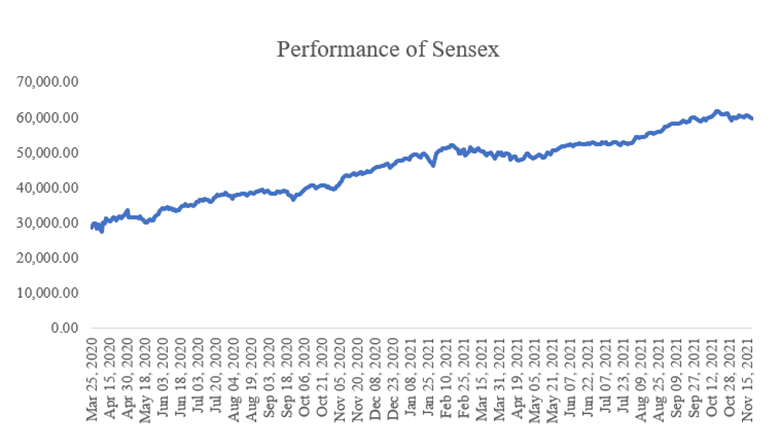

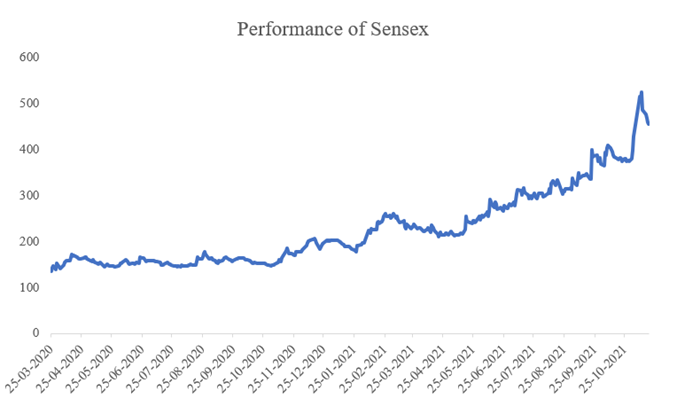

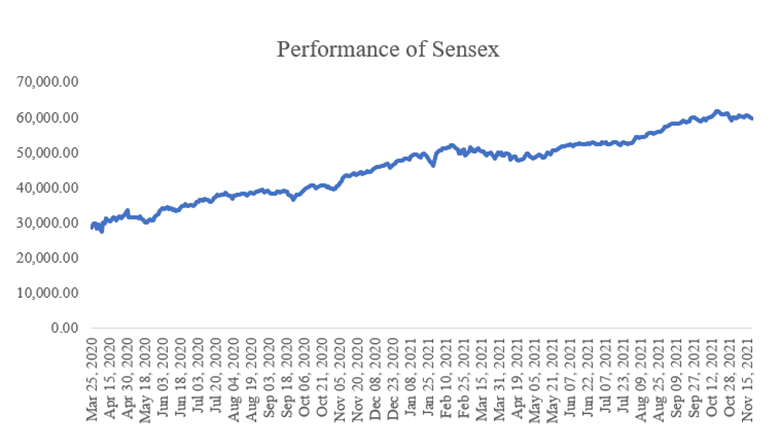

Stock of the company has seen a run up of ~234.84% between Mar 25, 2020- Nov 18, 2021. In comparison, Sensex has risen only ~108.99%. Growth in stock price was principally supported by revival in economic activities and better management of demand supply gap.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.