Bharat Dynamics Limited and Bharat Electronics Limited Are On Their Growth Paths

Summary

- Increasing R&D activities in association with DRDO and focus on exports should act as principal growth enablers for Bharat Dynamics Limited.

- Withdrawal of OEMs from China and strong order book should lend support to Bharat Electricals Limited.

- Defence and Aerospace market should seek support from increased participation of private sector.

About Bharat Dynamics Limited

Having its headquarters in Hyderabad, Bharat Dynamics Limited was incorporated on Jul 16, 1970 as public sector undertaking under Ministry of Defence, Government of India. The company acts as a base for manufacturing guided missile systems and allied equipment for Indian Armed Forces. Since its very inception, the company continues to work in collaboration with DRDO & foreign Original Equipment Manufacturers so that manufacturing and supply of missiles and allied equipment to Indian Armed Forces can be done. The company has now evolved as one among few industries having state-of-the-art facilities for manufacturing and supplying of guided missiles, underwater weapons etc. for Indian Armed Forces. This company provides product life cycle support and refurbishment/life extension of vintage missiles.

Growth Enablers of Bharat Dynamics Limited

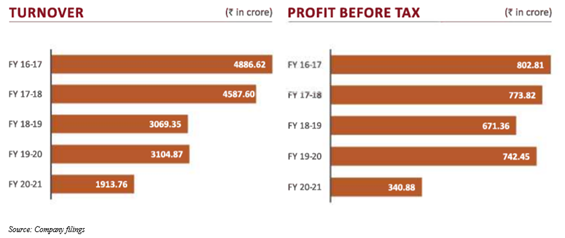

- New Orders and Projects Should Lend Support: During FY21, the company saw new orders worth INR2803 crores. This has led to further strengthening of existing order book position. Significant orders include Anti-Tank Guided Missiles order worth about ~INR1820 Cr. and Surface to Air Missiles order worth ~INR793 Cr. Apart from orders received, several orders are in pipeline and these are at various stages of progress. Significant orders expected to be received in FY22 are Akash Missiles or IAF, Akash 3rd and 4th regiment for Army, Astra Weapon System & Konkurs-M Missiles. Bharat Dynamics Limited continues to work for placement of these orders. The company received from Indian Navy a project sanction order for development and manufacture of “Mobile Target Emulator 5” under Make-II. Prototype is now being developed by the company. After it gets developed, it should fetch big business for the company. As a result of these orders, the company should be able to see high growth. Order book of the company continues to pick up and it continues to consolidate its orders that are in several stages of finalization. Interest is now being seen from export market and market is now opened up for its product like Akash Weapon Systems. This generated a significant amount of interest from potential buyers abroad. It saw leads for export of missile from ~9 countries. Apart from domestic market, Bharat Dynamics Limited has its eye on foreign customers to consolidate order books and be a global exporter of missiles system. The company continues to focus on increasing R&D activities in association with DRDO and it plans to have joint-development programs. The company continues to explore several business opportunities with foreign OEMs and it signed MoUs with overseas OEMs in FY21. This should help the company diversify offerings and mitigate product deficiencies.

- Focus on Exports: Apart from regular supplies to Indian Armed Forces, the company exports light weight torpedoes to a country through private channel partner. Ministry continues to create opportunities for export market and the company has seen 4 export orders. Out of these, the company supplied first and second contract of LWT-XP in 2019-20 and has supplied third and fourth contracts of LWT-XP worth INR145 Cr. in FY21. Offset implementation continues to offer opportunity in achieving export targets. The company interacts with aero-space and defence majors in Europe and Russia to seize available opportunities arising from offsets. Offset implementation provides major opportunity to achieve export targets.

- Capitalizing on Sectoral Dynamics: Because of new policies formulated by Indian government, Indian defence market is in a state of transition. This country is second largest armed forces in world. Over next 7-8 years, country plans to shell out $130 billion on military modernization. Achieving self-reliance in defence production is main target for Indian government. Ongoing DRDO projects in this country are worth around USD7.3 billion. Indian government has now opened up defence industry for participation of private sector to provide impetus to indigenous manufacturing. Due to opening up of industry, there is a possibility that foreign Original Equipment Manufacturers might enter into strategic partnerships with Indian companies. Defence export strategy was formulated to facilitate defence public sector undertakings and private defence players in analysing business opportunities present overseas. Rising concerns about national security should accelerate demand growth.

Conclusion

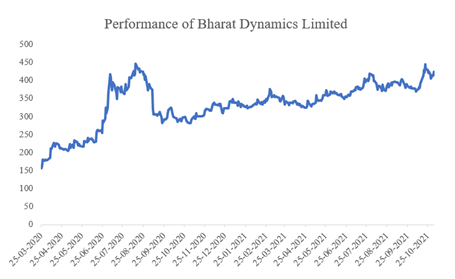

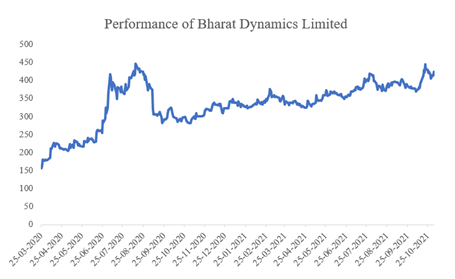

The company saw total income of INR15,619.16 lakhs in 1Q22, exhibiting a growth of ~154.68% on year-over-year basis. Its loss for period narrowed to INR2,095.06 lakhs in 1Q22 from INR7,803.80 lakhs in 1Q21. Stock price is expected to be supported by the company’s focus on exports and new orders and projects. Between Mar 25, 2020- Nov 3, 2021, stock of the company has seen a run up ~172.56%.

Bharat Electronics Limited

About Bharat Electronics Limited

Bharat Electronics Limited was set up to meet specialized electronic equipment requirements of Indian Defence Services. While this has been a continuous prime focus, the company continues to have a significant presence in civilian market. The company exports some of its products and services to other countries. It lays great emphasis on R&D right from its initial years. It has partnered with many DRDO labs as production agency.

Growth Enablers of Bharat Electronics Limited

- Export Initiatives Are Key: Bharat Electronics Limited continues to focus on attaining technological leadership in defence electronics by leveraging in-house R&D, partnership with defence/research laboratories & academic institutions. In FY21, the company’s R&D investment was 6.32% of turnover and revenue from defence business formed 78%. It filed application for 162 IPRs. It continues to enter new business areas and tries to keep pace with fast changing technological advancements apart from focusing on enhancing operational efficiency. On export front, the company’s order book was USD125.93 million as on Apr 1, 2021. This includes offset orders of USD46.35 million. To provide greater thrust to exports, the company opened marketing offices at Oman, New York, Singapore, Vietnam & Sri Lanka. It has plans to continue this and open offices in some other countries. The company’s focus is on increasing business opportunities in South East Asia, Europe, Middle East, Africa and North America. This can be achieved by engagement with customers and the company continues to work with other Indian Companies & local partners in respective countries. It should help maximize geo-strategic reach and increase global footprint.

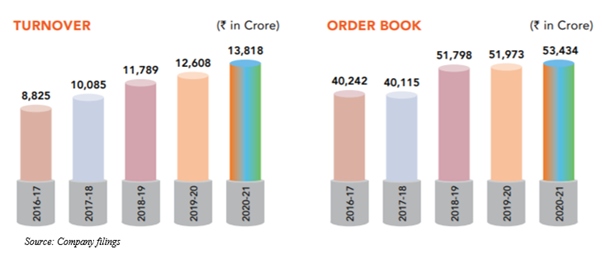

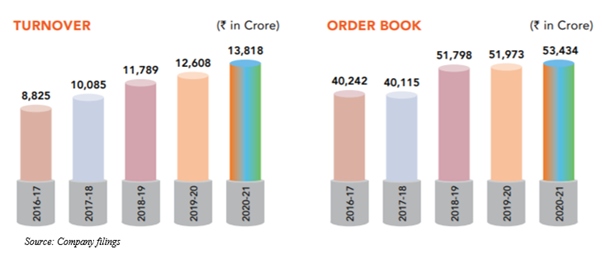

- Strong Order Book: The company saw turnover of INR3622.42 Cr, exhibiting a growth of 14.45% during 2Q22 over turnover of INR3164.99 Cr seen in corresponding period of FY21. PBT during 2Q22 was INR827.74 Cr, with 48.02% growth over PBT of INR559.22 Cr seen in 2Q21. Order book position of Bharat Electronics Limited was INR54627 Cr. as on Oct 1, 2021.

- Promising Future: It is working to achieve healthy growth of 12%-15% during FY22 with major contribution from segments like Radar and Missile Systems, Communication and Network Centric systems, Anti-Submarine Warfare & Sonar Systems, Tank Electronics, Gun upgrades, Electro Optic systems and Electronic Warfare & Avionics systems. Order book of the company as on Apr 1, 2021 was ~INR53,434 Cr. Modernisation of CPMF, Police, Railways, Airports and withdrawal of OEMs from China as a manufacturing base should act as growth enablers for achieving healthy growth.

- Various Strategies Should Lend Support: The company took several initiatives in FY21 and has increased contract manufacturing portfolio by increasing empanelment of the company as global supply chain partner with OEMs and it has proposed strategic alliance with foreign OEMs and it continues to address global markets by offering best value proposition. Concentrated efforts made by the company and export initiatives taken, a proactive approach with customers by offering new and complete systems and procedures, higher customer’s base, taking up new, customised & critical projects are expected to enable export sales.

To retain leadership position in strategic electronics, the company evolved various strategies and initiated plans to beat competition and maintain technological edge. Future of the company seems to be promising and challenging. In changing business scenario, the company focuses on enhancing interaction at various levels and managing relationships with customers, strategic partners and other stakeholders in Indian defence industry as trusted and committed partner. It took several mitigation measures to reduce Covid-19 impact on the company’s performance.

Conclusion:

The company offered its products and services to major platform OEMs and their Tier-I suppliers. This supported Bharat Electricals Limited in leveraging partnerships for purposes of co-development, co-production and similar arrangements with various OEM’s to get products manufacturing at the company and utilization of services of the company not only for Indian programs but for global requirements. Despite Covid-19 pandemic, the company saw export order acquisition of USD56.61 million during FY21. This was from global customers including US, France, Switzerland, Israel, Sweden, ASEAN countries, Mauritius and Sri Lanka.

Stock price of Bharat Electronics Limited saw a run up of ~232.7% between Mar 25, 2020- Nov 3, 2021. Concentrated efforts made and new export initiatives should support growth in stock price.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.