Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINWhat is a REIT?

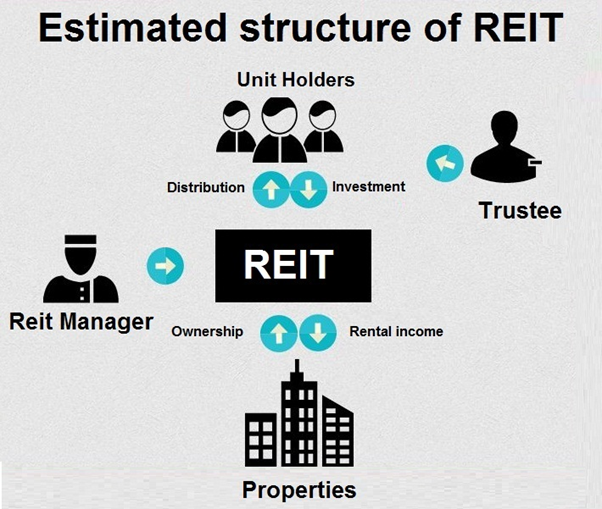

A REIT stands for Real Estate Investment Trust. The primary purpose of a REIT is to invest in rent-yielding properties. It has to distribute most of its income (min 90%) to the investors/unitholders.Minimum 80% of the REIT’s assets have to be completed and income-generating.Real Estate is generally a large ticket size investment, which makes it inaccessible for retail investors. A REIT enables investor participation in this asset class and helps diversify investments into rent-yielding real estate with small amounts (minimum is Rs. 50,000). REITs are governed by SEBI’s Real Estate Investment Trusts Regulation 2015. Several changes have been introduced to the regulations to make them more accessible to retail investors.

REITs are more than 50-years-old and were originally devised in the United States in 1960 under the Cigar Excise Tax Extension Act. The first REIT was listed on the New York Stock Exchange in 1965. In the coming decades, similar instruments debuted on European, Japanese, and Australian stock exchanges.In India, the Real Estate Investment Trusts were introduced by the Securities and Exchange Board of India (Sebi) in 2007. The securities watchdog only released draft regulations which due to certain limitations were later on rejected. In September, 2013, Sebi came out with revised regulations for REITs, which were approved on September 26, 2014.

REITs have many advantages for interested investors. It provides a regular income stream along with reduced portfolio volatility and dividends and wealth accumulation. As a result of it being a listed entity, it is bought and sold with ease providing great liquidity. It is a natural hedge against inflation as returns have been seen to consistently outpace Consumer Price Inflation.There are primarily two types of REITs – equity and mortgage. Real Estate Investment Trusts are extremely beneficial for the development of an economy as they allow dormant investable funds to be channeled into infrastructure projects such as apartment complexes, hospitals, schools, and the likes.

How does the REIT make money?

The primary source of operating revenue for the REIT is the rental income followed by common area service charges. The office spaces are usually leased out for 9 to 15 years with rent escalation of 10% to 15% every 3 years.When leases are renewed, there is an opportunity for the mark to market the rent, that is, align the rent to the current market rents.The tenants have long-term plans usually and hence provide a stable source of income. Even during the post-pandemic period, there were near complete recoveries including rent escalations.

Now that we have understood about RITES,lets have a look at the listed RIET companies in India and assess them on several basis:

1) Embassy Riet

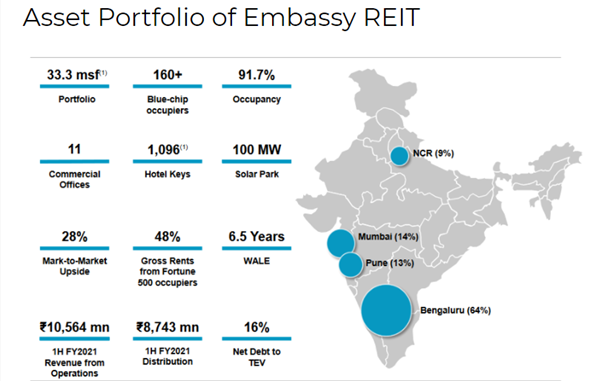

Embassy REIT owns and runs a 42.4 million square foot ("MSF") portfolio of eight infrastructure-like office parks and four city-center office buildings.Embassy REIT, sponsored by Embassy and Blackstone, is Asia's first and largest REIT (by area). The corporation owns and operates 42.4 million square feet of space (million square feet). It has eight office parks, two hotels, and a 100-megawatt solar power facility. Embassy Office Parks REIT reported a 12 percent increase in net operating income to Rs 2032 crore for the fiscal year ended March 2021, compared to the preceding financial year.

India's first listed Real Estate Investment Trust (REIT) and Asia's largest also recorded a 10% growth in revenues for FY2021 to Rs 2,360 crore, up from Rs 2144 crore in FY19-20, according to the company.

2) Mindspace Riet

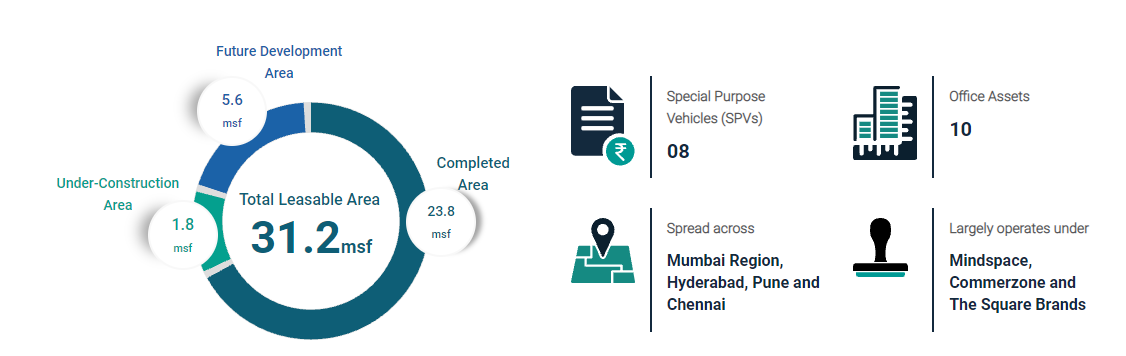

K Raheja Corp Group is the sponsor of Mindspace REIT. With a total leasable area of 30.2 msf, it has a solid portfolio of office spaces across Mumbai, Pune, Hyderabad, and Chennai. Mindspace Business Parks REIT, which is sponsored by K Raheja Corp and Blackstone Group, has announced a net operating income of over Rs 358 crore, with a portfolio size of 30.2 million sq ft, up from 29.5 million sq ft.

It has raised Rs 375 crore in market-linked debentures at a rate of 6.65 percent per annum, as well as Rs 75 crore in non-convertible debentures at a rate of 6.69 percent per annum. As of March 31, the REIT's average cost of debt was 7.1 percent.

3) Brookfield India Real Estate Trust Riet

Brookfield India Real Estate Trust Riet is a commercial real estate vehicle established in India. The Company's goal is to offer its unitholders with risk-adjusted total returns. During the quarter ended June 30, 2021, Brookfield India Real Estate Trust recorded a 3.8 percent increase in net operating income to 169.6 crores. It also announced a 181.7 crore payout to unitholders.

Operating lease rental collections remained strong at nearly 99 percent. Operating lease rental income increased by 7.3 percent to 161.6 crores in the April-June quarter, up from 150.7 crores in the previous year's quarter.The first quarter of this fiscal year, total revenue was 222.67 crore, with a profit of 73.83 crores, according to the company.

Peer Comparison:

Source: Screener.in

Embassy Riet remains as my first choice compared to Mindspace and Brookfield as the company makes higher sales and profits compared to its peers and is also trading at a lower price multiple. Though these two aren’t the only criteria to measure the company. All the companies have positive cash flows, however, Embassy Rites has negative reserves (accumulated losses) of (-1,733 crs) which is a concern. However, the same can be offset by the companies earning potential and being Asia’s largest Riet

Benefits and Limitations of Investing in REITs

The following are some key benefits of investing in REITs:

There are also a few limitations of REITs that you should be aware of:

share your thoughts

Only registered users can comment. Please register to the website.