Growth in Real Estate and Infrastructure Should Make Way for Orient Cements Limited

Summary

- Demand in cement industry should be supported by positive outlook on sectors like housing and commercial real estate, construction and infrastructure.

- In FY22 budget, government increased allocation for capital expenditure for creation of infrastructure by 34.5% to INR5.54 lakh crores.

- Rural infrastructure development fund was enhanced to INR40,000 crores, exhibiting increase from INR30,000 crores.

Overview of Orient Cement Limited

Orient Cement Limited was established in 1979 and was earlier a part of Orient Paper & Industries. The company was demerged in year 2012. Since then, the company emerged as one of fastest and leading cement manufacturers in India. Few years back, the company initiated its commercial production at integrated cement plant which is located at Chittapur, Gulbarga, Karnataka. Product mix consists of Pozzolana Portland Cement & Ordinary Portland Cement. These are marketed under brand name of Birla.A1 – Birla.A1 Premium Cement and Birla.A1 StrongCrete. Having a focus on resilience and durability, Orient Cement Limited created benchmarks in industry due to quality of products. Orient Cement Limited is a symbol of strength and trust, and the company has established a reputation for same. The company uses only high-grade raw materials. Products remain suitable for different types of industrial, residential and commercial constructions.

Growth Enablers of Orient Cement Limited:

- Operational Strengths Lent Support: FY21 was a tough year for obvious reasons and pandemic disrupted lives and businesses globally. Orient Cements Limited emerged successfully and had a focus on business continuity. The company exhibited strong rebound in revenues and profitability as it maintained strong focus on cost and cash management and innovative structural reforms. To overcome challenges seen, the company maintained its focus on optimising costs and on maximising cash generation. Orient Cements Limited achieved this as the company directed several measures across processes. Since there were factors that remained beyond the company’s control, it planned to leverage its operational strengths. With noticeable demand improving in latter part of FY21, demand for cement saw a significant rebound. This demand improved as there was short-lived respite from 1st wave of Covid-19 and resumption of infrastructure projects. Orient Cements Limited was able to service this demand due to strong connect with customers and channel partners. Team was able to channelise resources across supply chain network to make quickest product delivery. Demand from rural regions saw a significant improvement and the company saw volume growth for its products towards end of FY21. Besides, the company was seen focusing on marketing superior quality cement. The company’s premium product ‘Birla.A1 StrongCrete’ exhibited progressive growth over years. This validates the company’s conviction to improve margin growth. The company remains optimistic on capacity expansion to 11.5 million tonnes by FY24 and further to 14.5 million tonnes soon thereafter. Since it is focused to achieve this objective, the company has intensified focus on deleveraging its business and built healthier and stronger balance sheet.

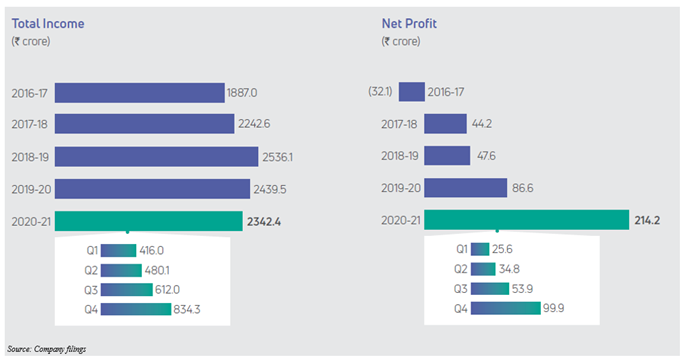

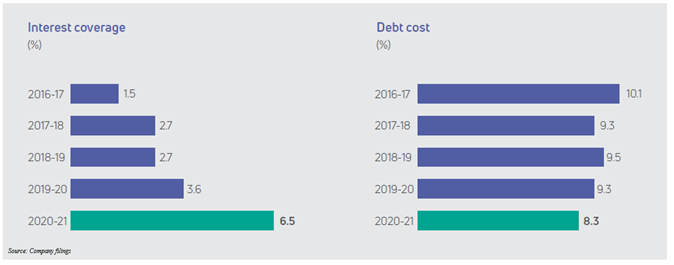

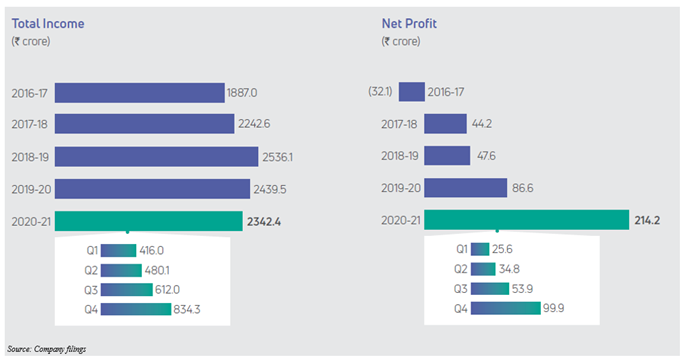

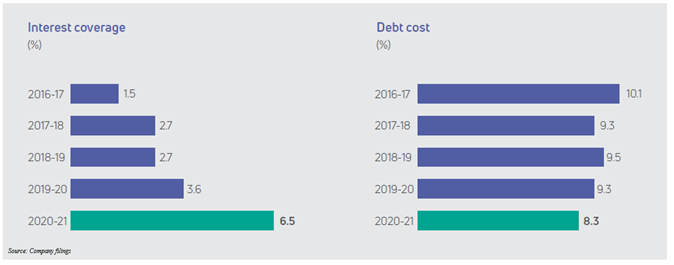

- Focused on Maintaining Healthier Balance Sheet: Despite all odds, the company was able to saw total debt come down by 4Q21 end. The company was able to deliver upon its commentary which it made in beginning of year. Committed fixed costs, variable costs of raw materials which remained volatile and fall in sales with onset of pandemic were some challenges the company saw. The company undertook review of every aspect of operations and took decisive and necessary actions so that it has sound liquidity and adequate access to capital. The company was able to identify opportunities focused on saving costs across value chain. It stepped up its collections from debtors, reducing debtors’ cycle and improving its working capital ratio. During tough times when the companies looked to bring down their inventory, the company took this bold step of not rushing to sell until and unless it was able to see visibility of collections. Cash flow generation saw some improvement on top of healthy EBIDTA. Since no significant capex was lined-up during FY21, the company was able to reduce its debt levels. It brought down gross debt to INR770.18 crore, with an interest coverage ratio of 6.5x. The company’s focus remains on strengthening its balance sheet and leverage for accelerated growth.

- Focused on Cutting Down Costs in FY21: Covid-19 induced healthcare and humanitarian crisis in FY21 resulted in significant challenges for Indian economy and society at large. Regional and state specific variations were visible in demand growth. While North, East and Central markets saw better demand situation year-on-year, both West and South saw moderate to large de-growth. Markets that Orient Cement Limited serves saw huge contractions because of higher impact of COVID-19 in Maharashtra, higher fiscal deficits and consequently a halt in large infrastructure projects that was seen in several states. Deep cost rationalisation steps, like one-off measures that involve deferral of various discretionary/ quasi-discretionary and several other significant cost cuts were adopted to deliver improved profitability. In view of significant uncertainty, decided investments in capacity enhancement were put on a halt until and unless better line of sight emerges from demand standpoint. Extraordinary and timely efforts supplemented by better sales realisation lent support to the company to emerge even stronger. Better sales realisation was because of optimisation of product-mix, customer-mix and market-mix. Net debt saw a reduction of ~46% during FY21, which creates strong platform for future growth opportunities. Total sales volume for FY21 was 51 lac tons as against 58 lac tons in FY20, exhibiting degrowth of ~12%. Net sales realization for FY21 was INR4,598 per ton against INR4,167 during last year. Though there was a fall in sales volumes, EBITDA of FY21 was INR569.03 crores. This exhibits a strong 42% improvement over INR400.59 crores in last year. The company saw ~147% improvement in net profit in FY21 against last year.

- Capitalising on Industry Dynamics: Cement production in country saw a hit as a result of demand contraction from housing and infrastructure sector and because of deferred capacity expansion. Lockdown announced in aftermath of COVID-19 severely impacted industry as it coincided with strong demand period. Fall in urban demand was seen being compensated by resilience in rural demand as a result of strong agricultural output and rural infrastructure projects. Demand and production saw some improvement in 2H21 over 1H21 as there was a push to infrastructure projects and improvement in retail demand in rural economy. Industry should be able to see volume growth because of demand revival in infrastructure and urban housing segments as a result of a low base. Industry’s want to improve operating leverage by focusing on improving capacity utilisation can impact price improvement. Recent rise seen in power and fuel prices can lead to margin compression, though volume growth should be able to support higher absolute profitability and reduction in debt. Industry should be able to see production growth of 10-12% and improved capacity utilization of 60%-65% in FY22. This is likely to stem from government’s focus on infrastructure spending and strong rural demand.

Conclusion

Real estate market should be able to see sound growth levels in upcoming years and this industry saw an investment of INR46,000 crores in FY20. Fall in home loan rates resulted in significant improvement in affordability of housing for urban areas. Real estate market in tier 1 cities should see growth as a result of higher adoption of work from home practices. Rural and affordable housing should be able to lend support to demand in cement industry. Capacity addition should be between 21-22 million metric tonnes in FY22. Growth in demand should support industry’s capacity utilisation levels to ~64% in FY22 from 55% low which was seen in previous year.

FY22 budget exhibited that government has enabled debt financing of InVITS by FPIs by making amendments in legislation. Orient Cements Limited saw its market share growing because of sustained innovation, better service to its customers and channels and improvement around operational efficiency. Optimisation of channel, higher realisation as a result of product mix and premiumisation are some other supportive factors. Since the company has a structured brand architecture, its products continue to be a stand out performer in market and these products gain trust.

Because of improved profitability and cash flows, the company’s focus was prioritising reduction in debt at an expedited rate. This created a good platform to address investments in capacity expansion which should soon become important as market demand picks up.

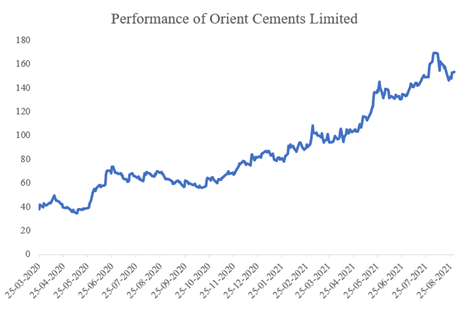

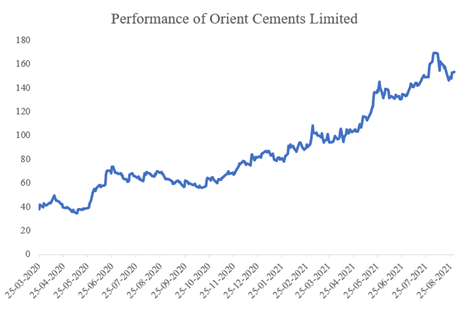

Stock of Orient Cements Limited has seen a strong run up of ~301.96%. This strong return was given by stock between Mar 25, 2020- Aug 30, 2021. Strong infrastructure push and removal of restrictions supported this price rise. Stock presently trades at ~15.04x FY21 EPS, which is at a deep discount to sectoral average of ~21.23x. This favours long position on this stock.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.