Cost Control Measures and Focus on Exports Should Help Aries Agro Limited Achieve Desirable Growth

Summary

- Diversified product portfolio and strong distribution network are expected to act as principal growth enablers.

- Its unaudited total income from operations in 1Q22 was INR10,176.81 lakhs against INR6,921.52 lakhs in 4Q21.

- In FY21, Aries Agro Limited received in-house R&D recognition from DSIR and it continues to strive to bring innovative products/technologies in field.

Overview of Aries Agro Limited

Aries Agro Limited is in business of manufacturing micronutrients and other customized nutritional products for plants and animals. In 1975, the company was diversified into nutrients for plant. It conducted research on compounds delivering mineral nutrients to plants more efficiently. The company can be broadly counted as focused specialty plant nutrition company and is being engaged in manufacturing of micronutrients for agriculture produce. Apart from this, Aries Agro Limited deals in veterinary products on smaller scale. It is dealing and manufacturing soluble fertilisers and sulphur-based fertilizers.

Growth Enablers of Aries Agro Limited:

- FY21 Saw Debt Reduction: For Aries Agro Limited, FY21 was a landmark year. To talk about how the company controlled pandemic situation, it undertook immediate steps to restart manufacturing at different locations. Operations’ automation in factories for manufacturing and packaging enabled operations to restart with limited workforce which was as per Government guidelines. Monsoon was at 109% of long period average during FY21, with 3 out of 4 Kharif season months getting above normal rainfall like Jun- 107%, Aug-127% and Sept-105%. Only July saw deficient rainfall. Even Rabi season was able to see favourable water and weather conditions and Aries Agro Limited performed well. On standalone basis, its gross revenue saw a growth of 27.72% from INR371.50 crores to INR474.50 crores. Total capacity utilization is 67.33% of total installed capacity which is 95,400 MT p.a. in India. Focus on strengthening of Indian manufacturing base was beneficial to improve profitability of the company. Undoubtedly, FY21 was a challenging one with pandemic lockdowns and uncertainties. Despite this, the company saw revenue growth of 27.72%, with increase in profitability by 45.02%. Not only this, debt reduction was by INR15.71 crores.

- Cost Control Measures Lent Support to Profitability: Stringent cost control measures were supplemented by continued focus on domestic manufacturing, helping the company increase its PAT by 45.02%. Orders that the company received during annual booking bazaars lent some support in better working capital management. The company used lockdown months for product ideation, for identifying new suppliers and trials on new product lines. During FY20-21, 7 new/upgraded products were launched. The company has strong plans for growth and expansion. Covid lockdowns have severely affected rural areas this time. This continuous to affect people movement to meet customers and farmers. Despite this, flow of material was continued without any interruptions under essential services. The company plans to face these challenges by using digital means of communication, better supply, inventory control etc.

- Focus on Exports: The company has its eyes on expanding export market in next few years. International clients of Aries Agro Limited are situated in Kenya, Nigeria, Nepal and Taiwan. It saw sales getting booked for Kenya, Nepal and Taiwan. Registration process was commenced in Nigeria and Bangladesh. Distributors which are present in Nepal have their own manufacturing unit to provide support and improve sales and distribution network in Nepal.

- Strong Plans for Coming Future: For this year, the company continues to have strong plans for growth and expansion. Second wave of Covid-19 affected rural areas and virus reached into remotest parts of India. Flow of material continued because of essential services. The company plans to face these challenges through using digital means of communication, better supply, inventory control and attractive time bound trade schemes. FY22 annual booking was done online and 1426 dealers in 22 states booked using Booking App. Total booking of INR574 crores was seen. This should achieve gross revenue of INR525 crores in FY22. In current year, the company plans to introduce some products in pesticides and organic range and extension of crop specific nutrition products and some fisheries and micronutrient complexes. The company incorporated a wholly owned subsidiary, M/s. Mirabelle Agro Manufacturing Pvt. Ltd. and its manufacturing unit was expected to be operational in 2Q22 and the company plans to commence bulk B2B business in India and overseas. Aries Agro Limited strengthened its procedure of digitizing booking and payment process using in-house application named Aries Integrated Management System. This led to order booking of INR574 crores generated online. 1Q22 saw conversion of these booked orders. Even though there was 45 days slow down because of second wave in rural markets, overall sales saw getting picked up by June end and the company sees good prospects of revenue growth in current FY22. Cost parameters saw significant pressure with raw material, freight and people cost rising. It is only with support of stringent cost control measures that profitability should be stable going forward. The company has decided to put in place systems to make sure this happens and rise in prices was brought to effect during 1H. Demand remained stable. The company continues to add new product line in pesticides, bio stimulant, fisheries and crop specific customized range. All these are developed as per requirements of several states and crops and responds to changes in FCO and CIB norms. It continues to explore B2B and bulk international opportunities by using existing and subsidiary network. All these efforts collectively should ensure that growth in revenue in current financial year remains satisfactory.

Conclusion

Aries Agro Limited was able to improve revenue from Indian operations by 27.72% with profitability before tax rising by 30.29 % on year-over-year basis. Global manufacturing operations were suspended. The company has diversified product portfolio, catering to all stages of agricultural activities. It manufactures and trades in wide range of products which expanded over years, including chelated micronutrients, specialty fertilizers etc. Product portfolio of the company continues to find application at different stages of farming. These include application of nutrients during soil preparation etc. The company has widespread distribution network as it has established relationship with distributors which should help Aries Agro Limited.

During FY21, earnings before interest, depreciation and tax was 16.36% in comparison to 18.23% in previous year. Total revenue (which does not consider other income) for FY21 net of discount/rebates was INR38,145.65 lakhs against INR29,614.46 lakhs in FY20. PAT for FY21 was 5.93% in comparison to 5.27% in prior year. Consolidated EBITDA of the company was INR5,702.15 lakhs in FY21 in comparison to INR4,701.68 lakhs in FY20. Consequently, PBT was INR2,461.44 lakhs in FY21 in comparison to INR1,611.85 lakhs in prior year.

The company focuses on innovation and development of products/technologies which are suited for agriculture, designing and development of new production processes to see improvement in cost effectiveness of products and their agronomical efficiency, developing production processes which use renewable energy and ensuring regular updation of in-house knowledge needed for development of products and services. Apart from these, some other focus areas of Aries Agro Limited include sourcing worldwide information associated with product development and agriculture best practices and developing environmental-friendly crop management techniques. Because of these factors, the company saw improvement in productivity/quality and fall in cost of production of the company’s plants and at customer’s end. Substitution of imports, safer environment and strategic resource management was also seen.

The company plans to conduct scientific research and studies, pilot scale development, test for new products’ development, new process development, improvise existing production process etc. It now focuses on efforts to develop India GAP on commercial crops and to try to establish link in between farmers and industry.

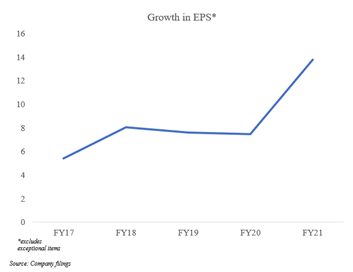

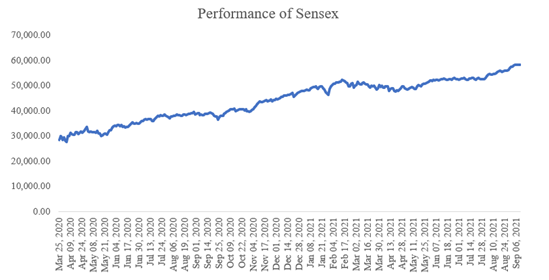

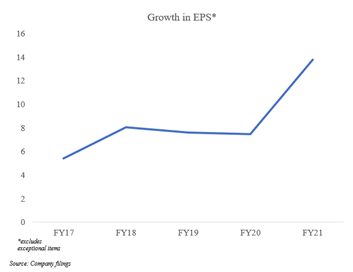

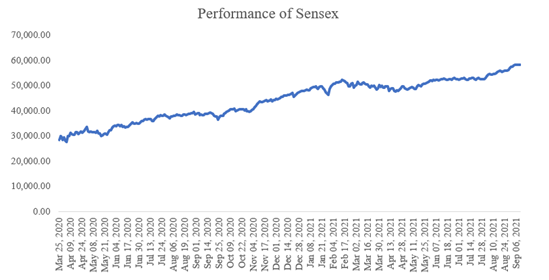

Stock of Aries Agro Limited saw a strong run up of ~291.34% between Mar 25, 2020- Sept 9, 2021. This means an investor who would have invested INR1,00,000 on Mar 25, 2020, would have seen capital grow to INR3,91,343.65. Aries Agro Limited has compounded its EPS at 20%+ over FY17-FY21. Mostly, share price of stocks and the company’s EPS move in tandem. The company has grown its EPS at ~84.38% in FY21 against last year. This EPS excludes exceptional items.

In comparison to performance of stock of Aries Agro Limited, Sensex was not able to outperform. Sensex saw a run up of ~104.3%. While this return is impressive, index was not able to match up returns delivered by stock of Aries Agro Limited. Stock of this company trades at ~8.74x FY21 EPS, favouring going long on this stock as sectoral average is ~15.21x.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.