Growth in Digital Media and Entertainment Consumption Should Lead Path to Recovery for Shemaroo Entertainment Limited

Summary

- Recovery in media and entertainment sector and growth in entertainment consumption are expected to act as principal growth enablers.

- The company marked its entry into broadcasting space by launching 2 new channels – Shemaroo MarathiBana and Shemaroo TV.

- This entry into broadcasting should be considered as a long-term strategic investment towards taking a bite of large advertising pool and this should diversify revenue model.

About Shemaroo Entertainment Limited

Shemaroo Entertainment Limited is a leading Indian content power house, having a global reach. This company plays a pioneering role in arena of content ownership, aggregation and distribution. This brand is into existence for 5+ decades and the company continues to redefine itself to respond to ever-changing consumer environment. The company continues to evolve to be a significant player in digital ecosystem. Commenced as a flagship book circulating library, the company made its presence in video rental business distributing content through home video segment in VHS format. Over years, the company adapted to changing content consumption pattern by expansion into content aggregation and distribution on several platforms globally.

The company identified that movies have longest shelf life for television and other media content. As a result of this, the company pioneered movie library syndication business as it has made acquisition of movie titles from producers. The company distributed it to broadcasters and other media platforms. Shemaroo Entertainment Limited was seen growing multi-fold over years as it has developed strong relationships across media industry value chain only to be counted as one of largest organized players in fragmented industry. The company has seen its digital business contribution growing from less than 10% in FY14 to 54% in 1Q22.

Growth Enablers of Shemaroo Entertainment Limited:

- M&E Sector on a Path to Recovery: Advertising, subscription and syndication revenues saw pressure in 1Q22 because of second wave of Covid-19 and lockdown due to same. Impact was seen more in traditional media than in digital media. Seeing that states continue to unlock and vaccinations underway, consumer and business sentiments should be improved. Recovery in M&E sector is underway. During 1Q22, the company considered several measures to optimize operations and rationalize businesses which were severely impacted because of Covid-19. While Shemaroo MarathiBana and ShemarooTV saw uptake in monetization as a result of advertisements, second wave of COVID-19 impacted advertising spends by brands in 1Q22. Shemaroo MarathiBana delivered steady ratings in 1Q22, establishing brand’s connect within short period of time. ShemarooTV was started in challenging economic environment and the company is strengthening proposition through focused approach for building programming, marketing and distribution.

- Revival Expected After COVID-19: To prevent spread of Covid-19, Indian government announced nationwide lockdowns of all activities but essential services. As people stayed at home having limited options of entertainment, Shemaroo Entertainment Limited saw spike in subscriber base and subscription-based businesses. Despite seeing an increase in consumption, its advertisement-dependent businesses saw significant unfavourable impacts due to most of brands slashing advertising spends as a result of slowdown in economy and in business activities. Availability of content was constrained as fresh production came to a halt since start of lockdown period and there was a decline in content buying by broadcasters because of drop in advertising revenue. This was considered to be a temporary setback. As Indian economy continues to open with easing of restrictions and vaccinations underway, media and entertainment sector should see a quicker bounce back with rejuvenated demand and advertising spends.

- Entertainment Consumption to See Strong Growth: Indian Media and Entertainment industry has been transforming quickly. Overall entertainment consumption ecosystem has been seeking support from enhanced connectivity, multiple screen options etc. In FY20, the company made investments as it entered into broadcasting with launch of 2 new channels “Shemaroo MarathiBana” and Shemaroo TV. The company’s content dominates programming schedule of several channels in country. Therefore, launching its own TV channels supported by strong understanding of content and comprehensive was a natural progression for the company. The company now focuses on strengthening its operating and financial performance as it starts delivering on some of its new initiatives which it undertook in past few years. Apart from this, the company plans to diversify and de-risk its business by back-to-back investments across various segments and by weaving partnerships across median value chain that should lend support to the company by deriving scale, optimizing costs and improving profitability.

- Core Strengths Should Lend Support: Shemaroo Entertainment Limited has presence across television, digital media and other media, with distribution reach acting as a primary advantage. The company is able to provide “anytime anywhere” entertainment to its consumers. It has created, maintained and built goodwill in industry as this brand has an existence for 55+ years. “Shemaroo” brand continues to have high consumer recall and media visibility. Most bollywood services requiring content would have at least some content provided by the company. In-depth and proper understanding of film industry, deep insights about technology and market trends should continue to stem growth for the company.

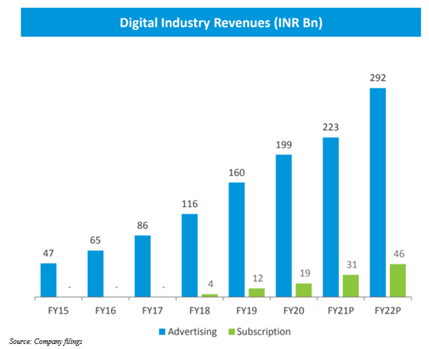

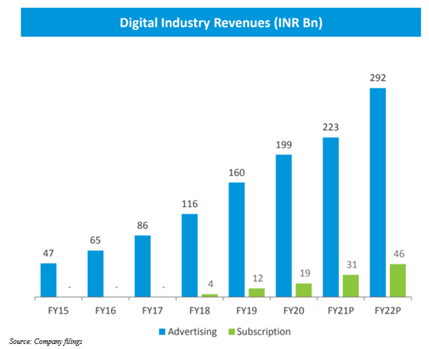

- Focus on Capitalising on Industry Dynamics: In India, digital advertising revenues saw a growth of 24% over FY19 to reach INR199 billion in FY20. Industry should be able to compound at 21% over FY20- FY22 to reach INR292 billion. Digital subscriptions revenues in country have grown by 47% to reach INR19 billion in FY20 and these revenues should touch INR46 billion by FY22. Video subscription ecosystem evolved over past couple years and now there are 40+ OTT players in this country.

Advancements seen in digital infrastructure, growth in penetration from non-urban areas, cheaper data and growth in adoption of mobile phones contributed to digital advertising growth.

- Pillars of Growth in Digital Media: Broadband infrastructure and technology are expected to act as principal growth enablers in digital media. Better 4G reach and decline in data prices should enhance consumption of videos and ‘Digital India’ initiative from government is expected to help digital media. Rise of OTT and quicker adoption of digital in non-metros are expected to supplement digital media growth. Increase in number of OTT destinations for online video watching should support industry. The company expects that next wave of internet video users should likely be coming from non-metros. This should stem video consumption in local languages.

- Digital Tools Have Significant Potential: Rising internet users and growth in share of regional language video consumption are expected to principally support digital wave. Growth in internet users stems from low-cost smart phones, improved internet connectivity in rural areas, growth in regional language popularity and voice enabled internet usage. Growth in online video viewers and strong data consumption by India should supplement additional growth.

Conclusion

The company’s multi-fold growth over years was because of its strong relationships with partners across media industry. It plans to strengthen its position in this industry by offering unparalleled value addition to its investors. With fundamental shift taking place in how content is being consumed, the company targets to be at forefront of digital and technological innovations. Shemaroo Entertainment Limited plans to focus on expanding its footprints globally. The company targets to significantly scale up presence internationally serving diaspora and non-diaspora audience to capture increasing demand.

Pandemic had some significant changes in trends which should change DNA of this sector for times to come. Most significant change was adoption of digital consumption. Though theatrical and physical events were most affected, penetration of broadband and smartphone accelerated. This pushed consumption of online entertainment including videos, games etc. Television was largest segment and digital media overtook print media. In FY20, digital and online gaming were segments that saw growth as these segments added an aggregate of INR25 billion. This resulted in increasing their contribution to M&E sector from 16% in FY19 to 23% in FY20. Other segments saw a fall by an aggregate value of INR465 billion.

FY21 was a challenging one for economy and media and entertainment sector. But since economy is on cusp of a rebound, media and entertainment sector should be able to see strong performance. The company’s strong track record and exciting new initiatives should support the company ride this growth wave and deliver desirable performance.

Shemaroo Entertainment Limited believes that digital video services should continue to be one of leading growth enablers of Indian entertainment over next few years. This growth should likely stem from large and growing connected consumer base, improved infrastructure and quality of storytelling etc. This pandemic accelerated consumption of digital content and changed lingual face of digital India. Regional content consumption preferences were brought to forefront, enabling investments in original regional content production and building of regional propositions.

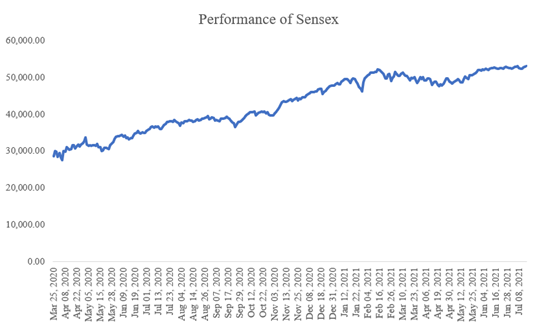

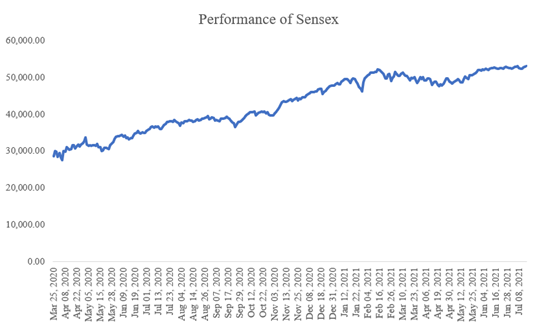

Stock of Shemaroo Entertainment Limited delivered ~196.07% return between Mar 25, 2020-Jul 15, 2021. This kind of return is not even close to return seen by Sensex.

Sensex delivered only ~86.3% return between Mar 25, 2020-Jul 15, 2021. Though opening up of economy, revival in businesses, support from government and roll out of vaccinations were seen, return of Sensex was not able to meet return delivered by stock of Shemaroo Entertainment Limited.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.