Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAgriculture is the first occupation of Man, and as it embraces the Earth, it is the foundation of all other Industries. – W.Stewart

The Rise of Indian Agriculture sector:

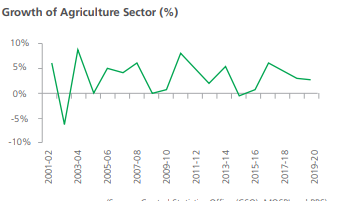

Agriculture is pivoted to the growth of the Indian economy, both in terms of its contribution to the GDP as well as a source of employment for a majority of the country’s population. As per NITI Aayog, the sector provides employment to more than 49% of India’s population, through direct and indirect employment opportunities related to this sector. The Agriculture sector contributed around 16.5% to GVA in FY19-20. Over the years, agriculture and its allied activities have been volatile and it is estimated to grow at 2.8% for FY 2019-20, as compared to 2.9% in 2018.

Seed is the basic and most critical input for sustainable agriculture. The global seeds market was worth US$ 55.4 billion in 2019 and is projected to reach USD 86 billion by 2025, growing at a CAGR of 7.6%6. North America represents the largest producer of agricultural seeds, accounting for around one-third of the global market. AsiaPacific, dominated by two major agricultural countries - India and China, is the fastest-growing geographical segment in the Global Seed Market. The region is witnessing increased adoption of hybrids and a rising seed replacement rate for key crops like Rice, Maize, and Vegetables.

About The Largest seed Manufacturer of India:

Kaveri Seed Co. Ltd. engages in the production, processing, and distribution of seeds. Its products include field crops and vegetables. The company was founded by Venkata Bhaskar Rao Gundavaram and Vanaja Devi Gundavaramin in 1976 and is headquartered in Secunderabad, India.

The competitive advantage of Kaveri Seeds:

Leading seed Manufacturer of India:

Incorporated in the year 1986, with a seed production unit, Kaveri Seed is today among the largest crop seeds producers premier multi-crop seed-producing Company in India specializing in Hybrid Seeds in Key Indian crops and specializes in the manufacturing of crop seeds including maize, cotton, rice, pearl millet, mustard, wheat, sorghum, sunflower and a number of vegetables.

Manufacturing Capabilities:

Headquartered in Hyderabad, Kaveri Seed has seven state-of-the-art seed processing plants and quality control lab along with a pan India distribution of network and marketing offices in 22 cities across India and has a cumulative warehouse capacity of 10,00,000 sq ft across six locations in India.

Strong R&D Division:

Kaveri Seeds successfully establishes itself as a market leader resting on its strong R&D team. Its research focuses on the development of quality hybrid and inbred seeds that offer higher yields. The Company has a fully equipped, state-of-the-art biotechnology laboratory and its R&D team comprises about 145 personnel, including more than 40 Scientists who strive to deliver exceptional results. Kaveri Seeds also has an enormous germplasm bank, built over a period of three decades, to sustain innovations in the seed market.

Kaveri Seeds focuses on the combined use of conventional breeding techniques and biotechnology to increase and stabilize yields. Utilizing innovative processes, the Company adopted an integrated molecular breeding program for accelerated crop production. State-of-the-art biotechnological tools were also employed to ensure precision breeding, which not only helped to save time but also focused on improving crops. At present, the Company has over 600 acres of dedicated research farms around Hyderabad and more than 300 acres of long lease Agriculture land in satellite environments across the country for target breeding.

World Class Infrastructure:

Kaveri Seeds has about 120 outreach trial centers across India for hybrid testing. The company also has 1 lakh+ loyal producers with 65000 acres of land area for seed production. It also has 07 Mega Seed Processing Plants equipped with modern equipment for pre-cleaning, grading, cob drying, storage, and packing. With 10 lakh sq. ft. cumulative warehouse space across India, the Company has climate-control godowns and 15000 MT cold storage capacities to support its world-class infrastructure.

• Strong Presence & Distribution Network in India:

The company has a strong distribution network consisting of about 40,000 dealers/distributors. It partners with more than 1 lakh farmers, through farm engagement programs, for seed production.

Diversified Product Portfolio:

Kaveri Seeds has consistently focused on building a robust portfolio of field crops and vegetables to help enhance farm yield. The Company has successfully launched the best quality hybrid seeds to further diversify its offerings. It also engages with farmers to educate them about its products and helps to implement best agricultural practices to improve yield.

Increasing Global Footprints:

Presently, the company exports its products to Egypt, Myanmar, Nepal, Bangladesh, Vietnam, Sri Lanka, and Pakistan, and a sizeable part of the revenue coming from Bangladesh. The company is exploring export opportunities; has shortlisted nine countries as potential export countries. Over the next 4-5 years, Kaveri aims to achieve a sizeable revenue share from export

Revenue Segmentation(FY21):

|

Crops

|

Revenue Contribution |

|

Cotton |

45% |

|

Maize |

21% |

|

Hybrid Rice |

13% |

|

Selection Rice |

10% |

|

Vegetables |

4% |

|

Bajra |

2% |

|

Other |

5% |

The Major issues faced by the company:

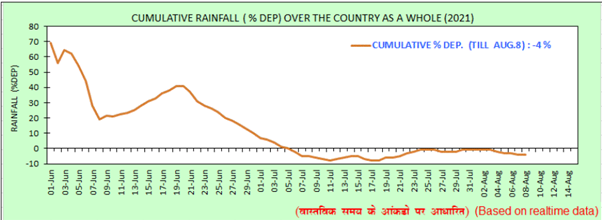

The success is at the mercy of the Rainfall

Kaveri seed's success is dependent on the success of the farmer's harvest and the success of the harvest is directly impacted by the Rainfall which is highly predictable.

If the rainfall is not enough or too much then the crop under harvest will have fewer chances of success and this cycle continues every year and with Global Warming shooting up and the weather becoming more unpredictable nowadays, A prolonged summer in the Southern states and an Increased rainfall in the Northern states have become the new normal and things are not getting any better and this is one of the major threat that acts an impediment for the growth of the company and has made the stock price more volatile to the headwind events.

Why Kaveri seeds became one of the worst performers in the past thirty days?

Kaveri seeds has fallen around 20% in just one month span of time and the reason is Kaveri Seed Company Ltd.'s Q1 FY22 revenue fell 12% on account of de-growth in the cotton and maize, offset by growth in the hybrid rice and vegetables segments. Kaveri Seed's cottonseed sales volumes were impacted by lower cotton acreage and the use of herbicide-tolerant seeds, which further impacted branded seed sales. However, this is a clear opportunity in disguise, the problem faced by the company is temporary and it's always a good strategy to buy good quality stocks during their tough times with a view on how the company will be performing in the days ahead rather than with a mindset on how the stock price will be impacted in the days ahead.

The Valuation and Other metrics:

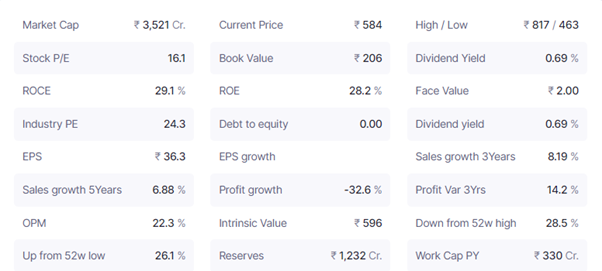

The company has a Market capitalization of 3500 Crs which implies that the company is a small cap company and the company is trading at a Price Multiples of 16.1x and has fallen 28% from its 52 - week high price which offers a good margin of safety and value for the investment and the companies ROCE and ROE are close 30%, which is nothing less than phenomenal and the added advantage is that the company doesn’t have any debts and has reserves of 1230 Crs as on Mar 2. However, the sales growth remains below the mark, the companies compounded sales growth stood at 8% for the past three years and the compounded Profit growth stood at 14% for the past three years with an operating profit margin of 22% and the companies profit will increase significantly only when the company manages to increase its sales significantly either by new product launches or by adding new geographies under its domain.

Do you wish to invest in Kaveri seeds, then kindly beware of the checklist below:

share your thoughts

Only registered users can comment. Please register to the website.