Healthy Financial Strength and Big Investments Should Supplement RSWM Limited's Growth

Summary

- Favourable industry dynamics and financial strength should act as principal growth enablers of RSWM Limited.

- India has abundance of raw material including cotton, wool, silk and jute and country has competitive advantage like skilled manpower.

- New Textile Policy 2020 of Indian government focuses on making sector competitive, modern, sustainable and inclusive.

About RSWM Limited

RSWM Limited produces and supplies high-quality yarns to some of renowned and leading brands in 76+ countries globally. The company is categorised as a leader in domestic and international textile industry. Diverse products of the company are used in several different markets worldwide. Yarns and fabrics of RSWM Limited can be customised for high-end fashion apparel and activewear. It uses advanced technology of fire retardancy, bacterial resistance and moisture control. The company creates fabrics and yarns that are suitable for uniforms for students and government professionals. It creates protective wear for military personnel and professions involving high-risk. Apart from these, the company specialises in home and commercial interior textiles. The company is focused on reducing its carbon footprint. Its facility near Jaipur transforms waste PET bottles into FibreGreen®.

Growth Enablers of RSWM Limited

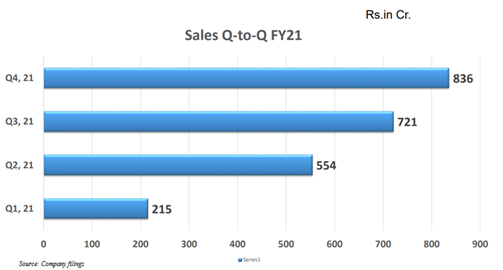

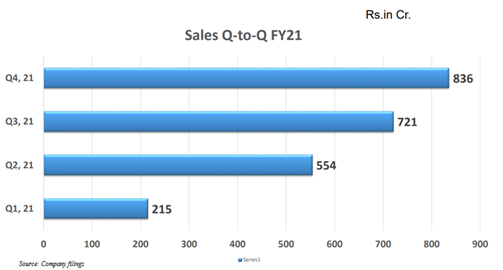

- Groundwork Laid to Achieve Growth: During 1H21, industry saw lockdown and shut down of manufacturing facilities. This caused disruption in supply chain and movement of migrant labourer. The company saw negative PAT of INR83 crores in 1H21 principally due to lower capacity utilisations. Time was used to analyse cost factors and revival of marketing strategy to prepare for future uncertainties. These efforts were not left in vain and the company’s improved marketing strategy and cost rationalisation measures resulted in delivering PAT of INR105 crores. The company closed FY21 with a positive note as its revenue from operations increased to INR836 crores in 4Q21 in comparison to INR612 crores in 4Q20 and INR721 crores in 3Q21. The company saw improvement in sales quarter by quarter from INR215 crores in 1Q21 to INR836 crores in 4Q21.

While there was improvement in the company’s liquidity, it reduced its debt by INR238 crores during FY21. While we talk about reduction in the company’s debt, it has reduced its debt by INR559 crores in last 4 years. From a debt of INR1,402 crores as on Mar 31, 2018, it is now reduced to INR843 crores as on Mar 31, 2021. The company saw revival and improvement in market sentiments in 3Q21 and continuation of this was seen in 4Q21.

- Plans to Make Big Investments: Since consumer confidence was upbeat in 4Q21, the company should be able to deliver improved performance. The company’s 4Q21 was one of best quarters in recent years, in terms of its profitability. The company’s manufacturing units continue to operate at normal capacity and its inventories are under control. With healthy cash generation, the company should be able to explore long-term growth opportunities. Plans are there to invest ~INR300 crores which should support its operational goals. The company expects its revenue to increase by ~INR375 crores with investment in Denim and Cotton Yarns.

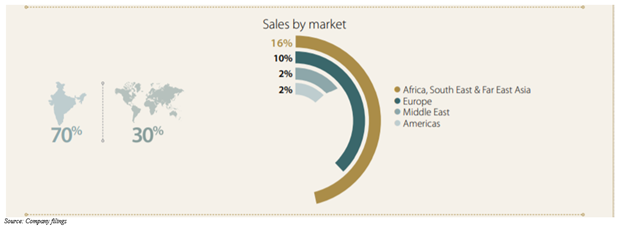

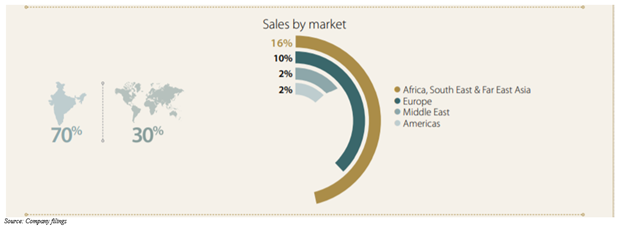

- Yarn Business Should Continue to Make Up Majority Portion: Despite adversity about COVID-19, the company performed well during FY20. Despite the company’s turnover declining to INR2,771.03 crores from INR2,960.58 crores a year ago, it saw significant improvement in profitability. Overhauling of raw material procurement system and significant control on costs, allowed RSWM Limited to report 25.6% rise in EBITDA – from INR210.01 crores in FY19 to INR263.74 crores in FY20. Out of total sales, the company’s yarn vertical made 79% and fabrics made 21%. Market-wise, ~70% of sales were made to domestic markets and 30% were done to global markets. Africa, South East & Far East Asia made up 16% and 10% of contribution came from Europe.

The company made significant progress in reducing its debt. The company liquidated its investments in group companies and sold non-productive assets and dead investments. It utilised its cash flow to pare debt by INR178 crores, including prepayment of high-cost loans of INR25 crores. With this, the company saw interest burden coming down by 9.32% in FY20 over FY19.

- Indian Textile Industry Offers Significant Opportunities: Textile and apparel industry is being categorised as one of earliest industries that were developed in India. This industry’s inherent and unique strength is incomparable employment potential. This is principally because of presence of entire value chain – from fibre to apparel manufacturing – within India. Country is being counted as a leading manufacturer of man-made textiles. Indian fabrics are known for excellent workmanship, colours and durability. Large investments in manufacturing plants, innovation, new product mix and market expansion should support Indian man-made fibres.

- Healthy Financial Strength and Strong Business Profile: RSWM Limited forms part of LNJ Bhilwara group, giving it reasonable financial flexibility to refinance bank loans. Business profile and cash flows are diversified across geography, customers and products. The company is counted among India’s leading yarn manufacturers. Profitability is likely to see some improvement over medium term, with profitability margin to improve to healthy levels in view of the company’s strong business profile. Growth should stem from improvements in EBITDA and with improvement in market demand. The company’s leverage position has significantly improved.

- Changing Trends in Denim Industry: Denim is being categorised as a high-growth category, with value growth supported by increased demand for stretch and light-weight fabric, different colours, styling and detailing. After few years of glut seen in domestic market because of excess capacity, Indian denim industry should see gap in demand-supply narrowing. Increased rural spending and youth segment should help industry achieve desired growth levels. Alternative retail channel and rise of private label should supplement growth of this industry.

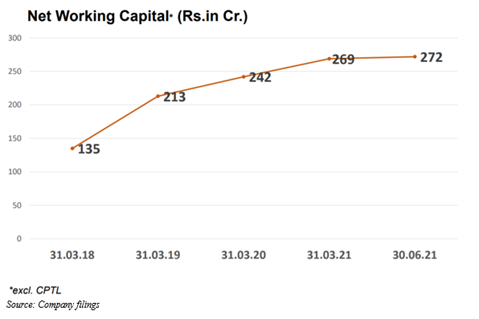

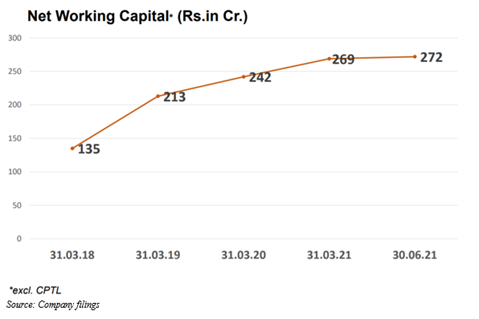

- Signs of Improvements Visible: The company saw its business bouncing back in 2H21 after lockdown and disruptions in 1H21. During period of restrictions, it was able to manage operations at full capacity. The company was able to end 1Q22 with total revenues at INR750 crores and PAT of INR37 crores. Despite lockdown/restrictions in 1Q22 due to second wave, the company was able to perform better in terms of its cash flow and profitability. The company saw doubling of net working capital in last 4 years from INR135 crores as on Mar 2018 to INR269 crores as on Mar 2021 and INR272 crores as on Jun 2021.

- Expectations of Strong Growth: RSWM Limited has comfortable liquidity position with healthy and sufficient cash generation. With this, the company continues to explore long-term growth opportunities. In 1Q22, resurgence of pandemic, local lockdowns and night/weekend curfews impacted dispatches. With increase in vaccination, fear continues to reduce and business should be able to see desirable growth. The company’s manufacturing units continue to operate at normal capacity, with inventories remaining under control. Demand of textiles should principally stem from increased penetration of organised retail and favourable demographics. Future of Indian textiles should likely be supported by abundant raw material like cotton, wool, silk and jute and competitive advantage of skilled manpower and production cost.

Conclusion

Net sales of RSWM Limited were INR741.91 crores in 1Q22, with yarn business making up INR682.38 crores and fabric business contributing INR114.16 crores. The company’s yarn business should continue to be largest contributor to revenues. This business should get support from focus on value-added products to increase contribution and healthy efforts to improve operational efficiency supporting better asset and resource utilisation. RSWM Limited has one of widest yarn ranges of fibre blends, counts and shades with focus on value-added variants.

Apart from large customer base in India having brand-enhancing downstream textile players, RSWM Limited’s yarns find acceptance in 45 countries. In FY20, exports made 26% of yarn business. In FY20, the company made structural changes in its yarn business. Raw material procurement and management systems were changed, while production planning was overhauled. Order procurement and delivery were monitored. Focus of operating capacities was changed from commodity products to value-added variants. Margins scaled considerably as a result of these moves.

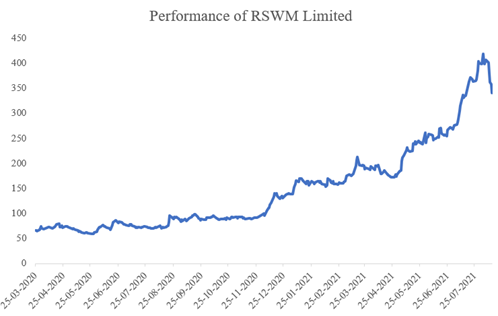

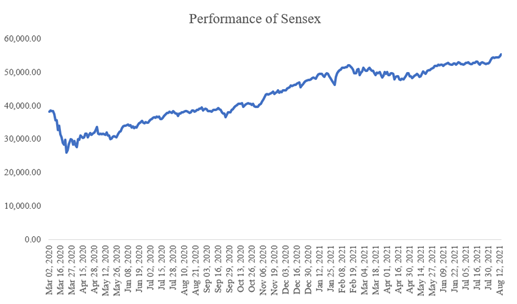

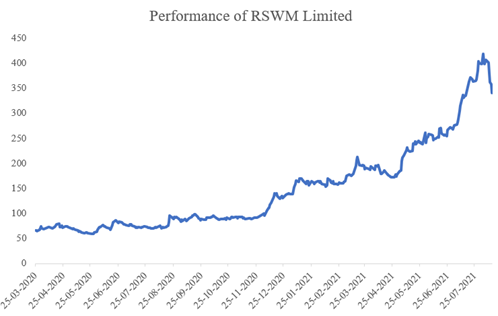

Stock of RSWM Limited delivered multi-bagger returns between Mar 25, 2020- Aug 13, 2021. This stock saw a run up of ~419.69% between this time. Any idea what this means? It means if an investor would have invested INR1,00,000 on Mar 25, 2020, that investor would have seen capital grow to INR5,19,694.65.

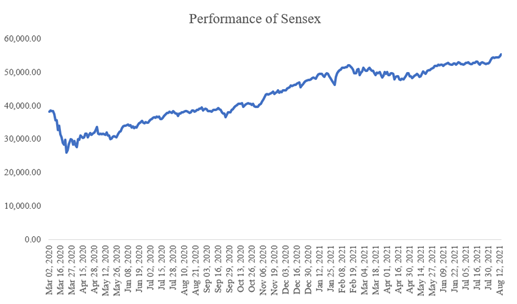

While this stock has seen a strong run up, significant improvement was seen in stock market as Indian economy started opening and vaccinations were available. Despite revival from Mar 2020 lows, Sensex delivered only ~94.27% return. This shows how important it is to identify stocks capable of beating market returns over long-term. Growth in the company’s stock price should stem from RSWM Limited’s investments in expansion and progress of its projects. Stock of the company trades at ~38.01x FY20 EPS in comparison to sectoral average of ~45.21x, which favours long position on this stock.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.