Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

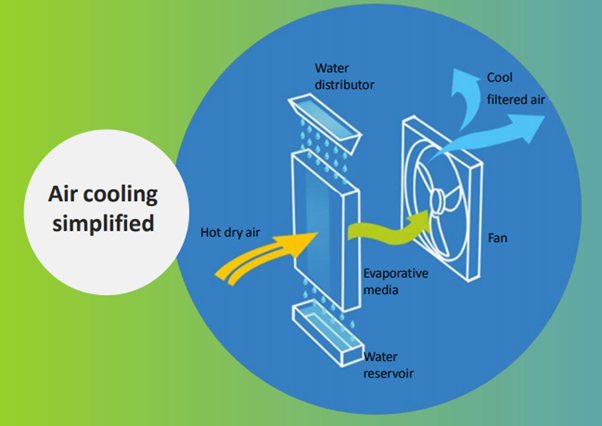

REGISTER NOW OR LOGINAir-coolers have emerged as one of the fastest growing segments within the consumer appliances space. They are energy-saving, moderate in power consumption, are eco-friendly and can cool effectively. They provide superior air quality and do not make the air overly dry. They do not use harmful cooling agents (CFC or HFC). They moderate the electricity bill by ~90% compared to ACs and is priced attractively lower than air conditioners. Due to above, the air cooler industry market in India, is expected to reach 9,000 crore in the next few years following increased incomes and temperatures, widened market presence, increased aspirations and a cost The global consumer electronics market's revenue trade value stood at US$358.5 billion in 2020, with a year-on-year rise of 7%. With the consumer electronics business going through a rapid expansion of new ideas, technologies, and economic models creating changes, there is a premium to keep in step. Although the market faced disruptions in the first half of the year on account of the pandemic, the second half of 2020 witnessed growth. Global consumer electronics market Indian appliances and consumer electronic industry Indian air coolers market 50 | Symphony Limited advantage over air-conditioners. The air cooler segment can be categorized into residential and industrial segments

What is the difference between the Air coolers and Air conditioners?

About the Company:

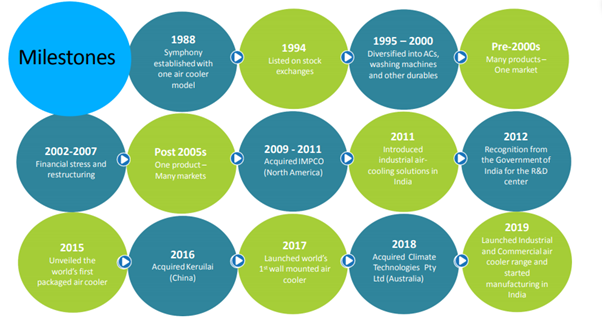

Symphony was established in 1988, in Ahmedabad, India. The company is engaged in the manufacturing and trading of residential, commercial, and industrial air coolers in the domestic and international markets. It is the largest air cooler manufacturer in the world

Symphony, an Indian Multi-National Company with a presence in over 60 countries is the world’s largest manufacturer of air coolers. From inventions to innovations, energy responsibility to environmental stewardship, Symphony is a market leader which has been cooling customers for generations. The massive supremacy of Symphony coolers in the residential, industrial and commercial segments has made the brand synonymous with ‘cooling’. Founded in 1988, in Gujarat, India, Symphony Limited established a new category of evaporative air-cooling in India, taking it to the globe. As a disruptor of a highly unorganized sector, the company has set high benchmarks comprising 201 trademarks, 64 registered designs, 15 copyrights, and 48 patents, defining the gold standard of air cooling. Symphony Limited was awarded the Guinness World Record for creating the world’s largest functioning air coolers. The company also provides solutions through its world’s largest air cooling project In Mecca-Madina at Hajj Camp and India’s largest air cooling project at Patanjali Yoga Bhavan, Haridwar, India.

Things to know before investing in the company:

Global Leader of Air cooler:

The air cooler industry is divided into organized and unorganized markets. The organized market is 30% of the total market and out of this 30%, the Company has 50% market share from the last 4 years.

Global Presence:

The company exports its products to 60+ countries and has local subsidiaries in Brazil, China, Australia, Mexico, and the U.S.A and the exports segment contributed 59% of the revenue of the company. Global markets enable the company de-risk the seasonality of the product as different countries have different seasons at a point in time

The Portfolio of Global Brands:

Distribution system

The company has increased 16000 dealers in the last 8 years and as of March 2020, the company has 30000+ dealers and 1000+ distributors. It has increased its presence from 500 towns to 5000+ towns in the last 8 years, ending FY20. It also has a presence in 60+ Countries. Symphony products are showcased by industrial giants like General Electric (US), Lear Corporation (US), and Walmart (US), also present in supermarkets like Sears, Metro, Carrefour, Lowe’s, The Home Depot, and others. The company has added two manufacturing units in the last 8 years and In 2020 and it has 11 manufacturing units.

Wide Range of Product Portfolio:

The Company offers products for the residential segment comprising models like tower, personal, desert, room and window air-coolers. The installation of the Company’s commercial air-cooling solutions in open restaurants, large halls, and party plots enabled consumers to enjoy improved air quality and ambiance. The company’s industrial air coolers largely address the growing demand from factories, schools, malls, assembly halls, warehouses, and metro stations, among others. The Company provides services to industries like banking, automobile, packaging, distilleries, and railways.

Brand Building and Marketing activities

The company spent 240 crores in the last 10 years on brand building. In FY 20, Company spent 4% of revenue. The company launched the app ‘SYMPARK’ in 2017 to reward the retailers for their loyalty and motivating them to push symphony products over other brands. Retailers will scan the QR code in the app and collect the gift points. This resulted in huge sales and has helped the Company in maintaining its No. 1 position in the market.

Research and Development

In FY20, It spent 4.4 crores on research and development which is 0.58% of total revenue. At Symphony, research and development and engineering technology is a sustainable competitive advantage. The company delivers market-leading products that comprise design innovation, energy efficiency, distinctive styling, and customer-centricity. As a pioneer in the air-cooling industry, Symphony develops breakthrough technologies to combat climate change. It provides solutions for affordable cooling and comfortable environments for maximum efficiency, productivity, and well-being.

New Product Launches

Diet 3D series of coolers were introduced with features like automatic pop-up touchscreen control panel, 3 side honeycomb cooling pads, etc. A double-decker model of Sumo and a new range of commercial coolers called Movicool was launched

Received several Prestigious projects

The company has done many prestigious projects during the year, which include a 40,000 sq. ft warehouse of Apollo Pharmacy, Amazon’s Lucknow sorting center, Delhi Public School, Godrej, RK Marble, and Supreme Industries, etc.

Strategic Initiatives

The company’s operating margin in FY17 reduced by 6% to 31% as compared to the previous year as co. had launched a new product which received 2.5 times sales order for new product and the company didn’t increase the prices despite the increase in costs. Co focused on increasing market share.

Technical Outlook:

The company is trading 40% below its 52 week high and it looks technically weak as we could see that every rise in price has been sold and the stock is in perfect bear’s grip and the next support level for the stock is around 880 levels and if that is broken then we could see 800 levels for this stock and as the stock is fundamentally strong, one should use the dips as an opportunity to accumulate the stock at better levels and expect the company to reverse at certain levels and usually Air cooler companies outperform the Index during the summer season and one can pick this stock on a longer-term perspective and can expect around 50% upside from here on.

The Next Version of Symphony Limited

One: The company will focus on widening its brand from residential to industrial and commercial applications across a widening global footprint, so that whenever anyone thinks of ‘cooling’, one would think only of Symphony, evolving from just a brand into a generic name. The focus will lie in proactively building markets.

Two: The company intends in doing what it has always done: by the time the consumer gets adjusted to a previous clutter-cutting product, Company reinvents the product to introduce a new generation of coolers comprising technology-led applications, addressing the vast demand that it expects will come out of increased incomes and the unprecedented growth out of the affordable housing Segment.

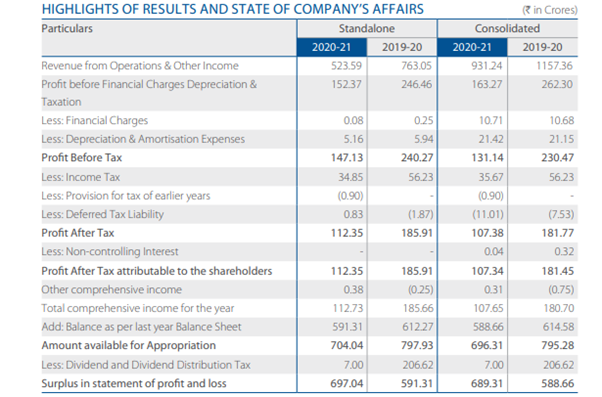

The Financial Performance of the company:

The consolidated revenue from operations along with other income stood at H 931.24 Crores and has an 18% YoY degrowth in the revenue. The Overseas business to support future sales growth The overseas business contribution to sales has increased significantly from 38% in FY18 to 46% in FY21 led by the strong performance of the Australian subsidiary CT. Despite supply-related concerns, a strong sales recovery in Q4FY21 led to 21% annual sales growth for CT in FY21. We believe ease in supply concerns along with increased export to the United States would further propel sales growth of CT. We build in overall subsidiary sales to grow at a CAGR of 12% FY20-23E led by a strong 21% revenue CAGR for CT.

The Road Ahead:

The company sales have been clearly hurt and the company is facing a difficult time on one side it is raising input cost on the other side it’s the covid tampering the consumption growth and symphony has got caught in between the chaos. However, the company is financially strong and has rich experience in the Industry being the market leader and the disruption is temporary but the growth is inevitable. It’s a good choice to buy a strong company in tough times and Symphony will be a great turnaround when the mist clears and one can buy the stock on every dip in the near term and hold for a long term to enjoy the perks of the growth of the company.

share your thoughts

Only registered users can comment. Please register to the website.