Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

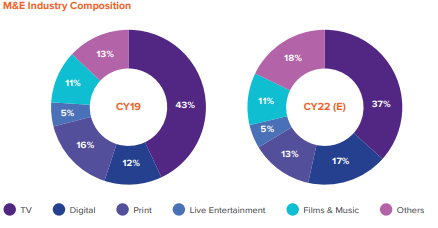

REGISTER NOW OR LOGINThe Indian Media and Entertainment (M&E) industry continued to grow during the year, albeit at a slower rate as compared to the previous year due to the weak macroeconomic environment. According to the FICCI-EY report (the Report), M&E industry revenue reached R 1,822 billion in 2019 with a 9% YoY growth. During the year, television continued to maintain its leadership in the M&E space as the primary choice of entertainment for Indian consumers despite a major regulatory change.

India broadcasting and cable TV market is segmented based on type, revenue generation and region. Based on type, the market is segmented into terrestrial television, cable tv and satellite. Cable tv & satellite dominated the market in FY2020 with share of 98.89%. Users are opting for the DTH or cable services which offers sufficient regional channels at the feasible prices. Especially users look for the songs, news and movies in the regional language or in a local content, consequently, driving the broadcasting & cable tv market of India. Major players operating in the India broadcasting and cable TV market are Siti Networks Limited, DEN Networks Limited, Tata Sky Limited, GTPL Hathway Limited, Sun Direct TV Private Limited, Dish TV India Limited, Bharti Telemedia Limited, NXTDIGITAL Limited, Fastway Transmission Private Limited and Asianet Satellite Communications Limited among others. There are 1471 registered MSOs in India, of which 1143 are currently operational. There are also about 100,000 local cable operators (LCOs) operating in the country.

Today, we are going to study one of the leading cable Tv operators who is also a leading Internet provider who was acquired by Reliance Industries and is all set to move beyond the growth Trajectory of the Industry.

The Strengths of Hathway cable & Datacomm Ltd

Acquired By Reliance Industries: Reliance Industries through its subsidiary acquired a 72% stake in the company during FY19 for 4100 Crores. The acquisition of Hathway is the second largest investment made by Reliance Industries and the first being Rjio, Hathway is plays strategic importance for the growth of RJIO as the company gives the acquirer access to 6 Million households

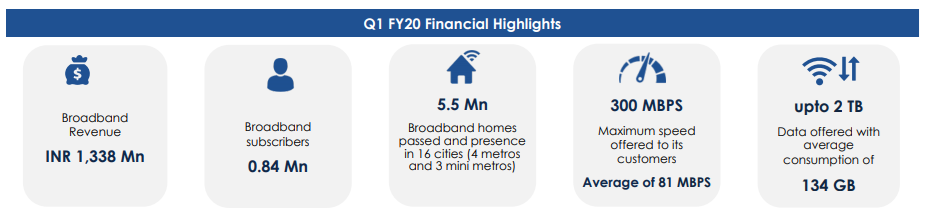

Leading Cable Tv and Broadband providers: Hathway is one of the leading Cable Tv and Broadband service providers, having a 5.5 million Home passes and 0.97 million subscribers base. Hathway is the first Cable operator company that provided Broadband services to its customers in India.

Cable TV business (64.5% of the revenue) The company through its wholly owned subsidiary Hathway Digital Ltd is one of India’s largest MSO’s with a nation wide subscribers across regions, the company caters to 5.5 Mn Digital Cable TV subscriber base. They also have 27 in – house channels and as on Mar 20, the company had 3,19,000 subscribers and 5.5 Mn set boxes and provides 15 in-house channels and 10 Value Added Services

The Broadband Business (35.5% of the revenue) The company is one of the leading Broadband players in India with a subscriber base of 0.97 Mn across 16 Major cities and their Average Bandwidth consumption stood at 1.04 Mbps with an Average data consumption of 188 GB per month.

PAN India Presence: Hathway holds a PAN India ISP license and the company has an extensive network connecting and 6 Mn digital cable households and provides its services across 350+ cities and major towns across India

GTPL Hathway – GTPL is a leading cable TV and Broadband services company with leadership in the states of Gujarat & West Bengal and has more than 8 Million Subscribers. GTPL is a subsidiary of Hathway cables and they hold a 37% stake in the company.

High Standard Infrastructure – The company has 6 primary Headend and 7 secondary headend networks and a network of approximately 35,000 Kms of optical fiber and coaxial cable, providing cable services to 5.5 million viewers

Strategic Importance to RJIO business: Hathway’s business is operationally integral to the vision of RJio’s fiber-to-the-home business. The core business functions of Hathway and RJio are integrated and this will provide more efficiency in the operations of the company. As RIL has the right to appoint the majority of the directors to the board of Hathway, through which RIL will provide hindsight and other support to the company., Hathway’s cable TV and broadband business are operationally integral and core to RJio’s fiber-to-the-home business. Hathway’s 9-member board includes three representatives from RIL and two members from the Raheja family. As per the shareholder agreement, RIL has the right to appoint the majority of the directors to the board of Hathway.

High Debt to Debt Free – From FY 2010 to FY 2020, the company had a net loss for 9 out of the 10 years majorly due to the Interest that it had to pay for its elevated debts and during Mar 20, the companies Borrowings stood at 1975 Crs and after being acquired, the company received Tangible support from Reliance Industries to the tune of 2900 Crs and with the aid, the company has repaid its borrowings and as on Mar21, the company has no borrowings and has achieved a debt-free status.

Growth Strategy:

Expanding outreach: The company intends to be a single point access provider, bringing into the home and workplace a converged world of information, entertainment, and services and to achieve this the company plans to expand its geographical presence in both the segment.

Cable Tv Business: In this segment, the company plans to launch Value-added services and to launch its own in-house channels, and provide better regional content.

Broadband Business: The company will deepen its penetration in the existing market and provide additional value proposition products and services and expand its FTTH customer base.

The threats faced by the company:

Highly Competitive Industry with High Customer Churn: Hathway operates in a fragmented and unorganized cable TV distribution industry. There is growing competition from alternative TV distribution technologies, such as direct-to-home and over-the-top platforms. The industry is vulnerable to fast-changing customer preferences. Low-end users may move to wireless service providers due to competitive pricing and improvement in wireless technology

The rise of OTT platforms: The Cable Tv business of the company can be affected largely when its High-end consumers / Nuclear families / Bachelors can move to TV viewing through OTT apps, which may directly impact its business and which is a serious threat faced by the company.

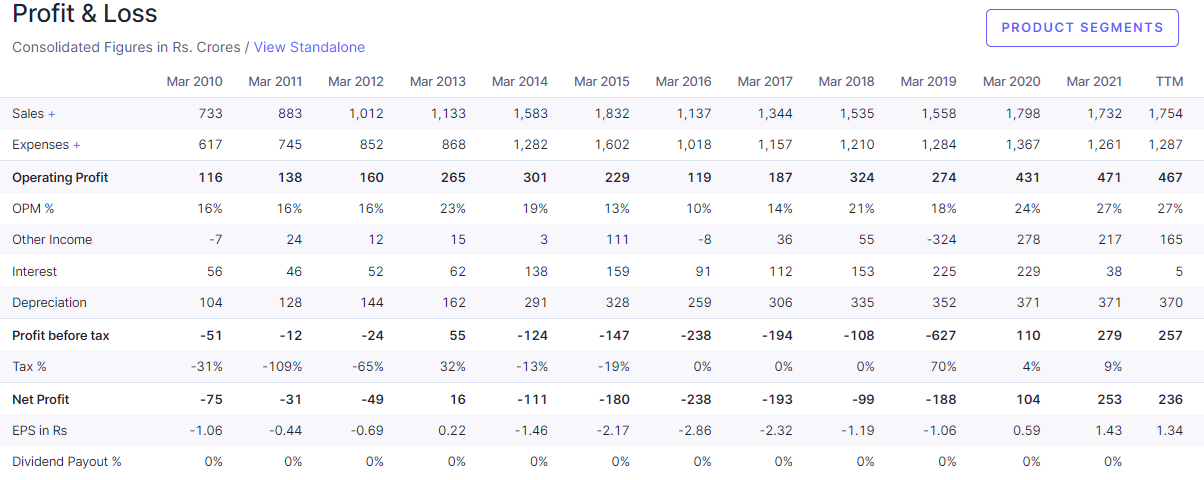

Let’s have a look at the past 10 years financial performance of the company:

The companies sales have been growing at a steady pace but there is no phenomenal growth and the Operating profit margin has been very commendable over the past few years, the company improved its operating profit margin significantly in the past three years. However, from 2010 to 2019, the company was having a net loss and it was majorly due to the Interest the company had to pay on its borrowings, but the company was able to clear all its debt owing to the strong support from Reliance Industries, the company is debt-free now and it doesn’t have any interest expenses which has enabled the company to be profitable and this scenario here is a proper textbook turn around story. However, the stock price hasn’t reflected its earnings yet, the stock is currently trading 40% below its 52 week high.

Balance Sheet Analysis:

The share capital of the company has been increased post the acquisition, the equity share capital has been increased due to the fresh issue made by the company for Reliance Industries and as a reason, the number of Equity shares has increased for the company from 71.4 Crs to 177 Crs and as the no of equity shares increases the EPS decreases. The company has a healthy reserve of 3642 Crs which will enable to the company to meet its future CAPEX without the dependence on other outside sources for funding and the real beauty is that the company has become Debt Free, from a borrowings of around 2000 Crs on Mar 20 to Debt free on Mar 21 and that is quite fascinating and now it can enjoy the perks of being a debt-free company. The company has a high fixed asset majorly owing to its business operations and The Capital Work in Progress is declining in the past few years which tells us that there are no major ongoing expansion plans for the company.

Conclusion:

Hathway Cable has enough moats and leadership to outperform its peers and in the previous years, high debts of the company was a major concern, and Reliance Industries acquiring the company will change its fortune altogether, The debts of the company are cleared and now it can focus on its growth trajectory and with the future support that it derives from Reliance will aid the growth of the company and this is a huge opportunity for investors to acquire the company at a right price and accumulate at every dip and wait for the day, where the market acknowledges the earnings of the company and reward it by the higher stock price appreciation.

share your thoughts

Only registered users can comment. Please register to the website.