Supportive Sectoral Initiatives and Transmission Business Should Support Elecon Engineering Company Ltd.

Summary

- Favourable industrial dynamics and strong order book should act as principal growth enablers of Elecon Engineering Company Ltd.

- Material handling equipment made ~10.1% of net sales in 1Q22, with transmission equipment making up ~89.9%.

- Favourable outlook of power sector is likely to lend support to Elecon Engineering Company Ltd.

Overview of Elecon Engineering Company Ltd.

Established in 1951, Elecon Engineering Company Ltd. is counted as pioneers in manufacturing of industrial geared motors and reducers, material handling equipment etc. In Asia, the company is categorised as one of biggest manufacturers of material handling equipments and industrial gears. The company’s acquisition of Benzlers- Radicon Group that belongs to David Brown Gear Systems should add to expertise for manufacture of custom-made gearboxes specially for steel mills, high-speed turbines, satellites for ISRO and for naval aircraft carries and several other growth sector industries successfully. It has a first-mover advantage in India as it manufactures sophisticated equipment for bulk Material Handling and has products catering to almost every industrial sector in India. Product solutions consist of designing, manufacturing, supplying, erecting and commissioning of the company’s products.

Growth Enablers of Elecon Engineering Company Ltd.

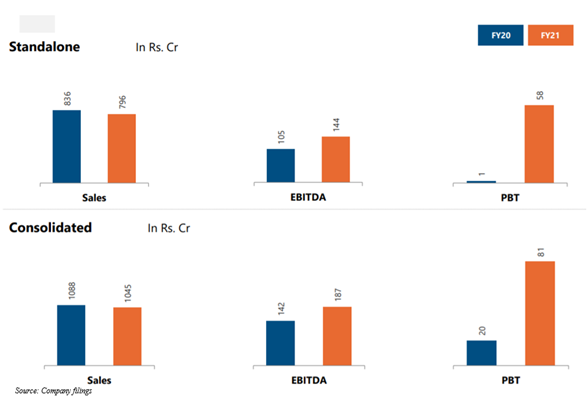

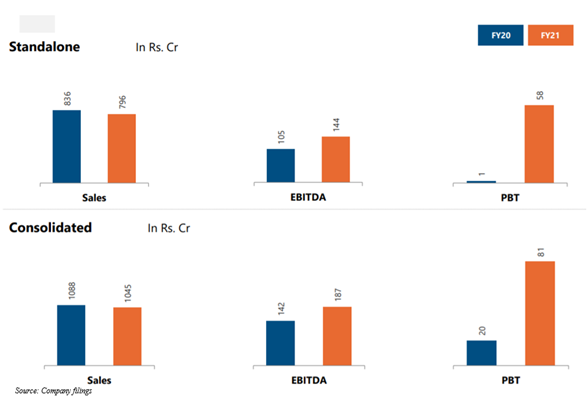

- Strong Order Book Should Stem Growth: On a consolidated basis, total operating income saw 31% growth on year-over-year basis to INR350 crores for 4Q21 in comparison to income of INR268 crores in 4Q20. Strong growth of 164% was seen in EBITDA as it was INR74 crores in comparison to INR28 crores in 4Q20. Profit before tax saw an increase of 3 times to INR81 crores for FY21 in comparison to INR20 crores in FY20. Strong performance in FY21 stemmed from healthy performance in gear division, despite external environment being challenging. After some hiccups during 1Q21 because of nationwide lockdown to control spread of COVID-19, the company saw improved performance in domestic and international business. Healthy order book was maintained, stemming from periodic order inflows from end segments such as power, steel, sugar, mining and cement sector. Efforts were channelized for reducing debt, inventory and receivables. This resulted in strengthening of balance sheet.

- Gears Business Led Show in FY21: Net sales in gear division was INR6,489 million in FY21, exhibiting a rise from INR5,979 million in FY20. Financial performance of gear business saw an improvement as focus was on exports, profitability decisions while taking orders, improved receivables management and temporary and sustainable cost mitigation. Growth enablers for this business involve products such as marine gears for naval warships, sugar mill planetary drives etc. The company has been aiming to critical gearbox applications to prove capability. Sophisticated layer of business should enable the company attain its leading position in gearbox industry along with dependable financials. It is seen that India’s power sector is undergoing a transformational and positive change. Indian government introduced some important reforms in this sector, having a clear aim to maximise power generation capacity and to improve distribution and promote investment. Recent announcement of INR3.05 trillion scheme focused on reviving power distribution companies and enhancing efficiency in power distribution sector should act as main growth enabler. Focus of government to replace conventional energy meters by prepaid smart meters should strengthen efficiency of T&D infrastructure, reduce AT&C losses, which should lead to improvement in financial health of DISCOMS.

- Capitalising on Industrial Dynamics: Indian engineering sector has been playing an important role in economic growth of India as it stems growth of core sectors of economy. Historically, country’s engineering export portfolio was focused on low and medium technology intensive engineering goods. Better adoption of digital tools in manufacturing should alter landscape of engineering exports. Engineering exports of India which was concentrated more on USA and EU is now fast shifting and favouring emerging economies like SAARC, ASEAN, Africa, CIS, and Latin America. Export potential of India is immense and huge doors of opportunity are likely to open to attain leadership across product categories. Even though this sector was adversely impacted because of Covid-19, recent tax reforms focused on reviving domestic capex cycle and introduction of production linked incentive schemes should help the companies in this industry through raising global competitive advantage. It should help India become manufacturing hub as it might result in new investments into manufacturing sector. Global industrial gearbox market should see significant growth stemming from higher level of automation across industries and increased adoption of energy-efficient and high-performance gearboxes. Investments by government and private organizations in end-user industries including material handling, power, and metal and mining sectors should propel growth in industrial gearbox market.Indian economy should rebound and attain healthy growth as improvements have been seen in trade and manufacturing principally due to widespread vaccination campaigns. The company should be able to capitalise on future growth prospects, with growth likely to come from revival in core sectors including power, steel, cement, and mining.

- Recovery Expected in Material Handling Equipment Business: Net sales in MHE division was INR1,387 million in FY21, exhibiting a decrease of 37.38% from FY20. Performance in MHE business saw negative impacts as there were losses from previous projects. Significant revival in profitability should be seen as a result of past restructuring measures targeted at taking profitable product business. Revival in economy should significantly improve performance of MHE business. Diversification of the company’s business by entering in new areas gave the company opportunity to new material handling requirements. Focus is on operation & maintenance of operating plants and efforts are being put to improve business through customer contacts. Investing in R&D results in high market participation by the company and such R&D can result in creation of new markets.

- Healthy Environment Should Result in Increased Future Growth: The company plans to optimise processes so that time and cost reduction can be seen. FY21 saw average performance principally because of Covid-19 pandemic. Material Handling business acted as a drag in challenging environment. Reduction of debt was principal focus of the company. Considerable efforts were focused on improving existing operation. Emphasis was laid on cost rationalization so that problems by slowing economy can be addressed.

Conclusion

In FY21, the company saw strong performance in Elecon Gear business. This was a highlight as its 1Q21 was washed out due to pandemic and lockdown thereof. Relentless focus on process optimization beginning from healthy quality order booking to efficient execution on time, resulted in quick completion of the company’s order cycle. Performance of the company’s subsidiaries was healthy and this should continue. In Elecon Gear, the company now focuses on several strategic initiatives which should enable the company enhance operational efficiencies so that it gets immuned from turmoil of global economy and uncertainty thereof. With opening up of Indian economy, some improvement can be seen in economic activity. This is being supported by various measures announced by government. Gear business of the company should be able to capitalize on opportunities and the company should be able to emerge stronger.

Announcements of lower corporate tax for new energy companies should result in new investments flowing in and support India in becoming a power surplus country. These developments should stem growth in the company’s business in power generation, distribution, transmission and equipment. Government extended INR111 lakh crores national infrastructure pipeline so that investment in energy, road transport, civil aviation, shipping etc. can be made and economic revival can be seen. Government approved capital infusion of INR6,000 crore in national investment and infrastructure fund to meet spending needs in infrastructure projects. Its infrastructure investment plan should be able to create increased demand for sector.

Currently, India is being counted as world’s second largest producer of crude steel. If Ministry of Steel is to be believed, steel industry makes a contribution of ~2% to country’s GDP. Fresh investment by government in highways, ports, airports, railways, and power development and focus on automobile sector should support growth of sector. Significant scope for growth is being offered by country’s comparatively low per capita steel consumption and higher demand for affordable housing. The companies operating in steel industry should continue to spend for capacity expansion. The company took some specific steps by negotiating favourable payment terms for new orders and cost rationalization initiatives so that management of cash flows and liquidity position can be done.

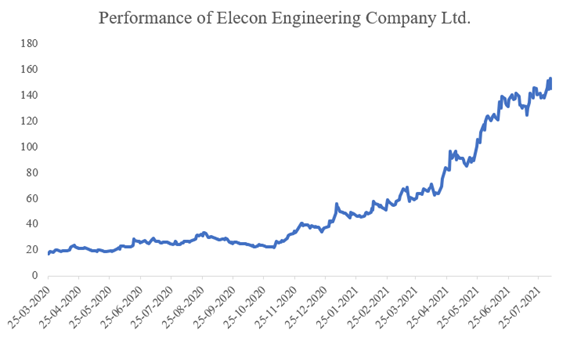

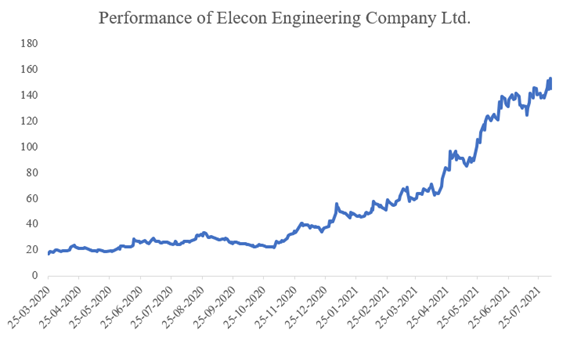

Stock of Elecon Engineering Company Ltd. has shown multi-bagger returns in just a little over one year. Precisely, this share has seen a strong run up of ~746.2% between Mar 25, 2020- Aug 6, 2021. An investor who would have invested INR1,00,000 on Mar 25, 2020, would have seen capital grow to INR7,46,211.33 on Aug 6, 2021. This is a true power of equity market. This clearly shows that any company with clear and focused growth strategy can actually help investors to see capital appreciation.

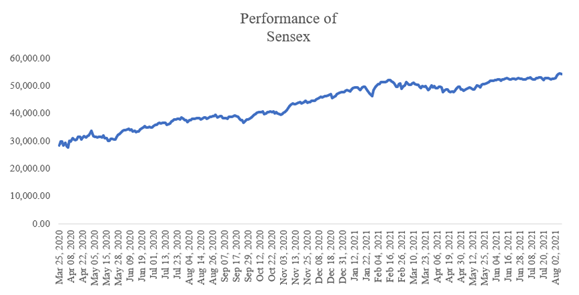

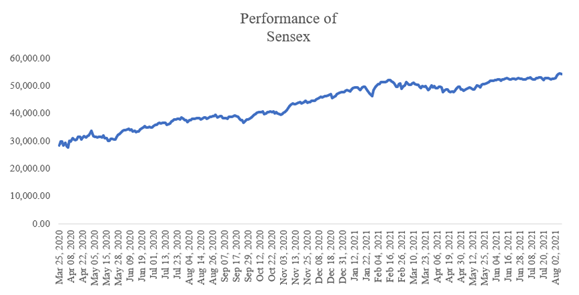

Between Mar 25, 2020-Aug 6, 2021, Sensex delivered only ~90% return. This clearly exhibits that selecting a stock capable of delivering multi-bagger returns is extremely important. Stock of Elecon Engineering Company Ltd. trades at ~28.24x of FY20 EPS, which is at a deep discount to sectoral average of 34.32x. This exhibits that investors should go long on this stock.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.