Strong Investments and Market Presence Make Up Growth Story for Sonata Software Limited

Summary

- Market position and growth of existing customers should continue to act as principal growth accelerators.

- GAPbusters acquisition strengthens footprint in Australia and opens up new opportunities in other geographies.

- Domestic business continues to see major revenue contribution from multi-year annuity enterprise sales.

About Sonata Software Limited

Sonata Software Limited is global technology company, having specialisation in platform-based digital transformation. The company supports businesses to become connected, open, intelligent and scalable. Its Platformation methodology results in bringing together industry expertise, platform technology excellence, design innovation and strategic engagement models. As leaders in digital technologies like IoT, Artificial Intelligence, Machine Learning etc., the company’s systems focus on delivering on commitment to excellence in business technology solutions. Sonata has strong alliances with some leading global technology companies and its deep collaboration with alliances helped the company provide best in class solutions. Path to innovation in digital era should be led by automation, integration, and optimization.

Growth Enablers of Sonata Software Limited:

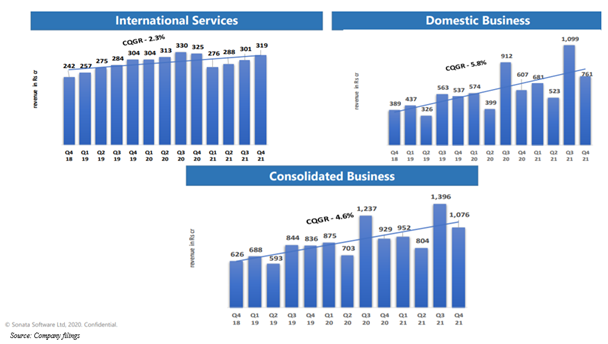

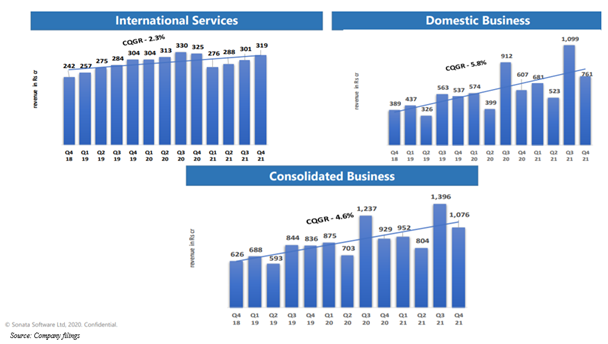

- Investments in Digital Tools Lent Support: Results for FY21 showed strong growth both in revenues and profits. This growth was seen across all business operations, geographies, digital services and industry verticals. Clear indication is there that strategy of building digital enterprises by creating platforms through unique Platformation methodology is relevant since greater investments by enterprises are now being seen in digital tools and automation. The company is now much stronger in quality of clients, relationships, and internal investments in creating competencies aligned to Platformation across platform engineering, cloud transformation etc. On a consolidated basis, the company saw revenues of INR1075.7 crores and EBITDA of INR122 crores in 4Q21. PAT of INR83.1 crores exhibits 54% growth quarter over quarter. In 4Q21, the company saw growth across two of its businesses. International IT services business saw revenues of INR319 crores, exhibiting 6% growth quarter over quarter. Its revenue in USD was 43.8 million, translating to 7.0% growth quarter over quarter in USD terms and 6.2% in constant currency. Growth was seen across geographies, with USA exhibiting 5.3%, Europe exhibiting 4.5% and rest of world exhibiting 13.1%. International IT services business saw addition of 10 new customers in 4Q21 and its overall strategy of creating digital enterprises by creating platform through Platformation methodology are showing results. Pipeline of this business was healthy and strong as there were multiple new digital wins from customers. Domestic products & services saw revenues of INR761.5 crores. While EBITDA of this business was INR31.8 crores, its PAT was INR22.6 crores. Domestic business saw strong customer retention and has established customer base and strong credit and risk management. There was addition of new business lines, favouring expansion and business saw gross margin growth. The company principally focuses on margins, strong cash management and sound capital allocation.

- Key Investments: The company’s key acquisition in FY20 was GAPbuster Limited (GBW), a Melbourne-headquartered company. The company made an investment in SemiCab, an Atlanta-based early-stage company in fleet management services ecosystem. This company aims to bring about digital disruption in long-haul trucking space by catering to a problem of “empty miles”, reducing distances trucks travel with empty payloads before/after it completes delivery. This problem of “empty miles” has implications for cost of freight and carbon footprint in an increasingly sustainability solution conscious world.

- Laying Groundwork for Future Growth: During FY20, the company focused on Platformation led solutions for customers across verticals of retail, travel, distribution and ISVs. Thus, the company demonstrated growth in both revenues and margins. Revenues of the company saw a growth 27% year-over-year, with PAT rising 11% on previous year. The company continues to make investments in IP, technology, people and process. Acquisitions made recently gave access to new industries such as services and commodities which should lend support to the company. Acquisitions include Scalable and Sopris. The company worked on strengthening alliance with Microsoft and focused on offering high quality services to clients, increasing stickiness of business. Investments focused on IP and creation of new technology competencies aligned to Platformation supported the company position itself better in digital-led opportunity space. Principal component of the company’s Platformation strategy is IP and it continued to focus on acquiring and improving IP. By FY20 end, the company signed definitive agreements to acquire GAPbuster Limited. This acquisition helped Sonata Software Limited penetrate markets in Australia and gaining a presence in newer markets in Japan and South East Asia. It consolidated its position in Europe and US.

- Growth of Existing Customers Should Continue to Lend Support: In FY20, total income saw 27% growth. Its EBITDA was 11% of total income, while net profit was 7% of total income. In FY20, International IT services made a contribution of 34% to total revenues and 77% of PAT. Domestic products and services made up 66% of total revenues and 23% of PAT. Total revenue of International IT Services was INR1,27,233 lakhs, exhibiting 14% growth. In US$ terms, it was $181 million, exhibiting 12% growth. The company saw good results consistently as it focused on serving and growing existing customers, new additions of 29 customers throughout FY20 and it maintained resource utilization at 87%.

- Improvement Seen in 4Q21 Should Sustain: The company should continue to see strong revenue growth which should stem from multi-year annuity license sales in domestic business. This business has seen addition of new strategic business lines which should support expansion. International services business saw consistent growth in revenues & margins over last 8 years and this should continue. In 4Q21, this business has seen acquisition of new clients and alliance-led growth. International business saw 6.0% growth quarter on quarter in revenues to INR319.0 crore, with EBITDA seeing quarter on quarter growth of 3.8%.

Conclusion

IT industry should be able to sustain growth in next decade as digital tools are being used in every industry. Technologies are deeply interwoven, with adoption being seen in every industry and across verticals & geographies. Future years are expected to be dominated by digital transformation initiatives. IT services industry should transform and this should stem from emerging technologies. Traditional businesses are expected to face challenges and IT services industry is likely to see new, digital and cloud-based opportunities. Organizations continue to adapt changes and increase their investments in new technologies to stay competitive. In FY20, the company saw good growth in both segments – International IT Services and Domestic Products and Services. Acquisitions and investments made over past two years should lend some additional capability in service industry and strong base to the company’s strategy. GAPbusters acquisition not only strengthens the company’s footprint in Australia but opens up new geographies in South East Asia & Europe where GBW has big clients in QSR, retail, automotive and oil & gas industries.

Growth should seek support from investment in new areas like cloud, security, IP and by penetrating client accounts with opportunities through cross sell and up sell. Plans are there to grow IP & proprietary platform revenues to acquire new clients for Platformation led digital transformation in various verticals including distribution, retail, travel, and ISVs.

Sonata Software Limited should be able to take advantage of opportunities to lend support to customers. The company plans to maintain its focus on strategy to be a digital transformation partner across core verticals. Basis of this strategy is its IPs and specialized services around digital technologies such as analytics, cloud etc. The company plans to focus on enhancing capabilities and invest in new innovative growth platform.

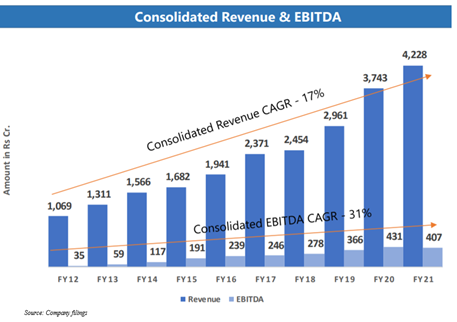

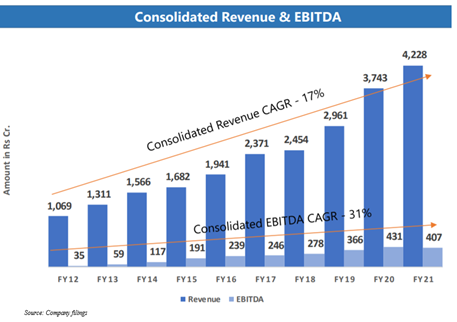

Over FY12-21, the company’s business saw consistent growth in consolidated revenue & EBITDA. Sonata Software Limited has compounded its consolidated revenue at ~17% and consolidated EBITDA at ~31% between FY12-21.

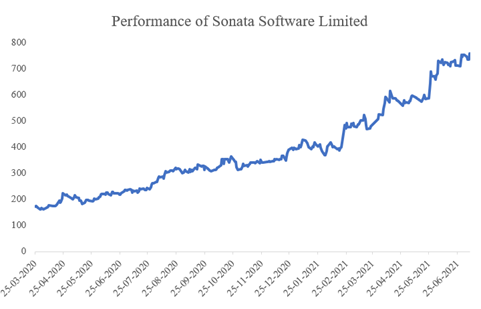

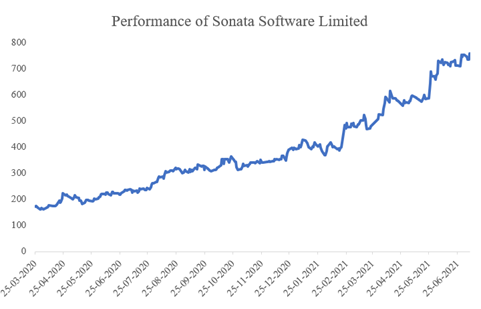

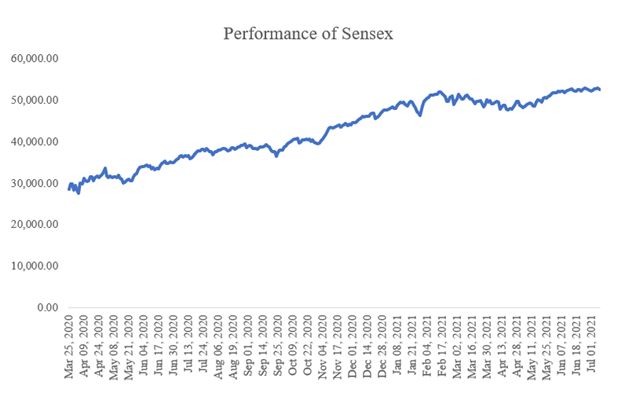

While most sectors saw brunt of lockdown due to COVID-19, experts believe that technology sector saw healthy returns. This stock saw a strong run up and investors were able to pocket ~343.02% between Mar 25, 2020 and Jul 8, 2021. Increased investments by companies in digital tools and healthy financial management stemmed this growth in stock price. Apart from these factors, future growth is likely to stem from margin management and sound capital allocation.

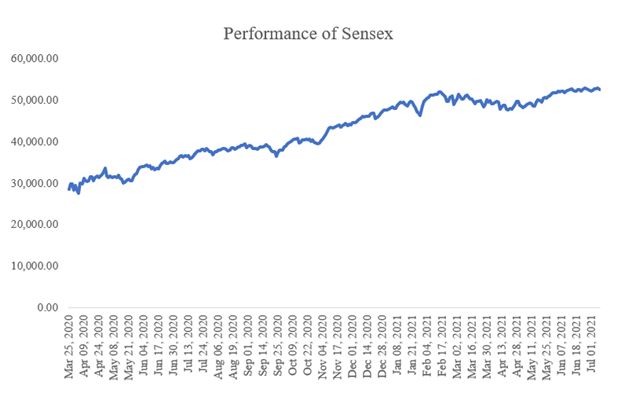

Sonata Software Limited has a total market cap of ~INR7,95,004.35 lakhs and free float market cap of ~INR5,46,847.85 lakhs. In comparison to Sonata Software Limited, Sensex has delivered only ~84.22% return.

Investors continue to focus on the company’s healthy financial risk profile and established market position. The company should be able to see expansion stemming from growth in domestic business. Recovery in business verticals like travel and non-essential retail should be able to help sustain growth. Improvement in revenue diversity is another point investors continue to rely upon. With growth in industry, the company should be able to achieve its growth plans as its sound capital structure should continue to lend support.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.