AU Small Finance Bank: Focus on Retail Assets Should Supplement Growth

Summary

- Strong base of retail assets and improvement in deposit franchise should act as principal growth enablers.

- AU Small Finance Bank continues to seek deposits from urban markets and it disburses in core markets.

- AU Small Finance Bank saw share of deposits in external funding getting increased.

Overview of AU Small Finance Bank

AU Small Finance Bank was founded in Jaipur in 1996 as Au Financiers and was a non-deposit taking non-banking finance company which worked on funding economic growth, especially for under-served and un-served low & middle-class individuals. Today, this bank is being categorised as scheduled commercial bank and a fortune India 500 Company. It enables convenient banking experience and has worked upon many industry-first initiatives. It is a retail focused bank and innovates to make banking simple for its customers. It is now moving towards being a digitally led bank with presence spanning across India. AU Small Finance Bank is now categorised as largest small finance bank having deep understanding of rural and semi-urban markets. This has enabled it build effective business model facilitating inclusive growth. AU initiated banking operation in Apr 2017. It has maintained high external credit rating from all leading and global rating agencies such as Crisil, ICRA, CARE and India Ratings.

Growth Enablers of AU Small Finance Bank:

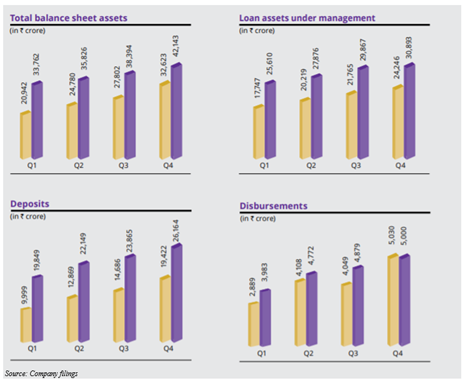

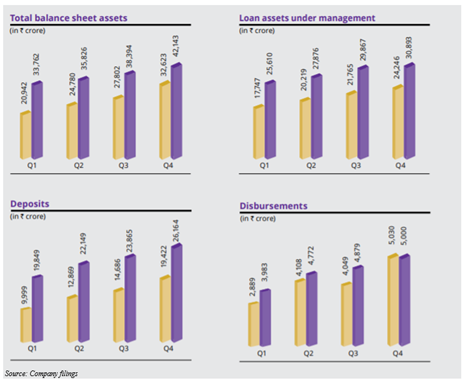

- Digital Initiatives Led This Show: AU Small Finance Bank saw strong performance in FY21, with AUM growing 22% year-over-year. It saw deposits growth of 38% year-over-year, with CASA ratio increasing to 23% from 14%. Significant progress was made towards becoming tech-led bank and it launched new mobile banking super app in 3Q21, having complete suite of payment and lifestyle services. Bank saw strong uptick in digital adoption in 4Q21. It saw growth across all its key verticals and growth returned to pre-Covid levels in 4Q21, with disbursements seeing 63% growth year-over-year. Overall cost of funds for FY21 was 6.8% as there was a reduction of 86 bps over FY20. Balance sheet growth stemmed from equity raised through qualified institutions placement and proceeds from sale of Aavas stake. Tier 1 ratio saw an increase to 21.5% from 18.4%.

- Growth in FY20 Supported by Strong Performance Across Quarters: AU Small Finance Bank saw strong FY20 as it strengthened its asset book with ~84% retail loans and saw ~INR5 lakh of average ticket size. Because of improving spread, there was an improvement in asset portfolio IRR to 14.7% in FY20 from 14.3% in FY19. It enhanced its focus on retail term deposits and CASA, forming 43% of total deposits in FY20. It maintained 98%+ secured book, which was a critical factor in containing credit cost. AU Small Finance Bank achieved average priority sector lending of 85% as on Mar 31, 2020. This was against requirement of maintaining average 75%.

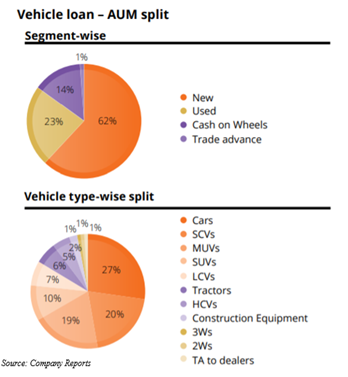

- Calibrated Growth Strategy: Principal reason for higher growth and profitability in relation to its peers is because of its ability to adapt quickly. It acted quickly upon an opportunity in used vehicles financing as it rapidly expanded used car dealer network and aligned resources accordingly. It was categorised as one of fewest early lenders to have built a scalable business model in used vehicle financing market. It has formalised connect with used vehicle ecosystem similar to what it has for new vehicles financing. AU Small Finance Bank was able to grow its small business loan book. This book addresses to underserved informal MSME segment. Banking industry is said as a backbone of any economy. Acting as an important enabler and critical contributor to capital formation and demand creation, this industry lays foundation for future growth of an economy. Large underbanked population offers multitude of opportunities to this industry, particularly for new banking enterprises. Higher customer wallet share and expansion across geographies have been lending support to its total income, while improvement in business operations, new product launches and better cost-to-income ratio are supporting its profit after tax.

- Focus on Retail Assets Continues: AU Small Finance Bank continues to build strength in its product range and value proposition in retail loans as it has strong domain experience. Share of retail loans at ~84% of total loans is being considered as one of highest in list of private sector banks. Growth in this segment should remain healthy and should stem from new product offerings and expansion across geographies. While wheels and MSME loans are acting as core retail asset products, home loan is another area where it has seen some importance. Its loans are principally for income generation purposes to self-employed and low and middle-income groups and these loans are secured by underlying assets. Bank is committed to scale up its retail asset book by following first principles and focusing on ‘essentials/consumption/ local economy businesses’. Plans are there to add more touchpoints through expansion, and explore opportunities in unbanked areas so that presence in existing geographies can be improved. Focus is on capitalising on proper understanding of local markets and local businesses and replicate strong underwriting and collections capabilities as this bank expands.

- Focus on Capitalising on Sectoral Dynamics: For near-term, recovery can be gradual and is likely to be affected by COVID-19 and growth outlook for Indian economy. Small finance banks were introduced by RBI so that financial inclusion can be seen for unbanked and under-banked sections of this economy. In three years of existence, these banks have made their presence felt as there has been market share growth in both loans and deposits. Significant scope for growth can be seen in several underserved segments. As branches mature and visibility for small finance banks improves, benefits from improving operating leverage should be able to improve core profitability. Small finance banks are seeing market share growth in loans and these loans should continue to gain market share over medium term. MSMEs are considered as engine of equitable economic development and these enterprises provide significant opportunities of employment in less developed regions. In India too, MSMEs are regarded as backbone of economy. Growth outlook for MSME segment seems to be encouraging due to its size of opportunity and several reforms like GST implementation, extension of credit guarantee fund scheme to NBFCs and lesser rates of tax. These reforms should be able to bring transparency and should incentivise lenders. These factors focus on increasing sector’s contribution to GDP to 50%+ as nation targets to become INR5 trillion economy.

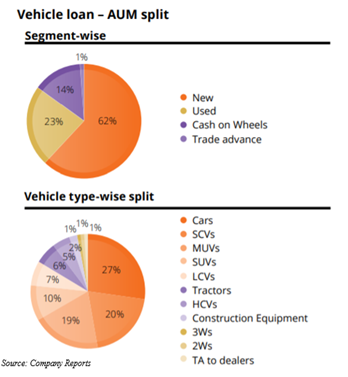

- Strong Record of Retail Assets: AU Small Finance Bank has a long, stable and strong track record in lending small ticket, secured, retail loans. These loans are disbursed principally to unbanked and underbanked self-employed individuals so that they can purchase assets and generate income. Vehicle loan acted as a key product since its inception and is categorised as a most seasoned book in portfolio. Despite automobile sector seeing a sluggish growth, its vehicle loan AUM saw 27% growth to INR12,985 crore. With this, it comprised 42.0% of total AUM during FY20. Wheels disbursements saw 16% year-over-year growth to INR7,799 crore during FY20.

Conclusion

AU Small Finance Bank is adequately capitalised and it has seen gradual improvement in deposit franchise. Bank’s deposit mix can be seen evolving as there is higher focus on retail deposits. Apart from growth in deposit base, its average cost of funds declined. Incremental funds are being sourced through low-cost deposits and there was refinancing from financial institutions. Healthy asset quality is likely to be sustained and this should principally seek support from change in business segment and improved underwriting practices.

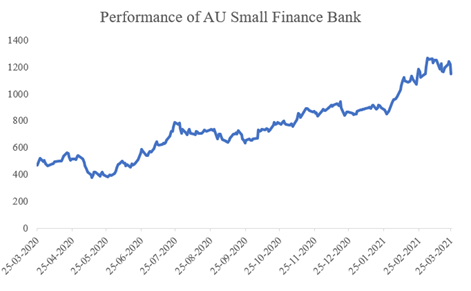

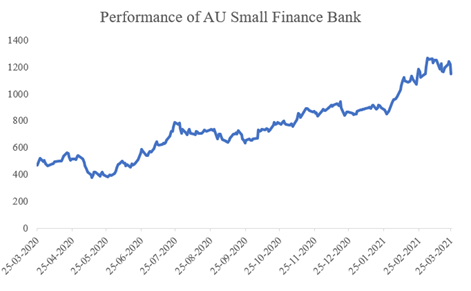

When Indian government announced lockdown in Mar 2020, significant fall in banking stocks was seen. As and when Indian economy opened, stock market saw a rebound. Stock of AU Small Finance Bank has seen a significant run up and has cheered investors. Between Mar 25, 2020- Mar 25, 2021, this stock saw ~143.18% rise. Simply put, if an investor would have invested INR1,00,000 on Mar 25, 2020, that investor would have seen capital grow to INR2,43,183.26.

AU Small Finance Bank’s incremental cost of funds saw a decline of 32 bps to 7.33% in FY20 and this decline stemmed from more granular liability base. Excluding certificates of deposit, cost of deposits was 7.44%. As on Mar 31, 2020, AU Small Finance Bank maintained statutory liquidity ratio investments of INR7,313 crore. Requirement is of INR5,303 crore. AU Small Finance Bank has compounded its AUM at ~37% and assets at ~52% over Mar 17-Mar 21. Though bank saw operational restrictions and negligible economic activity in 1H21, it was able to deliver improved CASA ratio and strong deposits growth. CASA ratio saw an improvement from 14% to 23%, with deposits growing 38% between Mar 31, 2020 to Mar 31, 2021.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.