Crisil Limited: Globally Renowned Brand Should Benefit From Its Market Presence

Summary

- Strong capital markets and client acquisitions supported growth in 1Q21.

- Completion of acquisition of Greenwich Associates complements strengths of Coalition business and should help Crisil Limited expand its suite of global benchmarking analytics.

- Technological investments and market position should act as principal growth enablers.

Overview of Crisil Limited

Crisil Limited is a leading, agile and innovative global analytics company, having a mission of making markets function better. The company is India’s foremost provider of ratings, data, research, analytics, and solutions, having a strong track record of growth, culture of innovation and global footprint. The company’s businesses operate across India, US, UK, Argentina, Poland, China, Hong Kong, Singapore, and UAE. Majority of the company is being owned by S&P Global Inc. The company’s clients span across micro, small and medium companies to large corporates, investors, and renowned global financial institutions. This company works with commercial and investment banks, insurance companies, large and renowned private equity players, asset management companies and governments and policy makers in infrastructure space in India and various other emerging markets.

Growth Enablers of Crisil Limited:

- Buoyant Capital Markets Lent Support: The company’s consolidated income from operations for quarter to Mar 31, 2021 saw 15.8% growth to INR495.2 crore in comparison to INR427.8 crore in corresponding quarter of previous year. Its consolidated total income for 1Q21 rose 11.0% to INR508.7 crore in comparison to INR458.2 crore in corresponding quarter of previous year. During 1Q21, the company saw good business momentum across Ratings, Research and Analytics. Better performance of capital markets and new client acquisitions stemmed growth. Demand for traded and credit-risk offerings lent some support. It continues to make investments in data and technology capabilities. 1Q21 started with positive developments as there were vaccination roll-outs, including India. Domestically, recovery in economic activity was uneven. Manufacturing related sectors saw faster pick-up than services. Concerns are there as COVID-19 cases are increasing. India Research saw higher demand for data, research and analytics as there was an uptick in capital market and industrial activity. New products like alternative investment fund benchmarks and wealth tracker helped in performance. Uptick was seen in credit to micro, small and medium enterprises, and agriculture. Corporate credit was not able to see any growth as companies decided to put capital expenditure on hold. Corporate credit forms nearly half of overall bank credit. Issuers targeting debt capital market saw 41% decline and issuances in terms of quantum saw 18% decline in 1Q21 on a year-over-year basis. Segment growth in advisory segment stemmed from improved demand across government and multilateral-supported programs in infrastructure space and for credit management and risk-monitoring solutions.

- Strong Performances by Businesses: Among the company’s businesses, Ratings, Global Analytical Centre and Global Research and Analytics saw strong performance in FY20 despite external environment. Ratings business saw consolidation of market leadership because of best-in-class ratings quality, market coverage and client engagement. Global analytical centre saw an increase in surveillance delegation and coverage on research and criteria support for S&P Global Ratings. Global Research and Analytics saw good growth in traditional areas like model and traded risk. It expanded its offerings in non-financial and credit risk space.

- Technological Investments and Market Presence Supported Crisil Limited: FY20 saw COVID-19 affecting countries, businesses and individuals. Lockdown and restrictions were imposed on various activities, calling for extraordinary changes. Technological investments, multi-country presence and analytical nature of offerings ensured full business continuity even as pandemic unfolded across locations. This company continued to fully operate and function seamlessly, serving clients and meeting stakeholders’ needs. The company’s ratings business saw new client acquisitions and strong existing relationships, improving its market leadership. On innovation front, the company was first port of call for innovative instruments even in an unfavourable bond market. Crisil Ratings assigned rating to 1st dealer securitisation transaction in India and 7 covered bond transactions. The company’s revenue from consolidated operations for FY20 was INR2,064.98 crore, 14.4% growth against INR1,804.56 crore in previous year. PAT was INR354.73 crore against INR343.95 crore in previous year.

- Global Research & Analytics Business Saw Expansion of Client Base: The company’s global research & analytics business secured wins and strategic renewals in risk technology, front office/middle office transformation, interbank offered rate transition, stress testing and Basel III. This business capitalised opportunities generated by regulatory guidelines for better credit risk management practices. Pace of conversations was slower than usual because of concerns around pandemic. However, opportunities should open up as credit risk transformation agendas gain momentum. Focus areas for banks are enterprise risk management optimisation, regulatory compliance simplification, etc. Business has successfully closed large renewals and it still pursues more business opportunities across risk and finance transformation. On buy-side, COVID-19 led to accelerate demand for research in riskier assets including distressed and private debt. It sees demand for emerging market, credit research, alternative investments, ESG missing data, etc. Global research & analytics saw gain in momentum in credit risk as there were new deals globally. It is focused on helping banks across credit transformation projects through credit workflow automation tools and industry utilities.

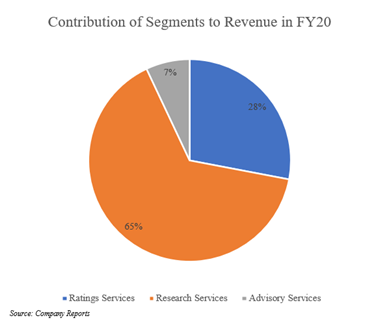

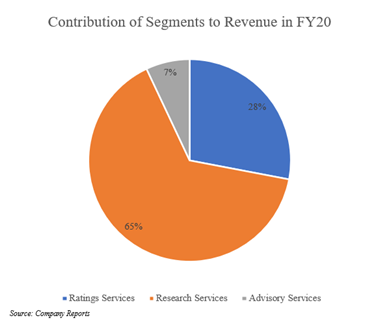

- Research Services Should Continue to Make Significant Share: Out of total revenue of INR2,064.98 crores in FY20, research services made up highest portion with ~65%, while ratings services and advisory services made up ~28% and ~7% respectively. Global Research and Analytics business closed big opportunities, lending support to the company’s research business. These opportunities relate to stress testing, model validation and large IBOR transition deal. It continues to look for better opportunities by regulatory guidelines around better credit risk management practices. Crisil coalition saw initiatives to enhance market relevance and broaden reach so that more regional players can be included. In FY20, Crisil Coalition added 2 new logos to its list of global investment banks. Despite slowdown, the company’s advisory business saw several new assignments getting booked especially after first half. Crisil rating continued to grow, with new client acquisitions and strong existing relationships strengthening market leadership in FY20. Crisil assigned 1,209 new BLRs and 7,000 SME gradings and assessments during FY20. With this, it assigned ratings to 34,000+ large and mid-sized corporates and evaluated performance of 150,000 SMEs. Focus on high-growth segments and its existing relationships resulted in increased share in bond market. It also saw 140+ new large corporate clients getting on-boarded. In this challenging credit environment, issuers and investors/lenders preferred working with quality-focused CRAs, principally Crisil, over others.

- Market Position and Quality Products Supported 4Q20: Crisil Limited saw an increase of 28.6% in its consolidated income from operations for 4Q20 to INR597.2 crore on INR464.3 crore in 4Q19. Consolidated total income saw an increase of 26.4% to INR612.2 crore in comparison to INR484.3 crore in 4Q19. Results for 4Q20 included Greenwich Associates LLC that was acquired in 1Q20. The company’s businesses were resilient and it served all its clientele having best in class insights, opinions and analytics. Proactive response to pandemic enabled continued growth through FY20. Differentiated positioning and high-quality products and strong client relationships should lend support to the company’s businesses to benefit from economic recovery across markets.

Conclusion

During FY20, Crisil Limited completed acquisition of Greenwich Associates. This company is a leading provider of proprietary benchmarking data, analytics and qualitative insights to financial services firms. Acquisition should be able to complement strengths of Crisil’s coalition business and should position it to enhance suite of global benchmarking analytics.

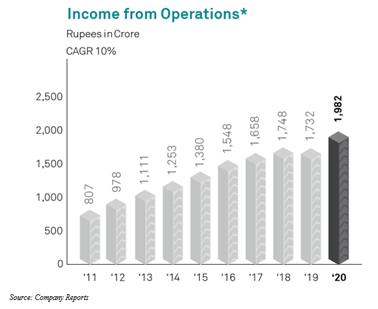

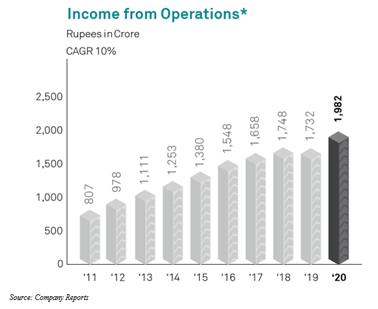

Crisil Limited has a total market cap of ~INR14,65,093.26 lakhs and free float market cap of ~INR4,51,802.94 lakhs. The company has compounded its income from operations at ~10% and profit after tax at ~6% over FY11-FY20.

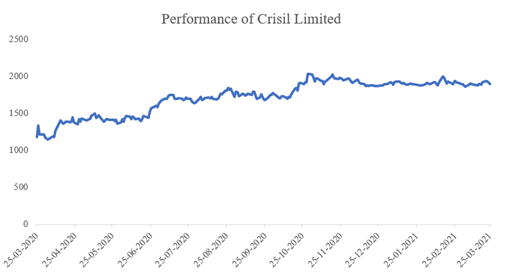

India was a country which was categorised as one of most affected countries by COVID-19. Country has seen a significant decline in GDP and most businesses were shut as a result of lockdowns initiated to curb its spread. Impact was also seen on Sensex and Nifty as they saw a huge fall. Though most losses as a result of lockdowns have now been recovered, India still deals with second wave of COVID-19. Almost all stocks saw a huge fall when Indian government announced its first lockdown. With re-opening of Indian economy, these businesses and stocks have seen a stark recovery.

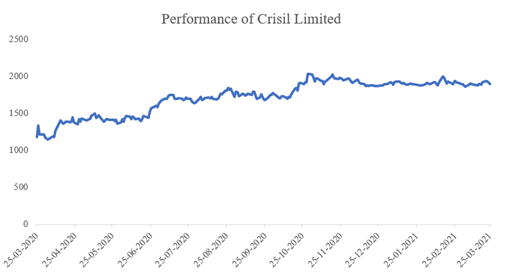

One such stock which saw significant improvement post lifting of lockdown restrictions and economic recovery is Crisil Limited. This stock saw an increase of ~61.11% between Mar 25, 2020- Mar 25, 2021. Such quick recovery has cheered a range of investors.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.