Exports and Strong Market Position Should Fast-track Trident Limited's Growth

Summary

- E-commerce vertical and exports should continue to act as principal growth accelerators.

- India’s superior quality of textile should continue to provide edge to Indian companies and major portion of India’s export of textiles is done to US & UK.

- Significant availability of raw material and manpower provides advantage to Indian companies in global textile space.

About Trident Limited

Trident Limited is flagship company of Trident Group, which is a USD1 billion Indian business conglomerate and global player. The company evolved over years into one of world’s largest integrated home textile manufacturer. It manufactures wide variety of yarn, bed & bath linen, paper, chemicals and captive power. Trident’s manufacturing facilities are situated in Barnala and Budni. The company is being counted amongst largest exporters of home textile products, having significant market share. Excellent quality and differentiated growth strategies led to strong clientele across global textile arena. In FY20, the company saw ~44% of total revenue flowing in from exports and ~56% coming in from domestic markets.

Growth Enablers of Trident Limited:

- Home Textile Business Led This Show: During 4Q21, home textiles business of Trident Limited showed strong recovery, with capacity utilization of 61% in bath linen segment. On bed linen side, it saw capacity utilization of 92%. Revenues for 4Q21 were 36% up on year-over-year basis and EBITDA margins were strong. Efforts adopted during FY21 resulted in business adapting to current situation and reasonable contribution was seen from e-commerce mode to overall business. Paper business saw strong recovery in 4Q21 as both volumes and realizations saw improvement of 9% and 10% respectively. The company saw net revenue in 4Q21 of INR1352.6 crore in comparison to INR997.3 crore in 4Q20. Home textile business was able to sustain demand momentum in 4Q21, with bath and bed linen segments registering revenue increase of 52% and 109% on year-over-year basis respectively. Exports have made a significant contribution of 64% to total revenue in 4Q21. Recovery in demand saw paper business reaching capacity utilization of 92%.

- Removal of Restrictions Should Lend Some Support: Global home textile market is being led by demand from USA and Europe. Indian export home textile market is known because of few large players. These organized and larger players principally address to export demand being made from large global retailers and these companies face intense competition from countries such as China, Pakistan, Vietnam, etc. This pandemic gave rise to disruption in operations of manufacturers and resulted in demand slowdown, in both Indian and export markets. Lockdown impacted operations of manufacturers and their supply chains. Even though orders/sales started picking up pace by 1Q21 end, home textile industry saw strong demand revival during 2Q21 on account of high demand from large retailers whose inventory pipeline was running dry as a result of huge demand build-up due to pandemic. Now, people are becoming more health conscious and they are looking more for home furnishing products. Work from home in some big cities contributed to demand revival, with people spending significant time on home improvement products. Growth momentum seen in previous quarter continued in 4Q21 and this should sustain.

- E-commerce Vertical Should Help Maintain Growth: The company’s products with anti-microbial treatment as standard across bath linen category received good response from customers. It has created separate e-commerce vertical to address to online mode which saw substantial growth during 4Q21 on account of buyers preferring digital mode of shopping. As a result of rise in number of cases of COVID-19 and state-wise lockdown, increase in orders from global retailers was seen in 1Q22 as uncertainty still prevails regarding supply chain. During first wave of COVID-19, inventory pipeline of these types of retailers dried up quickly as India saw its national lockdown. Retailers are expecting reoccurrence of this situation in India and other countries because of which global retailers increased their orders.

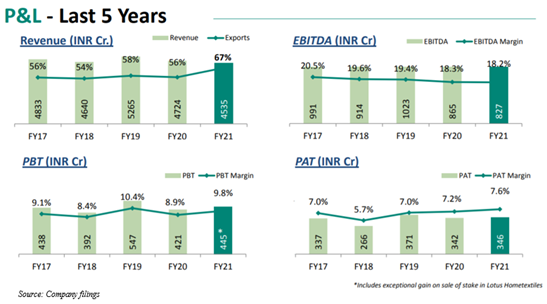

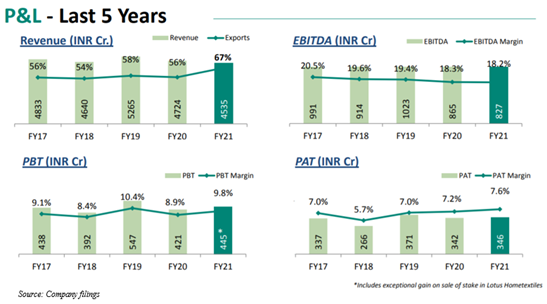

- Exports Should Continue to Make Up Majority Share of Revenue: Total revenue for FY21 was INR4535 crore, slightly less than FY20 principally because of low sales in 1Q21 in which the company’s operations were hampered as a result of national lockdown. Sheeting segment saw ~60% growth on year-over-year basis as there were both better sales volume and realisations. In 4Q21, exports made up 64% of total revenue. According to OTEXA data, India’s share in US cotton sheets saw an increase in overall percentage terms to 60% during initial 3 months of CY21. This was seen on expense of China and ROW. These two have combinedly lost ~8% share since last year. In terry towel segment, India’s share rose by 1% to 43% as on Mar 2021 on 42% in last year. India should continue to have advantage of being largest producer of raw cotton and major cotton surplus & cotton exporting country, giving distinct advantage to Indian home textile manufacturers. The company plans to consolidate its business and leverage investments done on scale and technology & systems. It plans to leverage capabilities with cost-efficient manufacturing & strong market presence and adding new customers to portfolio. Share of exports has increased to 67% in FY21 and this share should continue to increase because of India’s position and competitive edge the company has. US continues to be a leading consumer of home textile, with next name in this list being Europe.

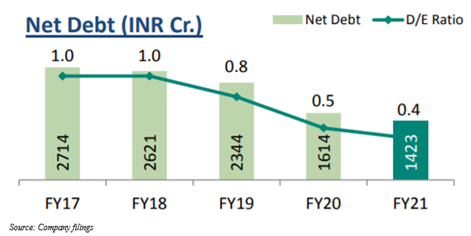

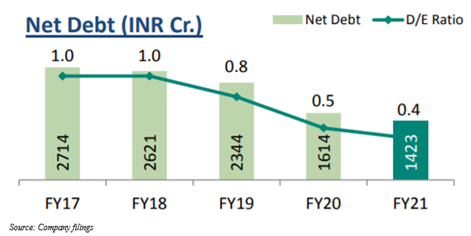

- Disciplined Financial Risk Profile: The company saw healthy improvement in financial risk profile after significant reduction in debt over past couple quarters principally because of ramp up of operational performance in home textiles division. Net debt saw a reduction from INR1614.5 crores as on Mar 31, 2020 to INR1423.2 crores as on Mar 31, 2021. The company made total repayment of INR1034 crores in FY21, including prepayment of term loans of INR650+ crores. Home textile division gathered strong interest, with both bed sheets and towels segments reaching reasonable capacity utilization. Strong demand for home textiles was because of increased stay-at-home period due to lockdowns and focus on hygiene for consumers. This should remain healthy in this fiscal year as second wave of COVID-19 engulfed India and there are some regional lockdowns.

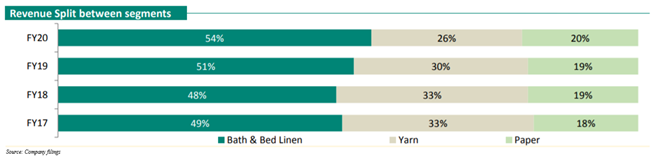

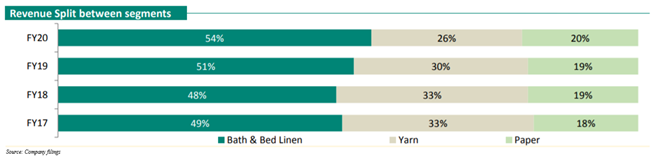

Diversification in Revenue Should Result in Lower Volatility

The company has an established market position in textiles and paper businesses, with bath & bed linen business making up ~54% and yarn business making up ~26% of revenues in FY20. Its paper business made up ~20% of total revenue in FY20. In upcoming years, the company’s bath and bed linen business should continue to lend support to its revenues as it is a leading player in terry towel capacity and in home textile space in India. Its paper business continues to have highest operating margin among main listed companies in India. Since the company’s revenue is diversified and not dependent on any one business, fluctuations in its revenues and net profits should be managed well. It has seen its capacity utilisation in bath linen business being improved from 29% in 1Q21 to 61% in 4Q21 and in bed linen business from 38% in 1Q21 to 92% in 4Q21.

Conclusion

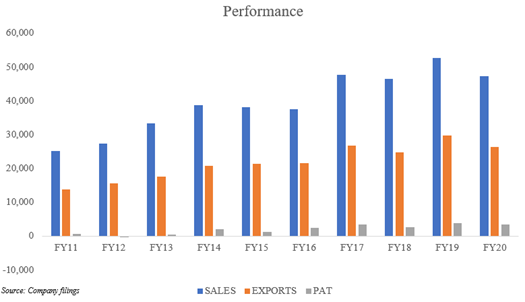

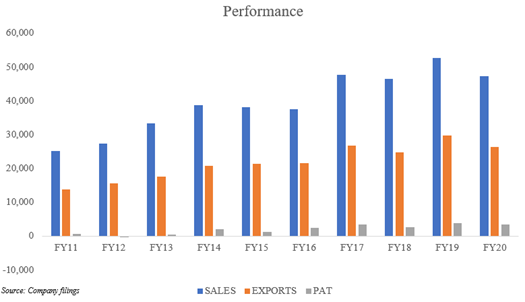

Trident Limited has a total market cap of ~INR8,51,024.60 lakhs and a free float market cap of ~INR1,77,084.46 lakhs. The company has compounded its sales at ~7.2% and PAT at ~19.8% over FY11-FY20. Since the company has sound financial risk profile, its credit-related measures should continue to improve as they have in prior years. The company’s net debt /EBITDA saw an improvement from 1.9x on Mar 31, 2020 to 1.7x on Mar 31, 2021. Credit measures should continue to seek support from healthy cash flows and moderate capex plan. The company should be able to fund its capex plan through internal cash flows which should result in better management of debt.

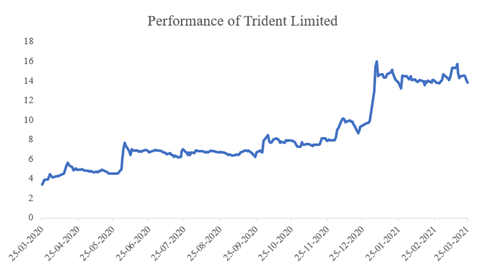

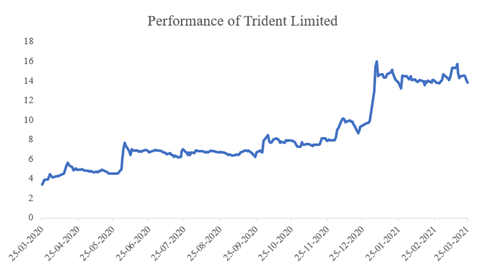

Trident Limited’s stock has seen strong run up since Mar 25, 2020 and has delivered strong return of ~305.88% between Mar 25, 2020- Mar 25, 2021. Simply put, an investor who would have invested INR1,00,000 on Mar 25, 2020, would have seen capital grow to INR4,05,882.4 on Mar 25, 2021. The company’s financial risk profile and strong market presence should continue to provide competitive edge which should further lend support to its performance. Home furnishing demand under wellness category should continue to get enhanced customer focus and e-commerce sales creation as separate vertical should be able to address increased demand of products through digital mode.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.