Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Castrol India (NSE:CASTROLIND) is a leading manufacturer and distributor of premium lubricating oils, greases, and specialty products. It is a part of the global BP Group.

Castrol has a strong and wide distribution network through strategic OEM partners, retail, and independent workshops. It has also developed online sales channels as additional resources and other new channels like the Jio-bp retail network and independent workshop channel which has further increased its footprint nationally.

Castrol India's key product segments include petroleum products and scrap. The company operates in all major categories such as automotive, industrial, and marine, and energy applications. Its products include lubricating oils, greases, and brake fluids.

Castrol caters to a large base of customers in the industrial, commercial and residential space, and marine, energy, manufacturing, and agricultural sectors. Its power brands such as Activ, Restart, Power1 Ultimate, GTX, continue to drive its powerful performance and the company invests aggressively in brand building campaigns.

Castrol India Pros

i) Large distribution network and sticky customer base - Castrol’s products are distributed through over 350 distributors who service close to one lakh customers and sub-distributors. The company serves close to 3,000 key institutional accounts directly. Over the years, the company has developed extensive relations with some of the leading brands in India and established original equipment manufacturers. Given its innovative streak and quality products, Castrol stands a good chance to win deals with large national players. The company recently entered into an exclusive supply arrangement with ki Mobility Solutions in India to supply its lubricant products to ki Mobility's multi-brand workshops in India. The expansion of Castrol’s distribution network across over 1,350 Jio-bp sites should further drive growth.

ii) New Products and innovations - The company continues to drive premiumization and synthetization in the personal mobility segment which is its primary market segment. It launched new products for cruiser bikes (Castrol Activ Cruise) and full synthetic performance oils in the premium segment for two-wheelers (Castrol POWER1 ULTIMATE). The company also spends aggressively towards brand-building. Castrol is striving to develop products that will help reduce emissions and improve efficiency and reliability for fast-developing technologies such as electric and hybrid vehicles.

iii) Well-positioned in the fundamental growth market - India is the world’s third-largest lubricants market after the US and China with approximately 2.8 billion liters of annual consumption and Castrol commands an 18% share in the Indian retail market. Lubricants are important in vehicles as they reduce the friction generated by metal-to-metal contact and also lower the noise and heat generation of metal parts. As the size of the vehicle population and personal disposable income increase, the demand for automotive lubricants will also grow. The personal mobility segment is less price-sensitive, and it is easier to pass on an increase in raw material costs. The demand for Castrol products will also benefit from the rising industrial, manufacturing, and agricultural sectors. In India, Castrol is focusing on the fast-growing motorcycle and scooter category.

Source: Company's AR

iv) Ready for the Future - It is being argued that the growth of electric vehicles in the future might pose a rising threat to Castrol’s products. However, it must be noted that EVs also use fluids, whether coolants, greases, or brake fluids. Castrol has also launched fluids for EVs and started supplies to Tata Motors and MG Motors. Castrol launched a future-ready product portfolio and entered the EV space with leading passenger car OEMs through exclusive lubricant recommendations. Out of the top 13 automotive markets in the world, Castrol is the No.1 brand in the top 10 markets and No. 2 in the rest of the markets.

COVID-19 Impact

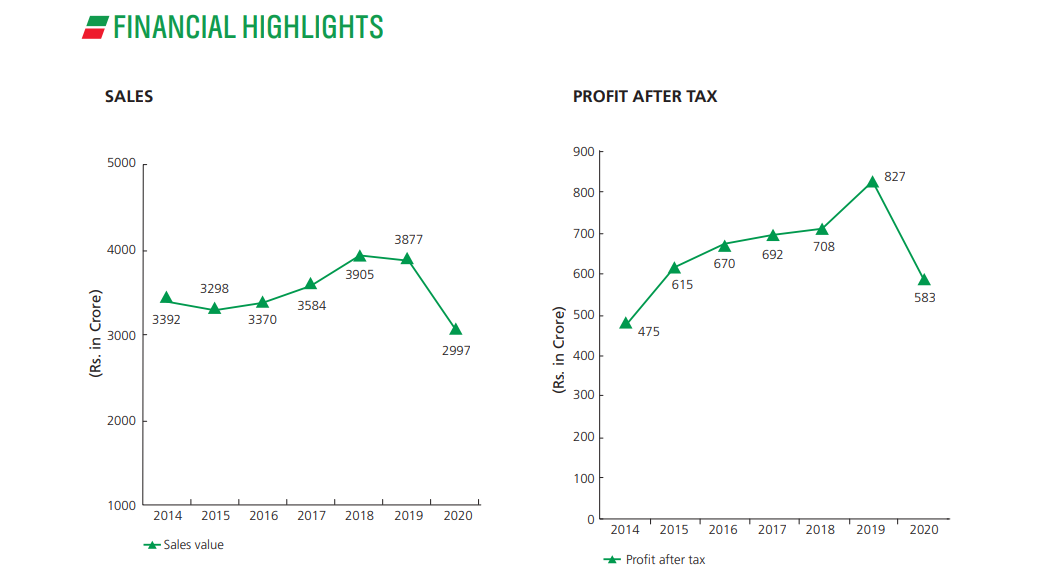

The pandemic-induced economic slowdown as well as continued volatility in input costs and foreign exchange adversely affected Castrol’s sales and profitability in the last year. Revenue from operations declined by 23% (FY2020) mainly on account of lower volume due to disruptions owing to the Covid-19 pandemic resulting in a continued slowdown of the economy including a decline in lubricant consumption. Castrol, however, gained some momentum in the second half with the revival of demand where revenue improved by 54% while profit from operations also grew 122% YoY. The company continued to invest in cutting-edge technology and launched several new brands in the last year.

Future Opportunities

Castrol is looking at tapping opportunities across smaller towns and rural areas, emerging new vehicle segments such as SUVs, premium bikes, and gearless scooters. It should also benefit from the growth in the MLCV segment. Additionally, the company is focusing on the industrial segment in the next 5-10 years. Castrol is looking at expanding its footprint in the car care fluids and other adjacent segments. It entered into a strategic collaboration with 3M India for vehicle care products for the automotive after-market.

Stricter emission norms and growth in the agricultural sector should drive newer technologies. Castrol is poised to take advantage of further enhanced technologies as it became the first company in the industry to have BS VI compliant products across all categories of automotive lubricants. The company continues to make strategic investments in initiatives such as digital payment solutions and brands.

Valuation

Castrol’s PE looks reasonable at 20x given its almost monopolistic existence and huge brand recall. It has a market capitalization value of more than Rs. 12,000 crores. Castrol sports an ROE and ROCE ratio of 41% and 56% respectively. Its share price has increased five times since 2006. The company is 100% debt-free and also has a dividend yield of 2.45%. The company has a promoter holding of 51% which has remained so for the last four years. Castrol’s profits and sales have just grown at a moderate 2% and 1% CAGR, respectively over the last decade. Predictable and stable cash flow, low re-investment requirements, and consistent payout ratio are its strong growth drivers. Castrol has reiterated that it will maintain an 80% dividend payout.

Source: Screener

Challenges

a) Declining vehicle sales - Overall vehicle sales declined by 24% YTD November 2020. The activities on the manufacturing, industrial and global shipping front also remained muted.

b) BS-VI Norms - Compliance with BS-VI emission norms for all new vehicles sold from April 2020 has been a significant development within the year. Castrol, however, has been working on product formulations and technology in this regard and also has experience with an equivalent of Bharat 6 in Europe as Euro 6.

c) Input Costs - The prices of Castrol’s products are heavily dependent upon forex, crude, and base oil prices which remained highly volatile in the last year owing to the COVID-19 pandemic. Lower fuel demand forced refiners to either shut their operations or operate at lower levels. The second wave of the pandemic will also affect demand adversely. In addition, supply disruptions due to base oil and raw materials availability, logistics challenges, and rupee depreciation will also have a negative impact.

d) Increasing Competition - The lubricants market in India is highly competitive. Castrol competes with the likes of national oil companies, several international majors, and a large number of local companies. There is also a trend of OEMs introducing lubricants under their own brand name, which will further increase competition. Despite intense competition, Castrol enjoys tremendous pricing power and enjoys a premium of 20-25% over the competition. India’s top four players IOC/ HPCL/ BPCL and Castrol control over 80% of the market. Gulf Oil Lubricants India Ltd., Panama Petrochem Ltd., GP Petroleum are other leading competitors.

Bottom Line

The COVID-19 second wave is poised to adversely affect volumes. However, the demand for Castrol products should increase driven by growth in the personal mobility, commercial vehicles, industrials, and marine lubricants categories as the economy recovers. The company has a strong competitive moat in the form of support from a strong and internationally-renowned parent company, premium products, and a strong brand recall in the country. Castrol is in a good position to leverage its technological strength and product development capabilities in order to benefit from new revenue models and gain market share.

share your thoughts

Only registered users can comment. Please register to the website.