Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Pidilite Industries (NSE:PIDILITIND) is a leading consumer-centric company in India dealing with adhesive products. It is a pioneer in consumer and specialty chemicals in India.

Pidilite has a diverse product portfolio comprising adhesives, sealants, waterproofing solutions, and construction chemicals, industrial resins, polymers, and more. Its business is divided into two divisions - consumer & bazaar products accounting for ~80% of the company’s revenues in 2020, and the B2B products segment that accounted for the balance ~20%. Pidilite has some iconic brands like Fevicol, Dr. Fixit, Fevi-Kwik, M-Seal, Roff, Chemifix, etc. in its bouquet of brands. These products have become synonymous with their respective product categories.

Pidilite started with a single factory manufacturing only one product, Fevicol, and has today expanded multifold to have a large global presence with operations in nine countries and a presence in ~80 countries. It derives a sizable portion of its revenue from Asia, America, and the Middle East & Africa.

Pidilite Pros

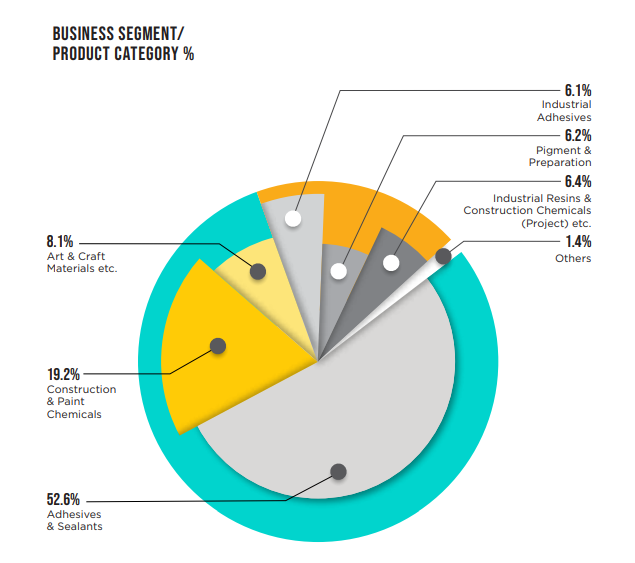

i) Highly diversified revenues from different product categories and catering to a wide range of consumers -

Pidilite earns more than 50% of its revenues from the adhesives & sealants category, followed by Construction & paint chemicals (~19%), art & craft materials (~8%), industrial adhesives (~6%), pigment & preparation (~6%) and industrial resins & construction chemicals (6%). Products under the Branded Consumer & Bazaar segment are widely used by carpenters, painters, plumbers, mechanics, households, students, offices, etc., while the B2B segment caters to various industries like packaging, joineries, textiles, paints, printing inks, paper, leather, etc. The ‘Others’ segment largely comprises the manufacture and sale of Speciality Acetates, raw materials, etc.

ii) Iconic brand name -

Pidilite enjoys a leadership position in the adhesives market in India. The company's adhesive business commands a ~70% market share in the country. It has a strong brand market share in the water-proofing and construction chemicals segments. Its Dr. Fixit brand is synonymous with water-proofing in India. The market size is Rs. 7,000 crore and Pidilite is the market leader in this segment.

iii) Wide reach and extensive network -

Pidilite operates through a network of 23 manufacturing facilities and 25 co-makers across India. It also has extensive R&D facilities with three units in India and five others globally. The company has a solid pan-India presence with a network of over 5,000 distributors, servicing 200,000 dealers, retailers, and contractors across the country. The company is expanding and plans to add ~12 new facilities till 2022. Pidilite is also spending aggressively in its research and development to maintain its leadership position with its R&D spending increasing by 150% since 2015. The company claims that more than two-thirds of its sales happen through in-house innovation.

iv) Stands a good chance to increase Market Share with the HAMSPL acquisition -

Pidilite announced its intention to acquire Huntsman Advanced Materials Solutions (HAMSPL), the consumer adhesive business of Huntsman Corporation, USA. The acquisition will grant Pidilite a trademark license for the Middle East, Africa, and ASEAN countries. In addition, Pidilite's adhesive and sealant brands will strengthen with the ownership of well-known Araldite adhesives in India.

v) Expanding global presence -

Pidilite has a large presence in Bangladesh, Sri Lanka, the USA, Brazil, Thailand, Egypt, and Dubai. The company is focusing on increasing its market share in Bangladesh and Sri Lanka. A growing population in India, increasing industrialization, construction and consumerism should act as tailwinds for Pidilite’s growth in the country.

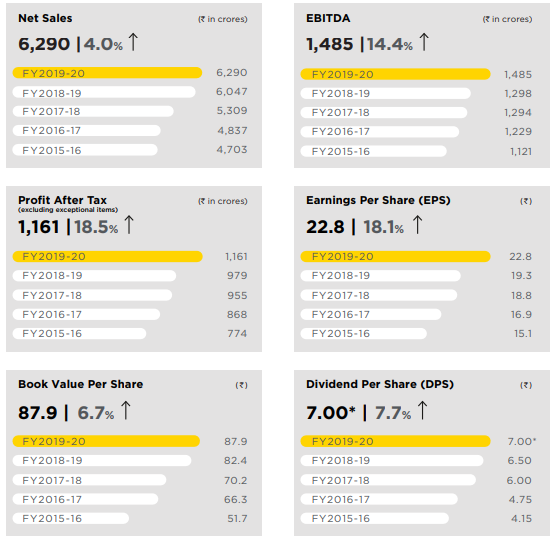

vi) Improving Operating metrics over the years -

Pidilite’s sales have grown at a rate of 11% CAGR in the last decade, while profits and dividends have also grown at over 15% and 26% CAGR, respectively. The company’s borrowings have significantly reduced to Rs. 260 crores from more than Rs. 600 crores in the last ten years. The company’s growth reveals a steady trend over the years. Pidilite’s recent quarter result benefited from lower input costs and discretionary spending, and robust growth across all verticals driven by continued demand momentum, and resurgence in industrial activity.

Source: Pidilite FY20 Annual Report

Challenges

Valuation

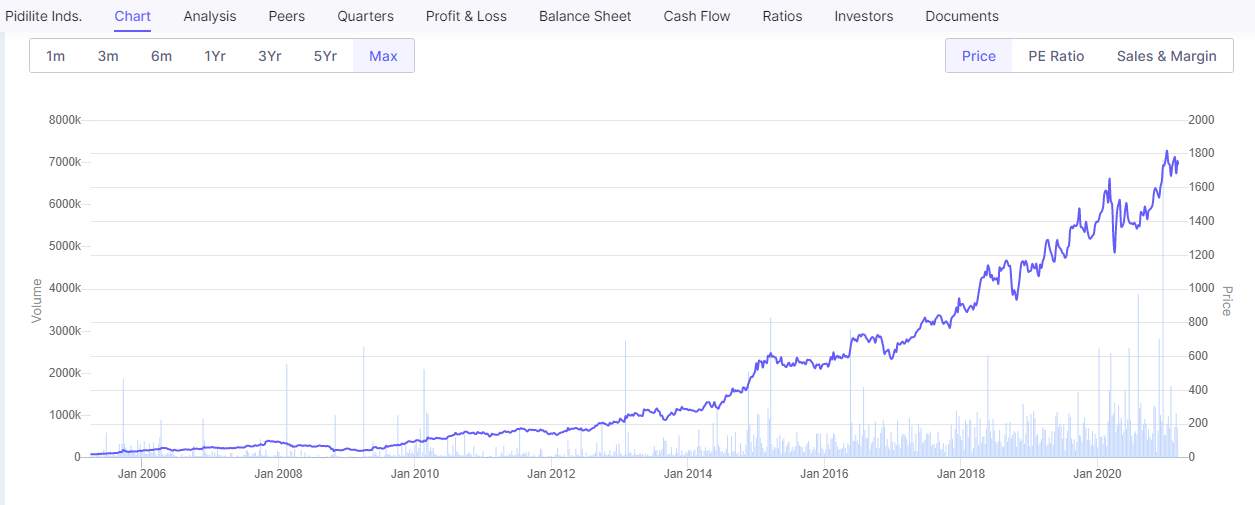

Pidilite has a market capitalization value of more than Rs. 88,000 crores and is currently trading near Rs. 1700 mark, just ~6% below its all-time high. The stock has returned more than 8000% since 2005. The company distributed 13% of its revenue as dividends in FY 2019-20 and has maintained a healthy dividend payout of 33%.

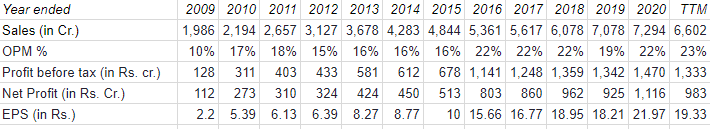

The company’s growth in the last ten years has been impressive with consistent growth in sales, OPM, PBT, PAT, and EPS.

Data Source: Screener

Pidilite is investing for the future as we see that the fixed assets balance has grown by three times over the last decade. The company is practically debt-free and does not need to take on any external debt to grow because of its increasing EBITDA, high net profit margin, and strong cash flow. Pidilite is also reinvesting a major portion of its surplus capital back into the business. Its RoCE has remained solid at more than ~35% over the last decade. The company also allocates capital prudently. Pidilite has a solid promoter holding of ~70% which has remained so since 2018.

Pidilite stock is expensive P/E is at 64 and is trading at more than 18 times its book value.

Source: Screener.in

COVID-19 Impact

Pidilite Q1 FY21 sales were negatively impacted as a result of the COVID-19-induced lockdowns. However, the company started to witness recovery starting in June-July. Pidilite benefited as a result of stringent cost control measures undertaken across the organization.

Future Opportunities

Pidilite is looking at growing its Growth and Pioneer categories which would lead to an expansion in the top line over the medium term. The company is also adopting technology in distribution. It is also expecting growth from the Core business that includes Fevicol and sub-brands Fevikwik, M-Seal, and Fevicryl as demand for customized furniture is still higher than readymade furniture in India. The company will focus on increased advertisement and commercial spends to drive sales and volumes in the future.

Bottom Line

The situation seems to be improving on the pandemic front with the successful rollout of the COVID-19 vaccine in India and abroad. Pidilite engages in providing essential goods and has shown tremendous growth in the last decade. The HAMSPL acquisition should further enhance Pidilite’s brand portfolio and increase its distribution channel footprint. The increasing roll-out of the vaccine, economic recovery, high consumer confidence, increased savings, and cheaper credit should act as tailwinds for the pent-up housing demand. Pidilite might face some near-term headwinds but it is a strong investment candidate in the long term given its rock-solid returns in the past decade, balanced portfolio of products across categories, large geographic footprint, and extensive distribution in India.

share your thoughts

Only registered users can comment. Please register to the website.