Bajaj Finance Limited: Strong Presence and Business Transformation Should Support Growth

Summary

- Once business transformation is fully delivered, it should be able to support significant velocity gains, reduction in operating costs and improvement in customer experience.

- Bajaj Finance Limited’s strong brand equity, strong focus on cross selling assets, payments, insurance and deposit products to its existing customers and strong balance sheet should act as growth enablers.

- Bajaj Finance Limited’s business construct should be able to help the company deliver a sustainable ROA of 3.3-3.5% and ROE of 19-21% over long-term.

Overview of Bajaj Finance Limited

Bajaj Finance Limited is a deposit-taking NBFC registered with Reserve Bank of India. It is a subsidiary of Bajaj Finserv Ltd. and is engaged in business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs and commercial customers, having significant presence in urban and rural India. It accepts public and corporate deposits and offers variety of financial services products to customers. BFL has two 100% subsidiaries:

- Bajaj Housing Finance Ltd. is registered with National Housing Bank as a Housing Finance Company

- Bajaj Financial Securities Ltd. is registered with SEBI as a stock broker and depository participant.

BHFL started its business in FY18. BFinsec commenced operations in FY20.

Growth Enablers of Bajaj Finance Limited:

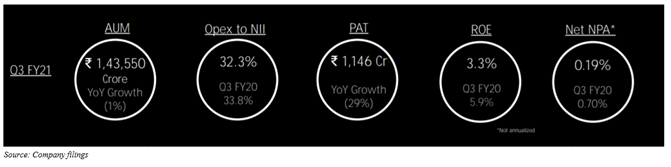

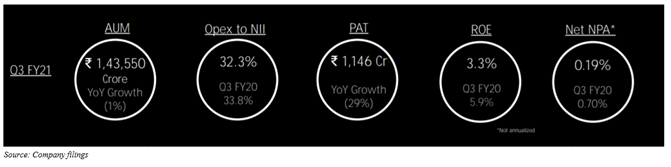

- Sound 3Q21 Results: Consolidated results of Bajaj Finance Limited include results of wholly owned subsidiaries. These subsidiaries are Bajaj Housing Finance Limited and Bajaj Financial Securities Limited. Consolidated assets under management were INR1,43,550 crores and consolidated profit after tax was INR1,146 crores. Highlights of this quarter included granular business recovery, significant improvement in risk metrics, keeping track of execution of business transformation plan and putting into motion a plan for pre-COVID growth and financial performance from 1Q22. Core growth in AUM in 3Q21 was ~INR8,000 crore in comparison to INR9,559 crore in 3Q20. Bajaj Finance expects to see growth in core AUM to pre-COVID levels by 4Q21. Barring auto finance, AUM growth was seen across all businesses. The company booked 6.04 million new loans in 3Q21 against 7.67 million in 3Q20. Most businesses are disbursing 85-100% of last year’s volumes and incremental growth was observed every month. Net interest income for 3Q21 was INR4,296 crore as against INR4,535 crore in 3Q20. NII for this quarter was lower by INR239 crore in comparison to 3Q20, principally because of higher reversal of interest income at INR450 crore against INR83 crore in 3Q20 and higher cost of liquidity surplus at INR213 crore against INR83 crore in 3Q20.

- Ample Liquidity: As of Dec 31, 2020, the company had consolidated liquidity buffer of INR14,347 crore. Average consolidated liquidity buffer for this quarter was INR19,373 crore. Given stable market conditions, the company brought down its liquidity buffer to 11.6% of total borrowing as of Dec 31, 2020 from 21.9% as of Oct 20, 2020. Focus has been on ensuring that cost of excess liquidity should normalize to pre-COVID levels in 4Q. Bajaj Finance has also allotted 360 secured redeemable non-convertible debentures having a face value of INR10 lakhs each with issue price of INR9,97,592, resulting in INR35.92 crore on private placement basis. Maturity date is Dec 24, 2030, with coupon rate of 6.92% per annum.

- Measuring Primary Indicators: Gross NPA and Net NPA as of Dec 31, 2020 was 0.55% and 0.19%, respectively, against 1.61% and 0.70% as of Dec 31, 2019. Provisioning coverage ratio as of Dec 31, 2020 was 65%. Provisioning coverage on stage 1 and 2 assets was 190 bps as of Dec 31, 2020. Hon'ble Supreme Court has specified that accounts which were not declared NPA till Aug 31, 2020 should not be declared as NPA until and unless further order is received. The company has not classified any accounts which were not NPA as of Aug 31, 2020, as per RBI norms, as NPA after Aug 31, 2020. Including Tier-II capital, capital adequacy ratio as of Dec 31, 2020 was 28.18% and tier-I capital was 24.73%.

- NIM Metrics and Management of Operating Expenses: Margin profile across lines of businesses was steady at pre-COVID levels except mortgages. Net interest income for 3Q21 was $581 million against $613 million in 3Q20. Net interest income for this quarter was lower by $32 million in comparison to 3Q20, principally caused by interest reversal of $61 million against $11 million in 3Q20 and cost of surplus liquidity of $29 million against $11 million in 3Q20.

- Business Transformation Should Foster Growth: Acceleration was seen in the company’s business transformation journey to provide financial products and services to 46 million customers in a seamless manner with creation of an omnichannel framework. Omnichannel model will enable a particular customer to move between online to offline and vice versa in frictionless manner. Business transformation needed significant change in operating processes and core technology stack. The company is developing or transforming 4 ‘Productivity apps’- sales one app, merchant app, collections app and partner app. All these apps should improve productivity and efficiencies of employees, channel partners and merchant ecosystem. There are plans to partner with 25+ adjunct app ecosystem, having relevant product/services for customers. These apps should provide adjacency to BFL’s core offerings, increasing stickiness. There are even plans to roll out first phase of business transformation by middle of July 21.

- Strong 1H21 Results Exhibit Confidence: As India has been opening up gradually, economic activity initiated gaining momentum in 2Q21, exhibited by several high frequency indicators. As a result of challenging conditions, the company has focused on risk management with a calibrated approach to growth, while ensuring that strong liquidity gets maintained, capital is preserved and operating expenses are reduced. Assets under management saw a growth of 1% to INR137,090 crore as of Sept 30, 2020 from INR135,533 crore as of Sept 30, 2019. Net interest income of 1H21 saw a growth of 8% to INR8,317 crore from INR7,694 crore in 1H20. The company has reversed capitalised interest of INR361 crore in 1H21. The company has been counted amongst best capitalised NBFCs in India. Including tier II capital, capital adequacy ratio as of Sept 30, 2020 stood at 26.64% and tier I capital was 23.01%. The company was focused on profitability over growth. Since there has been signs that normalization should be restored soon, this company seeks to enter FY22 having a positive outlook.

- Loan Losses and Provisions Should Revert to Pre-COVID-19 Levels: Loan losses and provisions for 3Q21 was INR1,352 crore as against INR831 crore in 3Q20. During latest quarter, the company has also done one-time principal write-off of INR1,970 crore due to COVID-19 related stress. For FY21, loan loss and provisions estimates are based on lifetime loss estimates due to COVID-19. It also exhibits that the company is accounting for additional losses that can occur in FY22. From FY22, the company hopes loan losses and provisions to get back to pre-COVID-19 levels of 160-170 bps of average assets. If this company sees that recovery is better in FY22, it may see lower net loan loss to average assets. Continued improvement in portfolio quality in 3Q21 was seen.

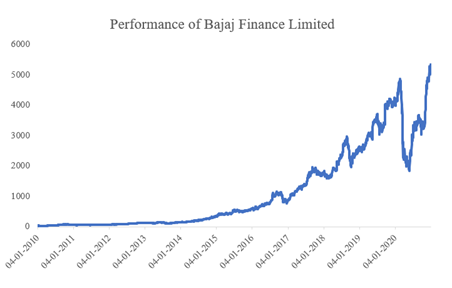

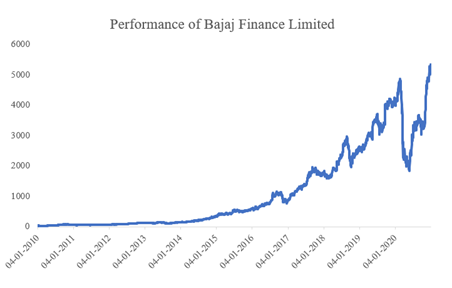

Multi-bagger Returns Over Past Decade

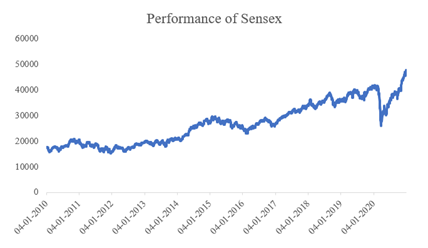

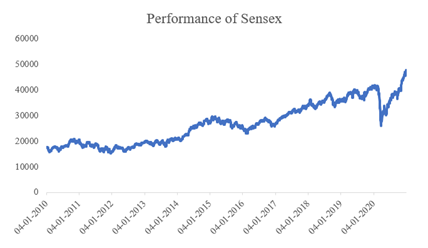

Investors believe that selection of stocks should be done in a way that a selected stock delivers strong returns over a given time frame. If possible, a multi-bagger return should be targeted. While it is extremely difficult to pick a stock having a potential to deliver multi-bagger returns, we have come across a stock where multi-bagger returns have been delivered. Bajaj Finance Limited has delivered a return of ~17,155% over past decade.

Do you know what that means? It means that if someone invested only INR1,00,000 on Jan 4, 2010, it would have become INR1,72,55,468.12 by December 30, 2020. Over past decade, sensex has just delivered a return of ~171.9%. Before jumping into equity markets, remember that not all stocks deliver these types of returns. Selection of these wealth builders stems from their market size, product offerings and other company-related measures.

Over past 10 years to FY20, the company has compounded its assets under management at ~39%, while its net interest income was compounded at ~36%. The company’s strong balance sheet, highly agile & innovative nature, continuous improvements in product features and digital technologies and its investment in technology and analytics should act as growth enablers. Bajaj Finance Limited is focused on continuous innovation, and this should transform customer experience and should also create growth opportunities. Over long-term, Bajaj Finance Limited plans to see growth in assets under management in corridor of 25-27% and profit growth in corridor of 23-24%. In consumer business, the company stated that it has presence in 1,210 locations, having 75,100+ active distribution points of sale as of Dec 31, 2020 and it occupies a place of largest consumer electronics, digital products & lifestyle products lender in this country.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.