Improvement in Demand Conditions and Cost Optimization Should Help Asian Paints Limited

Summary

- As business activities should improve and construction activities should resurge, demand conditions should see some improvement.

- Unforeseen circumstances due to COVID-19 pandemic should be taken care by the company’s sufficient liquidity resources.

- Global presence and distribution strength have supported in past and should continue to act as growth enablers.

About Asian Paints Limited

Asian Paints Limited manufactures a wide range of paints for decorative and industrial use and offers end-to-end painting and designing services, colour and decor consultancy, waterproofing solutions, etc. In Industrial coatings space, this company operates through 2 strategic 50:50 JVs with PPG Inc., USA. First JV - PPG Asian Paints Pvt Ltd, services requirements of Indian automotive coatings market. It manufactures packaging and marine coatings. Second JV - Asian Paints PPG Pvt Ltd, takes care of protective, industrial powder and light industrial coatings markets in India. Some products include paints, chemicals, wall coverings, textures painting aid, waterproofing solutions, etc.

Growth Enablers of Asian Paints Limited

- Improvement in Market Conditions: Normalization was seen across activities as increase in cases of COVID-19 was at a much lower rate and market conditions should continue to improve. There was a rebound in demand conditions in 2Q and 3Q after a dismal performance of 1Q. New construction/renovation and strong festive demand helped in recovery and sectors contributing to this recovery were manufacturing and construction. Demand conditions exhibited strong recovery across business segments, and this recovery was spread over most regions in 3Q. Domestic Decorative business delivered powerpack performance as there was more than 30% volume growth due to strong performance in premium and luxury portfolios. Home Décor foray saw a big fillip from strong performance of home improvement business. Industrial coatings too exhibited strong performance, particularly in protective coatings and auto OE businesses as these businesses rebounded in a big way due to resurgence in industrial activity. International business saw volume growth, led by good growth in Asia and Middle East.

- Growth Seen in Domestic Decorative Business: Strong growth was seen in paint market in Q3 after positive Q2 because of continued strong growth in tier 2/3/4 markets. Strong volume growth was also seen in tier 1 markets and metros. Volume growth of 33% in 3Q for domestic decorative business was seen with strong volume growth in each of months in this quarter.

- Cost Management Supported Industrial Business: Auto sector sales and builds data exhibited continued recovery in PPG Asian Paints Pvt Ltd. In Asian Paints PPG Pvt Ltd, demand recovery supported value growth in 3Q and growth was being led by powder segment. Both businesses saw profitability as costs were managed during 3Q.

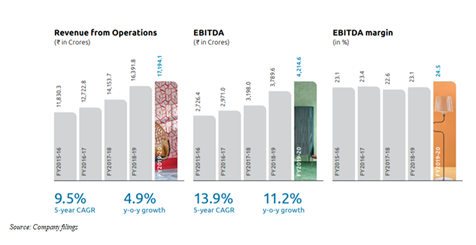

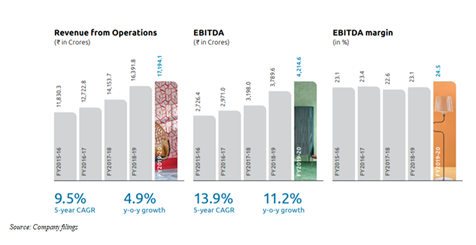

- Sound Growth Seen in FY20: During FY19-20, revenue from operations on standalone basis was INR17,194.1 crores against INR16,391.8 crores in previous year – exhibiting 4.9% growth. Profit after tax was INR2,654.0 crores against INR2,132.2 crores in previous year – a 24.5% growth. Despite economic slowdown, decorative business saw pleasing performance among organised players. Apart from getting support from reduction of formulation costs and focus on cost control measures for maintaining operating profitability, softness seen in raw material prices also lent some support. On a consolidated basis, the company, its subsidiaries and JV companies saw revenues of INR20,211.3 crores against INR19,248.4 crores in previous year – exhibiting 5.0% growth.

- Decorative Paints Business in India: In a tough operating environment in FY20, Asian paints was one of the fastest growing companies in sector and it has delivered good growth across product segments and geographies. Growth in volumes will be much higher than value growth, given its increased focus on upgradation emulsions, waterproofing and putty segment where there were significant gains. Growth was seen not only because of mainstream product categories but was visible in newer product categories of waterproofing, adhesives and tools.

- Favourable Industry Dynamics: Domestic paint industry consisting of decorative and industrial paint segment has been pegged at INR50,000 crores. Decorative paint segment comprises categories such as exterior wall paints, interior wall paints, wood finishes, enamels, undercoats such as primers, putties, etc. and constitutes more than 75% of paint market. Industrial paint segment comprises automotive coatings, marine coatings, packaging coatings, powder coatings, protective coatings, floor coatings and other general industrial coatings. Industrial paint segment accounts for balance 25% of paint market. Demand outlook will depend to a large extent on way normalcy gets restored in Indian economy. In general, demand for paint mirrors overall GDP growth in an economy. Hence, when overall demand in an economy sees an improvement, demand conditions for paint industry should see some improvement.

- Factors Benefiting Indian Decorative Sector: In 3Q, the company saw range of factors benefitting Indian decorative sector. To start with, upsurge was seen in festive demand and marriage demand. Next, lot of metro, T1, T2 cities saw significant growth in 2Q and 3Q. Projects in institutional segment saw a big boost from surge in construction activities and pickup in real estate. In 4Q, growth in metros, T1 and T2 should continue as customers are now moving out of their homes and they are also allowing people inside their homes to initiate home renovations or fresh paintings. Given that cases are now dropping, normalization should soon be restored.

- Financial Stability: The company is in comfortable liquidity position, meaning it has sufficient resources. Implementation of stringent cost control measures to conserve cash should help in addressing any evolving situation due to pandemic. The company is in constant touch with its key vendors and is working with them to mutually partner each other so that business can be propelled.

- Q4 Should See Improved Momentum: Demand conditions for Q4 should be strong as recovery in consumer sentiments should provide impetus. Roll-out of Covid vaccination program should be able to bring improvement in domestic demand. The company plans to work on cost optimization and it is planning to take up only business critical spends, across all its businesses.

- Performance of Industrial Business in India: PPG-AP is first 50:50 JV of Asian Paints with PPG Industries Inc., USA. It manufactures automotive Original Equipment Manufacturer, refinish, marine, packaging and certain industrial coatings and is 2nd largest supplier in India. Slowdown in economy, decreased spending, BS-VI compliance and COVID-19 impacted builds. Business in FY20 saw negative impacts principally because of auto and two-wheeler markets. These markets fell by 15% and 14%, respectively. Improved market conditions were seen in past couple months due to growing consumer appetite for personal mobility due to fear of COVID-19 and pent-up demand. Between December 1, 2020 and February 17, 2021, Nifty auto showcased ~22.1% return in comparison to Nifty, which has showcased only ~16% return.

-

AP-PPG caters to non-auto industrial coatings market of India and is the company’s second 50:50 JV with PPG Industries Inc., USA. Industrial coatings market saw challenging business environment as overall investments in manufacturing sector saw continued slowdown. AP-PPG focused on geographical network expansion and enhanced product propositions for customers. Favourable raw material prices and control on costs resulted in improvement in profitability as compared to previous financial year.

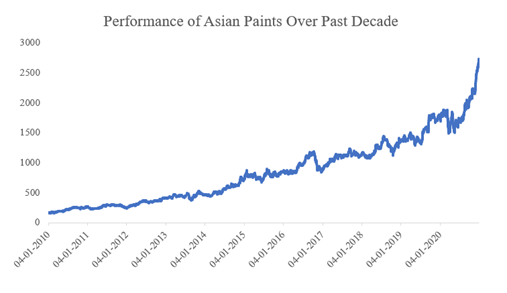

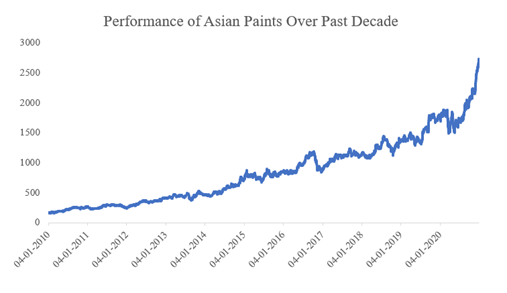

Asian Paints amongst Top Performers in Past Decade

Domestic investors continuously hunt for stocks having potential to deliver multi-bagger returns. Not all stocks have this much potential to deliver, and it’s not an easy task to pick such stocks. When we are talking about stocks generating multi-bagger returns, one name we cannot afford to miss is Asian Paints. Asian Paints has capitalised on overall demand conditions for paint industry in India and it should continue to do so given its market position. Stock of Asian Paints has delivered a return of ~1578.31% over FY10-FY20. This means if an investor would have invested INR1,00,000 on 4th January 2010, that investment would have become INR16,78,313.91 on December 30th 2020. The company’s global presence, manufacturing scale and distribution strength have all helped it achieve this strong performance over past decade.

Strong Market Position Should Continue to Lend Support

Asian Paints is having a total market cap of INR2,28,86,459.27 lakhs with free float market cap of INR1,07,66,328.55 lakhs. Over 5 years to FY20, it has compounded its revenues at ~9.5% and EBITDA at ~13.9% on a standalone basis. The company clearly occupies a position of market leader and it should continue to maintain this position given its diversified operations and good demand conditions. With fear of COVID-19 behind and business activities getting back on path, trading conditions should improve and construction activities should resurge.

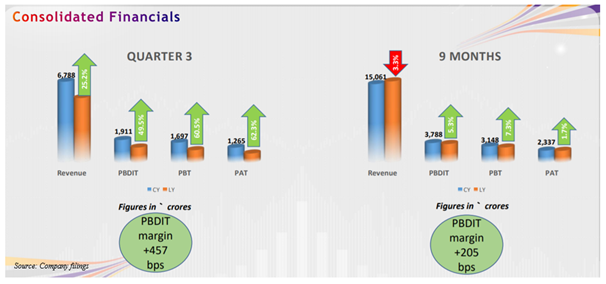

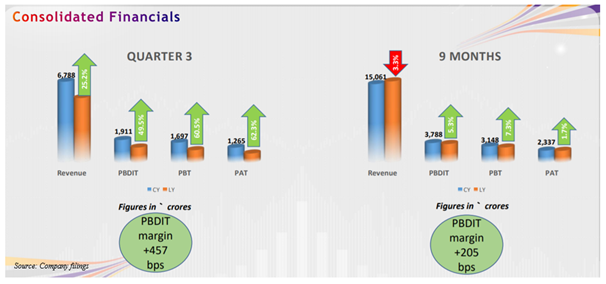

For 9M ended December 31, 2020, Asian Paints Group’s revenue from operations saw a decrease of 3.3% to INR15,061.36 crores from INR15,575.66 crores. PBDIT for group (before share in profit of associates) has seen an increase of 7.1% to INR3,537.34 crores from INR3,302.15 crores. Profit before tax (from continuing operations) increased 7.3% to INR3,148.04 crores from INR2,934.77 crores.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.