Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINICICI Lombard GIC is one of the leading private sector general insurance companies in India.

ICICI Lombard operates through a large network of 273 branches, 840 virtual offices, and a partner network of 8,800 garages and 6,536 hospitals. The company provides a wide range of risk management solutions to choose from like motor, car, two-wheeler, health, personal accident, home, travel, marine, business, third party, crop, rural, cyber insurance, etc. It commands a 7% industry market share in India.

ICICI Bank, India's second-largest bank is its biggest promoter holding nearly 52% of the shares. ICICI Lombard is leveraging its market leadership as India’s leading private non-life insurer since 2004. The company’s well-diversified product mix should further support in gaining market share and strengthening its leadership position in the market.

ICICI Lombard Pros

i) A large footprint and an extensive distribution network across India - ICICI Lombard provides protection solutions for business, personal, and project liabilities across rural as well as urban areas in India. The company operates through multiple channels such as Agents, Brokers, Bancassurance, Telesales, Direct Alliances, Motor Insurance Service Providers (MISPs), and online platforms. It caters to corporates, small, micro, and medium enterprises, governments, and individuals. ICICI Lombard offers a well-balanced product mix. It launched 18 new products in the last year.

ii) Technology and Innovative solutions - Over the years, ICICI Lombard has been continuously evolving in terms of adopting a robust risk management framework. With an experience of more than two decades, ICICI Lombard is known for its wide range of financial products, customer-centric approach, and innovative solutions. It has a good understanding of the customer base and deep underwriting capabilities. The company continues to enhance its capabilities in areas such as Artificial Intelligence, Machine Learning, etc., and is deploying its expertise in introducing new-age solutions. Given the company’s strong digital platforms, customers can now purchase, claim and renew their policies in a contactless and safe manner.

iii) Good Performance - ICICI Lombard’s Gross Domestic Premium Income rose to Rs. ~133 billion (excluding crop insurance), registering a growth of 10.5% over FY2019. The company issued over 26.2 million policies and settled over 1.86 million claims as of March 31, 2020. Its Gross Written Premium stood at Rs135.92 billion during the same time. ICICI Lombard’s large distribution network forms a key component of its competitive strength. The company keeps investing in scaling up its distribution channels.

iv) Leading position in the huge Untapped Indian market - The insurance sector in India is witnessing momentum since the opening of private players in FY 2000. The country’s large population, a rising level of affluence, and increased awareness towards financial products act as strong tailwinds for the company. Non-life insurance is also a fast-growing area providing financial protection from loss due to a risk event. It covers people, property, and legal liabilities. The non-life insurance industry grew at 16.7% CAGR in the last two decades. ICICI Lombard continues to maintain a leadership position in the private non-life insurer segment and grew its market share across all the commercial lines of Fire, Engineering, Marine Cargo, and Liability.

Valuation

ICICI Lombard General Insurance has a market capitalization value of more than Rs.62,300 crores and trades at a PE of 44x. Shares of ICICI Lombard are currently trading near the Rs. 1,300 mark, ~18% below its 52-week high price. Though shares have not gained much in the last year, they have doubled in the last five years. The company has a strong financial position as is evident from its debt-free status and a combined ratio of 100%+. It has also maintained a healthy dividend payout of 18%.

The stock is trading more than 8x its book value, which is higher for one’s liking. Promoter holding has decreased by 4% over the last 3 years. ICICI Lombard should also benefit from the potential merger with Bharti AXA's non-life insurance business, creating the third largest player. The merger would result in an entity with an expected combined annual premium of Rs 16,400 crore and a market share of ~8.7%.

COVID-19

ICICI Lombard launched COVID-19 Protection Cover, a dedicated product that provides 100% of the sum insured on the first diagnosis of the virus infection. It also introduced a teleconsulting feature on the mobile app. It also introduced an AI-enabled claim settlement engine to authorize the health claims. During the lockdown months of April and May, more than 30% of its cashless claims were authorized using this tool. The current pandemic situation has further emphasized the importance of insurance products. ICICI Lombard acquired Unbox Technologies which further automated customer relationship management solutions during these challenging times. The company is making use of its technology to further reach out to clients even in the remotest parts of the country.

Future Opportunities

The non-life insurance industry in India accounts for just 0.97% of India’s GDP, highlighting enough untapped potential in the country. There is a large scope for developing new and innovative risk mitigation models. ICICI Lombard continues to grow its presence and increase penetration in small towns and rural areas, particularly in Tier 3 & 4 cities. It also focuses on cross-selling its existing diverse products to existing customers.

Challenges

The insurance industry is highly competitive in India and has both well-established private and public players. ICICI Lombard ranks among the top three companies in the private sector in terms of new business premium. SBI and HDFC Insurance are the other two large competitors. ICICI Lombard also faces intense competition from a rising number of new players and startups coming online. The company is also exposed to regulatory, concentration, market, and interest rate risks.

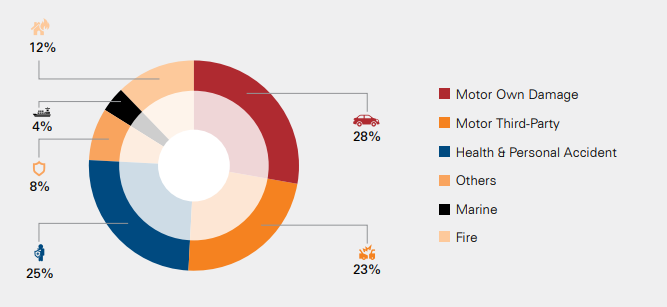

The insurance market is fast evolving and is very competitive in India. With the rise of aggregators, consumers can now seek the lowest possible price at the click of a button. The private sector accounts for ~48% of the market share and ICICI Lombard commands a more than14% market share in the private sector. ICICI Lombard maintains a leadership position across motor own damage, health, fire, engineering, liability, and marine segments.

Bottom Line

The Indian life insurance industry has grown multifold over the last 20 years. The current pandemic situation has further brought to light the ever-changing risk scenario in the non-life insurance industry. The company’s focus on digital transformation has reduced the need for face-to-face interactions and further supported new investments from potential clients. ICICI Lombard is one of the few general insurance companies listed in India. The company continues to invest in new-age technologies to further increase its operational efficiency and financial performance. Insurance is a long-term opportunity in India and investors are well poised to maximize the long term growth potential through investing in ICICI Lombard.

share your thoughts

Only registered users can comment. Please register to the website.