Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINNucleus Software is a leading provider of lending and transaction banking products. The company caters to the global financial services industry. It provides retail lending, corporate banking, cash management, mobile and internet banking, automotive finance, and other business services. In addition, Nucleus Software also offers professional, application, and managed infrastructure services.

About 300,000 members log in to Nucleus Software systems daily. The company serves clients in the financial services landscape, ranging from banks to non-bank financial companies, from a single site to multi-country implementations, and from large, global brands to focused, niche players. The company was recently awarded for excellence in IT & IT-enabled services in the mid-corporate segment. It manages close to $200 billion in loans and processes 26 million transactions daily. Nucleus also manages 100 million active loans on its systems globally. It has nine subsidiaries across the globe. The company derives ~40% of its revenues from India, followed by Middle East (18%), South East Asia (11%), Europe (9%), Australia, Africa, and others. The company operates in seven main geographical segments: India, Far East, South East Asia, Europe, Middle East, Africa, and Australia which also represent the reportable segments.

Nucleus Software Pros

i) Strong focus on BFS segment - Nucleus develops and markets software products and services for business entities in the Banking and Financial Services (BFS) vertical. Nucleus Software is a pioneer in retail and corporate banking software since 1986. Over the last three decades, the company has established strong ties with its customers. It serves three customers in the top 15 banks globally and three out of the top ten automotive finance companies. Nucleus serves more than 200 financial institutions in over 50 countries. The company caters to companies in a wide range of business areas including auto, personal, housing, gold, dealers funding, bill discounting, wholesale finance as well as Islamic banking. HDFC Bank, ICICI Bank, General Motors Vehicle Financing, Manappuram Housing Finance, Amcon, Bajaj Finserv, Bank of Florida, Bangkok Bank, etc. are a few of its clients. The company has developed strong expertise and has a sound track record of serving its clients over the years. Nucleus Software is known for its innovation in lending and transaction banking technology.

ii) Award-Winning Products - Nucleus Software provides a wide range of financial products and services. Its solutions span across retail, corporate, and internet banking, cash management, and credit cards. Its FinnOne Neo is ten times winner of the world’s best selling lending solution. FinnAxia, Nucleus’s integrated transaction banking solution is used by 20% of the world’s top banks. It also added voice-assisted loan servicing via Google Home and Chatbots. In addition, the company also launched PaySe, India’s first online payment solution targeted at customers in areas with challenging mobile data connectivity.

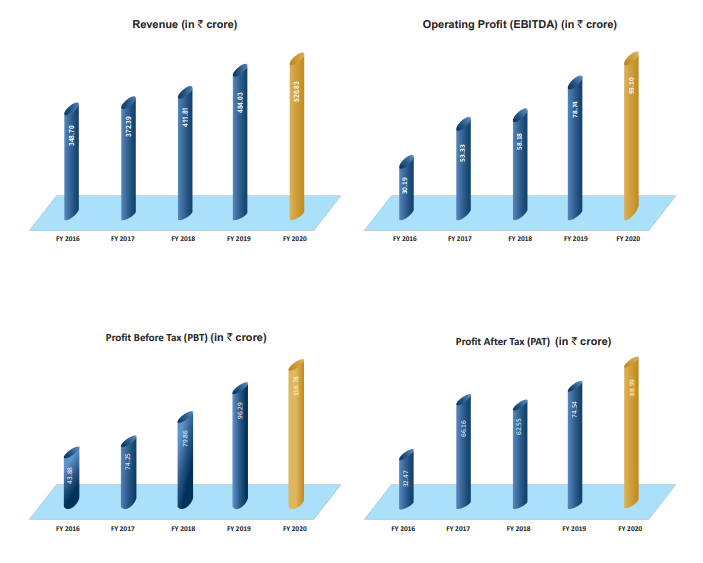

iii) End-to-end solutions leading to better financial metrics - Nucleus Software helps digitize the complete loan lifecycle end to end. Its solutions help make better credit decisions and can be deployed both cloud and on-premise. Most of Nucleus’s solutions can be deployed in partnership with leading cloud providers without high upfront capital expenditure. The company’s financial metrics have improved over the years. Its revenues comprise of income from time and material and fixed-price contracts. Nucleus derives the majority of its revenues from Products (~94%) and 6% from projects and services. It charges a subscription-based fee on pay per use model for FinnOne Neo usage.

iv) Extensive R&D Capabilities - Nucleus stands to gain from India's growing information technology and back-office sector which is expected to grow 7.7% in FY 2020 to a $191-billion industry. The company has been using technology to deliver innovative products and services for its customers and continues to invest significantly in product R&D. Nucleus Software spends more than 7% of its revenues on research and development activities.

Future Opportunities

Innovations in the cloud, analytics, and technologies are strong tailwinds for Nucleus. The finance industry is at the forefront of exploiting technology and continues to spend a fortune on sophisticated technologies such as Artificial Intelligence, Blockchain, Robotic Process Automation, Big Data, Analytics, and Facial recognition worldwide. Cloud adoption will continue to rise as companies embrace flexible consumption through both hybrid and multi-cloud environments. Nucleus Software is well-positioned to benefit from the shift to machine intelligence and has already embedded many of these new tools into its solutions. The company continues to focus on key markets, including India, South East Asia, the Middle East and Africa, as well as growing markets in Australia and Europe. The company won 32 product orders during the last year both nationally and internationally.

COVID-19 Impact

The COVID-19 pandemic has resulted in a slowdown in the overall economy, and also in the IT services market. The company added only four new customers, won ten product orders during the quarter, and implemented 17 product modules worldwide. Nucleus continued to add tremendous capabilities to its solutions and launched the latest version of its digital transaction banking solution – FinnAxia. Muthoot Fincorp selected FinnOne Neo to drive its business growth. Nucleus also launched an AI chatbot for loan self-service on WhatsApp as a part of FinnOne Neo Digital Channel solutions to aid contactless lending in the post-COVID-19.

Challenges

Nucleus might lose some of its NBFC customers who have been growing their loan book in recent years, as the Covid pandemic threatens the financial health of these institutions. Moreover, the company has delivered a sales poor growth of ~8% over the past five years.

Nucleus operates in markets that are highly competitive in terms of both existing and new competitors. Its competition range from start-ups and FinTechs, to international software vendors and large technology companies. Nucleus competes with the likes of Oracle Financial Services Software, the banking arm of Oracle Corp., SAP, Misys, Polaris, Sopra Banking, etc. In addition, it also competes with small indigenous companies in various geographic markets.

Valuation

Shares of Nucleus Software are currently trading near the Rs. 600 mark. The company has good investment fundamentals with ROE and ROCE at 16% and 21% respectively. The stock is trading at 15x its earnings which is cheaper than the industry PE of 30x. Nucleus Software’s market capitalization value is Rs. 1,735 crores. Its shares have grown at a rate of nearly 17% CAGR in the last decade. Nucleus Software has a debt-free business model. The company is capable of generating adequate revenue and cash flow to remain debt-free. Nucleus Software has been paying regular dividends in the last ten years and sports a dividend yield of 1.5%. While the yield may not sound exciting the long payment history surely rings a bell. The company has been maintaining a healthy dividend payout of over ~30%.

Nucleus had declared an interim dividend of Rs.9 but canceled it as the pandemic dawned. It is quite conservative when it comes to cash disbursement. Nucleus stock has been making new highs lately.

Source: Money Control

Bottom Line

Nucleus Software provides world-class software solutions to banking and financial services. There is a growing need for large legacy banks using old core banking systems for immediate upgradation and it is difficult for newcomers to replicate the expertise, product knowledge, and extensive client base. It takes years to build that kind of competitive advantage. As a leading player in digital lending services, Nucleus is well-positioned to benefit from the booming digital lending market worldwide.

share your thoughts

Only registered users can comment. Please register to the website.