Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINTata Consumer Products (NSE:TATACONSUM) is a leading consumer products company in India. The company is a household name in India reaching over 200 million households. Starting out with Tata Salt at its core, the company has come a long way and expanded its portfolio to include salt variants and other nourishing food items. Tata Consumer Products offers a portfolio of products spanning food and beverages. It offers products in teas, coffees, water, and food categories. Its Tata Salt, Tata Tea, and Himalayan Water are the No.1 brands in the country with Tata Sampann being another mega brand in the making.

Tata Consumer Products was formed as a result of the merger of the Consumer Products business of Tata Chemicals with itself. It was earlier known as Tata Global Beverages. The company has a large footprint extending to Asia, Africa, the USA, Europe, Australia, and the Middle East. Tata Consumer Products has a wide customer reach with a large network of 2.5 million retail outlets.

Tata Consumer Products - Pros

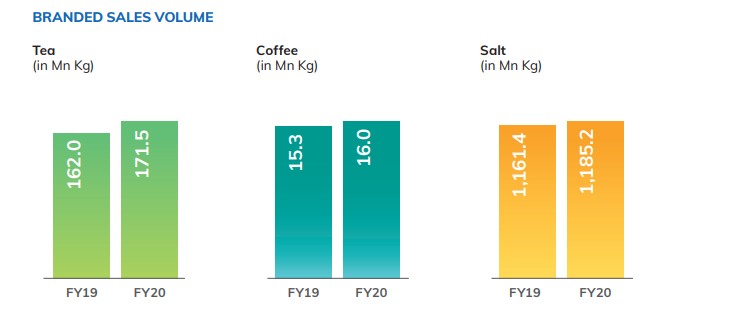

i) Multiple iconic brands - Tata Consumer Products owns key brands such as Tata Tea, Tetley, Tata Salt, and Tata Sampann. It offers a variety of products ranging from tea, coffee, water, and ready-to-drink to salt, pulses, spices, ready-to-eat, and more. Its household in-the-kitchen brands are very popular in India. A few of its leading beverage brands include Tata Tea, Tetley, Vitax, Eight O’Clock Coffee, Himalayan Natural Mineral Water, Tata Coffee Grand, and Joekels. Tata Tea is the most popular brand of Tata Consumer Products with one in every three households consuming a Tata Tea brand. It is No.1 in the category by volume in India. Tata Salt is the undisputed market leader in India. The company offers a good combination of staples as well as an organic line of premium products.

ii) A large pie in the fast growing FMCG market - Tata Consumer Products is the second largest player in branded tea in the world. The company has a brand presence in over 40 countries. Tetley, Good Earth, teapigs, Eight O’Clock are a few of the most popular brands internationally. It boasts of 330 million servings every day across the world. The company’s name change from Tata Global Beverages earlier signifies its commitment to the consumer products category both in India and internationally where it has a strong base. India’s food and beverage industry is very large, and the demand for food and beverage is poised to grow, given a large and growing population and rising affluence. The share of organized players in this segment is less than 10% leaving enough room for Tata Consumer Products to expand in the future.

iii) Strong Reputation and sticky customer relations - With a lineage of the TATA group, Tata Consumer Products is a widely trusted brand in India. Customers regard the TATA brand highly in India and trust it for its quality products and goodness. This forms sticky customer relationships. As a premier diversified consumer products company, the company offers a wide range of daily consumer products. Over the years, the company has developed a strong understanding of customer choices and preferences and is at the forefront to deliver products based on changing consumer tastes and preferences.

iv) Growth through Strategic Alliances - Tata Consumer Products has been growing through both acquisitions and organic growth. The company’s joint venture with Starbucks, Tata Starbucks, has expanded to 185 stores in 11 Indian cities, with many more stores on the line. Tata Consumer owns and operates Starbucks cafes in India through a 50:50 JV. It also has seven Tata Cha stores. Its subsidiary NourishCo which is a JV with PepsiCo in India produces non-carbonated ready-to-drink beverages focusing on health and wellness. Tata Water Plus, Tata Gluco Plus, and Himalayan water are marketed and distributed through NourishCo. Tata Coffee is one of India’s largest exporters of instant coffee.

COVID-19 Impact

Tata Consumer’s digital sales now account for 15% of the total sales. The company witnessed a surge in e-commerce sales led by Amazon, Instacart, and the corporate direct-to-consumer site. It adapted innovative and new delivery models. The decline in out of home consumption impacted its cafes while consumer staples witnessed good growth. Tata Consumer Products is now expanding its direct reach to its customers.

Challenges

Tata Consumer Products is highly dependent upon the prices of commodities and raw materials used in production. Any inflation in commodity prices will have a direct impact on the cost of the finished products and hence on the company’s profitability. It has delivered poor growth of 3.81% over the past five years. The company also faces intense competition and competes with the likes of ITC, Hindustan Unilever Ltd., ITC Ltd., Nestle India, Godrej Consumer Products Ltd, etc.

Future Opportunities

Tata Consumer Products is focusing on expanding its global footprint by entering new markets and new channels. The company is in the process of acquiring a 50% stake of PepsiCo in NourishCo Beverages to expand its portfolio of food and beverages in India. Tata Consumer is well-positioned to unveil massive opportunities leveraging its market strength, brand power, innovative products, and large distribution network. The company also plans to increase its network of social hubs/ cafes with food and beverages at the core. Tata Consumer Products has a proven track record of creating category-defining brands like Tata Tea and Tata Salt. Its pace of innovation and the depth of consumer insights should help to combat competition and moving forward. The company has a large headroom for growth in the core categories.

Valuation

Tata Consumer Products has a market capitalization value of more than Rs. 51,100 crores and its shares are currently trading at more than 80 times its earnings which is expensive compared to the industry PE of 60x. Shares of Tata Consumer Products are trading just 5% below its 52-week high price, near the Rs.560 mark currently. It also pays regular dividends and sports a modest dividend yield of 0.49%. Its revenues and net profits have both grown at 12% CAGR in the last three years. Tata Consumer Products is almost debt-free. The combination of food and beverage businesses will generate revenue and cost synergies to drive significant shareholder value. Shares have gained more than 75% in the last year.

Data from Money Control

Bottom Line

As a diverse group of consumer businesses, Tata Consumer is better positioned to address the growing needs of consumers both in India and internationally. The company caters to consumer staples which is a recession proof business. Its integration of food and beverage businesses granted it a wider scale critical for future growth and the synergy should significantly improve the bottom line too. The national brands in the tea business are also gaining market share. Tata Consumer’s partnerships with some of the biggest players in the beverages industry position it better to deliver products and innovations. NourishCo should contribute meaningfully going forward. Investors could buy on the dips to benefit from the massive potential of this multi-category FMCG company.

share your thoughts

Only registered users can comment. Please register to the website.