Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINWipro Ltd. (NSE:WIPRO) is a leading multinational information technology, consulting, and business process services company. It provides a wide range of service offerings including data, analytics & AI, applications, digital platforms, infrastructure services, and cybersecurity. It caters to many industries ranging from aerospace & defensive, automotive, banking, capital markets to consumer electronics and packaged goods, healthcare, insurance, and professional services, retail, utilities, etc.

Wipro serves over 1,000 active clients across six continents and over 55 countries. It derives nearly ~60% of its revenues from the Americas, ~25% from Europe, and the balance from the rest of the world. The company is adept in cognitive computing, hyper-automation, robotics, cloud, analytics, and emerging technologies to help in faster digital adoption.

Wipro Ltd.’s Pros

i) Comprehensive portfolio of services - Wipro derives a majority of its revenues from Application services (more than 40%), followed by cloud and infrastructure services (~25%), digital operations and platforms (~15%), and data, analytics, and AI, and industrial and engineering services. The company is known for its comprehensive portfolio of services worldwide. Its business comprises the IT Services, IT Products, and ISRE segments.

ii) Well-positioned to take advantage of the changing landscape in a post-COVID world - The company is well-positioned to gain from building adaptive solutions from the emerging business -anywhere trend worldwide. It will leverage its solutions to provide virtual and community work models, such as Talent as a Service (“TaaS”) through Topcoder. With global supply chains reeling, Wipro is uniquely positioned to develop new technologies that will help its clients respond to changing market conditions in the future. Moreover, Wipro’s full-stack offerings and Cloud Studios position it to continue delivering meaningful solutions to its clients.

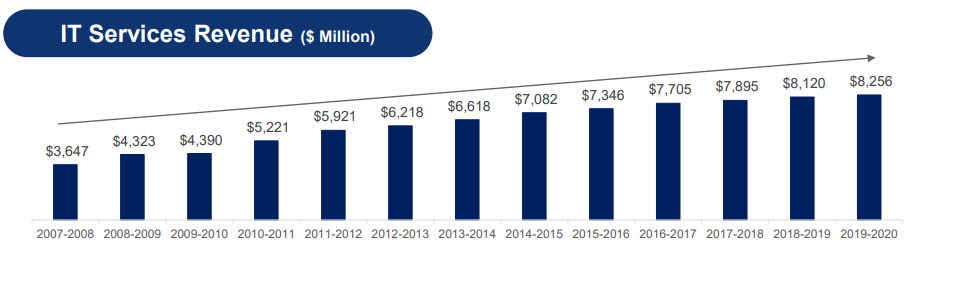

iii) Aggressive growth in Services and security - Wipro has registered a growth of 6.5% CAGR from its IT Services business over the last decade. The company derived 41% of its revenue from digital services. It is also expanding aggressively in cybersecurity in areas like Security Strategy, Compliance Advisory, Cloud Security, and OT & IoT Security to address the dynamic threat landscape. Wipro has 15 cyber defense centers across the world to locally manage security operations.

iv) Benefits of diversification and strong alliances - Wipro has a large customer base that is diversified by geographies and industries. Over the years, the company has developed extensive expertise in addressing the complex needs of clients in different varied industries. Wipro has been growing through strategic partnerships who include the likes of Microsoft, Amazon, HP Enterprises, IBM, Google, Cisco, etc. Extensive partnerships with leading global enterprises further strengthen the company’s large footprint. Top two technology companies in the world collaborated with Wipro to reimagine their supply-chain engagements in the last year.

v) The growing relevance of India as a leading offshoring market - Wipro is one of India’s top four IT services companies. India has been a leading provider of offshore IT and BPO to other countries worldwide. Given the cheap yet expert talent resource in India, the country has witnessed a growth in the exports of these services abroad. The offshoring market in India grew at a rate of ~15% CAGR in the last 15 years. Given the current health crisis, Wipro is well-positioned to win strategic services contracts from healthcare technology companies in the U.S. and worldwide.

Wipro Challenges

a) Rising Competition - The market for IT services is competitive and rapidly changing. Wipro competes with leading global consulting firms and IT services companies as well as local and niche services providers. TCS, Infosys, Tech Mahindra, and HCL Tech are its top competitors.

b) Growth in the number of active clients - Wipro’s client list has grown by just 7% over the last six years to 1,089 in 2Q’21, whereas Infosys’ active clients have grown by more than 60% during the same period. The company is facing challenges in adding new client accounts. However, Wipro has designed a new model to address this issue by assigning global account executives to its key large accounts.

Covid Impact

COVID-19 has changed the way businesses will operate in the future and Wipro stands a good chance to benefit from this transformation. Its IT Services segment revenue increased by 3.7% QoQ. Total revenues increased by 1.4% QoQ. The quarter was marked by growth in revenues, expansion of margins, and robust cash generation. Wipro gained momentum in winning large deals with customers during the quarter and added 97 new customers in 2Q’21. Wipro is expecting revenue from the IT Services business to be in the range of $2,022 million to $2,062 million, i.e. growth of 1.5%-3.5%, for the upcoming quarter.

Opportunities

Wipro will continue to focus on growth in prioritized sectors and markets led by vertical solution offerings. Increased cloud adoption, automation, and modernization at work will act as strong tailwinds for the company. Wipro will focus on key markets and sectors such as healthcare, and technology and software. Banking and financial services, retail, energy and utilities, and manufacturing are expected to contribute more than 50% in incremental revenue.

ValuationWipro has a market capitalization value of INR 201,522 crores currently. It is trading near the INR 350 mark at present and has a trailing P/E of 22x whereas Industry PE stands at 28x. The stock had hit a 52-week low in March this year losing almost 50% of its value but quickly recovered and touched its 52-week high again in October. The company’s board recently approved a share buyback offer, which sent the stock surging 4%.

Wipro is buying back shares in December at Rs. 400 for each share aggregating to Rs.9,500 crore. A share buyback is a good short term opportunity for investors. Wipro has a prudent capital allocation policy including buyback and dividends. The company last bought back shares in October last year at Rs. 325 per share and spent a total of Rs.10,500 crore for the buyback. It also pursues strategic organic investments as well as mergers and acquisitions. Wipro is also listed on the NYSE.

Source: Money Control

Bottom Line

Over the years, Wipro has built extensive expertise across industry domains, technologies, and delivery models to enable growth and innovation. The company has been at the forefront helping its clients expand into new market segments as traditional business stands interrupted today. Remote, community-based, and distributed work models will become mainstream, empowered by collaborative technologies developed by companies like Wipro. The company offers a good long term investment opportunity on the back of strong digital growth and its strong global reputation as a leading digital solutions provider. Wipro is expected to gain from leadership change and Joe Biden win with his promise to reverse Trump’s suspension of H-1B visas.

share your thoughts

Only registered users can comment. Please register to the website.