Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Granules India (NSE:GRANULES) is a leading pharmaceutical company in India engaging in the production of Active Pharmaceutical Ingredients (APIs), Pharmaceutical Formulation Intermediates (PFIs), and Finished Dosages (FDs). Granules India has installed capacities of 39,360 TPA of API, 24,640 TPA of PFI, and 23.5 Bn dosages of FD. It operates the world’s largest PFI facility and one of the largest finished dosage capacities, globally.

Granules India derives more than 70% of its revenue from the regulated markets of the US, Europe, and Canada. The US alone accounts for more than half of its revenue, followed by Europe (18%), India (15%), and LATAM (~8%). The company caters to customers in more than 75 countries and serves more than 300 customers. It operates eight manufacturing facilities with one in the US.

The company has a strong portfolio of rapid-release caplets, bi-layer tablets, first-line defense products, and other value-added products.

Granules India Pros

i) A vertically integrated company with a large presence in Indian and international markets - Granules India is a vertically integrated pharma company. It has a presence across the entire pharmaceutical manufacturing value chain from API to finished dosages. Its in-house API manufacturing focuses on key therapeutic categories. Starting out as just an API manufacturer, today the company has become a global pharmaceutical player. The company benefits from economies to scale and is well-positioned to supply to large-scale customers as well. It partners with leading players in the US, Europe, and other regulated markets. The company derives 84% of its revenues from exports. Granules India is known for offering high-quality, cost-effective products to its customers. Its current product portfolio comprises of growth-oriented stable APIs, PFIs, and FDs that cater to the needs of global giants. Granules’ customer base includes some of the leading generic, as well as, branded pharmaceutical companies.

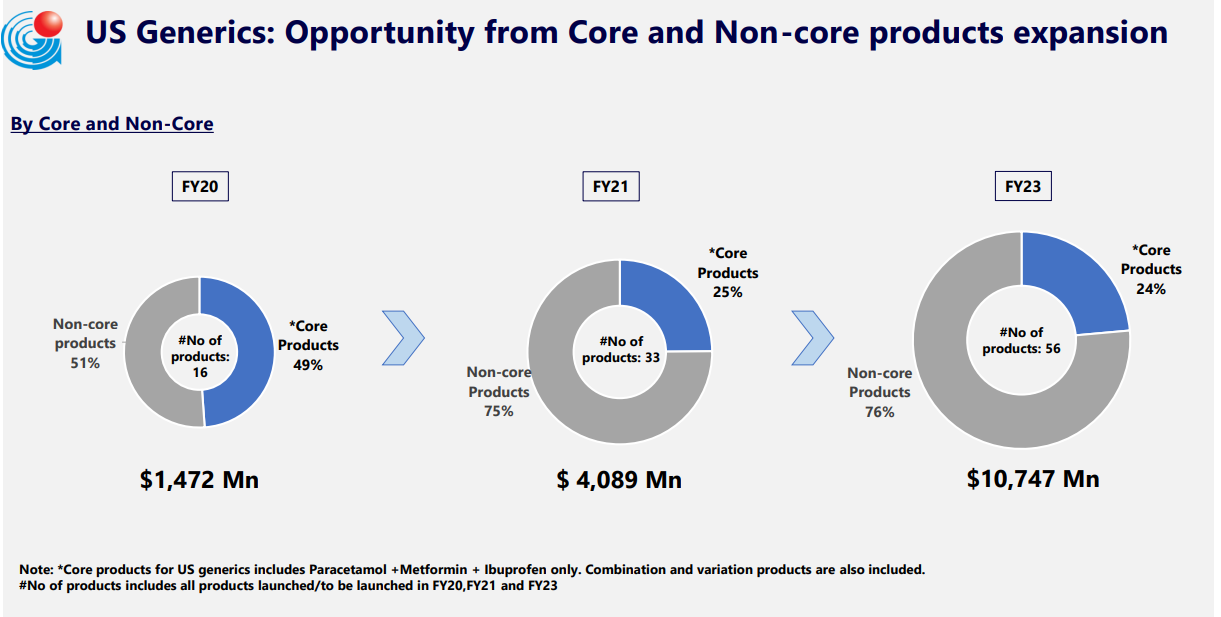

ii) Wide range of products - Granules India operates in three main categories - Core business comprising of its core molecules- Paracetamol, Ibuprofen, Metformin, Guaifenesin, and Methocarbamol; US Generics and the Emerging business focusing on manufacturing APIs. Its revenue stream is thus highly diversified from volume-based products in India, US Generics, and multi-product APIs to FDs. Granules India derives over 50% of its revenues from FDs, followed by ~30% from APIs and 15% from PFIs. The company provides dossiers/ANDAs for APIs and finished dosages, which can be repacked and marketed by customers under their own brand name. Granules India has a strong portfolio of drugs that are used as the first line of defense and other lifestyle diseases. It currently has 45 ANDA fillings out of which 32 are approved. It has a strong presence in general but critical core drugs. Granules India has a presence in both regulated and semi-regulated markets. The company exited both its joint venture businesses - Granules Omnichem and Granules Biocause to focus on its core business and generate free cash.

iii) Extensive research and innovative technologies - Granules India is also growing through strategic acquisitions. Its acquisition of Auctus Pharma back in 2014, granted it access to 12 APIs, as well as key intermediates in therapeutic categories, such as anti-histaminic, antihypertensive, anti-thrombotic, proton pump inhibitors, and anti-convulsants, among others. The company has strong R&D facilities that engage in creating a diverse range of cost-effective offerings. Its R&D efforts are focused on adding new APIs to the portfolio as well as on improving the existing products within the New API business. It is also investing aggressively in expanding capacities.

COVID-19 Impacts

The US and European markets drove higher volume sales of FD in the last year resulting in an overall 14% revenue growth. However, the coronavirus pandemic resulted in some initial supply disruption for the company. The global pandemic greatly affected the Indian Pharma industries. The Indian government took proactive steps to boost domestic manufacturing and also lower the costs. Delayed foreign inspections by USFDA led to delays in pre-approval inspections and clearances. Continued pandemic conditions have also delayed visits to doctors resulting in slower take-up of new products and slower adoption of biosimilars in the US. Lower exports will also impact the top-line growth for the company. But as economies began reopening, Granules India benefited from increased demand for critical drugs which should continue to improve as the coronavirus situation prevails. Granule India's subsidiary company Granules Pharmaceuticals Inc. received approval from US FDA for Ramelteon tablets in August this year.

Opportunities

Granules India is focusing on volume-based products in its core business. It also stands a good chance to gain from widening its existing portfolio into several dosage forms e.g. Paracetamol 500, Paracetamol 650, Metformin XR. The company has been expanding into complex generics and strengthening its market penetration in regulated markets. It is expanding its base business by entering into new geographies like Europe, Canada, South Africa. Granules India is expecting 8-9 launches in FY21 with an addressable market size of about $1.3 billion based on IQVIA. Strong and growing core products, approvals for new products from the USFDA, and new capacities installations should drive the top-line growth in the future.

Source: Granules India Investor Presentation

Challenges

a) High debt on the books - Granules India still has net debt of Rs. 6,133 million as of the end of the most recent quarter declining from Rs. 8,265 million a year ago. The company is focusing to reduce its debt and is targeting 1x net debt to EBITDA by FY22 and ROCE of 20%+.

b) Declining Promoters holding - The promoters holding has reduced in the last three years which might indicate a lack of confidence of promoters in the business.

c) Dependence on China from raw materials - The company’s dependence on Chinese ingredients for raw materials to produce medicines could be a major headache during the current times. Granules India depends on China for one KSM (key starting material) which is for their main product.

Valuation

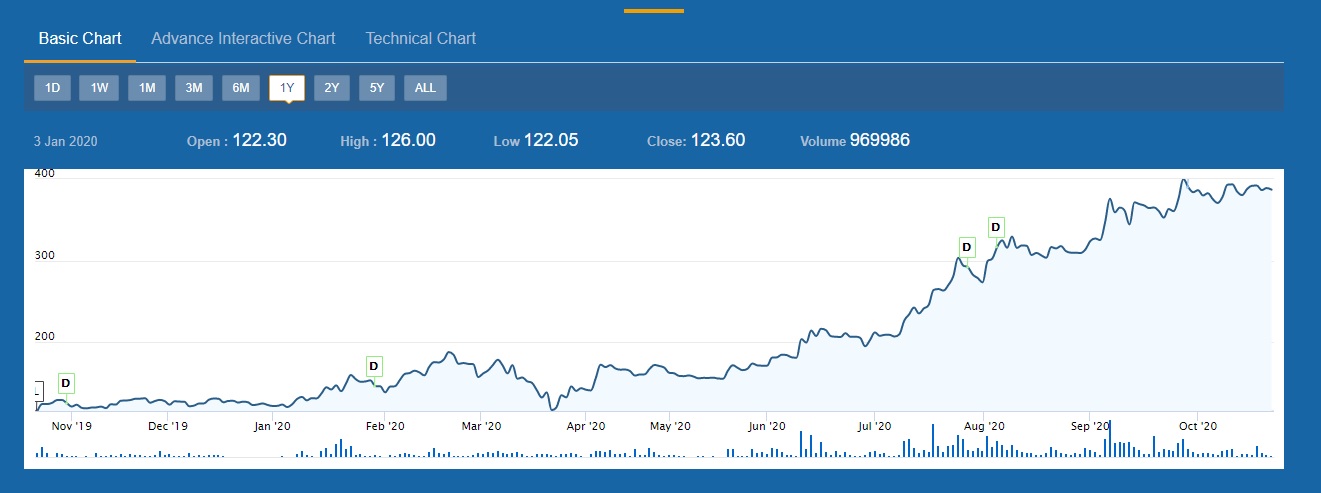

Shares of Granules India are currently trading near the Rs. 380 mark, more than doubling in the last year. The company has decent investment fundamentals with ROE and ROCE at 18% and 17% respectively. The stock is currently trading at 23x its earnings which is cheaper than the industry PE of 36x. Granules India’s market capitalization value is more than Rs. 9,600 crores. The company also has a share buyback program. The board approved a buyback offer to the extent of 4.9% of the total paid-up share capital earlier this year.

Source: Moneycontrol

Competition

Granules India’s industry-leading six-ton PFI batch size grants it a significant edge over the competition as it leads to lower testing costs and more consistent production. The company faces limited competition with respect to integration-presence across both Rx and OTC. About 80% of Granules’ GPI products have below three to four players in the US Generics pharmaceuticals market. A large scale, operational efficiencies, and long-term customer relationships are its other competitive advantages. The company will continue to gain from its generic medicines prescribed in large dosages which will lead to heavy global demand.

Bottom Line

Granules India is an integrated player with a strong market presence. Customers trust the company for its value-added products, internal product development capability, reliability, and service. Given that the company is vertically integrated, it is well-positioned to gain from opportunities in new areas, segments, and divisions. The company has multiple growth drivers that provide visibility for long-term growth and is well-positioned to establish its footprint in almost all the sectors including the finished dosage. Granules’ dominance in key APIs e.g. paracetamol, ibuprofen, etc. will support it becoming a key beneficiary of the Covid-19 outbreak.

share your thoughts

Only registered users can comment. Please register to the website.