Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINLaurus Labs (NSE:LAURUSLABS) is a research-driven pharmaceutical company in India. Apart from manufacturing APIs, it develops and manufactures oral solid formulations, provides CRAMS services to other global pharmaceutical companies, and also produces specialty ingredients for nutraceuticals, dietary supplements, and cosmeceuticals. The company’s major focus areas are anti-retroviral, Hepatitis C, and Oncology drugs. Laurus Labs is the supplier of APIs to some of the biggest global pharma companies.

Laurus has more than 55 R&D labs in India and the U.S. and eight manufacturing facilities. The company has a wide international footprint and sells its APIs in 56 countries to more than 200 global customers. It operates through three business lines - Generics APIs, which is the largest accounting for ~54% of Q1 revenues (development, manufacture and sale of APIs) followed by Generics FDFs -36% (development and manufacture of oral solid formulations), and Synthesis/ Ingredients -10% (contract development and manufacturing services for global pharmaceutical companies).

Pros of Laurus Labs

i) Long-standing Partner Relationships - Starting out as a humble one-product company in 2010 to an Active Pharmaceutical Ingredients (APIs) company, Laurus has become one of India’s leading manufacturers of generics APIs for various complex therapies. The company is known for its quality medicines and affordability. Over the years, the company has developed an integrated strategy from APIs to formulations to synthesis and ingredients businesses. It also has long-standing relationships with several multinational pharmaceutical companies as well as mid and small biotech companies. Laurus enjoys strong relationships with regulators and health authorities across its markets. It is favorably placed to win supply tenders in competitive global tenders for ARVs and gain a foothold in the US generics market.

ii) Large base of R&D facilities and innovation technology - Continuous innovation and extensive R&D are necessary for medical companies to stay competitive. Laurus filed 262 patents out of which it owns 121 patents. It has commercialized more than 60 products since inception across its three distinct business units. Laurus’s business lines leverage deep synergies and research-driven chemistry skills.

iii) Extensive Business Lines - Laurus is leveraging the high-growth potential in the contract development and manufacturing space through its synthesis business. The company incorporated Laurus Synthesis Pvt. Ltd. in 2020. Laurus’s finished dosage formulation is a fast-growing, high-margin business segment. It develops and manufactures oral solid formulations, and provides CRAMS and CDMO to reputed global pharmaceutical firms. The formulations business registered a 30% revenue contribution in the last year.

iv) Future Growth Opportunities - Laurus is targeting various high-growth markets like LMIC, US, Canada, and Europe for generic FDFDs leveraging its API cost advantage. A streamlined and strong portfolio positions the company well in attractive markets. It plans to construct a second formulation block to enhance the capacity to 10 billion units per year which are expected to be completed by FY 2022. The company also has a strong opportunity in other API space and is currently working with the top 10 large global generic pharma companies. Laurus also has future prospects to expand in the nutraceutical and cosmeceutical sectors. The company continues to increase capacity utilization, improve business processes, and simplify the organizational structure.

v) Positive Covid-19 Impact - Laurus’s Q1 revenues increased by 77% YoY, with generic API recording a growth of 40% and revenue contributions from the FDF segment increasing to 36%. The company is on track to improve its ARV API sales. It also got approval for two first-line products - TLE400 and TLE600 during the quarter. Laurus is witnessing good business in the U.S. and EU region with a robust outlook and order book. It entered into a long-term partnership with a leading generic player in EU region for contract manufacturing opportunities and benefited from increased volumes in the US. The company has experienced growth on the back of successful tender activities through participation in Global Fund, PEPFAR, and other African tenders.

Competition

Laurus faces intense competition in domestic and international markets. Strong R&D and API manufacturing capabilities are strong growth enablers for Laurus. The company should benefit from growing future trends like shifting demographics, increasing demand for healthcare, growing advanced analytics across the pharmaceutical value chain, cross-industry collaborations.

Valuation

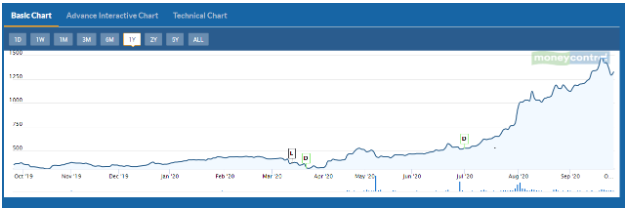

Laurus Labs’ last one-year stock performance has been spectacular with the shares returning more than 250%. The company has a market capitalization value of more than Rs.14,400 crores. The stock PE is 35x and is currently trading just 17% shy of its 52-week high price. The stock has gained nearly 150% in the past three months. The company has further announced a share split for 1:5 on September 29th, 2020 wherein shares with a face value of Rs 10 would be subdivided into shares of Rs 2 each.

Source: Moneycontrol

Conclusion

Laurus Labs is known for developing competitive drugs for some of the most challenging diseases and addressing the critical needs of the world’s key pharmaceutical markets. It is in a good position to leverage API synergies for forward integration. According to ICRA, the Indian pharmaceutical industry is likely to grow at 10%-13% in 2021. The company expects future growth to come from its CDMO business and generic API contract manufacturing. Buyers can look at adding on dips.

share your thoughts

Only registered users can comment. Please register to the website.