Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIntroduction

CyberTech Systems and Software Ltd is a provider of next-gen geospatial, networking and enterprise IT solutions. The company’s contemporary, component solutions, supported by established global delivery model, assure consistent quality and are designed to help organization in becoming competitive, efficient, and responsive. Services offered span across all industries such as government, education, utilities, etc.

Growth Enablers of CyberTech

Strong Q1FY21 Results: Covid-19 significantly impacted both the US and Indian markets. The companies have been adapting to new normal like market uncertainty, higher unemployment, work from home and cloud transformation. Its 1Q21 results were strong by most measures. CyberTech’s revenue was INR321 million, exhibiting 17% growth on year-over-year basis. EBITDA, at 27% of revenue, saw a growth of 42% over prior year and PAT saw a growth of 77%. Significant momentum on Cloud transformation should help it achieve growth given increased reliance on digital infrastructure. Investment in marketing should help revenue growth as digital environment which has been created is likely to stay.

US Remains Major Contributor: As of June 30, 2020, total active client base was 43 (LTM) and the US business was major contributor, making up 95% of operating revenue. According to NASSCOM’s Strategic Review report, the global technology industry was US$1.5 trillion in 2019, exhibiting 5.6% growth over 2018. Global IT services was at US$729 billion, 3.5% increase as a result of increased demand for application development and management services. In FY21, the US should be highest contributor to operating revenue as there will be changes in terms of business models and traditional ways of working. Emphasis on remote working is expected to be more and organizations should revisit R&D, marketing and sales strategies.

Continuous Cash Generation Should Support Revenues: CyberTech should report revenues of INR319.38 million in 2Q21, exhibiting a rise of 5.20% quarter-on-quarter, with cash flow management and continuous cash generation from operations acting as growth enablers. COVID-19 pandemic scenario pushed the world into uncertain times, enabling quicker adoption of digital infrastructure. Growth should also stem from aggressive cost control and optimization plan which is focused on liquidity and cash.

CyberTech continues to focus on enterprise solutions offerings. Increase in offshore related services is likely to have an effect of higher margins and profitability and increased longevity of business contracts.

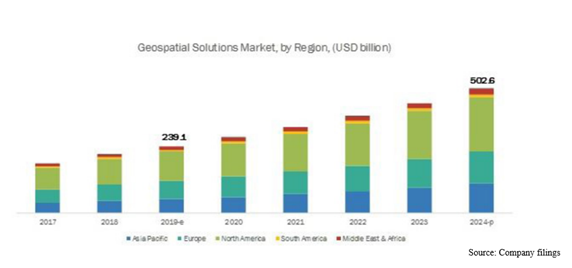

Supportive Industry Dynamics: Global geospatial solutions market should reach US$502.6 billion by CY24, compounding at ~13.2% during CY19-CY24. This growth is likely to stem from continuous advancements and rapid incorporation of geospatial technologies in mainline technologies such as Artificial Intelligence, Cloud, Big Data, Automation, Internet of Things (IoT), etc.

North America should see itself to be largest geospatial market by CY24. The US, Canada and Mexico are considered as main users of geospatial technology. In FY20, the United States was major revenue contributor, making up 94% of operating revenue with India accounting for only 6%. The company saw steady growth from its US business, growing at 16% on year-over-year basis. Given the company’s alliances and partnerships, recent investments it has made in research and development activities and rapid adoption of digitalization and modernization, CyberTech should be able to capitalize on industry-wide opportunities.

Alliances Should Support Growth: Geospatial industry should align with mainstream technologies. Mainstreaming of geospatial market spurred demand for geospatial content and solutions across governments, businesses and consumers. CyberTech has made investments in its R&D activities so that it can stay competitive. It is focused on Public sector and Enterprise SAP® and GIS custom technology applications. Spatialitics LLC is focusing on growth opportunities in the US market. CyberTech continues to work with its present alliances like Cisco®, SAP®, Microsoft®, IBM® and esri®. Optimism around these alliances is there and should help profitability. Growth momentum and margin strength should continue.

Challenges

Economic uncertainty of worldwide markets resulted in making future less predictable. The US market is being pressurized from general economic conditions as growth diminishes. There has been slow down in the US spending on off-shore services because of challenging market conditions and adoption of protectionist measures by policy makers. However, healthy payout ratios, stable revenue growth, sound profitability variables, alliance partnerships and focus on enterprise solutions offerings should help overcome challenging market environment.

Technology Industry is Likely to Continue Growth Momentum

Technology industry showed strength and continued to grow while grappling challenges. There has been significant rise in demand for big data because of increasing cloud services, growing accumulation of data, and strong and sustainable demand for data analytics. CyberTech plans to continue its investment in new age technologies such as ERP Digital Core, Spatial, Analytics, and Cloud Transformation. This will help CyberTech strengthen its capability and generate sustainable value.

Valuation

CyberTech Systems and Software Ltd has market cap of ~INR17,338.69 lakhs with a trailing P/E multiple of 11.13x. Its stock now trades at ~13.08x of FY20 EPS, exhibiting sound valuations. CyberTech has compounded its top line at ~7% over FY17-FY20, with growth being helped by reliance on digital infrastructure, impeccable market reputation and strong balance sheet. It has compounded its profit at ~10.48% as efficient cashflow management and continuous cash generation provided support. CyberTech has been delivering return on equity of ~9.03% for past 10 years. Return on capital employed was 18% (March 2020). Despite having superior return ratios and continuous focus on innovation, CyberTech’s liquidity levels are quite impressive given its size. Cash and cash equivalents were INR791.15 lakhs (March 31, 2020). With sound liquidity levels and geographical diversification, the company should be able to achieve higher growth than average of the sector.

With sectoral average of ~21.8x, target price comes out to be INR75.2, exhibiting a rise of ~19.5% from current price of INR62.95. Growth should stem from product portfolio and balance sheet strength. CyberTech’s stable revenue growth is a big advantage and it gives the company competitive edge. In FY20, CyberTech saw finance costs coming at INR50.59 lakhs which is being taken care by lease rental income of INR479.81 lakhs.

share your thoughts

Only registered users can comment. Please register to the website.