Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIntroduction:

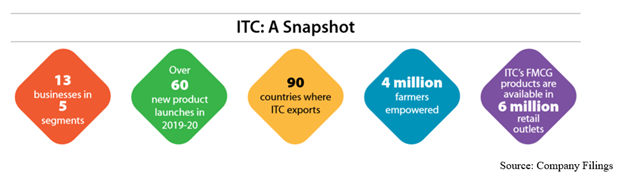

ITC Limited (ITC) is being counted as one of India's foremost private sector companies with a diversified presence in FMCG, Hotels, Packaging, Paperboards & Specialty Papers and Agri-Business. Its businesses and value chains create sustainable livelihoods for over 6 million people. The company seeks to be an engine of growth for the economy through a vibrant portfolio of future-ready businesses. These businesses should serve emerging needs of an evolving market.

Growth Enablers for ITC

Potential to grow earnings over long-term: For FY19-20, gross revenue came in at INR46323.72 crores, increasing by 2.4% and PBT was INR19298.92 crores, exhibiting a rise of 4.6% on year-over-year basis. ITC’s PAT grew at a much rapid pace of 21.4% to stand at INR15136.05 crores, because of reduction in corporate income tax rates. Out of gross revenue, ~73.4% is being made up by FMCG-Cigarettes and FMCG-Others. FMCG-Others businesses saw segment revenue of INR12844.23 crores, exhibiting an increase of 5% over previous year (on comparable basis). Strong momentum in essential consumer goods space, i.e. staples, was a key growth enabler. We expect pandemic to result in surge in ‘Health and Hygiene' portfolio demand (like hand sanitizers, etc.). Enhanced scale, product mix enrichment, reduced distance-to-market and strategic cost management initiatives should help in growth for this segment in upcoming quarters.

Restoration to normalcy- A big positive for ITC: Improvement in consumer sentiments and revival of growth momentum should be seen as enablers for growth of ITC. Essential items, health and hygiene products are likely to sustain recent buoyancy seen in demand. Growth in ITC is likely to stem from rising disposable incomes and consumer awareness, lower penetration levels of consumer goods, favorable demographics and increasing urbanization.

Distribution network remains sustainable and formidable:

Distribution network of ITC facilitates availability of products in 6 million+ retail outlets in various trade channels. Strong supply chain and logistics capabilities are playing a vital role in enabling superior market servicing and it also helps in managing costs. Several initiatives were undertaken in FY20 to enhance supply chain responsiveness and cost competitiveness. Reduction of distance to market, enhancing flexibility to support fresh launches, leveraging technology so that efficiencies can be enhanced are some of core initiatives. Addition of more markets and outlets to servicing base, technology-related routing solutions, and joint business planning with channel partners are likely to further strengthen its distribution network which should result in execution of more product launches in various geographies.

Recent acquisition should be EPS and revenue accretive:

ITC entered into a share purchase agreement for acquisition of 100% of equity share capital of Sunrise Foods Private Limited (SFPL). SFPL is chiefly involved in business of spices under its trademark ‘Sunrise’. We expect this acquisition to be EPS and revenue accretive, scaling up its FMCG Businesses in profitable manner. This acquisition should be able to augment ITC’s product portfolio and is perfectly aligned to the company’s aspiration to significantly scale up spices business and enhance footprint. Deep consumer connect and strength of distribution of SFPL in focus markets, and synergies arising out of supply chain and sourcing capabilities of ITC’s agri business and well-appreciated distribution network, should provide significant growth opportunities.

Revenues and EPS should see marginal rise:

We expect ITC should compound its revenue between FY19-FY22E at ~5% after considering impacts of slowdown and fall in consumer sentiments. We expect that growth should chiefly stem from normalization of operations, market share gains, rapid growth in FMCG businesses and strong distribution network. Sustained focus on innovation, portfolio premiumisation and enhancement of distribution reach should help achieve growth in personal care products.

ITC is expected to compound its EPS between FY19-FY22E at ~7.2%, with efficient management of costs, strong FCF position and innovative business capabilities to act as primary growth enablers. Increased awareness for personal hygiene in the wake of COVID-19 pandemic resulted in increased demand for products in ‘Health and Hygiene’ portfolio (hand sanitizers, handwash, antiseptic liquids and floor cleaners). We expect that this demand momentum should continue for foreseeable future. Given the company’s focus on increasing revenues, it is all set to seize emerging opportunities and emerge as a dominant player.

Healthy balance sheet provides visibility of earnings growth:

Enhanced scale, product mix and cost management initiatives should lend support to ITC’s balance sheet growth. Distribution reach expansion and focus on innovation are factors likely to help improve performance of FMCG-Others. In upcoming periods, balance sheet should seek growth from increased demand for hygiene products and supportive industry dynamics. Increasing urbanisation and rising disposable income are some other factors providing visibility of earnings growth.

Growth in Industry should support ITC:

Indian retail market has been estimated to reach US$1.1 trillion by CY20 from US$840 billion in CY17, while modern trade should grow at 20-25% p.a., which is likely to boost revenues of FMCG companies. Expected rise in rural consumption will support FMCG market. This market is expected to contribute ~36% to FMCG spending. Given ITC’s leadership position and capabilities to handle a wide array of responsibilities in manufacturing, operations and IT, we expect that the company should be able to capitalize on opportunities. Easier access, changing lifestyles and growing awareness are expected to help growth of FMCG businesses. By end of CY20, India’s contribution to global consumption should double to 5.8%.

Challenges:

Taxation and regulatory regime and sharp increase in illegal trade, especially at premium end, are posing risks for ITC’s cigarettes business. Initial phase of lockdown was tough for the company’s cigarettes business as it saw disruptions across value chain. But, with ease in lockdown restrictions, all factories are now operational with sales & distribution channels normalizing. We expect introduction of several new variants, continuous focus on innovation and strong product development capabilities are expected to overcome challenges.

Onset of COVID-19 pandemic disrupted operations of ITC’s hotels business. With normalization of situation and opening up of the economy, we expect growth momentum to stem from increase in inbound & domestic tourism and meetings & conventions. Recently commissioned hotels like ITC Kohenur, Hyderabad and ITC Grand Goa Resort & Spa, Goa saw scaling up of operations and strengthening of customer franchise.

Valuation:

The company has compounded its profit at ~13% between FY17-FY20 as a result of focus on sustainability of business, scale and market share of FMCG businesses, strong distribution network and efficient management of free cash flows. The company’s stock trades at ~17.18x FY21E EPS as compared to sectoral average of ~21.2x, exhibiting that stock is trading at a discount. The stock currently trades at ~42.16% below its 52-week high. When the company having such growth potential and has ability to grow at a much faster pace than the industry, going long would be a wise decision.

The company focuses on brand extensions across its entire portfolio to push profitability and maintain growth momentum. ITC responded with agility when there was lockdown in the country to ramp up operations and enhance essential products’ capacity. Given the sectoral average of ~21.2x, we have estimated a target price of INR231.08, exhibiting ~23.4% growth from current price.

share your thoughts

Only registered users can comment. Please register to the website.