Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIntroduction: Founded in 1992, Parag Milk Foods Ltd is one of the country’s private sector dairy company, having diverse portfolio in over 15 consumer centric product categories. Recently, it has transitioned from being a pure-play dairy major into FMCG company. As a result of long-term trends and evolving consumer habits, management continues to launch market-leading products and create categories that are ahead of the industry.

Growth Enablers for Parag Milk Foods Limited

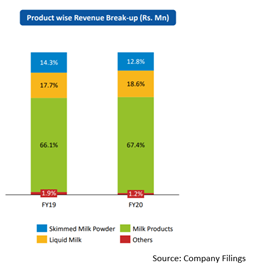

Favorable Industry Dynamics: The company’s consolidated revenue from operations for FY20 came in at INR24,379 million, exhibiting 2% year-over-year growth. Growth was impacted by drop in volumes and higher base of 4Q last year. However, 4Q20 was impacted because of sales disruption due to COVID-19. Sales of FMCG were dependent on month-end. For FY20, share of milk products was 67.4% of total revenue and liquid milk contributed 18.6% to total revenue. Skimmed milk powder made up 12.8% of total revenue.

We expect impact of sales of commodities and HORECA (Hotel, Restaurants and catering) segments should be offset by demand growth across all core consumer product categories like ghee, cheese, paneer & UHT because of significant increase in at-home consumption. Long-term outlook for the country’s dairy sector remains intact on account of increasing population, per capita consumption, expenditure on packaged foods, and brand awareness. Increase in nuclear families and government support should be primary growth enablers. Growth should mainly be supported by value-added milk products, expected to grow at 15-25%, and liquid milk, expected to grow at 8- 10%.

Despite seeing substantial compression in gross margins, Parag Milk Foods saw EBITDA margin coming at 8.7%, stemming from tight spends on A&P, lower other expenses and productivity measures.

HORECA Business- Recovery on The Cards: HORECA saw impacts from lockdown as commercial places like offices, hotels, restaurants, catering, small tea/ coffee stalls were not operating. As unlock 1.0 kicked in, HORECA business has started seeing some movement. We expect the company to see pre-COVID-19 level of business with partners by first week of November 2020.

Cheese and Paneer make up 2 categories of HORECA business. Cheese business was further divided into 2 verticals – Consumer & Institutional. It enjoys tremendous consumer acceptance of cheese business with ~35% market share in India. Home consumption of Ghee, Butter, Paneer and Cheese saw unprecedented increase in this pandemic period.

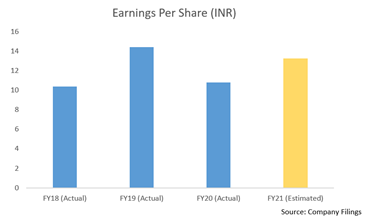

![]() Consumer Spending Growth to Support Bottom Line: We expect Parag Milk Foods to post EPS of INR13.26 in FY21, exhibiting a growth of ~22.78% on year-over- year basis. The company should compound its EPS at ~9% over FY18-FY21. Shift from unorganised to organised sector, growth in disposable income and change in dietary patterns should stem this growth in EPS. Productivity measures and disciplined management of costs should keep a check on its expenses. Profitability should get improved as a result of cost rationalization measures and strong milk production.

Consumer Spending Growth to Support Bottom Line: We expect Parag Milk Foods to post EPS of INR13.26 in FY21, exhibiting a growth of ~22.78% on year-over- year basis. The company should compound its EPS at ~9% over FY18-FY21. Shift from unorganised to organised sector, growth in disposable income and change in dietary patterns should stem this growth in EPS. Productivity measures and disciplined management of costs should keep a check on its expenses. Profitability should get improved as a result of cost rationalization measures and strong milk production.

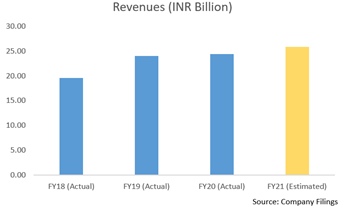

Resumption of Business Activities Should Support Top Line Growth: Parag Milk Foods should deliver revenues of ~INR25.83 billion in FY21, exhibiting a growth of ~6%. Growing health consciousness, emerging value-added categories, resumption of trade activities, phased opening up of the economy from lockdown restrictions and improvement in volumes are some factors to help this growth. However, challenges in distribution and in procurement of packaging material can cap this growth.

Recovery from COVID-19 Impact: The company has reallocated its advertising spends between different channels, placing greater focus on digital media. It has initiated cost rationalization measures which should help improve profitability.

Value Creation Strategy: Plans to recover from slowdown are all set as it aims to increase operational efficiencies, value-added product portfolio, product reach and milk procurement. Between CY10-CY20E, traditional and modern products should see CAGR of ~15% and ~26%, respectively.

Should Outweigh Industry’s Growth: On a global scale, India is on the list of 15 leading exporters of agricultural products. Agricultural export from India touched US$38.54 billion in FY19. In FY20, it touched US$28.93 billion (till January 2020). Organic food segment should compound growth at ~10% during FY15-25 and should reach INR75,000 crore (US$10.73 billion) by FY25 from INR2,700 crore (US$386.32 million) in FY15. Given the focus on improving distribution capabilities, bouquet of strong brands, in-house milk procurement expertise and diversified product portfolio, it should easily outweigh the industry’s growth.

Challenges

The company faced initial supply chain and distribution challenges because of COVID-19 pandemic. There were challenges in procurement of packaging material and other raw material as there were disruptions at suppliers’ level. Even though its products were categorized as “essential goods”, there were issues in inter-state movement and other hindrances. Limited clarity by regulatory authorities made situation even worse. Even though these challenges could cap revenues and earnings growth, we expect that well-integrated supply chain network, healthy balance sheet metrics and sound ROE and ROCE position should help offset impact from these short-term challenges.

Valuation

The company has a market cap of ~INR9.57 billion while its EV is ~INR12.81 billion, highlighting reasonable debt position. It has reduced its borrowings from INR646.2 million in FY19 to INR481.5 million in FY20, resulting improvement in debt/equity ratio. Improvements in free cash flow and operating efficiency should further reduce its net debt. The company plans to leverage in-house technology and R&D capabilities to maintain strict operational controls and develop customised systems and processes.

Parag Milk Foods currently trades at INR113.85 and is ~54% below its 52-week high. Parag Milk Foods is trading at 8.58x FY21E EPS of INR13.26 which is at a deep discount to sectoral average of 11.2x. Given this sectoral average, we expect stock price to reach at INR148.51, suggesting a rise of ~30% from current price of INR113.85.

We have discounted impact in the company’s HORECA business, uncertainty about duration of COVID- 19, operational disruptions, and global slowdown. However, impact of these measures should offset by increased demand for core consumer products categories such as ghee, cheese, paneer, UHT, support of Indian government and consumption growth.

share your thoughts

Only registered users can comment. Please register to the website.