Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

KPR Mill is one of the largest vertically integrated apparel manufacturing companies in India producing yarn, knitted grey, and dyed fabric and readymade garments. The company can knit 27,000 MT of fabrics or 95 million pieces of readymade knitted apparel annually. It has also started to venture into retail business under its own brand and ethanol production.

KPR Mill also engages in other businesses like sugar, power generation, automobiles, and education. The company operates through its various subsidiaries like Quantum Knits Pvt. Ltd, KPR Sugar Mill Ltd., Jahnvi Motor Pvt. Ltd., Galaxy Knits Ltd. and KPR Exports. KPR ranks amongst the top ten knitted garment manufacturers in India and also exports to Europe, Australia and the U.S. Here are a few of KPR Mills' key competitive strengths:

i) Extensive Manufacturing Infrastructure - KPR Mill has extensive vertically integrated manufacturing facilities spanning across spinning, knitting, dyeing, and garmenting. Together, it has 12 manufacturing units of advanced technology. The company has an annual capacity to produce 1,00,000 MT of yarn and 27,000 MT of fabrics. These manufacturing units are strategically located within a 50 km radius from Tirupur, which is one of Asia’s largest apparel manufacturing clusters. KPR Mill is also opening a new garment facility in Ethiopia.

KPR Mill also has 66 windmills with a total captive power generation capacity of 61.92 MW, which makes it an independent power producer to some extent. In addition, it also has Co-gen cum sugar plant with a capacity of 30 MW and 5,000 TCD.

ii) Manufacturing prowess and expertise - Over the years, KPR Mill has developed significant operational expertise in the apparel sector which helps it to produce superior quality products. This has helped the company retain a trusted base of customers, both domestic as well as international. KPR Mill has also established strong ties with its suppliers which has helped the company to procure best quality cotton for smooth production. The company has a strong presence in the international markets as well. More than 40% of the company’s overall revenues comprise of export sales.

iii) Growing Market in India - From humble beginnings as a small textile manufacturer, KPR has today grown into a leading apparel manufacturer in the country with a large global presence. As one of the largest vertically integrated textile manufacturers in India, KPR Mill benefits from its large size, decades long experience, and an increasing demand for textiles in India. As per USDA report, India is expected to regain the top cotton producer status in 2019-20 due to favorable price trend and increased yield. Textile exports will continue to account for a bigger portion of India's international trade for the current financial year. India is the largest cotton producer and the company should benefit from its leading market share in the country.

iv) Expansion into diversified businesses - KPR has embarked into retail business by launching of new innerwear and athleisure brand FASO initially in three main cities in Tamilnadu. The company has ventured into a new project 'ethanol' at a cost of Rs. 120 crores which is expected to commence its operations in the coming season. KPR is also expanding its geographical presence in Ethiopia which will help it better realize multiple scale and economical advantages such as better realization, margin and improved return ratios. The company’s product revenue mix stood at Yarn & Fabric (49%), Garments (37%), Sugar (8%) and Others (6%). The company also owns a subsidiary in Singapore. All these businesses add significant diversification for KPR Mill safeguarding it from perils in any one business.

Challenges

KPR Mill operates in a cost sensitive industry. Rising cost of cotton is one of the major headaches for the company. KPR Mill, however, claims that it has stored the inventory much earlier, covering best quality cotton at economical rates. KPR ranks amongst the top ten leading apparel manufacturers in the country. It faces intense competition from the likes of Raymond, Arvind Mill, Sutlej Textiles, Bombay Rayon Fashions, etc.

Valuation

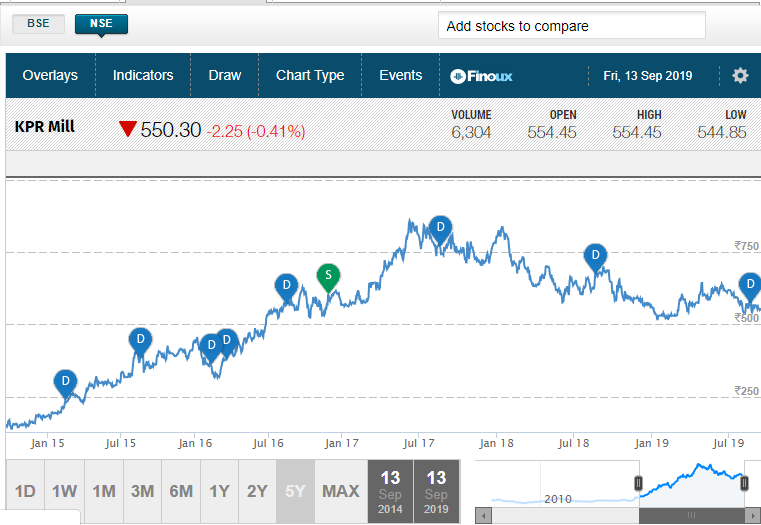

KPR is a shareholder-friendly company and has returned cash to shareholders in the form of extensive dividend payments and share buybacks. The stock sports a dividend yield of 0.14% and is currently trading at 14 times its trailing EPS. Industry PE is near 9x. Shares of KPR Mill is trading near the Rs. 550 mark, nearly 21% below its 52-week high price. The company’s market capitalization value is Rs. 4,008 crores. The stock has gained more than 300% in the last five years. The company’s ROE and ROCE both stand near the 20% mark.

Source: Money Control

Bottom Line

KPR Mill should continue to benefit from Indian government support in the form of rebates on apparel taxes and a better balance of volume, pricing, and capacity. The company’s large scale, quality, technology, and expertise should support growth in both international and domestic markets. Its plans for expanding its garment facility to cater to the rising demand for its garments should support future growth. With strong fundamentals and unique key strengths, KPR is marching towards achieving further milestones in the years to come. As one of the largest knitted apparel manufacturers, KPR is in a good position to benefit from the rising demand for textiles in the country and growing footprint abroad.

share your thoughts

Only registered users can comment. Please register to the website.