Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

KRBL Limited (NSE: KRBL) is the world’s largest rice millers and Basmati rice exporters. Basmati rice is a popular household name in India, since ages. KRBL enjoys a 35% market share in the branded Basmati sale in the Indian market and accounts for 25% of total branded Basmati exports from India. The company has 195 MT/per hour of manufacturing capacity. It operates through a huge network of four processing and grading plants and modern packaging and foodgrain warehousing facility in India.

With over a century old existence, KRBL has become India’s first integrated rice company boasting of a comprehensive product chain. The company also has a diversified energy portfolio which consists of more than 114 MW in wind power projects, 15 MW in solar power projects and 17.55 MW in the biomass projects.

KRBL Positives

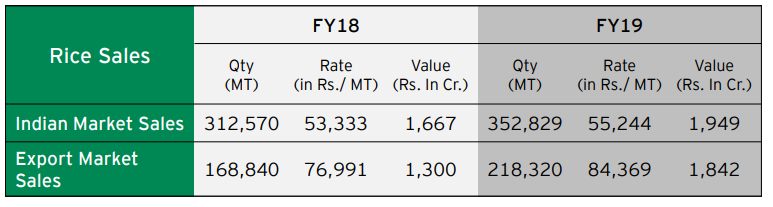

i) Huge Presence - KRBL has a solid footprint in India and across other countries. The company earns its revenues from Agri-India (more than 50% of total revenues), Agri-export (more than 40%) and energy. KRBL’s agriculture segment comprises of agricultural commodities and constitutes 96% of total revenue. Its energy business which accounts for 4% of total revenues at present, engages in power generation from wind and solar power. The company exports to more than 80 countries worldwide. Its export business contribution increased to 45% from 40% in the last year. It has a strong presence in the Gulf countries, where it enjoys a 76% market share in the premium category.

Source: KRBL Corporate Presentation

ii) Strong brands and a wide range of products - KRBL’s flagship brand, India Gate is recognized both in India and abroad. India Gate is the largest selling brand of Basmati rice in India. Consumers trust it for its quality and taste. KRBL also manufactures different variants catering to different consumers, right from the bottom of pyramid consumers to super premium consumers, and comes in a wide range of sizes. Some of its popular brands are Nur Jahan, Bemisal, Doon, Lotus, Al Wisam, etc. The company also produces and sells non-Basmati rice. Other than rice, KRBL is also focusing on healthy foods like sprouted brown rice, quinoa, chia seed, flax seed, etc. It is constantly innovating its offerings according to the changing consumer preferences. As the by-products of the manufacturing process, bran oil, furfural, and furfural alcohol, and de-oiled cakes are produced.

iii) Unique Competitive Advantages - KRBL enjoys the first-mover advantage in accessing the latest technology for the paddy processing industry. It has a strong manufacturing and distribution strength with a fully integrated business model. KRBL has a presence across the entire value chain from seed development and multiplication, contact farming, production to marketing. Its manufacturing facilities are located in close proximity to the Basmati growing regions. KRBL continually invests in enhancing capacities and innovating new milling techniques. As the No.1 Basmati rice producer and miller in India, the company has the largest installed capacities. KRBL is in a good position to benefit from attractive Basmati rice industry dynamics. The company enjoys a dominant position in a niche market opportunity as Basmati producing regions are limited in the world (only in India and Pakistan).

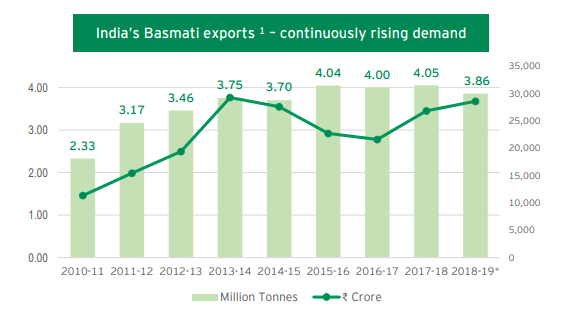

iv) Improving agricultural techniques and lifestyles act as strong tailwinds - KRBL’s sales have grown by more than 9% over the last five years, while its profits have registered a growth of 28% during the same time. Basmati production is experiencing strong growth over the last two decades, driven by the introduction of higher-yielding and shorter duration variety. Shorter growth time and lower irrigation requirement have also eased farmers’ stress over time. Basmati rice consumption is also supported by growing urbanization, rising income levels, and better retail marketing in India. KRBL has also witnessed solid demand growth from the export markets. Emerging online retailing presents a good opportunity for KRBL and the company has extensive ties with leading online players like BigBasket, Amazon, Flipkart, Grofers, in India and Walmart, Costco, etc. in the west. Total exports from India have already increased by 17% in the ten months of FY 2019 when compared to the same period last year. According to the IBEF, India’s Basmati rice export is likely to grow by 4-5% in FY20, supported by strong demand from Iran and a steady increase in paddy prices. Being a leading producer and marketer of Basmati rice, KRBL is favorably placed to benefit from these growth trends.

KRBL Challenges

The company’s dependence on agriculture produce is its biggest challenge. Abrupt changes in policies and market conditions also act as strong headwinds. The imposition of GST has also increased some competition in this segment. KRBL competes not only with large companies like LT Foods (Dawat), ASCW (Lal Qilla), Kohinoor, etc. but also faces competition from unorganized segment which accounts for nearly 40%-45% of the Indian Basmati market. KRBL also competes fiercely with many leading Pakistani companies as the major exporter of Basmati rice to world markets. Tightening of pesticide residue norms by key importers could be a long-term risk for the company and the industry at large.

Basmati rice prices have been hit by an increase in the overall acreage. Basmati rice companies are also suffering from delays in payments from US sanction-hit Iran, which is one of the largest buyers of India’s Basmati rice. However, the interests of rice exporters are safeguarded to the extent of Rs 1,800 crore received in advance from Iranian importers. Iran is the largest buyer of basmati rice, contributing nearly 25% of India’s annual basmati exports. Any continued strain in this regard could further pressurize Basmati rice prices. KRBL earns around 5% of its turnover from Iran, hence it should not be overly worried about US sanctions on Iran.

Valuation

KRBL is trading near the Rs. 250, mark 40% down from its 52-week high price. The company has decent valuation multiple with both ROE and ROCE above 20%. KRBL has reduced its debt over the years and is virtually debt-free now with a low debt to equity ratio of 0.06. The stock is trading at 11 times its earnings (after adjusting for extraordinary items). Though it looks expensive when compared to LT Foods trading at a PE of just 4.7x, the company commands nine times higher market capitalization value when compared to LT Foods. India Gate’s high brand recall and decades of management experience justify its premium valuations.

KRBL Stock Performance

Source: Money Control

Conclusion

A multi-brand presence across India and international markets, premium market share, brand loyalty, and customer stickiness are KRBL’s huge competitive strengths. The company’s efforts to capture additional market share in all its product and brand segments should drive long term growth. It is highly diversified by customers, geographies, and products. Though KRBL is suffering from temporary price declines as a result of weakness in Iranian export, I think it is temporary and should ease in the future. Now might be a good time to build a position in the premium rice stock of India.

share your thoughts

Only registered users can comment. Please register to the website.